by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

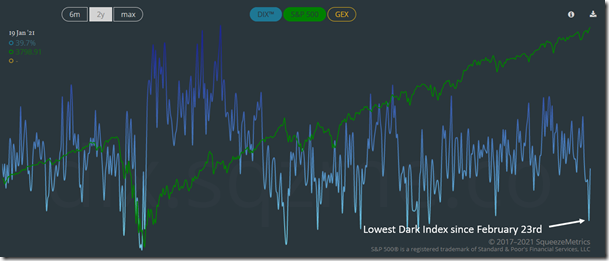

The Dark Index just fell to the lowest level since February 23rd as institutional investors show a lack of excitement towards the market at these heights. equityclock.com/2021/08/30/… $STUDY $SPX $SPY #DIX

Cameco $CCO.CA a TSX 60 stock moved above intermediate resistance at Cdn$22.89 and US$21.95.

Uranium Equity ETF $URA with a heavy weight in $CCO.CA moved above intermediate resistance at $20.61

Canadian Pacific $CP.CA a TSX 60 stock moved below $89.16, $88.52 and $87.58 completing a Head & Shoulders pattern.

DexCom $DXCM a NASDAQ 100 stock moved above $527.10 to an all-time high extending an intermediate uptrend

Trader’s Corner

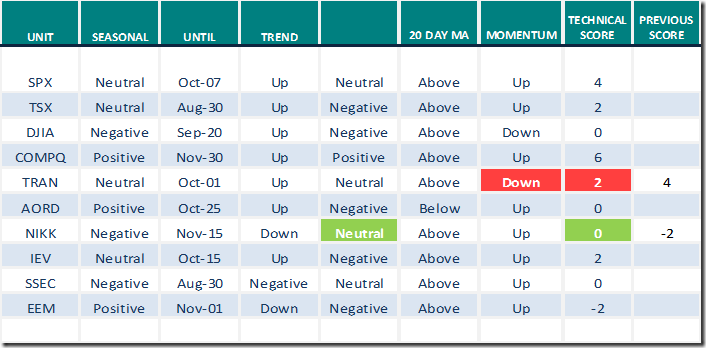

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 31st 2021

Green: Increase from previous day

Red: Decrease from previous day

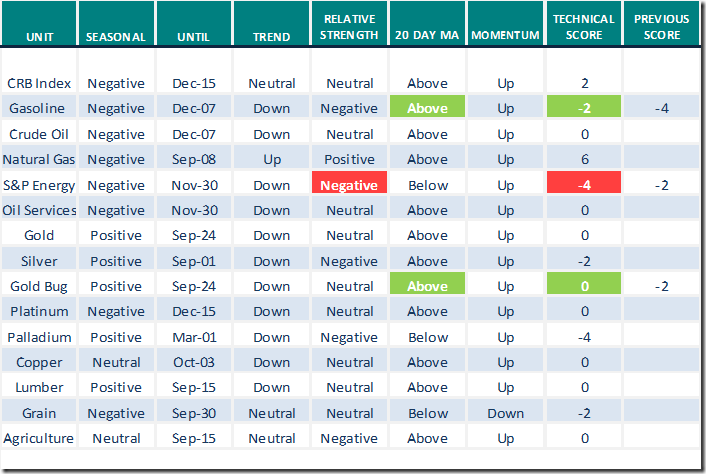

Commodities

Daily Seasonal/Technical Commodities Trends for August 31st 2021

Green: Increase from previous day

Red: Decrease from previous day

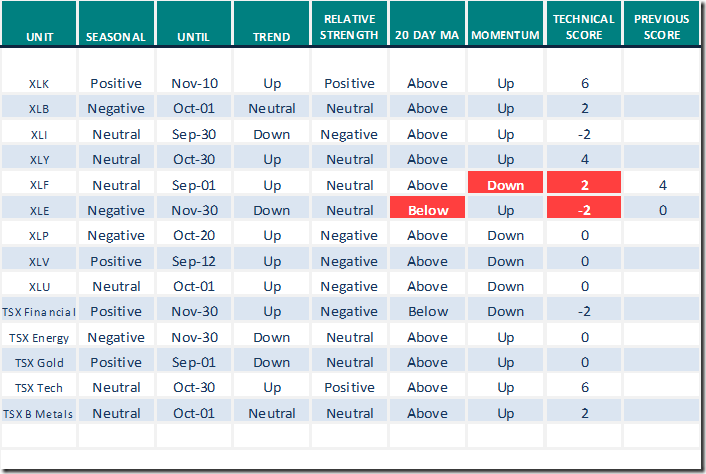

Sectors

Daily Seasonal/Technical Sector Trends for August 31st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The Canadian Technician

Greg Schnell asks, “Is lumber out of its slumber”? Following is the link:

Is Lumber Out Of It’s Slumber? | The Canadian Technician | StockCharts.com

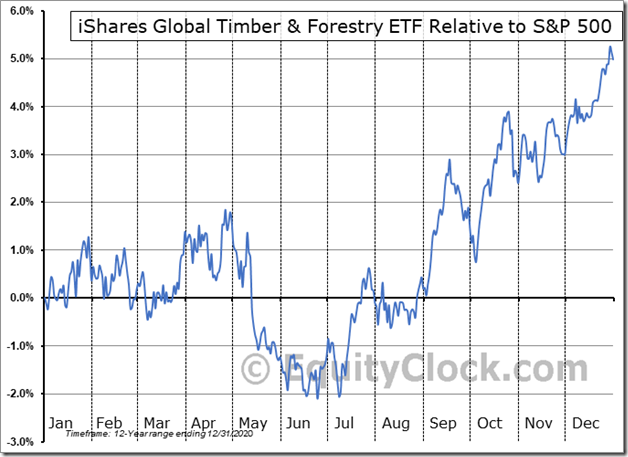

Seasonaliity Chart of the Day from www.EquityClock.com

Seasonal influences on a real and relative basis for the forest product sector are favourable between now and the end of January.

On the charts, Canadian and U.S. forest product stocks are recording bottoming patterns. Timber iShares recently moved above their 20 and 50 day moving average, broke above a 3 month trading range and recorded positive short term momentum indicators (RSI, Stochastics, MACD).

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.00 to 68.14 yesterday. It remains Overbought.

The long term Barometer added 0.80 to 81.95 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 1.74 to 58.05 yesterday. It remains Neutral.

The long term Barometer added 0.35 to 72.68 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.