by Christopher Nikolich, AllianceBernstein

Inflation has been on the rise recently, raising concerns about long-run inflation and its impact on the spending power of those who can least afford it—investors approaching or already in retirement. Target-date funds, owned by many defined contribution (DC) plan participants, are designed to simplify investment decisions and reduce principal risk as investors edge toward retirement.

But will target-date funds really help participants retain their spending power in inflationary times? There are strategies to help retirement portfolios guard against inflation, and they’re more critical today than ever before—but with inflation dormant for so many years, not every target-date fund is similarly equipped to be an inflation fighter.

Is Inflation Really a Threat? A Closer Look

It’s been years since investors have needed to incorporate inflation in their investment plans. But as the global economy climbs its way out of the pandemic-induced recession, the demand for goods and services is increasing faster than supply. Prices are rising, and inflation is real—particularly in the US.

Today’s inflation spike is transitory, in our opinion: supply and demand will eventually come into balance as supply chains are unkinked. But, over the longer-term, structural factors and policy regimes may push inflation higher than it’s been in recent experience.

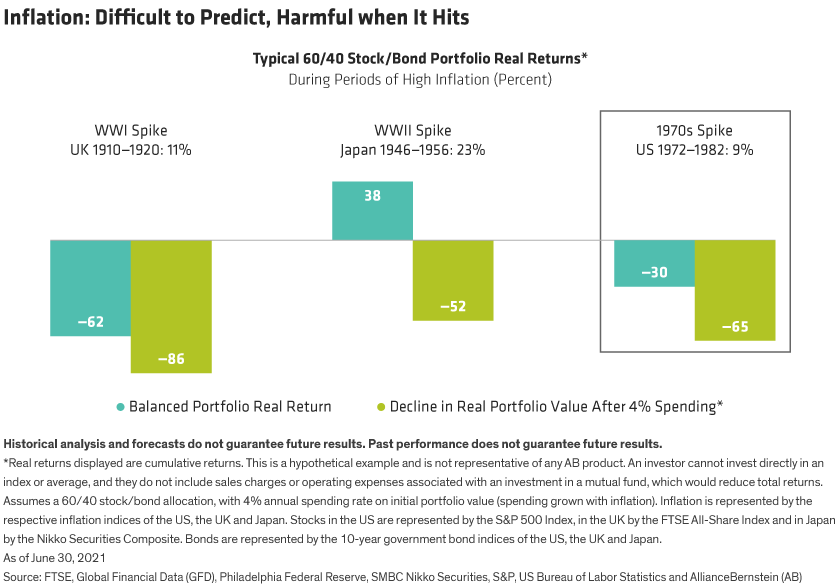

Investors nearing retirement today were children or young adults the last time inflation was a major concern. While we don’t believe this bout of inflation will be anything like the 1970s, that era does provide a good illustration of inflation’s pain. Between 1972 and 1982, inflation averaged 9%, inflicting a 30% inflation-adjusted loss on a classic 60/40 portfolio. What if an investor was retired and also spending 4% of portfolio assets per year during this time? The portfolio value in real terms would have dropped by 65% (Display).

Of course, inflation doesn’t have to be 1970s-style to jeopardize a retirement plan. Inflation spikes might not often happen, but they can be particularly detrimental for retirees who are drawing on their assets. In the short run, pent-up consumer demand, combined with supply friction, should keep inflation higher than normal. Even as supply lines are restored, fiscal and monetary policy will continue to flow into the real economy.

The longer-term outlook for prices will be greatly influenced, in our view, by structural factors such as demographics, technological progress and populism, not to mention the policy regime itself. When combined, these factors will likely increase the probability of higher inflation in the future. How target-date funds are equipped to handle it is an all-important consideration for DC plans.

What Does It Take to Protect a Portfolio from Inflation?

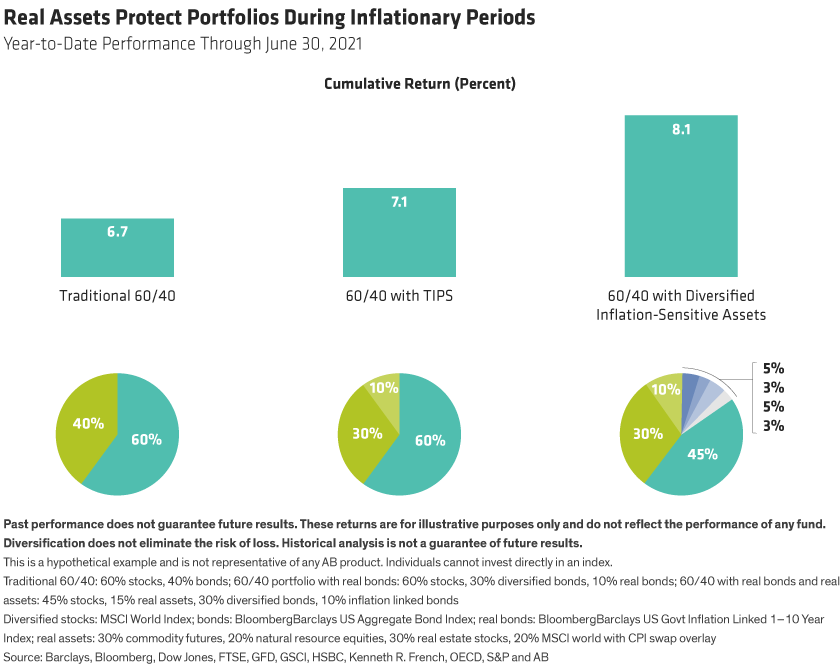

Some target-date funds have tried to solve for inflation by including Treasury Inflation-Protected Securities (TIPS) in their bond allocations. While TIPS can offer some relief from price hikes, they have a downside, too. Investors give up income when TIPS are substituted for bonds—TIPS yields are almost always lower than those of comparable Treasury bonds. So, while an allocation to TIPS can make sense, they won’t provide enough protection on their own when inflation strikes.

Most target-date funds rely primarily on TIPS, counting on a combination of TIPS and equity exposure, which can have inflation-fighting capability. We believe that target-date funds can—and should—do better. There’s no silver bullet to slay inflation—no single asset is a perfect weapon—but we believe that a diversified mix of growth-oriented and inflation-sensitive assets can provide an answer to the inflation problem.

Target-date funds that include a blended bundle of inflation-sensitive real assets in their portfolios— such as commodities, real estate, natural resource stocks and infrastructure—have fared much better than a traditional 60/40 portfolio, or even a 60/40 portfolio that includes TIPS during this year’s inflation run up (Display).

The allocation to real assets marginally decreases the equity exposure; if inflation is muted or absent, that lower equity exposure can cause performance to lag. But we think forgoing some upside to protect retirement savings from the potential devastation of inflation is a sensible choice. The difference real assets can make in a portfolio performance during inflation is striking.

Inflation-Sensitive Assets Aren’t One Size Fits All

Of course, investors’ needs change as they move toward retirement, and the mix of inflation-fighting assets should evolve to address these needs. The risk, return and inflation-sensitivity of real assets vary, so the mixture should change as investors get closer to retirement.

For younger investors, the allocation to inflation-sensitive assets is more about diversification, because their equity exposure should outpace inflation over very long horizons. Investors approaching or in retirement, in contrast, need more defense against inflation. Their inflation protection should not only be a bigger portion of their portfolio but also increasingly focused on assets most responsive to inflation.

Within target-date funds, managers should be making these types of adjustments, but many don’t. Some funds may include a token allocation to TIPS or hold a smattering of real assets, but few go far enough, in our opinion. We think inflation fighting deserves a more thoughtful approach tailored to an investor’s position in their lifecycle.

As inflation comes back into the retirement savings conversation, DC plan sponsors should take a close look at their target-date funds to ensure they have the most effective tools to keep the ravages of inflation at bay. If inflation risk hasn’t been a focus in 2021, it’s probably exacted a toll on performance.

Christopher Nikolich is Head of Glide Path Strategies (US)—Multi-Asset Solutions at AB, Vinod Chathlani is Portfolio Manager—Multi-Asset Solutions at AB, Elena Wang is a Research Analyst—Multi-Asset Solutions at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the official blog of AllianceBernstein..