by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

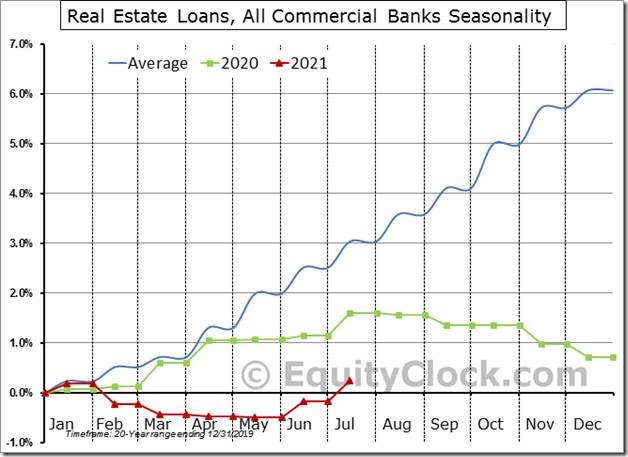

Real Estate loans are finally back on the rise as housing inventory starts to make its way to the market, allowing for the pickup in sales activity. equityclock.com/2021/08/24/… $STUDY $XLF $KBE $KRE #Economy #Housing #RealEstate

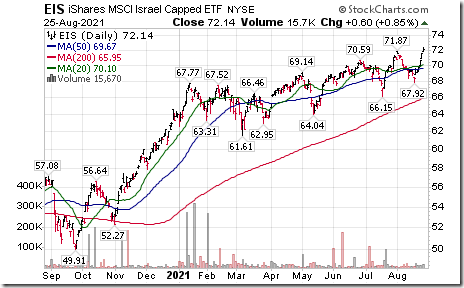

Israel iShares $EIS moved above $71.87 to an all-time high extending an intermediate uptrend.

Verizon $VZ a Dow Jones Industrial Average stock moved below $54.95 extending an intermediate downtrend.

Workday $WDAY a NASDAQ 100 stock moved above $246.61 resuming an intermediate uptrend.

Xilinx $XLNX a NASDAQ 100 stock moved above $154.93 to an all-time high extending an intermediate uptrend.

Cerner $CERN a NASDAQ 100 stock moved below intermediate support at $76.07

Allstate $ALL an S&P 100 stock moved above $139.18 to an all-time high extending an intermediate uptrend.

Booking Holdings $BKNG an S&P 100 stock moved above $2,264.64 setting an intermediate uptrend.

Trader’s Corner

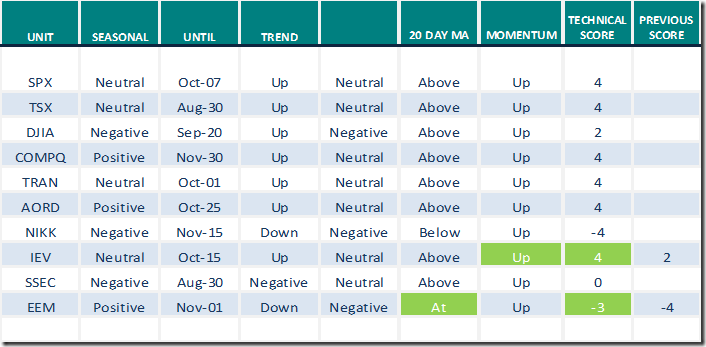

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

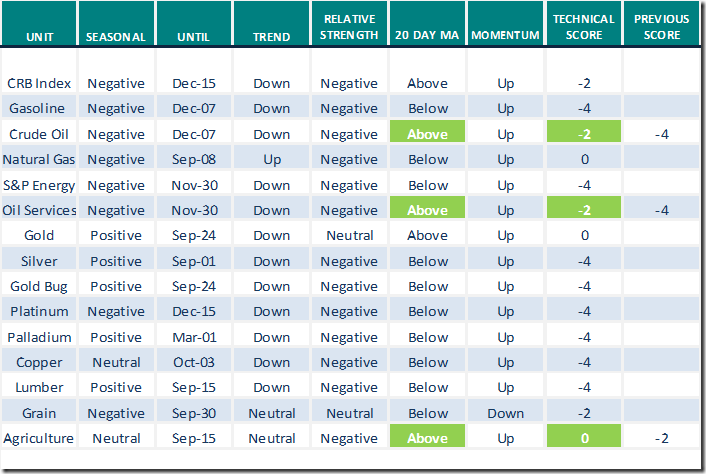

Commodities

Daily Seasonal/Technical Commodities Trends for August 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

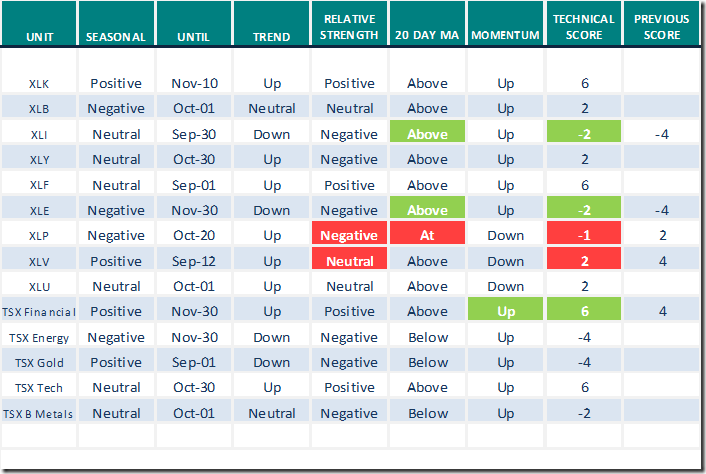

Daily Seasonal/Technical Sector Trends for August 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Note from www.uncommonsenseinvestor.com

Thank you to Mark Bunting and uncommon Sense Investor for links to the following interesting investment report on Canadian equities.

10 "Dividend Dynasties" Growing Their Payouts – Uncommon Sense Investor

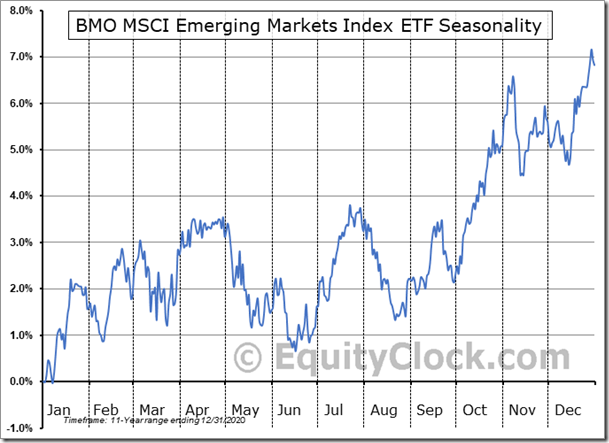

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences on a real and relative basis for Emerging Markets ETFs on both sides of the border (ZEM and XEM on the TSX and EEM in the U.S.) are positive from now to early November. Units are heavily weighted (64%) to equities in China, South Korea and Taiwan.

On the charts, FXI (China), EWT (Taiwan) and EWY (South Korea) show improving daily momentum (i.e Stochastics, RSI, MACD) and are about to move above their 20 day moving averages. Their strength relative to the S&P 500 Index has turned positive.

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.81 to 69.54 yesterday. It remains Overbought

The long term Barometer added 1.80 to 83.97 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.40 to 52.20 yesterday. It remains Neutral.

The long term Barometer also added 0.49 yesterday to 70.73. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.