by Don Vialoux, EquityClock.com

Technical Notes for yesterday at

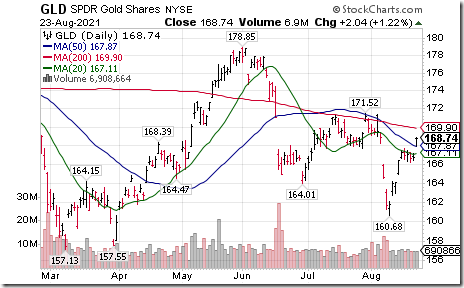

Gold Bullion ETN $GLD moved above its 20 and 50 day moving average, an encouraging technical sign. Seasonal influences have come in later than usual this year, but finally have shown up on the charts. Seasonal influences are positive on a real and relative basis. If you are a www.EquityClock.com subscriber, see charts.equityclock.com/spdr…

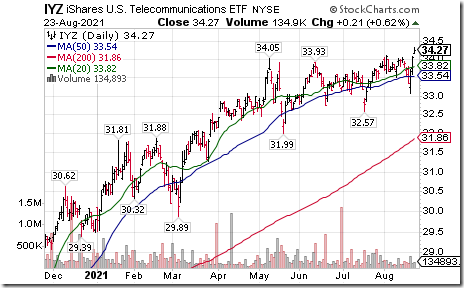

U.S. Telecommunications iShares $IYZ moved above $34.10 to an all-time high extending an intermediate uptrend.

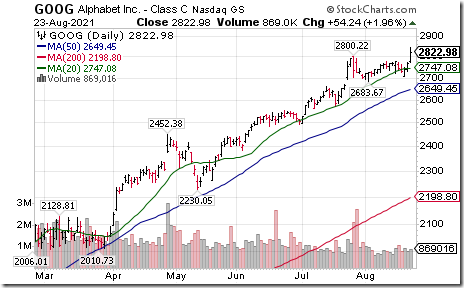

Alphabet $GOOG a NASDAQ 100 stock moved above $2,800.22 to an all-time high extending an intermediate uptrend. Seasonal influences are positive on a real and relative basis. If you are a www.EquityClock subscriber, see:

https://charts.equityclock.com/comcast-corporation-nasdaqcmcsa-seasonal-chart

NVIDIA $NVDA a NASDAQ 100 stock moved above $208.75 to an all-time high extending an intermediate uptrend. Seasonal influences are positive on a real and relative basis. If you are a www.EquityClock.com subscriber, see: https://charts.equityclock.com/nvidia-corporation-nasdaqnvda-seasonal-chart

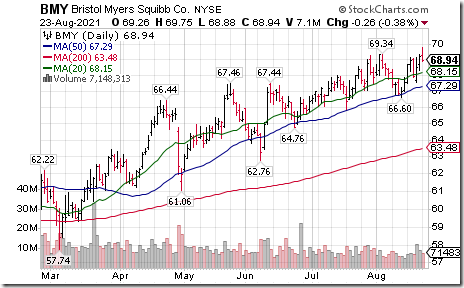

Bristol-Myers $BMY an S&P 100 stock moved above $69.34 to an all-time high extending an intermediate uptrend. Seasonal influences are positive on a real a relative basis. If you are a www.EquityClock.com subscriber, see: https://charts.equityclock.com/bristol-myers-squibb-co-nysebmy-seasonal-chart

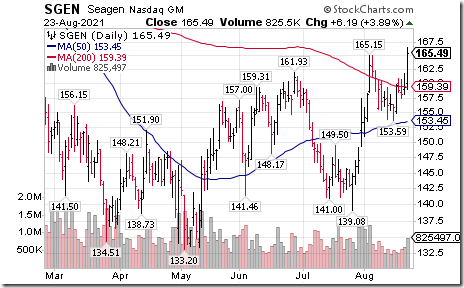

Seattle Genetics $SGEN a NASDAQ 100 stock moved above $165.15 extending an intermediate uptrend. Seasonal influences are positive on a real and relative basis. If you are a subscriber to www.equityclock.com , see charts.equityclock.com/seat…

Trader’s Corner

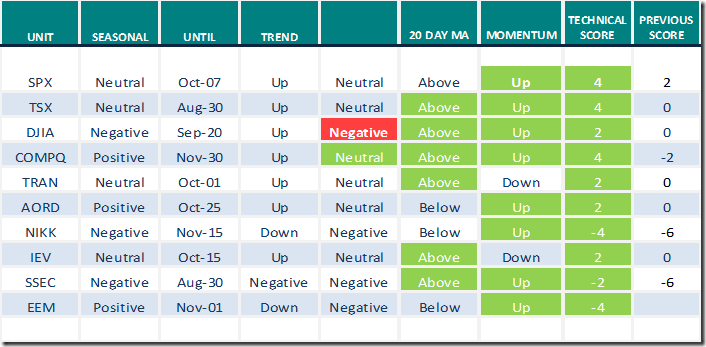

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

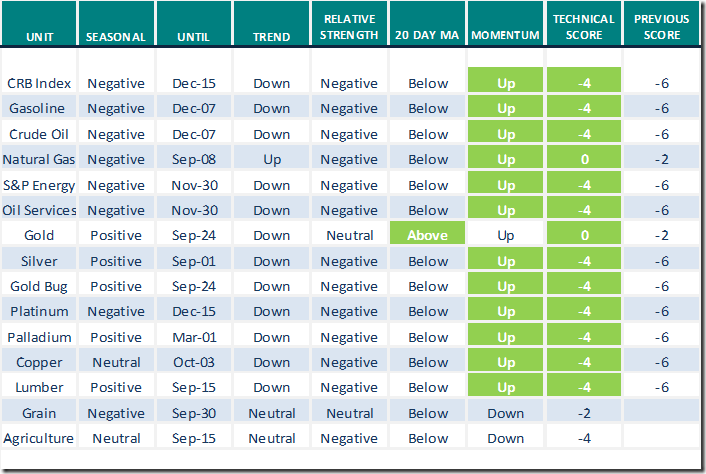

Commodities

Daily Seasonal/Technical Commodities Trends for August 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

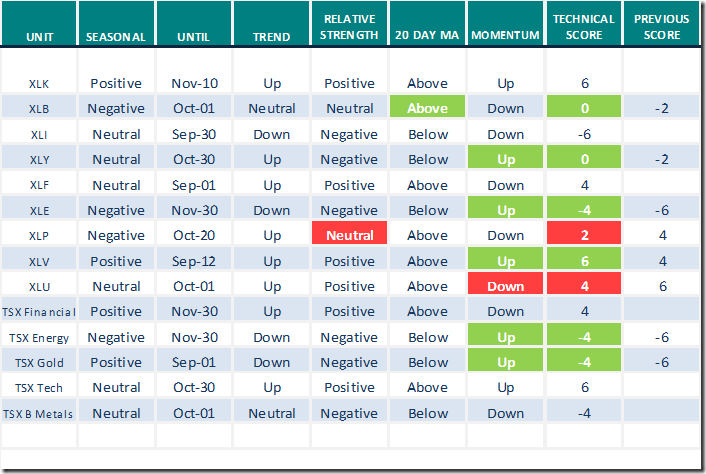

Sectors

Daily Seasonal/Technical Sector Trends for August 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Technical Scoop

Technical Scoop is back after a brief holiday. Thank you to David Chapman and www.EnrichedInvesting.com for the link. Headline reads, “Delta rise, Heat impact, Gold view, Toppy market, Downward revision, Taper watch”

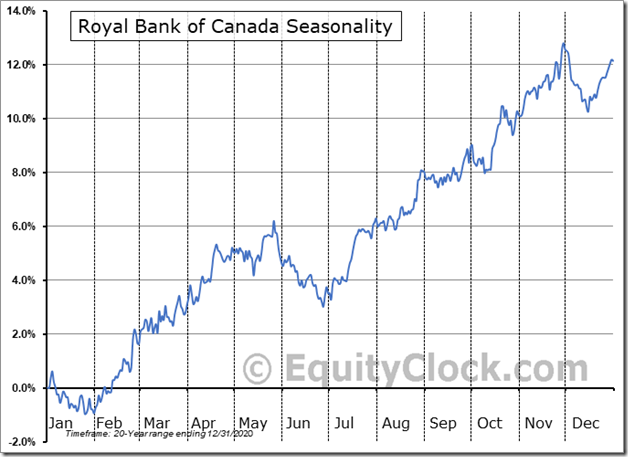

Seasonality Chart of the Day from www.EquityClock.com

Royal Bank is well into its period of seasonal strength on a real and relative basis between July and the beginning of December.

Canada’s major banks are scheduled to release fiscal third quarter earnings this week. Royal Bank is scheduled to report on Wednesday. Traders are anticipating good news. Royal Bank moved to an all-time high yesterday.

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.21 to 63.33 yesterday. It remains Overbought.

The long term Barometer added 2.61 to 80.36 yesterday. It changed from Overbought to Extremely Overbought on a move above 80.00.

TSX Momentum Barometers

The intermediate term Barometer gained 4.88 to 48.78 yesterday. It remains Neutral.

The long term Barometer added 4.88 to 69.76 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.