by Andrew Stumacher, AllianceBernstein

In the buildup to retirement, plan participants and sponsors prioritize saving and protecting assets to generate a retirement income. As a result, most retirement income products focus on alleviating key risks such as outliving assets and market volatility.

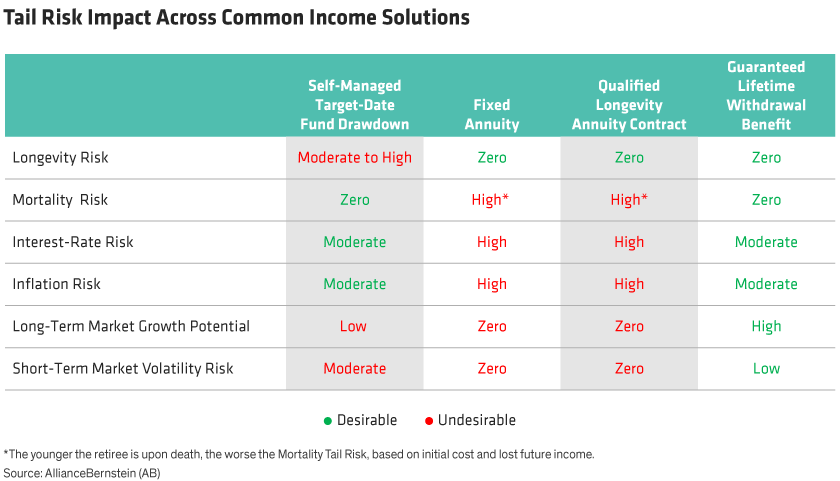

But different risks lurk on the other side of retirement too, such as premature death, interest-rate and inflation hikes, and missed growth opportunities. These so-called tail risks can change a participant’s retirement course just as much, and not all income products address them equally, if at all.

The Severe Impact of a Retirement Cut Short

When Social Security was created in the 1930s, the average lifespan was 65. Those who reach this age in the US today are very likely to see 85 too, according to the United States Department of Health and Human Services. This means most people will experience a 25- to 30-year retirement, which is a long time without a paycheck.

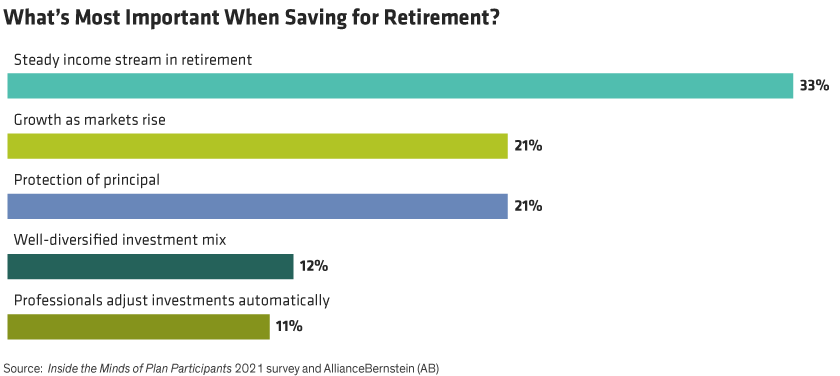

Understandably, the biggest worry is running out of retirement savings while otherwise enjoying a long and happy life. And it’s probably why one of every three participants we surveyed rank income as their chief retirement savings goal (Display). And as more plan sponsors provide a clearer picture of what that income could look like, participation levels have popped as well.

Creating lifetime income via an annuity may solve the problem of running out of money in retirement, but it can force the hand of another: mortality risk. That is, what if a participant dies younger, for example at age 70? Besides the human toll, the financial impact can be catastrophic depending on the product. For example, fixed annuity payouts and fees are rigidly based on life expectancies. But the product’s mortality-risk exposure is severe if the retiree dies young, given that the participant would have expected many years of additional income payments.

Interest Rates and Inflation Can Also Foil Retirement Income

Interest-rate and inflation risks are also potential concerns for retirees, and some guaranteed income options are much more sensitive to these risks than others. For instance, rising rates are a big tail risk for fixed annuities and qualified longevity annuity contracts, because their income is locked in and retirees can’t benefit later from higher rates. Same goes for inflation risk, which leads to higher living costs that erode purchasing power for retirees whose guaranteed income is fixed.

No one can predict the direction of interest rates or inflation. But with rates historically so low for this long, and inflation picking up some, it’s fair to say these tail risks seem more likely than not. And sponsor decisions about income products, some of which are irrevocable, should carefully weigh how interest rate and inflation risk can be managed, both in retirement and leading up to it.

There’s Market Risk on the Upside Too

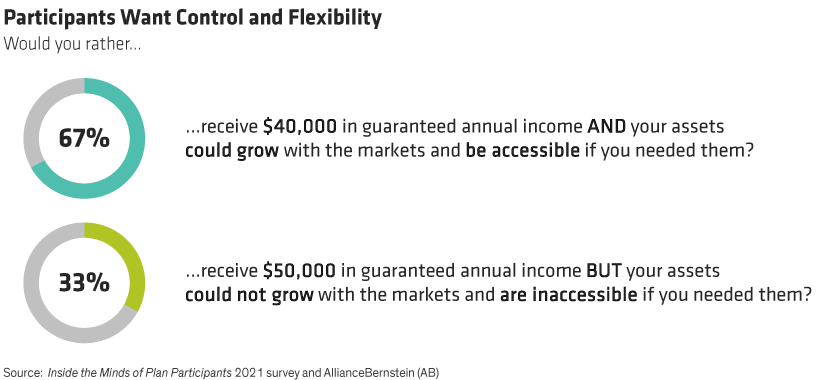

The flip side of the risk equation also applies to asset allocation in retirement. Retirees may dial down their equity exposure to avoid the downdraft of a poor market. But this can create a tail risk in the other direction by reducing or eliminating upside market participation, which remains just as important for many retirees, as does easy access to their funds.

In fact, even knowing what they may have to give up in income to get more liquidity and upside potential, 67% were willing to do it (Display).

Growth potential with downside protection follows the same asset-allocation logic in retirement as it does while saving for it. It all boils down to market exposure, which varies across income options. Fixed annuities and qualified longevity annuity contracts have no equity positions once annuitized, eliminating any short-term volatility risk but giving up all upside growth potential. In our view, this price is too high. Retirement income needs a chance to strategically grow to keep up with inflation and raise income levels, if possible.

Weigh Pressing and Potential Risks Together…and Now

Insurance companies design income products and fiduciaries self-fund their retirement programs based on averages, from life spans to administrative costs. But retirement also has extreme tail risks that can make it more personal and unconventional for participants. And depending on the chosen income solution, such risks can either be harmful or nothing to worry about (Display).

Tail risks in retirement are unpredictable. And few income products can deal with all of them perfectly. But if providing a meaningful retirement is the broader goal, plan sponsors should weigh all of the potential risks that a participant may face and be careful not to solve certain risks while exacerbating others.

Andrew Stumacher is Product Director—Custom Defined Contribution Solutions at AB.

Howard Li is Research Analyst for Multi-Asset Solutions at AB.

Christopher Nikolich is Head of Glide Path Strategies (US) for Multi-Asset Solutions at AB.

“Target date” in a fund’s name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..