by Brooks Ritchey, Franklin Templeton Investments

Q4 2021 Outlook: Summary

As we move into the fourth quarter (Q4), markets are in a tug-of-war involving various good news versus bad news debates. COVID-19 cases are declining, but central banks are considering tightening monetary policy. Earnings growth is strong, but year-over-year comparisons will become tougher. Employment statistics are improving, but supply chain constraints persist. These debates and others lead us to believe that certain hedge fund strategies will outperform in a potentially choppy environment.

Strategy Highlights

- Long/Short Credit: Managers engage companies directly on refinancing transactions. An accommodative primary market allows the issuer to push out maturities.

- Commodities: Tightening supplies and increased demand following further reopening of the economy has led to multi-year highs across a variety of commodity markets.

- Event Driven: Record volumes of activity and greater dispersion of outcomes because of regulatory and monetary uncertainties are favoring managers who can produce alpha through security selection and trading.

Strategy Outlook Long/Short Equity We worry than many unpredictable macro factors will continue to challenge managers as earnings are not reliably driving stock prices. Moreover, relatively high net and gross exposures of most long/short managers leave them vulnerable to market disruptions. Relative Value Mixed outlook for relative value strategies—fewer trading opportunities in fixed income due to volatility and dispersion remaining depressed, but certain strategies such as convertible arbitrage benefit from busy new issuance and corporate activity. Event Driven Positive outlook due to continued strong pipeline of events combined with more attractive spreads and greater diversity of outcomes due to increased regulatory and geopolitical uncertainty. Credit Spreads remain near historic tights, which favours trading-oriented strategies such as long/short credit at the expense of more directional ones such as distressed and direct lending. Pricing in structured credit remains inefficient, and managers expect dispersion to persist in certain sectors. Global Macro Managers continue to focus on the outlook for inflation and its implications for monetary and fiscal policy changes, especially in the United States. As policy decisions begin to be implemented, the opportunity set may become increasingly attractive for thematic macro strategies. Commodities A continued tight supply and demand environment will likely lead to relative value trading opportunities. Despite renewed institutional interest, commodity managers have remained disciplined in accepting investments and are managing capacity closely. Insurance-Linked Securities (ILS) Initial 1 January pricing indications appear strong following Hurricane Ida and the European flooding in Q3. Despite tightening over the course of the year, cat bond pricing remains attractive on an absolute basis and relative to high yield instruments.

Macro Themes We Are Discussing

Global equity markets edged down during 2021’s third quarter (Q3). Early in the period, strong corporate earnings in several parts of the world, full US regulatory approval for a COVID-19 vaccine, and the Chinese central bank’s liquidity-boosting measures aided markets. However, many investors were also pricing in the potential for the US Federal Reserve (Fed) to begin tapering stimulus. Late in Q3, persistent inflation, more hawkish central bank messaging and a continued regulatory crackdown in China all dampened investor sentiment. Going forward, our hedge fund managers and the K2 Investment Committee are discussing some key themes that we believe will drive market sentiment and performance in the coming quarters.

Is inflation transitory?

The gradual reopening of economies has created increased demand for goods and raw materials. While this is good news, workers’ lingering COVID-19 concerns are keeping factory staffing (and production) at low levels. Thus, the supply of goods is hindered, and price increases are evident for those products that are available. Adding to these production cuts are the blockages in the global supply chain as dock workers, truckers and shipping containers are in short supply. As a result, the current levels of inflation may hold for longer than was expected a few months ago.

Will central banks shift to a less accommodative interest rate and liquidity policy?

Given that inflation is running above central banks’ target levels and COVID-19 cases are declining in many parts of the world, central bankers have begun preparing investors for a reduction in monetary stimulus and for future interest rate hikes. This is to be expected at this point in the recovery cycle, and we believe this will be a major influence on markets for the next 12–18 months. Real (and nominal) interest rates are near historically low levels, and much excess liquidity has helped the world to stabilise and recover from the COVID-19 crisis. The disparate impact of this less stimulative policy regime on various asset classes, sectors and companies may increase volatility but will present potential opportunities for active managers.

Will strong corporate earnings continue to boost equity valuations?

Much discussion over the past 12 months has focused on the risk of above-average equity market valuations being reduced by the convergence of the strong year-over-year earnings growth trend. Clearly earnings (and revenue) growth has been exceptional, and this has helped to reduce valuation concerns. That said, many of our hedge fund managers are monitoring 2022 earnings growth estimates as the comparisons to 2021 earnings become tougher and growth rates slow. With a reduction in Fed asset purchases, possibly higher interest rates, and pressure from raw material and wage inflation, the potential for reduced profit margins and earnings growth rates may lead to a wider gap between the performance of those companies with low debt and efficient production processes versus those less well positioned.

Will regulatory and tax policy constraints hinder (or rotate) growth?

Investors are weighing potential government initiatives involving tighter data privacy policies, more aggressive antitrust regulation, and higher corporate and personal tax rates. For example, Europe continues to lead the way with internet privacy laws, and US policymakers are starting to pay more attention to issues regarding the appropriate use of personal data. Companies in this area are adjusting to this new regime and the impact on earnings could be detrimental. China has recently reminded the world of its “common prosperity” initiative, which, among other things, aims to reduce the income gap, limit the prosperity of technology and finance conglomerates, and reform tax rates to benefit the labor class. In the United States, there is talk of tax hikes to help pay for infrastructure projects and ongoing concerns over the outsized influence of the largest US companies. In this environment, those companies able to adapt to (or better compete in) this new policy world stand to benefit while others may experience lower margins and slower growth rates. In sum, the world may well be in a transition phase as economies, workers, consumers, governments and central banks adapt to a post-COVID-19 world. Oftentimes, change creates opportunities for those nimble enough to capture the new tailwinds while hedging out the risks associated with a shifting environment. We remain vigilant in this regard.

Q4 2021 Outlook: Strategy Highlights

Long/Short Credit

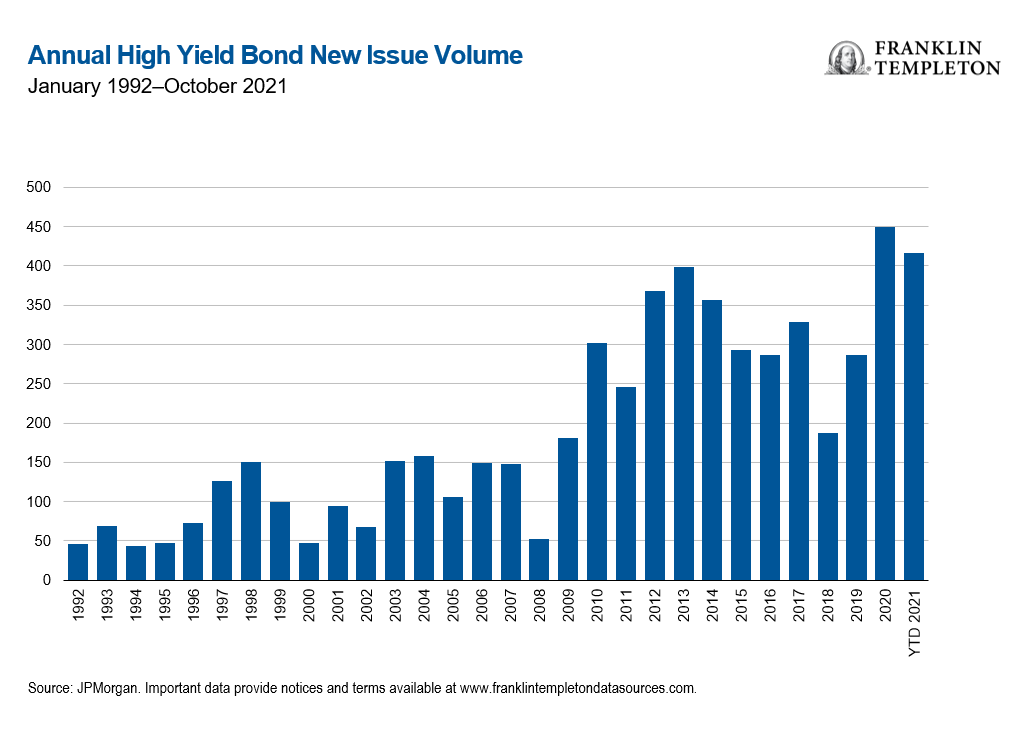

The macro environment has been very supportive of credit conditions, resulting in tight spreads across the board. We look forward to higher levels of dispersion among issuers and therefore a better opportunity set for pure credit pickers. In the meantime, however, managers remain focused on events to generate performance. In high yield, for example, the primary market remains extremely busy. Following a record year for activity in 2020, this year is on pace for an even greater volume of deals. Managers often take an active role and work with issuers on completing refinancing or recapitalization transactions. An accommodative primary market allows the issuer to push out maturities, lower the weighted average cost of capital, and streamline the capital structure—all positives for the overall credit quality of the company. As a result, the entire debt stack often trades tighter, resulting in gains on existing positions. Even more directly, managers can extract fees from the transactions and flip primary market allocations into the secondary market for a gain.

Commodities

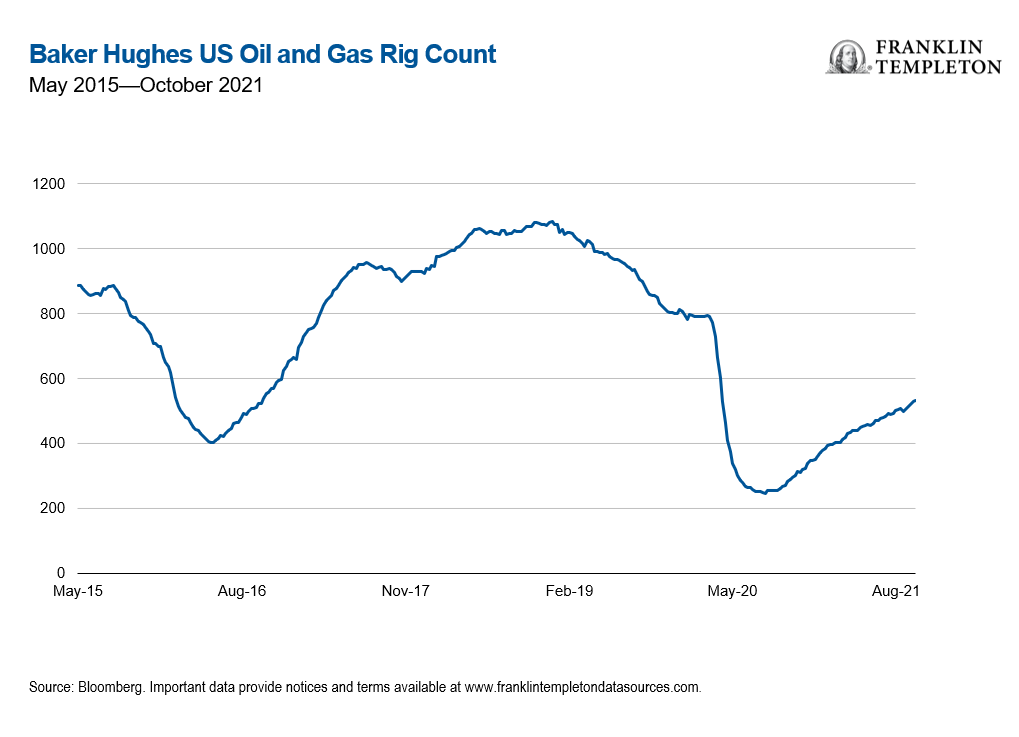

The global environment has been a tailwind to the broader commodities markets leading to multi-year highs in the Bloomberg Commodity Total Return Index. We look forward to a rich opportunity set, particularly in the energy sector, as volatility and prices increase. As the reopening of economies accelerates, demand for oil and products will likely increase as both work and personal travel picks up. Supply across the energy complex is unlikely to grow fast enough to accommodate the demand growth leading to higher prices across global crude and natural gas markets without factoring in any potential weather shocks as we move closer towards winter. Typically, there is a significant lag between deciding to increase physical production and the result of higher supplies. We are seeing the impact of this disconnect with prices across the energy sector including crude, natural gas, heating oil and gasoline all at multi-year highs.

Event Driven

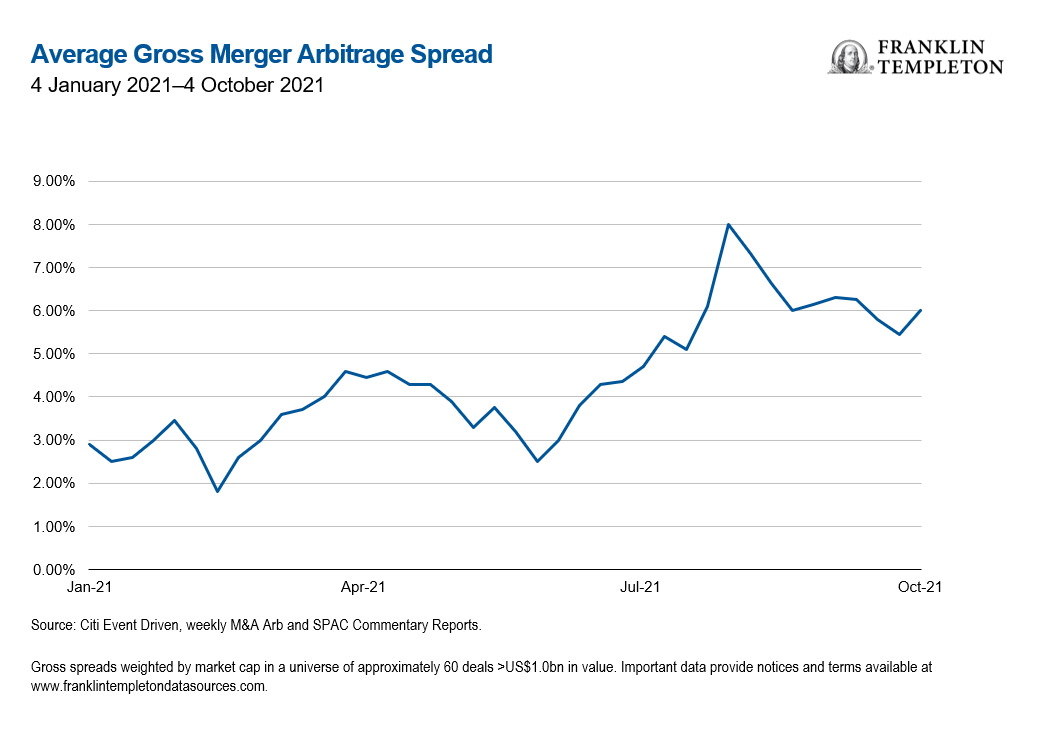

Corporate activity is on pace to exceed all-time records across mergers and acquisition (M&A), leveraged buyouts (LBOs), activist campaigns, buybacks and other types of events. What makes the strategy particularly attractive today, however, is the increased dispersion of outcomes given greater risks associated with them. Greater regulatory involvement in the United States and abroad, increased fundamental uncertainties due to changing monetary policies, and more active shareholder and management activism. These risks have translated to wider spreads and greater potential upside for managers who can produce alpha through security selection and trading.

What Are the Risks?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

Important Legal Information

This information contains a general discussion of certain strategies pursued by underlying hedge strategies, which may be allocated across several K2 strategies. This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of any of the funds employing K2 strategies. Nothing in this document should be construed as investment advice. Specific performance information relating to K2 strategies is available from K2. This presentation should not be reproduced without the written consent of K2.

Past performance is not an indicator or guarantee of future results.

Certain information contained in this document represents or is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. K2 believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, too much reliance should not be placed on such forward-looking statements and information.

Professional care and diligence have been exercised in the collection of information in this document. However, data from third party sources may have been used in its preparation and Franklin Templeton/K2 has not independently verified, validated or audited such data.

Any research and analysis contained in this document has been procured by Franklin Templeton/K2 Investments for its own purposes and is provided to you only incidentally. Franklin Templeton/K2 shall not be liable to any user of this document or to any other person or entity for the inaccuracy of information or any errors or omissions in its contents, regardless of the cause of such inaccuracy, error or omission.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at 12 October 2021, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Investments are not FDIC insured; may lose value; and are not bank guaranteed.

This post was first published at the official blog of Franklin Templeton Investments.