by Sound Choices, AGF Management Ltd.

Education Savings:

Are you taking advantage of the government incentives?

The content in the article below is meant for Canadian investors only.

Did you know RESP (Registered Education Savings Plan) savings can be supplemented with government education savings initiatives, with the main one being the Canada Education Savings Grant (CESG) paid by the federal government?

Key Facts about the Canada Education Savings Grant (CESG)

- All RESPs are eligible for Basic CESG

- The Government of Canada will match a percentage of your RESP contributions by depositing the CESG directly into the RESP

- $500 each year (20% of the first $2,500 of annual contributions per beneficiary)

- Up to $1,000 if carry-forward room is available (grant room is cumulative and can be carried forward). So if you cannot make a contribution in any given year, you can carry over unused Basic CESG.

- CESG paid into a Family Plan RESP may be used by any beneficiary of the RESP to a lifetime maximum of $7,200 per beneficiary – this includes both the Basic and Additional CESG

What determines if you are eligible for the CESG?

How much of a difference can the CESG make?*

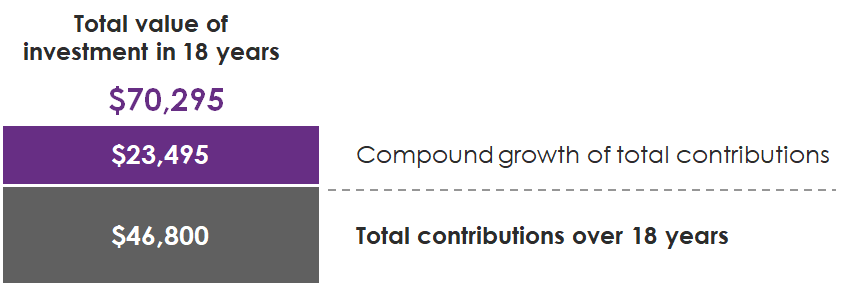

Family #1 – no CESG

- Invested $100 bi-weekly into a non-registered account

- This investment doesn’t qualify for the Canada Education Savings Grant (CESG)

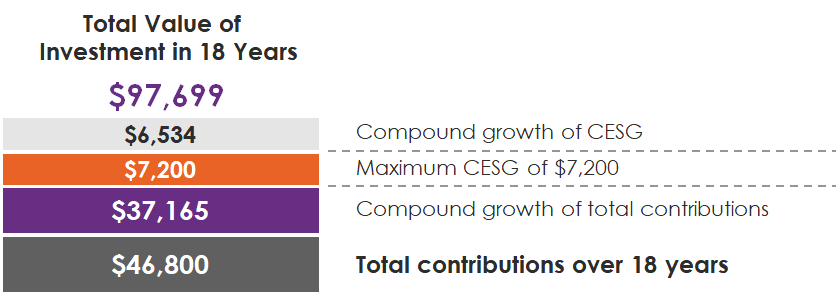

Family #2 – RESP with CESG

- Also invested $100 bi-weekly – but into an RESP account

- This investment qualifies for the CESG – 20% of their monthly contributions

Do you qualify for additional education savings grants?

Additional CESG is available to qualifying families**:

$500 (Basic CESG) +

$100 (additional 20% on the first $500 of annual contributions per beneficiary)$49,021–$98,040$550:

$500 (Basic CESG) +

$50 (additional 20% on the first $500 of annual contributions per beneficiary)

How do I apply for the CESG?

- Ensure your tax returns are up to date

- Open and contribute to an RESP with the child named as a beneficiary – make sure the RESP promoter allows for the Additional CESG payment as not all do

- Complete the CESG application form. Your RESP provider will then request the CESG.

Once the application is approved, the appropriate amount will be deposited directly into that RESP.

Talk to a financial advisor to learn how they can help you and visit AGF.com/RESP.

Additional Resources

* Source: AGF Investment Operations. Both examples are based on bi-weekly contributions of $100 (for a total of $2,600 over 12 months) and exclude fees. For the RESP example, Family #2 received the Canada Education Savings Grant of 20% of contributions to a maximum of $500 per year. Family #1 invested in a non-registered account that consisted of only interest earnings and assumes a marginal tax rate of 40%. Family #1 paid taxes on their non-registered investment at the beginning of the 17th week each year except the first year. Growth of investments for both families is based on the assumption of a 6% average annual compound rate of return over 18 years. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values or returns on investments.

** Source: https://www.canada.ca/en/employment-social-development/services/student-financial-aid/education-savings/resp/resp-promoters/bulletin/notice-2020-887.html. Dollar amounts are updated annually based in part on the rate of inflation.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

Commissions, management fees and expenses all may be associated with investing in ETFs. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. There is no guarantee that ETFs will achieve their stated objectives and there is risk involved in investing in the ETFs. Before investing you should read the prospectus or relevant ETF Facts and carefully consider, among other things, each ETF’s investment objectives, risks, charges and expenses. A copy of the prospectus and ETF Facts is available on AGF.com.

The commentaries contained herein are provided as a general source of information and should not be considered personal investment or tax advice. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained here.

The contents of this Web site are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.

AGF Management Limited (“AGF”), a Canadian reporting issuer, is an independent firm composed of wholly owned globally diverse asset management firms. AGF’s investment management subsidiaries include AGF Investments Inc. (“AGFI”), AGF Investments America Inc. (“AGFA”), Highstreet Asset Management Inc. (“Highstreet”), AGF Investments LLC (formerly FFCM LLC) (“AGFUS”), AGF International Advisors Company Limited (“AGFIA”), Doherty & Associates Ltd. (“Doherty”) and Cypress Capital Management Ltd. (“CCM”). AGFI, Highstreet, Doherty and Cypress are registered as portfolio managers across various Canadian securities commissions, in addition to other Canadian registrations. AGFA and AGFUS are U.S. registered investment advisers. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF investment management subsidiaries manage a variety of mandates composed of equity, fixed income and balanced assets.

® The “AGF” logo and “Sound Choices” are registered trademarks of AGF Management Limited and used under licence.

RO 1855682

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.