by Mike Archibald, CFA®, CMT, CAIA, AGF Management Ltd.

Insights and Market Perspectives

Author: Mike Archibald

August 25, 2021

Real estate investment trusts (REITs) have not exactly generated a lot of enthusiasm among Canadian investors over the years, but 2021 might be changing all that. So far this year, the S&P/TSX REIT Index has returned more than 27%, and as of the end of July it was the second-best performer in the broader S&P/TSX Composite Index, according to Bloomberg data. At just over 3% of the Composite overall, REITs comprise a fairly small sector in Canada, but for the past several months they have not been hard to notice.

Why? Those strong returns seem to be the result of a combination of macro and micro factors that are increasingly attracting positive capital flows. Among them is the impending resurgence in economic activity as the world emerges from the worst of the COVID-19 environment. Of course, that rebound also raises the spectre of inflation, but the prospect of higher prices is anything but distressing for REITs – especially those that enjoy pricing power in their markets. The durability of those twin trends of recovery and inflation will, in large part, determine the fortunes of REIT investors going forward, but there is reason to believe the sector will likely enjoy continued strength at least through the second half of the year.

From a micro perspective, the REIT sector has some unique attributes that are making it very attractive in the current backdrop. As a group, REITs stand to benefit from the economic re-acceleration theme and a return to normal operating conditions. (Think workers going back to offices, shoppers returning to malls and tenants happy to live side-by-side with their neighbours in an apartment building.) Then there is the macro lever of higher expected inflation, driven by the recovery as normal economic behaviour returns, as well as ongoing fiscal and monetary stimulus and the willingness of most central banks to allow pricing pressures to run hotter than in previous recoveries. In the coming quarters, higher inflation seems like a pretty safe bet. And historically, it has been very beneficial to REITs.

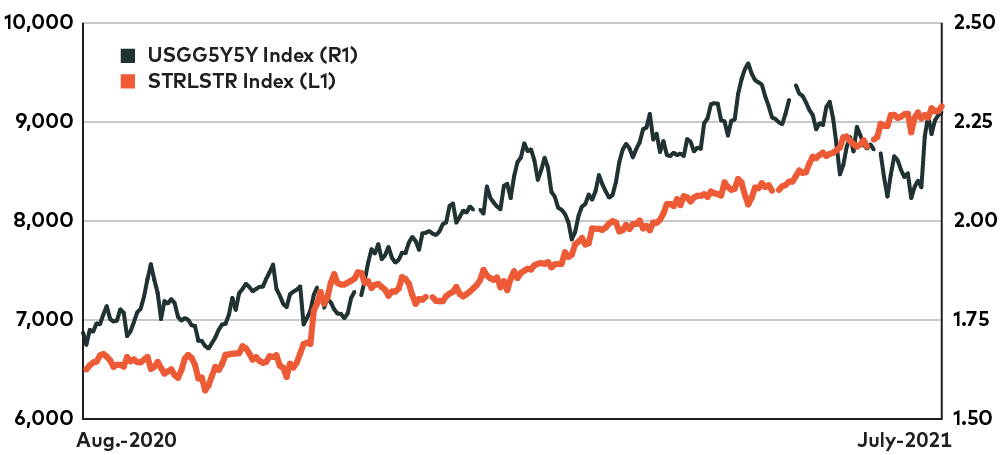

As can be seen below, the correlation between the TSX REIT sector and 5-year forward inflation expectations is quite strong. As inflation expectations move up, REIT pricing tends to move higher as well, resulting in stronger funds from operations for many of the companies in the sector. Reasonably enough, REITs that have shorter lease periods in markets with strong demand benefit the most and the quickest. In the current environment, the companies with the best leverage to strong end markets are the industrial REITs, where occupancy is extremely high. In fact, industrial rent prices have remained strong throughout the entire pandemic period, and as the economy recovers, new operating spaces and buildings are in high demand.

REIT Performance in Relation to Inflation Expectations

Source: Bloomberg LP as of July 30, 2021. Black line represents 5-Year forward inflation expectations; Orange line, represents TSX REIT sector.

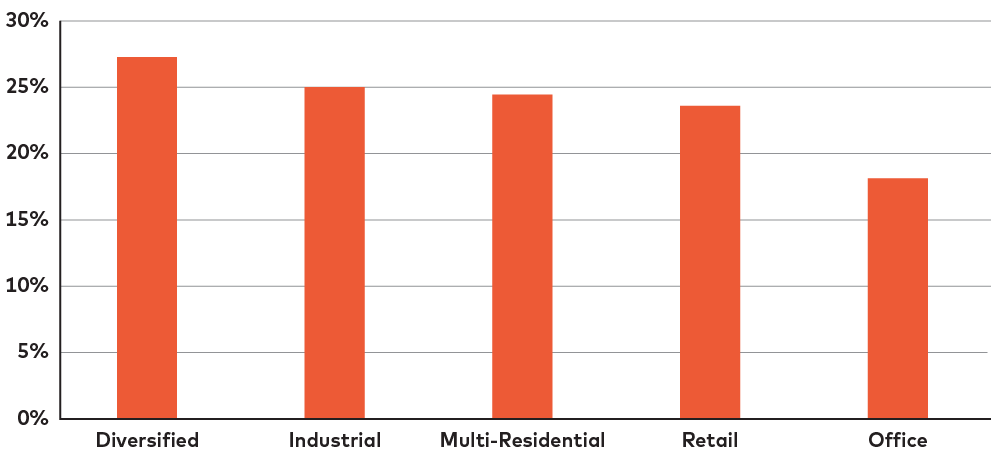

If we look at REIT subsectors and how they have fared so far in 2021, four of the five have outperformed the TSX composite.

REITs: Sub-Sector Performance

Source: Bloomberg LP as of July 30, 2021. Based on a breakdown of constituents listed on the S&P/TSX REIT Index.

In the context of how fast the economy is recovering, this sub-sector performance makes good sense. Clearly, industrial REITs are benefiting from new demand from large consumer firms in need of space to warehouse products and service customers who are increasingly ordering more product online and looking for same-day delivery. Residential and retail REITs are also seeing improving demand and better cash flows – which, again, makes sense. As people get rehired and feel more financially confident, they tend to look for new lodging. Meanwhile, residential REIT revenues are recovering as deferred payments from tenants who were unemployed and receiving government benefits continue to normalize lower month by month. In the retail space, businesses are being allowed to reopen and are beginning to see their revenues start to climb back towards normal. Those REITs servicing the sector are seeing stronger monthly cash flows and lower delinquencies. And in some markets, they are also reaping the reward of heightened demand for better locations – which may result in some early pricing advantages.

Not surprisingly, the relative laggards in the sector are office REITs. Many businesses have not fully returned to in-person operations, and while most of these leases are quite long in duration, tenant delinquencies and future demand are much less clear. Over the long term, the future of the traditional office environment itself remains unclear – will workers and companies simply decide they can get just as much (if not more) done from home at lower cost? – and that is certainly a headwind for office REIT performance.

Obviously, not all REITs are created equal, but the rising tide of recovery and inflation has helped to lift a lot of boats. (Even office REITs have not performed that poorly: the subsector’s return is well in line with the TSX composite’s 17.5% year-to-date return, according to Bloomberg) And we do not see much reason to expect their time in investors’ focus will end anytime soon, as most evidence suggests the recovery remains intact and heightened inflation expectations are here to stay in the near to medium term. Of course, if events of the past 18 months have taught us anything, it’s that anything can happen. But barring the unforeseen, REITs should be well positioned to continue to benefit from a world that, at long last, seems to be on the mend.

Mike Archibald is a Vice-President and Portfolio Manager at AGF Investments Inc. He is a regular contributor to AGF Perspectives.

To learn more about our fundamental capabilities, please click here.

To learn more about our fundamental capabilities, please click here.

To learn more about our fundamental capabilities, please click here.

The commentaries contained herein are provided as a general source of information based on information available as of July 30, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

RO:1749593

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.