by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

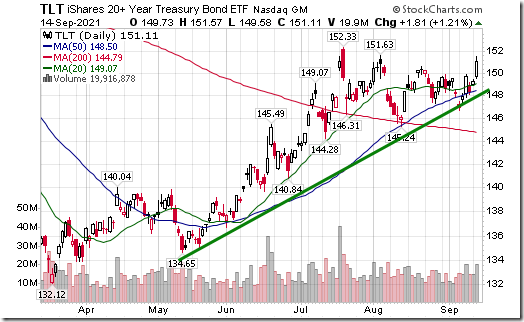

Bond prices gain following a weaker than expected read of inflation. Find out what seasonal tendencies have to say about when this rising trend in the bond market will come to an end in today’s report. equityclock.com/2021/09/14/… $TLT $IEF $SHY $TBT

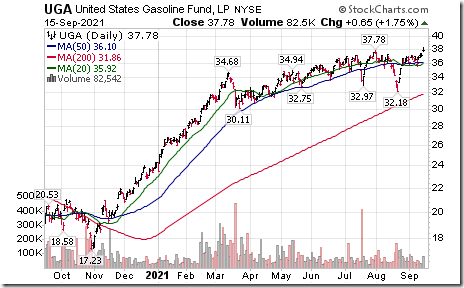

Gasoline ETN $UGA moved above $37.78 extending an intermediate uptrend.

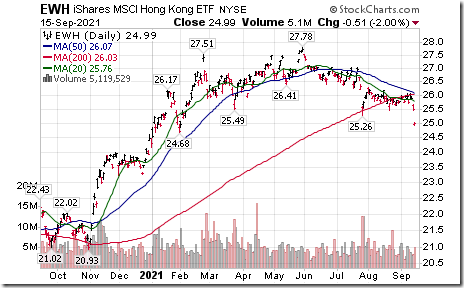

Hong Kong iShares $EWH moved below $25.26 completing a Head & Shoulders pattern.

Starbucks $SBUX an S&P 100 stock moved below $113.61 completing a double top pattern.

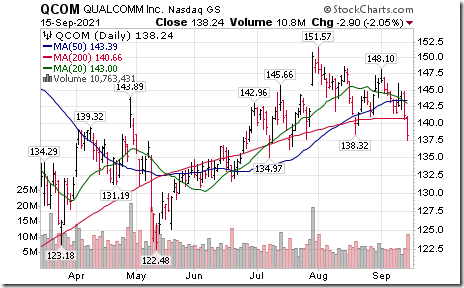

Qualcomm $QCOM an S&P 100 stock moved below intermediate support at $138.32 setting an intermediate downtrend.

Trader’s Corner

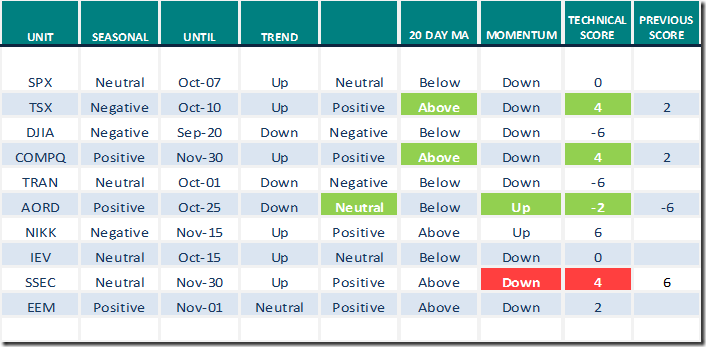

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

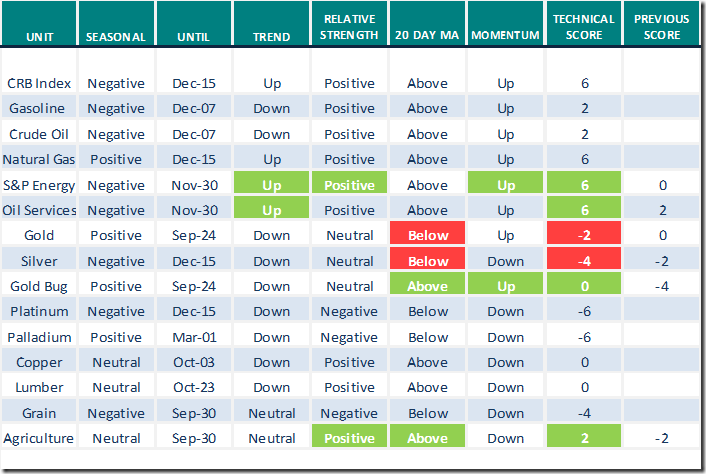

Commodities

Daily Seasonal/Technical Commodities Trends for September 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

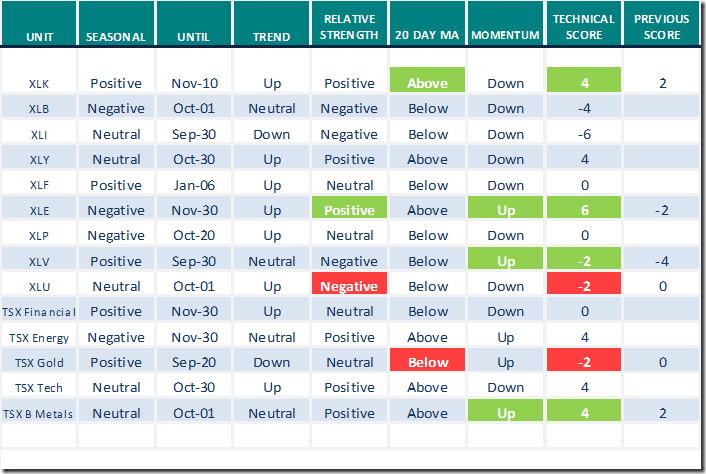

Sectors

Daily Seasonal/Technical Sector Trends for September 15th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Notes from Mark Bunting and www.uncommonsenseinvestor.com

Eight Extreme Charts to Make You Question Your Assumptions – Uncommon Sense Investor

12 New Quotes From Billionaire Investor Howard Marks – Uncommon Sense Investor

Market Buzz

Greg Schnell looks at the Retail sector. This education video is entitled, “Out with the old, in with the new: finding winning stocks”. Following is a link:

Out With The Old, In With The New (Finding Winning Stocks) | Greg Schnell, CMT (09.15.21) – YouTube

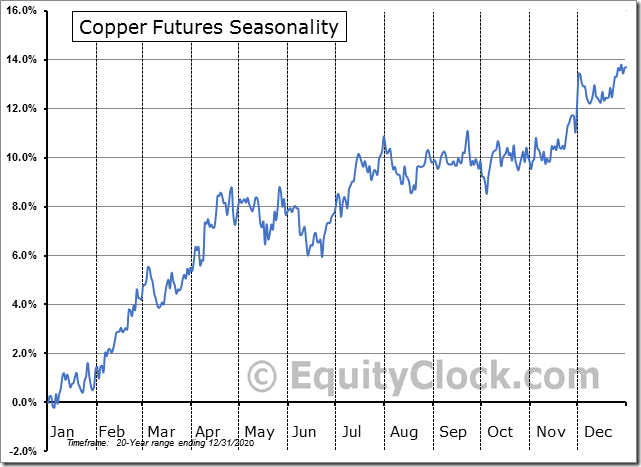

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences for copper turn positive at the beginning of October.

On the charts, copper futures recorded an intermediate bottom in the third week in August. Technical action has been encouraging prior to start of its period of seasonal strength: Strength relative to the S&P 500 Index turned positive earlier this week, short term momentum indicators are trending higher and prices moved above their 20 and 50 day moving average yesterday.

S&P 500 Momentum Barometers

The intermediate term Barometer added 7.82 to 56.71 yesterday. It remains Neutral.

The long term Barometer gained 1.80 to 75.55 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 1.47 to 62.25 yesterday. It remains Overbought.

The long term Barometer was unchanged yesterday at 70.59. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.