by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

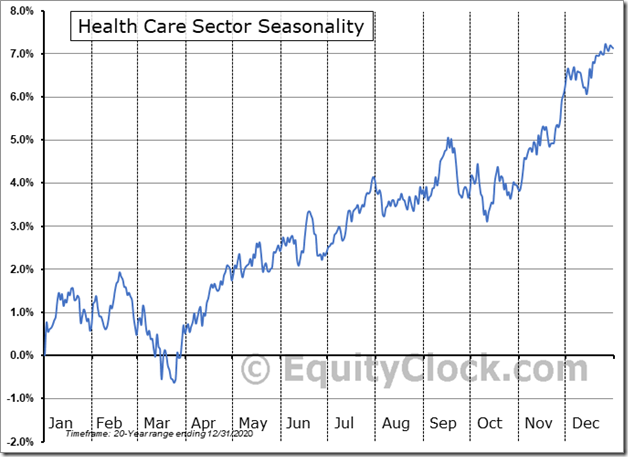

Buying demand in the health care sector is starting to materialize. Find out which health care industry has been upgraded in our weekly chart books. equityclock.com/2021/07/12/… $XLV $IHI $XHE $XPH $IHF $VHT

South Africa iShares $EZA moved below $47.83 completing a Head & Shoulders pattern

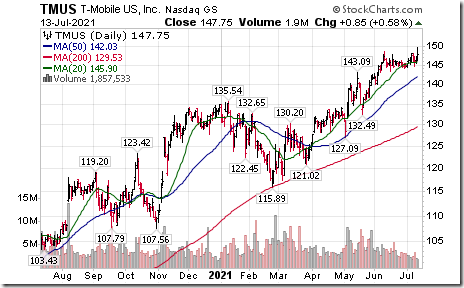

T Mobile $TMUS a NASDAQ 100 stock moved above $148.70 to an all-time high extending an intermediate uptrend.

Early Warning Signs for U.S.Traders

Responses to second quarter reports released yesterday were mixed at best.

Pepsico rose sharply after reporting blow out second quarter revenues and earnings.

Goldman Sachs opened higher, but came under “sell on news” pressures after reporting blow out second quarter revenues and earnings.

JP Morgan came under “sell on news” pressures after releasing blow out second quarter earnings, but lower than consensus revenues.

Conagra dropped significantly after reporting slightly lower than consensus second quarter revenues and earnings.

Quarterly reports today by Wells Fargo, Bank of America, Citigroup, and PNC Financial will be watched closely for possible “sell on news” responses.

After the close, Canaccord Genuity’s chief market strategist Tony Dwyer discussed on CNBC “a summer of indigestion” for U.S. equities followed by a recovery in the fourth quarter.

Trader’s Corner

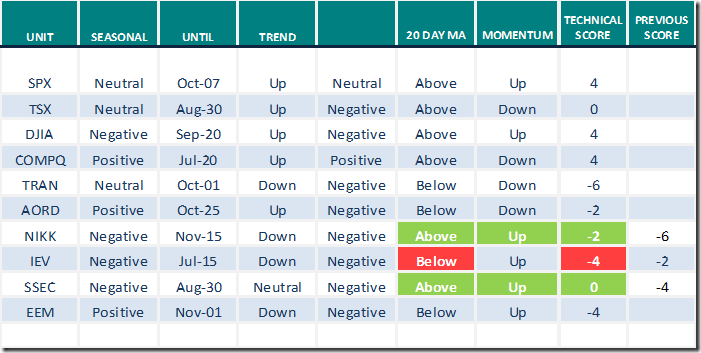

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

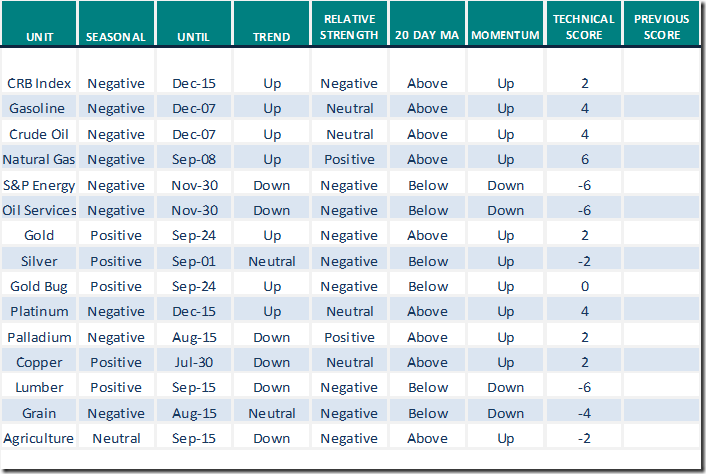

Commodities

Daily Seasonal/Technical Commodities Trends for July 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

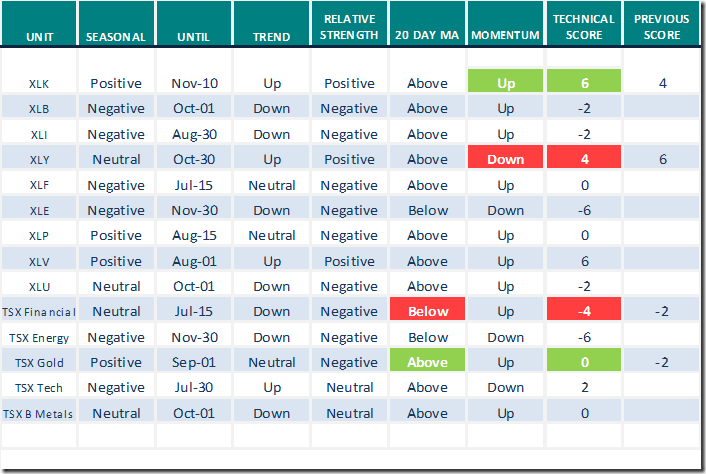

Sectors

Daily Seasonal/Technical Sector Trends for July 13th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The timely $500 million dollar tax refund announced yesterday

The IRS announced Tuesday it is refunding about 4 million people who overpaid their 2020 unemployment insurance (UI) taxes in 2020.

Taxpayers can expect refunds in the coming days: They will be direct deposited to some recipients’ bank accounts on Wednesday, July 14, and paper checks will start being mailed Friday, July 16. Taxpayers can expect to receive a refund of $1,265, on average.

The American Rescue Plan (ARP), signed by President Joe Biden in March, excluded up to $10,200 in 2020 unemployment compensation from many recipients’ taxable income. Because many people filed their tax returns before it was signed into law, the IRS is now refunding those who overpaid.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.81 to 49.90 yesterday. It remains Neutral.

The long term Barometer slipped 1.80 to 90.58 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer slipped 1.18 to 59.09 yesterday. It changed from Overbought to Neutral on a drop below 60.00.

The long term Barometer added 0.11 to 76.82 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.