by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Match $MTCH a NASDAQ 100 stock moved below intermediate support at $152.48 after reporting lower than consensus second quarter earnings.

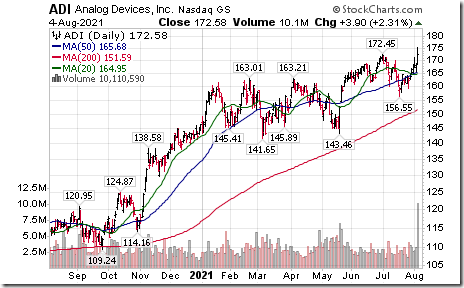

Analog Devices $ADI a NASDAQ 100 stock moved above $172.45 to an all-time high extending an intermediate uptrend.

Following an abrupt uptick in strength of core cyclical sectors to end the month of July, we see hints of risk-taking re-emerging. equityclock.com/2021/08/03/… $NUE $STLD $MT $VALE $CLF $X $WOR $RS $CMC

Platinum ETN $PPLT moved below $97.08 extending an intermediate downtrend.

Merck $MRK a Dow Jones Industrial Average stock moved below $75.64 completing a double top pattern.

Verisign $VRSN a NASDAQ 100 stock moved below intermediate support at $214.04

Seagen $SGEN a NASDAQ 100 stock moved above $161.93 resuming an intermediate uptrend.

General Motors $GM an S&P 100 stock moved below $52.63 completing a Head & Shoulders pattern.

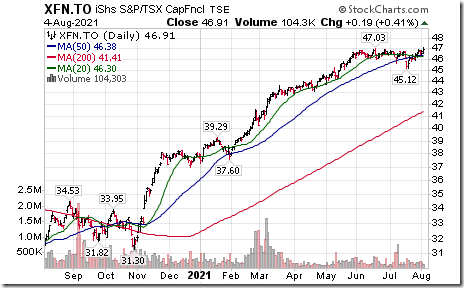

TSX Financials iShares $XFN.CA moved above $47.03 to an all-time high extending an intermediate uptrend.

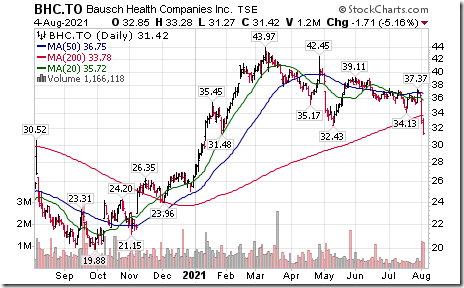

Bausch Health $BHC.CA a TSX 60 stock moved below $32.43 resuming an intermediate downtrend.

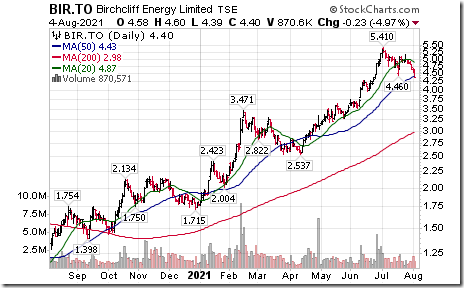

Canadian energy stocks are under technical pressure mainly due to falling crude oil prices. Birchcliffe Energy $BIR.CA dropped through $4.46 completing a double top pattern.

Another Canadian energy stock breakdown! ARC Resources $ARX.CA moved below $8.79 completing a Head & Shoulders pattern.

Trader’s Corner

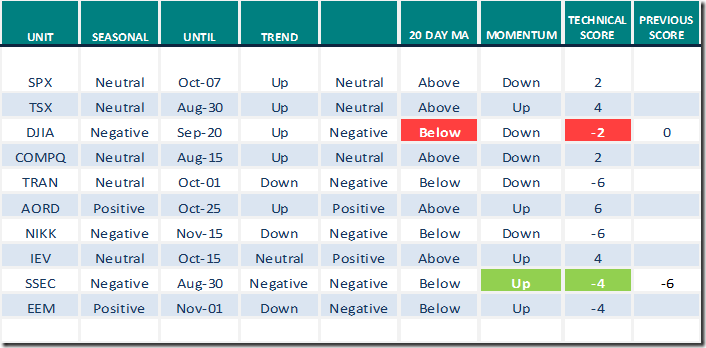

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

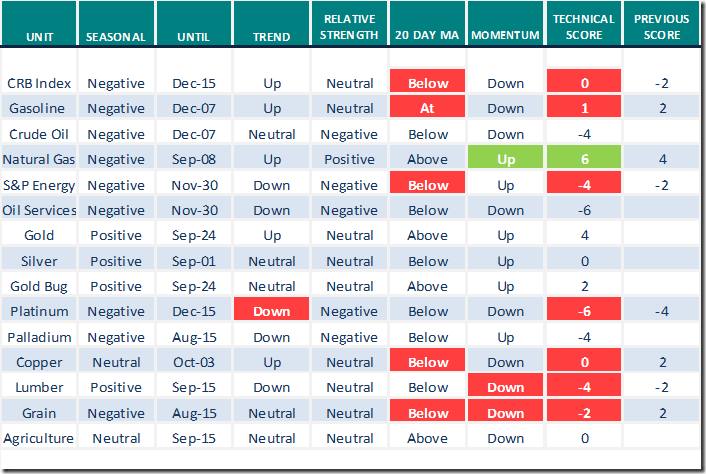

Commodities

Daily Seasonal/Technical Commodities Trends for August 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

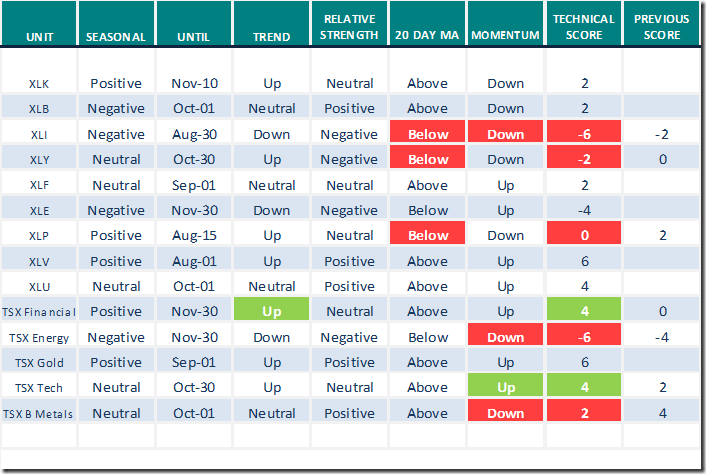

Sectors

Daily Seasonal/Technical Sector Trends for August 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

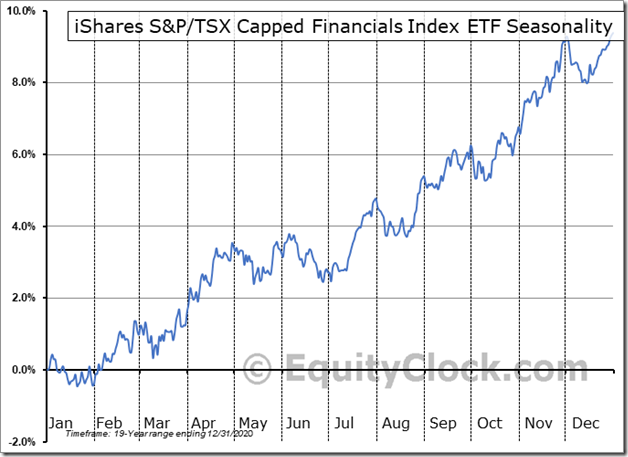

Seasonality Chart of the Day from www.EquityClock.com

Canadian financial services stocks (notably Canadian bank stocks) and related ETFs have a history of moving higher on a real and relative basis (relative to the S&P 500 Index) between July and the end of November. This year, TSX financials ETFs started to move higher in anticipation of strong fiscal third quarter results by Canada’s banks to be reported at the end of August. In addition, possibility of withdrawal of Bank of Canada’s moral suasion on the banks to discontinue dividend increases and share buybacks is pending. Nice breakout yesterday by TSX Financials iShares to an all-time high!

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 7.01 to 53.91 yesterday. It changed back from Overbought to Neutral on a return below 60.00.

The long term Barometer dropped 4.21 to 83.57 yesterday. It remains Extremely Overbought and showing early signs of trending down.

TSX Momentum Barometers

The intermediate term Barometer slipped 2.93 to 55.12 yesterday. It remains Neutral

The long term Barometer dropped 3.90 to 73.17 yesterday. It remains Overbought and showing early signs of trending lower.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.