by Don Vialoux, EquityClock.com

The Bottom Line

U.S. and Canadian equity indices were slightly higher again last week. Greatest influences remain ramping up of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a COVID 19 vaccine (positive).

Observations

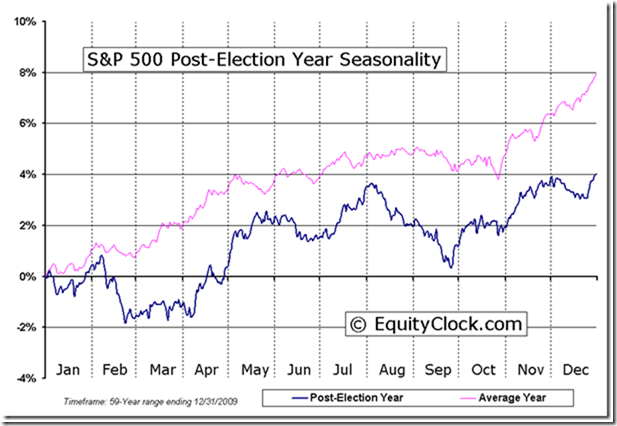

Favourable seasonal influences for U.S. equity markets to the beginning of August (particularly in a Post-U.S. Presidential Election year) were extended last week. The S&P 500 Index and Dow Jones Industrial Average continued to rally to all-time highs while the NASDAQ Composite Index weakened slightly. Strength into early August during Post-U.S. Presidential Election years is related to a “honey moon” period when investors anticipate launch of a new mandate by the President. Strength by U.S. equity markets last week was triggered once again by surprisingly strong second quarter results that overwhelmed growing COVID 19 concerns: Of the 91% of S&P 500 companies that have released quarterly results to date, 87% exceeding consensus earnings estimates and 87% exceeding consensus revenue estimates. However, if history repeats, North American equity markets shortly will reach an important intermediate top. Normally, U.S. equity markets record a mild correction of 3%-4% between now and the end of September.

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) mostly moved higher last week.

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week and changed from Neutral to Overbought on a move above 60.00%. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) was slightly lower last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were higher last week, particularly the financials sector. Exception was the gold sector.

Intermediate term technical indicator for Canadian equity markets moved slightly lower last week. It remained Neutral. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) moved slightly lower last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies increased slightly from our report last week. According to www.FactSet.com earnings in the second quarter on a year-over-year basis are projected to increase 89.3% (versus previous estimate last week at 88.8%) and revenues are projected to increase 24.8% (versus previous estimate at 24.7%). Earnings in the third quarter are projected to increase 27.8% (versus previous estimate at 28.0%) and revenues are projected to increase 14.5% (versus previous estimate at14.4%. Earnings in the fourth quarter are projected to increase 21.3% (versus previous estimate at 21.4%) and revenues are projected to increase 11.0%. Earnings for all of 2021 are projected to increase 41.9% (versus previous estimate at 41.6%) and revenues are projected to increase 14.5% (versus previous estimate at 14.3%). Earnings in 2022 are projected to increase 9.4% (versus previous estimate at 9.5%) and revenues are projected to increase 6.5%.

Economic News This Week

August Empire State Manufacturing Survey to be released at 8:30 AM EDT on Monday is expected to ease to 30.00 from 43.00 in July.

July Retail Sales to be released at 8:30 AM EDT on Tuesday are expected to slip 0.2% versus a gain of 0.6% in June. Excluding auto sales July Retail Sales are expected to increase 0.2% versus a gain of 1.3% in June.

Canadian July Housing Starts to be released at 8:15 AM EDT on Tuesday are expected to slip to 270,800 from 282,100 in June.

July Capacity Utilization to be released at 9:15 AM EDT on Tuesday is expected to increase to 75.7 from 75.4 in June. July Industrial Production is expected to increase 0.5% versus a gain of 0.4% in June.

July Business Inventories to be released at 10:00 AM EDT on Tuesday are expected to increase 0.8% versus a gain of 0.5% in June.

July U.S. Housing Starts to be released at 8:30 AM EDT on Wednesday are expected to slip to 1.608 million units from 1.643 million units in June.

July Canadian Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.4% versus a gain of 0.3% in June.

August Philly Fed Index to be released at 8:30 AM EDT on Thursday is expected to increase to 28.0 from 21.9 in July.

Canadian June Retail Sales to be released at 8:30 AM EDT on Friday are expected to drop 4.4% versus a decline of 2.1% in May. Excluding auto sales, June retail sales are expected to slip 2.2% versus a decline of 2.0% in May.

Selected Earnings News This Week

Frequency of quarterly reports by S&P 500 and TSX 60 companies is winding down: 91% of S&P 500 reports have been released to date. Another 19 S&P 500 companies are scheduled to release results this week (including three Dow Jones Industrial Average companies: Wal-Mart, Home Depot and Cisco).

Focus this week is on U.S. Retailers.

Trader’s Corner

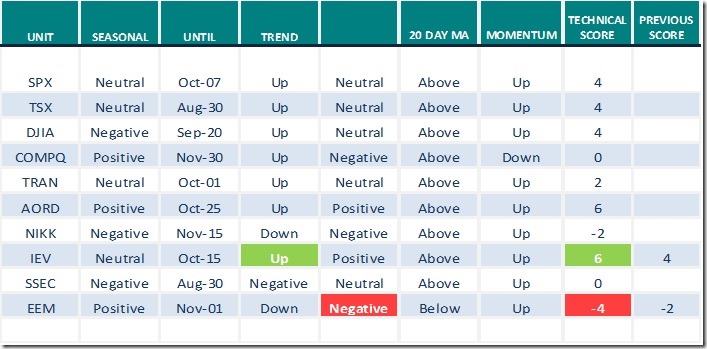

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

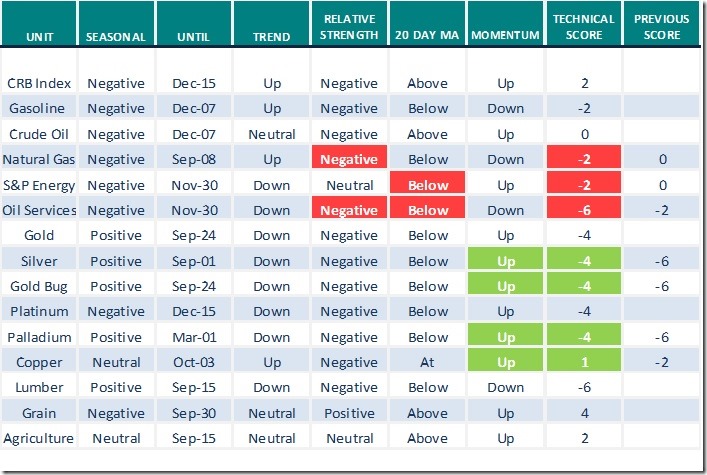

Commodities

Daily Seasonal/Technical Commodities Trends for August 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

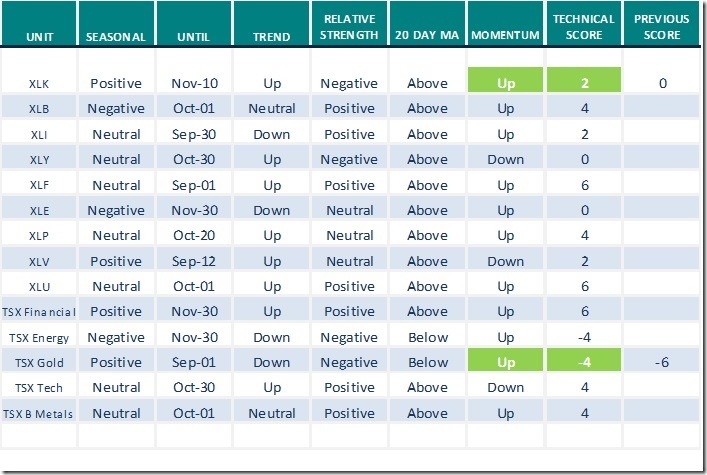

Sectors

Daily Seasonal/Technical Sector Trends for August 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Market Seasonality 101

An explanation and proof that seasonality works.

Pulver Report – Market Seasonality (Trading Trends & Ranges in Stocks & Forex) – YouTube

Other Links

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following reports:

11 Mighty U.S. Mid-Caps

11 Mighty U.S. Mid-Caps – Uncommon Sense Investor

Dumb Money at Highest Percentage in 70 Years Breaking Legend’s Classic Rule: A list of Bob Farrell’s 10 rules of investment also is provided.

Three Canadian Stocks to Sell

3 Canadian Stocks to Sell | Morningstar

Wall Street is the most bullish on stocks in almost two decades

Wall Street Is the Most Bullish on Stocks in Almost Two Decades (yahoo.com)

The 21 best stocks to buy for the rest of 2021

The 21 Best Stocks to Buy for the Rest of 2021 | Kiplinger

10 reasons why stocks fall

10 Reasons Why Stocks Fall – The Irrelevant Investor

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

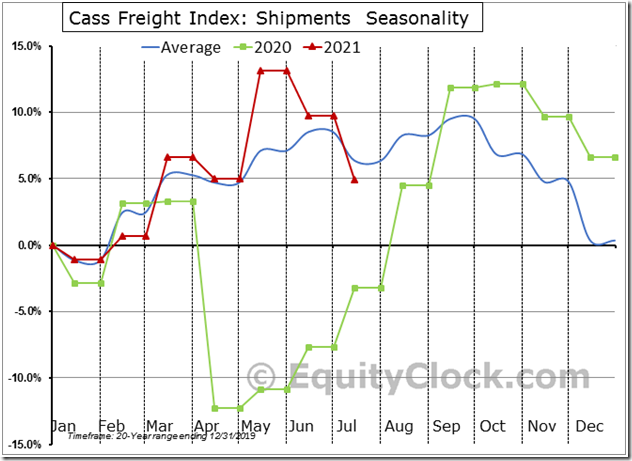

As the period of strength for the transportation sector approaches, we look to the fundamental backdrop to determine if a position is warranted.

equityclock.com/2021/08/13/… $IYT $XTN $DJT $STUDY #Economy

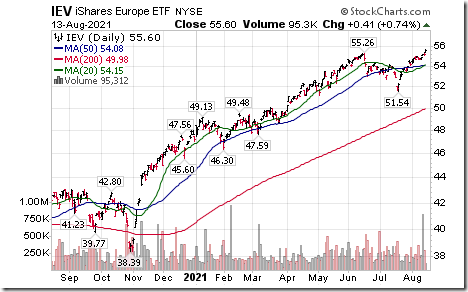

Europe iShares $IEV moved above $55.26 to an all-time high extending an intermediate uptrend.

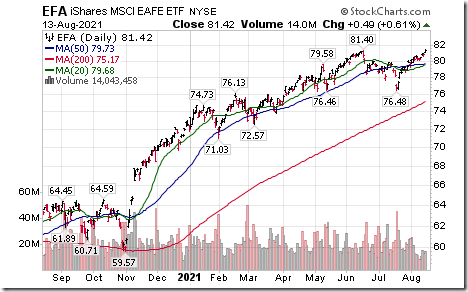

Europe, Africa, Far East iShares $EFA moved above $81.40 to an all-time high extending an intermediate uptrend.

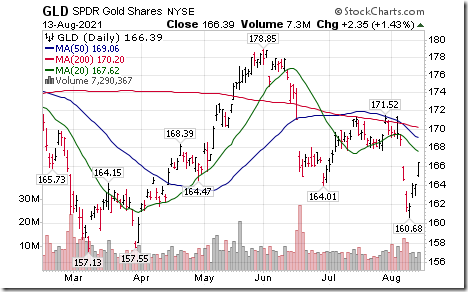

Gold $GLD and gold stocks/related ETFs $GDX $GDXJ $XGD.CA advanced on weakness in the U.S. Dollar Index. Investors are questioning the ability of Congress to pass an Infrastructure Bill on a timely basis.

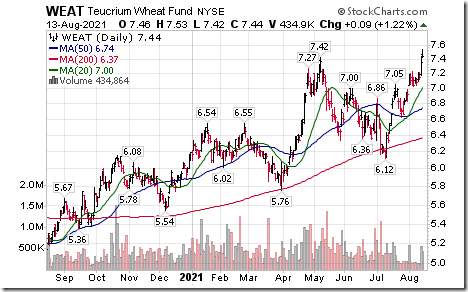

Wheat ETN $WEAT moved above $7.42 extending an intermediate uptrend. Responding to continuing dry conditions in North American wheat growing areas.

Disney $DIS a Dow Jones Industrial Average stock moved above $186.29 extending an intermediate uptrend. Responding to higher than consensus fiscal third quarter revenues and earnings.

Baidu $BIDU a NASDAQ 100 stock moved below $153.14 extending an intermediate downtrend.

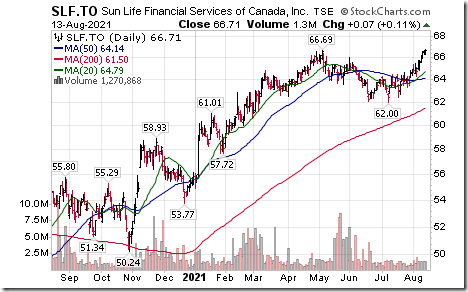

Sun Life Financial $SLF.CA a TSX 60 stock moved above $66.69 to an all-time high extending an intermediate uptrend.

Canopy Growth $WEED.CA a TSX 60 stock moved below $22.72 extending an intermediate downtrend.

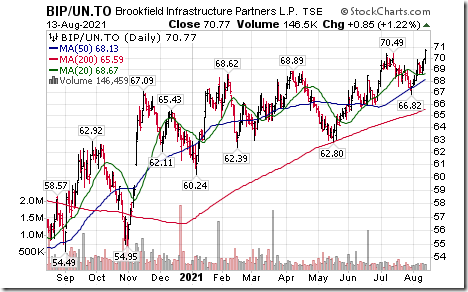

Brookfield Infrastructure $BIP.U.CA a TSX 60 stock moved above $70.49 to an all-time high extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate term Barometer was unchanged on Friday and increased 5.61 last week to 68.94. It remained Overbought

The long term Barometer slipped 0.20 on Friday, but added 0.80 last week to 85.37. It remained extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.97 on Friday and 1.94 last week to 55.34. It remained Neutral.

The long term Barometer added 0.97 on Friday, but slipped 1.46 last week. It remained Overbought

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.