by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

U.S. Dollar Index $USD moved above 93.47 to 93.56 completing a double bottom pattern

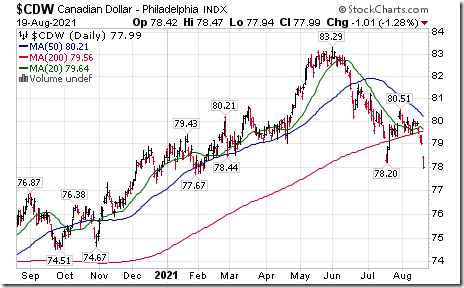

Canadian Dollar responded strongly to U.S. Dollar strength. The Canuck Buck $CDW moved below US78.20 cents completing a modified Head & Shoulders pattern.

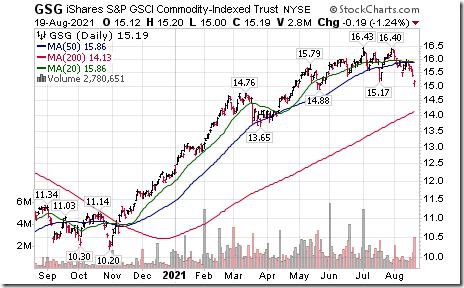

Commodity prices responded to strength in the U.S. Dollar Index. Industrial commodities iShares $GSG moved below $15.17 completing a Head & Shoulders pattern.

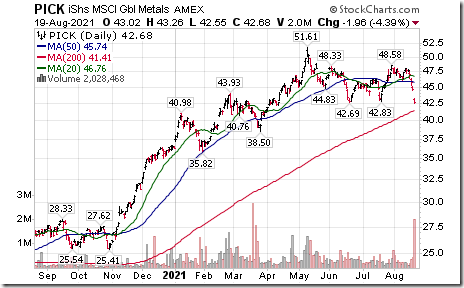

Base metals ETFs on both sides of the border have completed double top patterns. $PICK $ZMT.CA

Copper equity ETF $COPX moved below $33.35 completing a Head & Shoulders pattern

Base metal stocks $RIO $LUN.CA $HBM.CA completed Head & Shoulders and Double Top patterns by moving below intermediate support

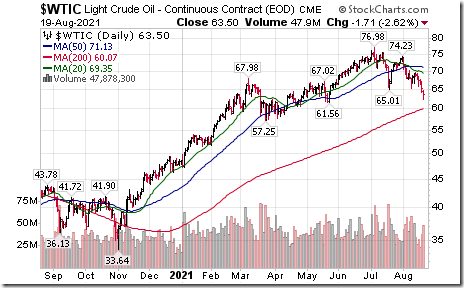

The market is showing signs of instability, something that the price action in Copper and Oil are telegraphing nicely. equityclock.com/2021/08/18/… $HG_F $CL_F $CPER $USO

Another base metals stock breakdown! Teck Resources $TECK a TSX 60 stock moved below $19.67 extending an intermediate downtrend.

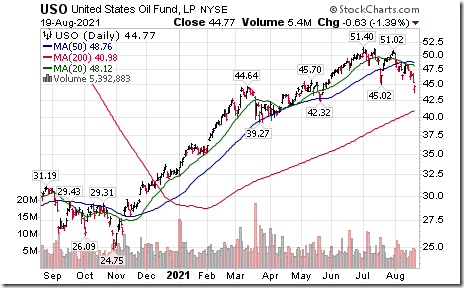

U.S. Crude Oil ETN $USO moved below $45.02 completing a double top pattern.

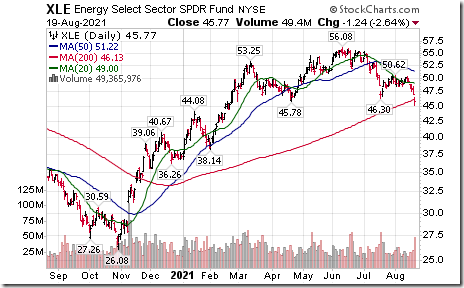

Energy SPDRs $XLE and related U.S. energy stocks $COP $XOM $CVX completed Head & Shoulders and Double Top patterns by moving below intermediate support

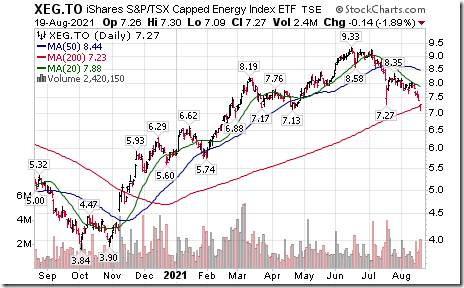

Canadian energy ETFs $$XEG.CA and related "oily" stocks $CVE.CA $CNQ.CA completed Head & Shoulders and Double Top patterns by breaking intermediate support.

Oil service stocks on both sides of the border are moving lower in response to dropping crude oil prices. Schlumberger $SLB moved below $25.91 Trican Well Services $TCW.CA broke support at $2.33.

Franco-Nevada $FNV a TSX 60 stock moved below intermediate support at US$142.01.

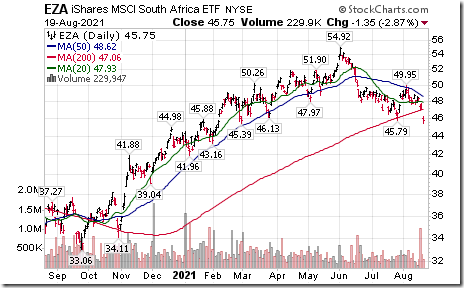

South Africa iShares $EZA moved below $45.79 extending an intermediate downtrend.

Intel $INTC a Dow Jones Industrial Average stock moved below $51.97 extending an intermediate downtrend.

Coca Cola $KO a Dow Jones Industrial Average stock moved below $56.00 completing a double top pattern.

Ford $F an S&P 100 stock moved below $12.79 extending an intermediate downtrend.

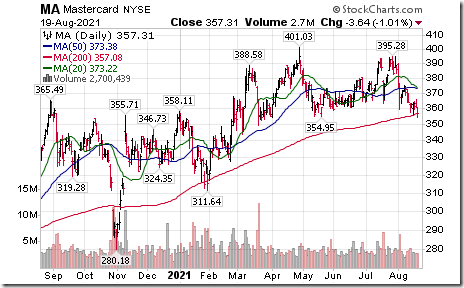

Mastercard $MA an S&P 100 stock moved below $354.95 completing a double top pattern.

Synopsis $SNPS a NASDAQ 100 stock moved above $300.91 to an all-time high extending an intermediate uptrend.

Pepsico $PEP a NASDAQ 100 stock moved above $158.66 to an all-time high extending an intermediate uptrend.

Waste Connections $WCN.CA , a TSX 60 stock moved above $160.90 to an all-time high extending an intermediate uptrend.

Magna International $MG.CA a TSX 60 stock moved below $99.33 extending an intermediate downtrend.

Trader’s Corner

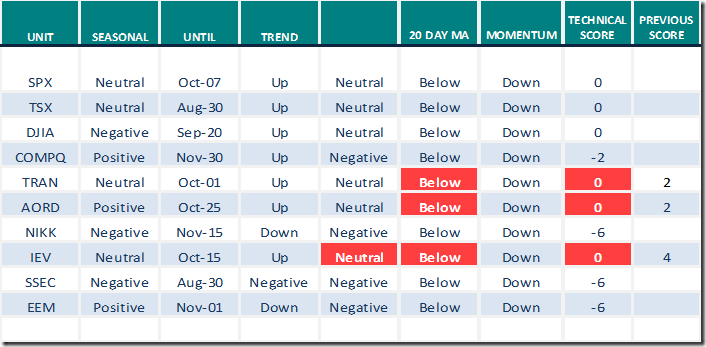

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 19th 2021

Green: Increase from previous day

Red: Decrease from previous day

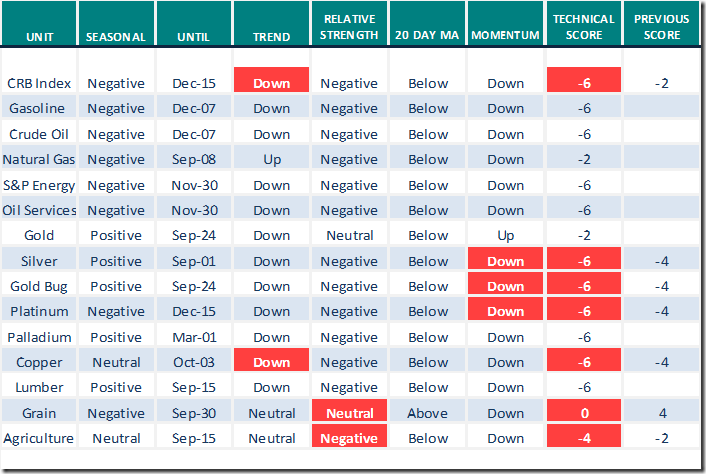

Commodities

Daily Seasonal/Technical Commodities Trends for August 19th 2021

Green: Increase from previous day

Red: Decrease from previous day

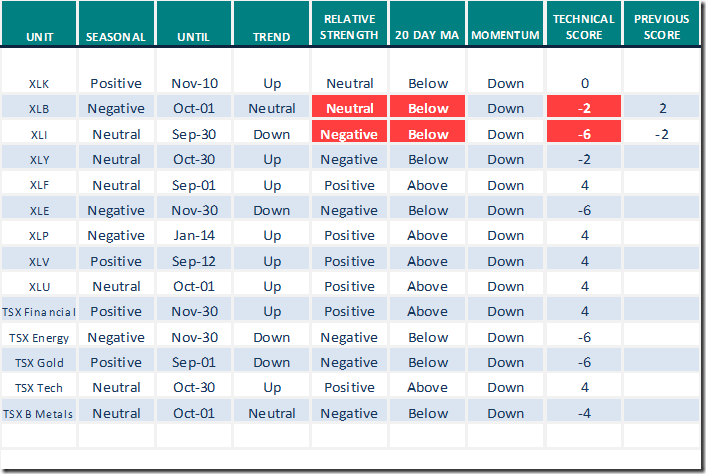

Sectors

Daily Seasonal/Technical Sector Trends for August 19th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

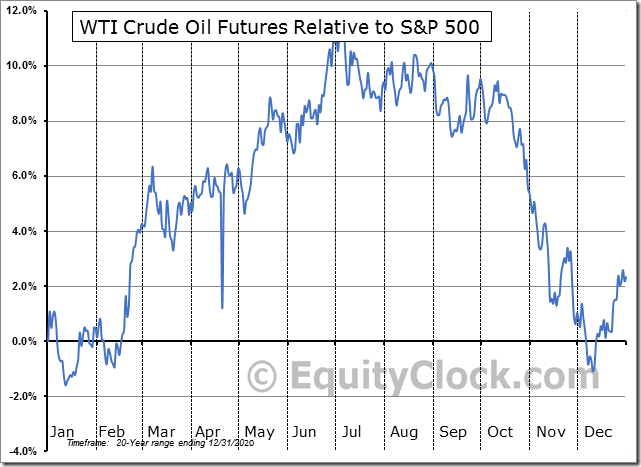

Seasonality Chart of the Day from www.EquityClock.com

Crude oil has a history of moving lower on a real and relative basis (relative to the S&P 500 Index) from the beginning of July to the middle of December.

On the charts, WTI crude oil closely is following its seasonal pattern. “Oily” stocks have a similar seasonal and technical profile.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.20 to 56.51 yesterday. It remains Neutral and trending down.

The long term Barometer dropped another 3.81to 75.95 yesterday. It remains Overbought and trending down.

TSX Momentum Barometers

The intermediate term Barometer dropped 4.88 to 40.00 yesterday. It remains Neutral and trending down.

The long term Barometer slipped 0.98 to 64.39 yesterday. It remains Overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.