Post-recession productivity gains usually fade, but this time around may be different.

by Carl Tannenbaum, Executive Vice President, and Chief Economist, Northern Trust

The debate over post-pandemic scheduling often centers on productivity. There are those who assert that working from home has allowed them to get more done, while others contend that the collaboration that can be achieved in person allows everyone to be more effective.

To understand more about the subject, I decided to analyze my own experience. Working remotely saves me about two hours a day of commuting; that’s a plus. But I probably sleep in longer each morning when I don’t go into the office. Family members (including my daughter’s dog) periodically invade my study and distract me. Errands and chores that would normally be completed on weekends often find their way into the weekday schedule. In conclusion: I am not very productive, wherever I am.

Seriously speaking, though, the debate over productivity is central to post-pandemic economic outlooks. Have changes to business practices prompted by COVID-19 placed the global economy on a more efficient path? And how will the adaptations of the past eighteen months change the work we do, and how we do it? Read on.

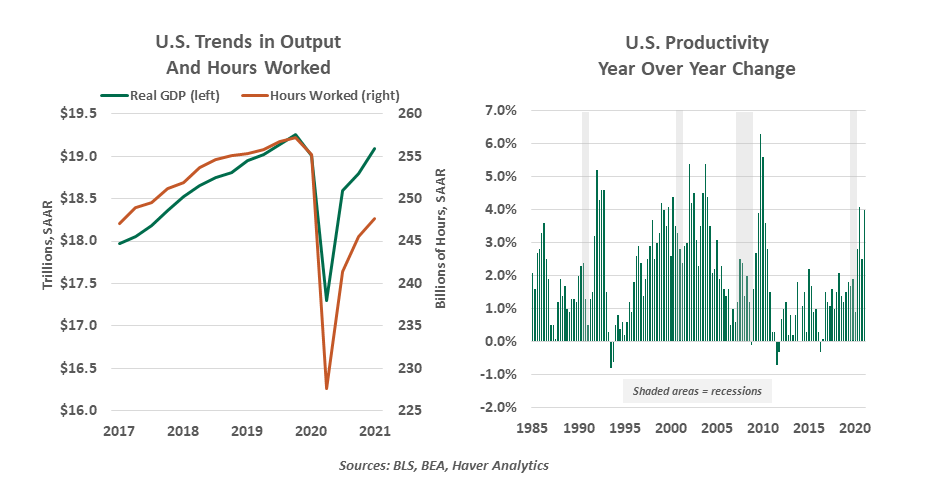

the realm of economic statistics, productivity is simply output divided by hours worked. By that measure, we are currently enjoying an efficiency boom: during the past couple of quarters, gross domestic product (GDP) has escalated much more sharply than the time required to produce it.

Annualized productivity growth has averaged better than 3% since the current recovery began last April. That is twice the pace observed during the record expansion that ended early last year. Bursts in productivity are not uncommon coming out of downturns, though: firms often hold back on adding human resources until they are sure that demand is strong enough to justify them. Once that confidence is secured, staffing increases.

That pattern seems consistent with the narratives of this summer, where demand is stressing supply. Labor shortages are forcing workers to cover more ground until reinforcements arrive. The scores of open positions in the U.S. economy, and evidence of rising wages, suggest that firms are looking to staff up. In situations like this, productivity growth probably cannot be sustained at recent levels.

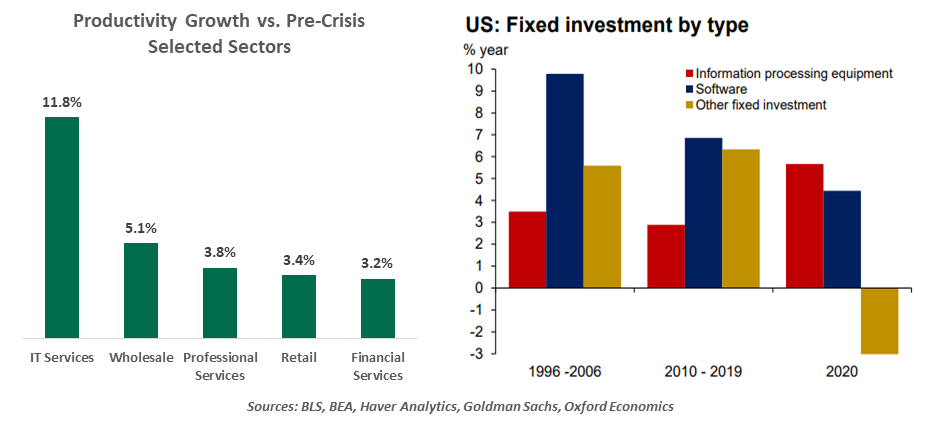

But in many cases, firms report the aggressive application of automation to overcome tight labor markets. The examples are many and varied: e-commerce sites have reduced the need for sales clerks; digitized restaurant menus allow fewer servers to cover more tables; and telemedicine visits allow clinicians to visit with more patients each day. These measures serve to keep output high and costs modest over a much longer period of time.

The pandemic accelerated adoption of many kinds of technology.

Many of these approaches are not novel. But the pandemic greatly accelerated adoption. Concerned about COVID-19, consumers moved to embrace contactless transacting. In many cases, they found it preferable to traditional channels, and will probably not go back to their old ways of doing business.

Professional services firms are also seeing stronger-than-normal productivity gains. Conducting business using videoconferencing has reduced travel costs, while fees have not diminished commensurately. This has resulted in an expansion of profit margins for service firms, which is expected to persist even as pandemic-related restrictions ease.

Businesses are in the midst of a significant push for additional productivity gains in the years ahead. Overall investment in information technology (IT) is growing much faster than the overall economy is at the moment, and much faster than other types of business investment. A survey taken by the World Economic Forum last fall found that 80% of executives were accelerating their efforts to increase productivity.

A particular area of emphasis is data science, which allows firms to study their operations and their markets to provide goods and services most efficiently. Companies are now able to harvest and analyze huge quantities of information that yield insights not visible to the human eye. The discoveries that emerge from these processes will result in better products and lower costs.

In the aggregate, productivity growth is a significant positive for an economy. If workers are able to support more output with less time, they become more valuable and can command higher wages. More efficient companies have better earnings and returns. Countries that have higher productivity are able to grow faster without inflation, manage higher debt levels, and attract inbound capital. In an era where demographic trends are worrisome, accelerated productivity gains are especially welcome.

But on a more granular basis, productivity-enhancing measures can create transitional challenges for some workers. Numerous studies have found that large fractions of the tasks performed by a variety of occupations were within range of automation. As that automation advances, fewer jobs will be available in those fields; many lower-wage roles are among those at highest risk for elimination. The positions that will be most in demand are those with higher levels of skills, which may not be resident or within reach of those who are at risk of displacement.

We may be on the verge of a significant industrial transition.

Countries around the world have struggled to find a formula for re-assimilating workers during periods of technological change. As we wrote in our examination of retraining programs, investment by firms and governments in renewing human capital is inadequate. Failure on this front creates inequality, public discontent, and complicated politics.

In sum, one of the tightest labor markets in decades has added momentum to efforts that will reduce the demand for labor over the long term. Post-recession productivity gains usually fade after a few quarters, but this time around may be very different.

To keep pace on this front, I have taken to locking myself into my study at home to avoid distractions, and taking my laptop with me on trips to the grocery store. I have offered to increase the number of forecasts I produce, too, but demand is far below potential supply on that front.

Don’t miss our latest insights:

Copyright © Northern Trust