by Talley Leger, Investment Strategist, Invesco Canada

Cyclical stocks have surged off their early-2020 lows, but Talley Leger believes there’s still room to run. Learn more about his outlook for cyclical stocks.

As I expected, the economy-sensitive segments of the stock market have enjoyed an impressive run since their early-2020 lows.1 Now, investors are naturally wondering whether the bulk of the pro-cyclical advance is behind them.

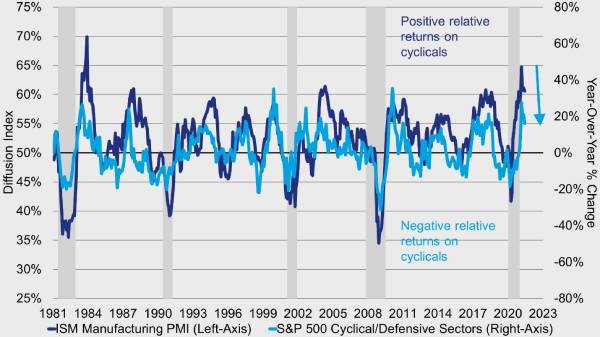

Granted, government bond yields have softened on the back of a China-led early-to-mid cycle slowdown (Figure 1).2 Admittedly, those dynamics could challenge my bullish “reflation” thesis but ultimately may present another attractive entry point for cyclicals, in my view.

Figure 1: A China slowdown could challenge cyclical leadership but ultimately present another attractive entry point

True, we’ve had business cycle compression, meaning much activity and wealth has been lost and regained in a short period of time. But even if the riskier sectors outperform for half as long (three years) as the historical norm (six years), they should still have plenty of room to run. As such, I remain in the buy-the-dips camp.

Within cyclicals, the growth style of investing and technology stocks seem to be benefiting tactically from the very same China-related easing of bond yields. Beyond that, I believe there’s a window of opportunity for the value style of investing, but I’ve always considered it as a finite “recovery” trade. Ultimately, I think growth stocks should regain durable leadership as economic gravity sets in and the world settles back into a more sustainable pace of output.

Sine wave analysis helps inform the cyclical outlook

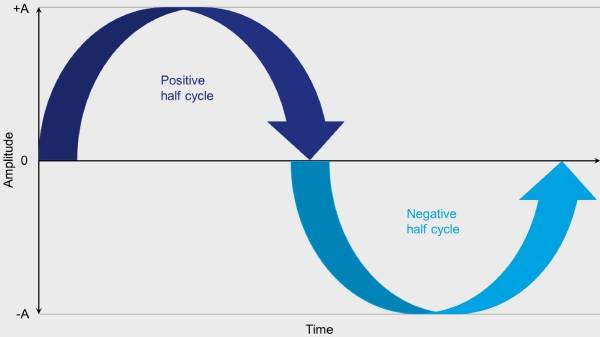

Markets don’t move in straight lines. Indeed, they undulate in complex tactical, cyclical, and secular patterns. In fact, cyclicals’ relative returns behave and look a lot like sine waves — geometric waveforms that oscillate above and below zero (Figure 2).

Figure 2: Sine wave analysis suggests decelerating but positive returns on cyclicals in the year ahead

From my lens, it took us about a year to complete the first quarter (25%) of one sine wave. In the second quarter (or next 25%) of the same wave, I think we should see decelerating but positive returns on cyclicals over the coming 12 months (Figure 3).

More importantly, there appear to have been two to three of these sine waves over the course of a given business cycle, bookended by two economic recessions. If that’s right, I don’t think investors can easily conclude that the bulk of the move in cyclicals is behind them.

Figure 3: I expect cyclicals to remain in the “positive half cycle” of the current sine wave

The bottom line: I foresee plenty of room to run

In short, China was the first out of the gate and is digesting those gains before the next potential leg higher. The U.S. was next and may also require a healthy consolidation phase at some point.

From a policy perspective, I believe something devasting would have to happen in either of the two biggest economies of the world in order to end the global expansion prematurely. In the absence of such a major policy error, I think there’s time left on the clock for economy-sensitive, pro-cyclical, risk-on trades to keep working. Stay buckled in and enjoy the ride.

1 Sources: Bloomberg L.P., Standard & Poor’s, Invesco, March 31, 2020 through June 30, 2021. Cyclical returns are calculated from the S&P 500 Consumer Discretionary, Energy, Financials, Industrials, Information Technology, and Materials sector indices. Defensive returns are calculated from the S&P 500 Consumer Staples, Health Care, Telecommunication Services, and Utilities sector indices. Past performance does not guarantee future results. An investment cannot be made directly into an index.

2 Sources: Bloomberg L.P., Invesco as of June 30, 2021

This post was first published at the official blog of Invesco Canada.