by Don Vialoux, EquityClock.com

The Bottom Line

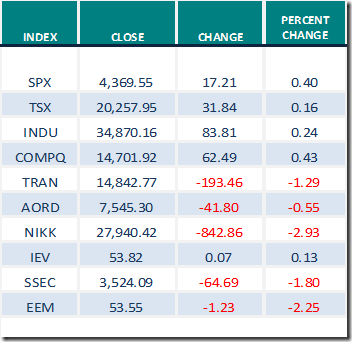

World equity indices were mixed last week. Far East indices were lower, European equity indices were mixed, the TSX Composite Index was virtually unchanged and U.S. equity indices were slightly higher (except for the Dow Jones Transportation Average). Greatest influences on equity markets were possibility of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a COVID 19 vaccine (positive).

Observations

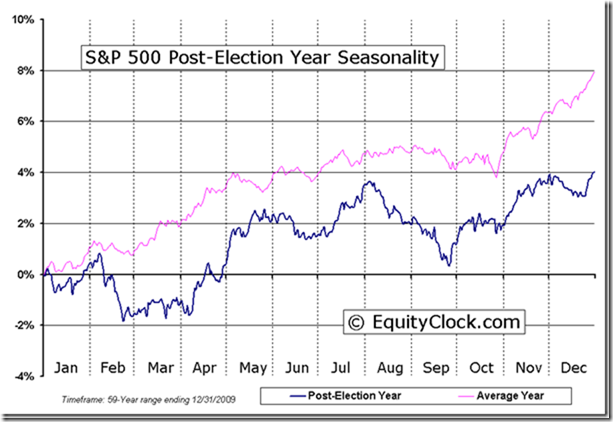

Seasonal influences for North American equity markets are positive in the month of July (particularly in a Post-U.S. Presidential Election year). Strength is Post-U.S. Presidential Election years is related to a “honey moon” period when investors anticipate launch of a new mandate by the President.

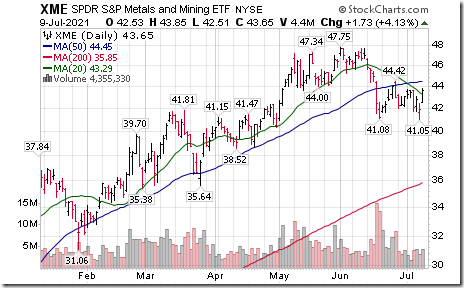

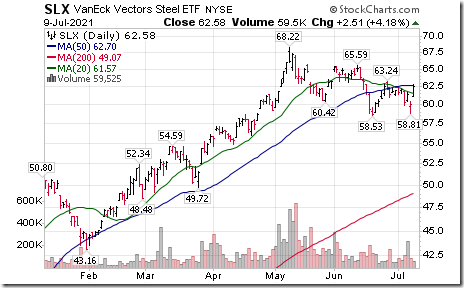

Strength by equity markets on Friday was triggered by China’s announcement to cut in its reserve requirements for major banks. Traders understood the news to mean that China wants to start to reflate its economy. The news had is greatest impact on equities expected to benefit from an increase in demand for basic materials (e.g. copper, nickel, zinc, steel). Advances of 3%-4% were recorded by major base metal producers such as Rio Tinto, BHP and VALE. Metals and Mining SPDRs (XME) holding large weightings in these stocks was the star ETF performer on Friday Its performance was matched by the U.S. Steel ETF, SLX

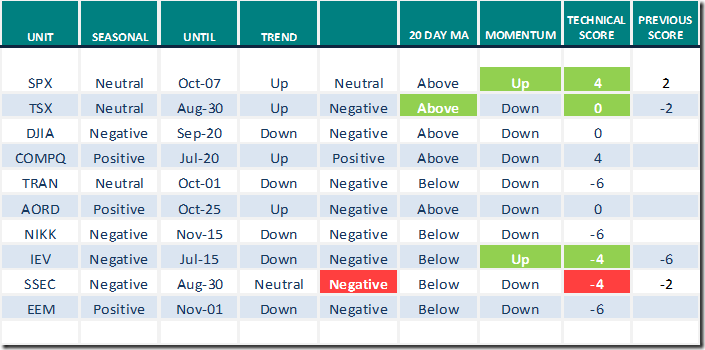

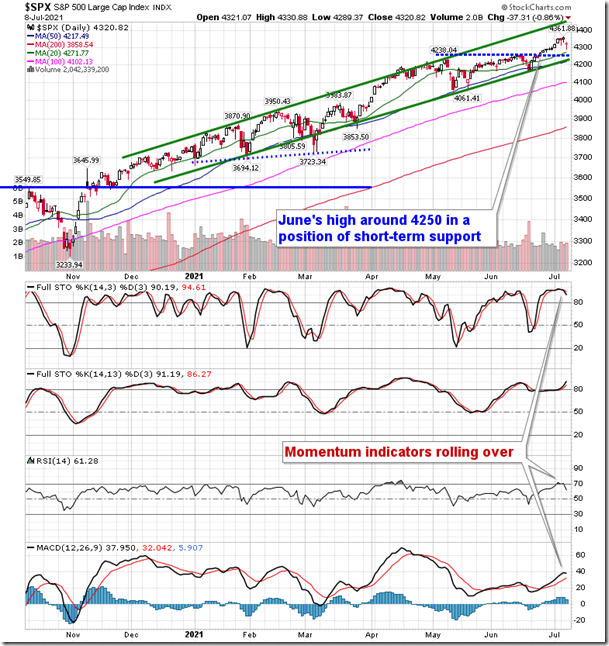

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) were mixed last week.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) was virtually unchanged last week. It remained Neutral. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) was virtually unchanged last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were mixed last week.

Intermediate term technical indicator for Canadian equity markets moved slightly lower last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) moved slightly higher last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase from our report last week. According to www.FactSet.com earnings in the second quarter on a year-over-year basis are expected to increase 64.0% (versus previous estimate at 63.6%) and revenues are expected to increase 19.7% (versus previous estimate at19.6%). Earnings in the third quarter are expected to increase 23.7% (versus previous estimate at 23.6%) and revenues are expected to increase 12.4% (versus previous estimate at12.3%. Earnings in the fourth quarter are expected to increase 18.3% (versus previous estimate at 18.1%) and revenues are expected to increase 9.3% (versus previous estimate at 9.2%). Earnings for all of 2021 are expected to increase 35.6% (versus previous estimate at 35.5%) and revenues are expected to increase 12.6% (versus previous estimate at 12.4%).

Economic News This Week

U.S. June Consumer Price Index to be released at 8:30 AM EDT on Tuesday is expected to increase 0.4% versus a gain of 0.6% in May. Excluding food and energy, the June Consumer Price Index is expected to increase 0.4% versus a gain of 0.7% in May.

U.S. June Producer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.5% versus a gain of 0.7% in May. Excluding food and energy, the June Producer Price Index is expected to increase 0.5% versus a gain of 0.7% in May.

Bank of Canada is scheduled to update its monetary policy at 10:00 AM EDT on Wednesday. Lending rate to major banks is expected to remain unchanged at 0.25%.

Beige Book is scheduled to be released at 2:00 PM EDT on Wednesday.

July Empire State Manufacturing Survey to be released at 8:30 AM EDT on Thursday is expected to increase to 18.50 from 17.40 in June.

July Philly Fed Index to be released at 8:30 AM EDT on Thursday is expected to slip to 28.3 from 30.7 in June.

June Capacity Utilization to be released at 9:15 AM EDT on Thursday is expected to increase to 75.6 from 75.2 in May. June Industrial Production is expected to increase 0.7% versus a gain of 0.8% in May.

June Canadian Housing Starts to be released at 8:15 AM EDT on Friday are expected to slip to 270,000 from 275,900 in May.

June U.S. Retail Sales to be released at 8:30 AM EDT on Friday are expected to drop 0.4% from a revised decline of 1.3% in May. Excluding auto sales, June Retail Sales are expected to increase 0.5% versus a drop of 0.7% in May.

May U.S. Business Inventories to be released at 10:00 AM EDT on Friday are expected to increase 0.5% versus a decline of 0.2% in April.

July Michigan Consumer Sentiment to be released at 10:00 AM EDT on Friday is expected to increase to 86.5 from 85.5 in June.

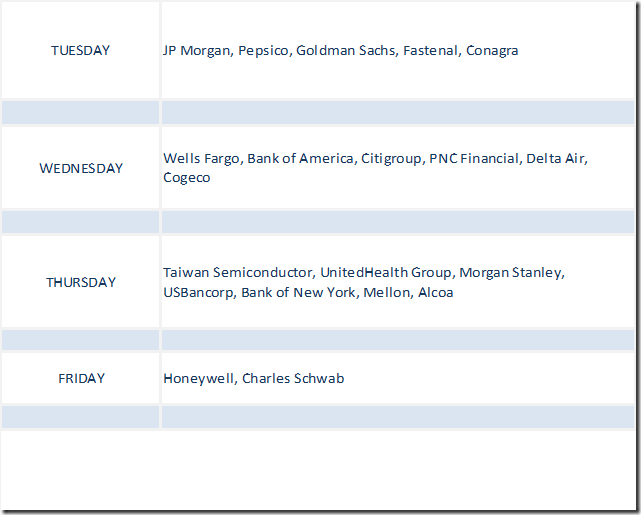

Selected Earnings News This Week

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 9th 2021

Green: Increase from previous day

Red: Decrease from previous day

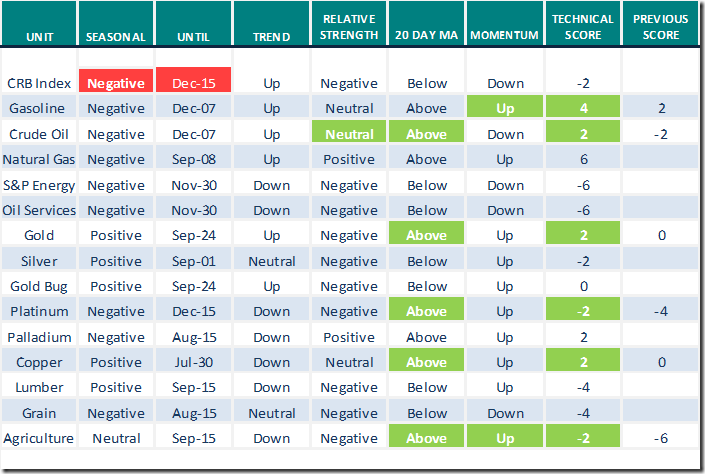

Commodities

Daily Seasonal/Technical Commodities Trends for July 9th 2021

Green: Increase from previous day

Red: Decrease from previous day

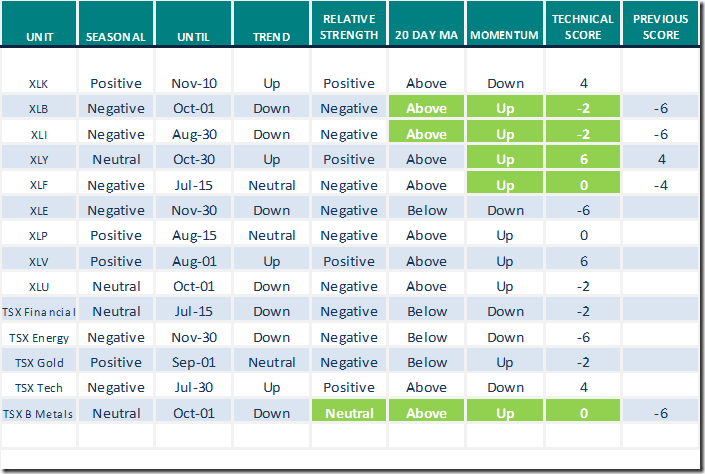

Sectors

Daily Seasonal/Technical Sector Trends for July 9th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Focus on the U.S. Dollar

Greg Schnell notes that “This is a pivotal point for the U.S.Dollar”. Following is a link to his comment:

Focus on the US Dollar | ChartWatchers | StockCharts.com

Technical Scoop

Thank you to David Chapman and wwwEnrichedInvesting.com for a link to their weekly comment.

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday

The market has jitters and we’re reacting. equityclock.com/2021/07/08/… $SPX $SPY $ES_F

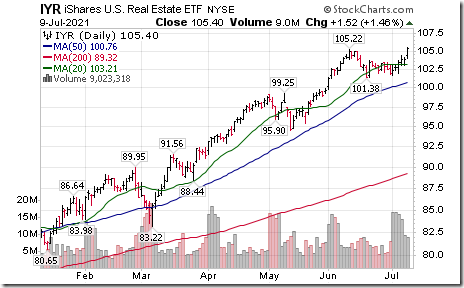

U.S. REIT iShares $IYR moved above $105.32 to an all-time high extending an intermediate uptrend.

Check Point Software $CHKP a NASDAQ 100 stock moved above $122.19 extending an intermediate uptrend.

Bristol-Myers Squibb $BMY an S&P 100 stock moved above $67.46 to an all-time high extending an intermediate uptrend.

Links to reports and videos from uncommon Sense Investor

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following reports

17 Top TSX Stock Picks for July: The Motley Fool Canada

17 Top TSX Stock Picks for July 2021 | The Motley Fool Canada

11 Best Growth Stocks for the Rest of 2021: Kiplinger

11 Best Growth Stocks for the Rest of 2021 | Kiplinger

Gold prices steamrolling toward $2,000 – Goldman Sachs

Gold prices steamrolling toward $2,000: Goldman Sachs (yahoo.com)

Banks Poised for 13% Dividend Boost When Canada Regulator Allows: Yahoo.com

Banks Poised for 13% Dividend Boost When Canada Regulator Allows (yahoo.com)

Third quarter investment survey

uncommon SENSE Investor is running s survey. Test your forecasting abilities by answering a handful of questions The person with the most accurate answers wins free Apple Air Pods Pro.

The winner must be a subscriber, so please tell your family and friends if you think they’d be interested in taking part.

|

Here’s where they can sign up for free. Good luck! |

S&P 500 Momentum Barometers

The intermediate Barometer jumped 11.82 on Friday but gained only 0.40 last week to 56.11. It remains Neutral.

The long term Barometer added 0.80 on Friday and 0.41 last week to 92.79. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer added 7.40 on Friday, but dropped 2.73 last week to 60.45. On Friday it returned to Overbought from Neutral on a recovery above 60.00.

The long term Barometer added 2.84 on Friday and 1.36 last week to 77.27. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.