by Brian Levitt, Global Market Strategist, Invesco Canada

While investors watch the debt ceiling drama unfold in Washington, Brian Levitt explores what the 2011 and 2013 debt debates meant for U.S. stocks.

It’s time again for America’s least favourite pastime — the debate over whether to raise the debt ceiling. Recent comments by Senator Mitch McConnell that Republicans will not vote for a debt ceiling increase without major structural spending reforms have driven concern from market participants. Unlike 2011 (or other past debt ceiling standoffs), the Democrats don’t need Republican votes to raise the debt ceiling. However, House Majority Leader Nancy Pelosi has warned that the Democrats will not go it alone and raise the debt ceiling through the reconciliation process. The political game of chicken is upon us.

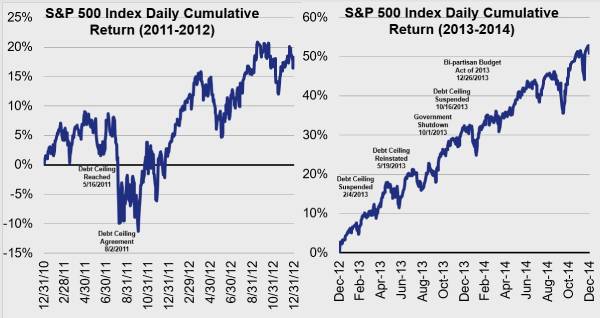

So what comes next, and what could it all mean for U.S. stocks? It’s possible that markets could have a few unsettled days in the coming weeks as investors price in the prospect of the government not being able to meet its obligations, meaning a potential large fiscal drag at a very inopportune time. But it’s important to remember that in the last two standoffs over the debt ceiling, 2011 and 2013, U.S. equities declined in the month leading up to the “feared date” only to post substantial returns in the following 12 months after the drama subsided.1

In the following commentary, we answer the most frequently asked questions about the debt ceiling and conclude with an optimistic view that the latest standoff will pass without meaningful incident.

What is the debt ceiling?

Every day the U.S. federal government spends more money than it brings in and makes up the difference with borrowed money — but there’s a limit to how much debt it can take on. In 1917, the Second Liberty Bond Act placed an $8 billion limit on the amount of government bonds that can be issued. Congress has voted to increase the limit many times since 1917, including 18 times during the Reagan administration, eight times during the Clinton administration, and seven times during George W. Bush’s administration, when the practice was treated as a mere formality by Congress. Congress even raised the debt ceiling five times during the Obama administration, when the process was more contentious. The Trump administration raised the debt ceiling multiple times before suspending it in 2019.2

Why has the debt ceiling debate reemerged?

The U.S. debt limit in 2019, at the time it was suspended, stood at $22 trillion.3 It was recently reinstated at approximately $28.5 trillion. The current U.S. federal government debt outstanding is $28.427316 trillion.4 The Treasury Department’s legal authority to issue additional debt that increases the amount outstanding expired on Aug. 1, 2021.

According to U.S. Treasury Secretary Janet Yellen, the government has so far managed to pay its bills through extraordinary measures and accounting manoeuvres. Extraordinary measures have included suspending investments in certain government pension funds, suspending state and local government series securities, and borrowing money set aside to manage exchange rate fluctuations.

When will the extraordinary measures be exhausted?

The U.S. Treasury Department has not provided a specific estimate for how long the extraordinary measures will last, but Yellen estimated that cash and extraordinary measures could be exhausted in October.

What happens then?

After that date, the U.S. Treasury will no longer be able to issue new debt to fund expenses. As Yellen stated, “Once all available measures and cash on hand are fully exhausted, the United States of America would be unable to meet its obligations for the first time in our history.”

So does that mean the U.S. would default on its debt?

No. The U.S. government would still be able to spend the tax money it receives from Americans, which is expected to total over $315 billion per month in 2021 and 2022, according to the White House Office of Budget and Management. The U.S. Treasury would have to prioritize how to spend that money, but it would be enough to cover Social Security and Medicare payments, debt service, and payments to the military.

But without being able to borrow from the market, the government would be strapped. Everything from federal salaries to IRS refunds to payments to the Department of Education could be cut off. The federal government employs 2.2 million people; a stoppage of paycheques to almost 1.5% of the total labour force would slow the U.S. economy.5

Will the U.S. raise the debt ceiling?

Ultimately, we expect the debt ceiling to be raised. Make no mistake, the debate will be very combative, and we will likely once again approach the 11th hour with the outcome unknown. It’s possible that we will follow a similar pattern as with the debt ceiling debates of 2011 and 2013, when the nation’s policymakers cobbled together a necessary, albeit suboptimal, deal that saves face for both sides. It’s also still possible that the Congressional Democrats, despite their recent pledge to not do so, will raise the debt ceiling through the reconciliation process.

What could this mean for U.S. stocks?

In the last two standoffs over the debt ceiling, 2011 and 2013, U.S. equities declined in the month leading up to the “feared date” only to post substantial returns in the following 12 months.6 U.S. Treasury rates have been below 3% since 2011 and declined following the 2013 debt ceiling standoff as sharp spending cuts known as sequestration slowed the U.S. economy.7

Historically, debt ceiling dramas haven’t kept U.S. stocks down for long

What happens to financial markets as we get closer to the deadline?

We do not expect significant disruptions to the financial markets but would not be surprised for stocks could be more volatile as the deadline approaches, as was the case with the days ahead of the 2011 and 2013 “feared dates.” Ultimately, I believe another incremental step by our nation’s politicians to stave off a fiscal crisis should prod markets higher. As Winston Churchill is said to have said, “Americans always do the right thing, but only after exhausting all other options.”

1 Source: Bloomberg, L.P. U.S. equities are represented by the S&P 500 Index. The S&P 500 Index is a market capitalization weighted index of the 500 largest domestic U.S. stocks. Indices cannot be purchased directly by investors. Past performance does not guarantee future results.

2 Source: Congressional Budget Office

3 Source: Congressional Budget Office

4 Source: US Treasury, Aug. 31, 2021

5 Source: US Bureau of Labor Statistics, Aug. 31, 2021

6 Source: Bloomberg, L.P. U.S. equities are represented by the S&P 500 Index. The S&P 500 Index is a market capitalization weighted index of the 500 largest domestic U.S. stocks. Indices cannot be purchased directly by investors. Past performance does not guarantee future results.

7 Source: Bloomberg, L.P., as represented by the 10-year U.S. Treasury rate.

This post was first published at the official blog of Invesco Canada.