by Don Vialoux, EquityClock.com

Editor’s Note

Although Monday August 2nd is a partial holiday in Canada, Tech Talk will appear as usual. #alwaysthereforyou

Technical Notes released yesterday at

StockTwits.com@EquityClock

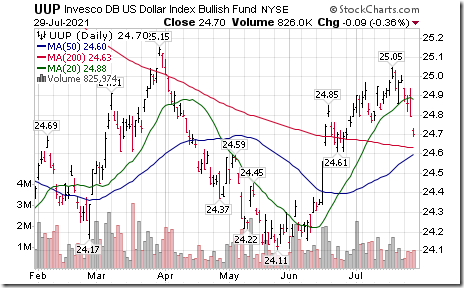

US Dollar Index turning lower from resistance, which bodes well for the seasonal trade in Gold at this time of year. equityclock.com/2021/07/28/… $6C_F $USDCAD $USDX $UUP

Equal Weight S&P 500 ETF $RSP moved above $152.54 to an all-time high extending an intermediate uptrend.

U.S. Brokers iShares $IAI moved above $103.39 to an all-time high extending an intermediate uptrend.

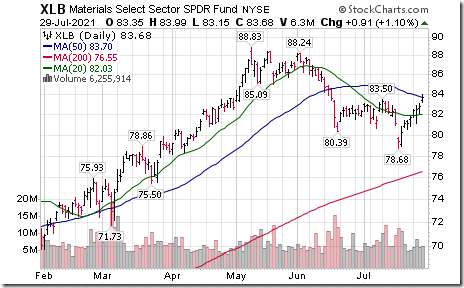

Strength in industrial commodity and precious metal stocks today is related to a sharp drop in the U.S. Dollar Index and its related ETF $UUP

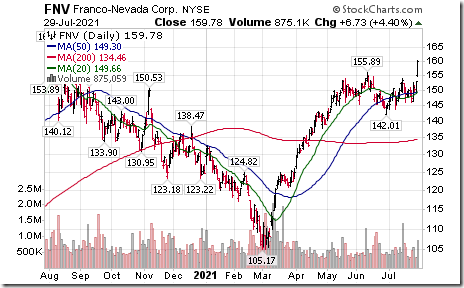

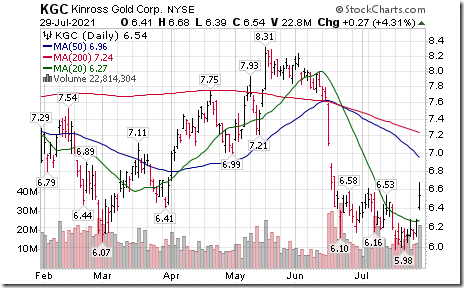

Weakness in the U.S. Dollar has triggered interest in gold and gold stocks/ETFs. Nice breakout by TSX Gold iShares $XGD.TO above $19.28 setting an intermediate uptrend!

Franco.Nevada $FNV a TSX 60 stock moved above US$155.89 extending an intermediate uptrend.

Kinross Gold $KGC a TSX 60 stock moved above intermediate resistance at US$6.58.

Materials SPDRs XLB moved above intermediate resistance at $83.50

Base Metals iShares $XBM.CA moved above intermediate resistance at Cdn$18.55. Ditto for equal weight base metals ETF $ZMT.CA!

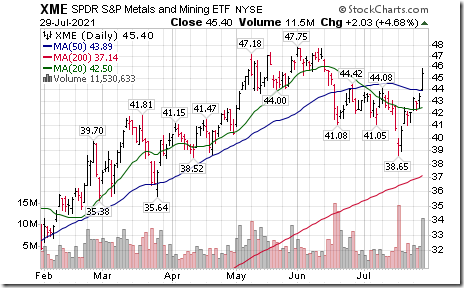

Metals and Mining iShares $XME moved above intermediate resistance at $44.42

Global Base Metals iShares $PICK moved above intermediate resistance at $48.33

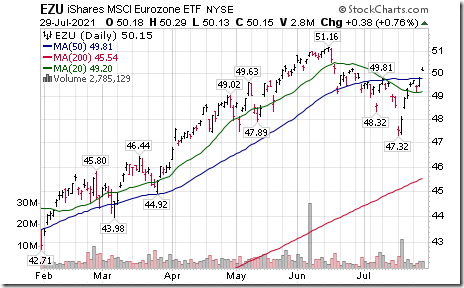

Eurozone iShares $EZU moved above $50.02 extending an intermediate uptrend.

Mexico iShares $EWW moved above $49.82 extending an intermediate uptrend.

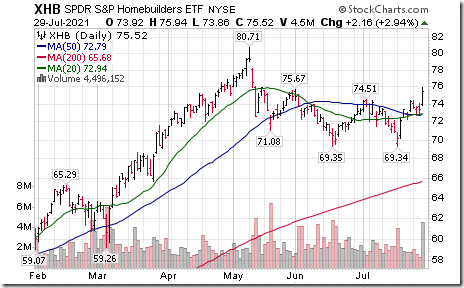

Home Builders SPDRs $XHB moved above intermediate resistance at $74.51

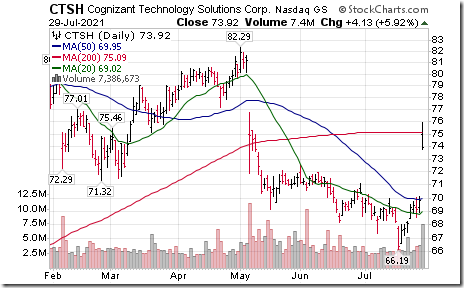

Cognizant $CTSH a NASDAQ 100 stock moved above $71.13 and $72.47 setting an intermediate uptrend. Responded to higher than consensus quarterly results.

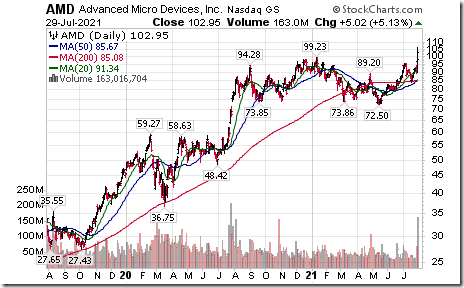

Advanced Micro Devices $AMD a NASDAQ 100 stock moved above $99.23 to an all-time high extending an intermediate uptrend.

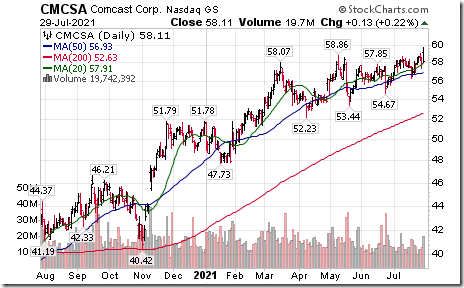

Comcast $CMCSA a NASDAQ 100 stock moved above $58.86 to an all-time high extending an intermediate uptrend.

Xilinx $XLNX a NASDAQ 100 stock moved above $145.55 extending an intermediate uptrend

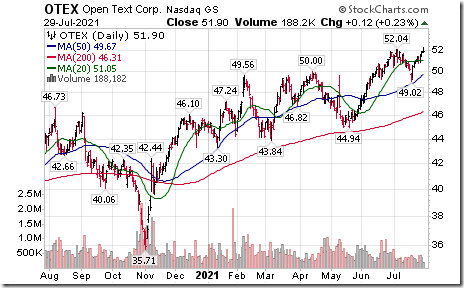

Open Text $OTEX a TSX 60 stock moved above US$52.04 to an all-time high extending an intermediate uptrend.

Trader’s Corner

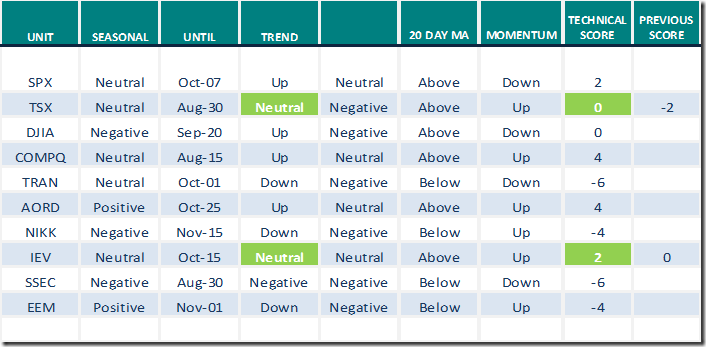

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 29th 2021

Green: Increase from previous day

Red: Decrease from previous day

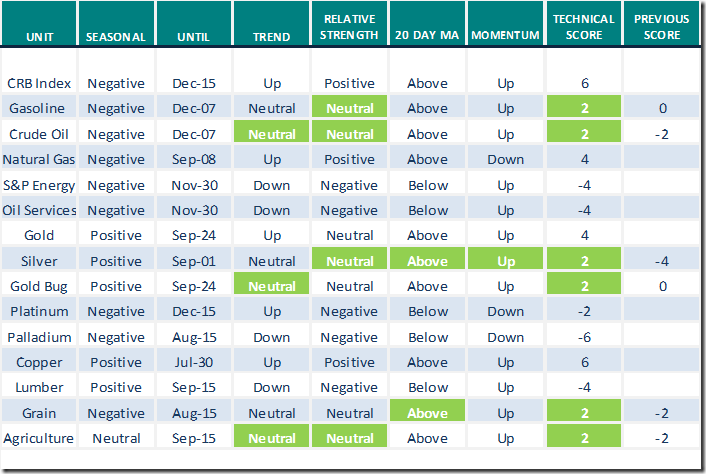

Commodities

Daily Seasonal/Technical Commodities Trends for July 29th 2021

Green: Increase from previous day

Red: Decrease from previous day

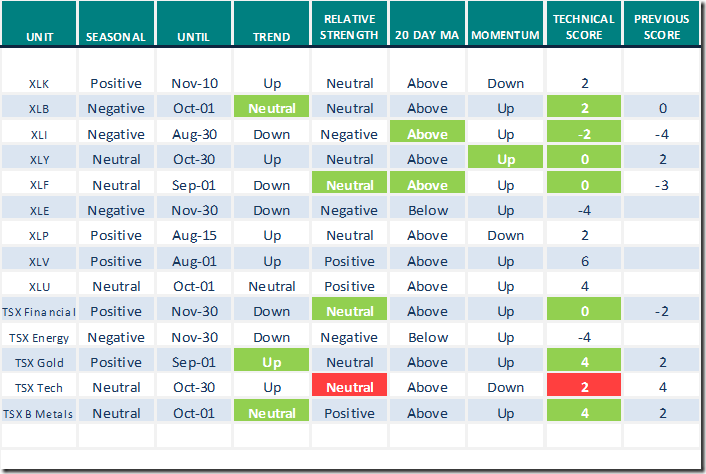

Sectors

Daily Seasonal/Technical Sector Trends for July 29th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

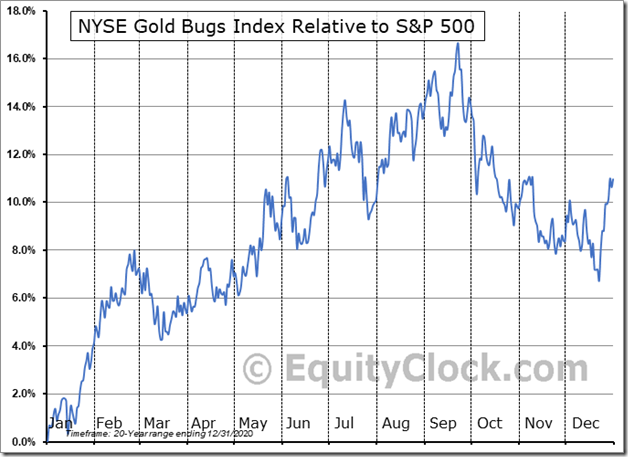

Seasonality Chart of the Day

Favourable seasonal influences on a real and relative basis for gold and gold stocks/ETFs have appeared on schedule near the end of July for an upside move to the third week in September.

S&P 500 Momentum Barometer

The intermediate term Barometer gained 5.01 to 59.32 yesterday. It remains Neutral

The long term Barometer slipped 0.20 to 89.58 yesterday. It remains Extremely Overbought.

TSX Momentum Barometer

The intermediate term Barometer added 2.96 to 54.90 yesterday. It remains Neutral.

The long term Barometer added 2.21 to 77.45 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.