by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Despite the S&P 500 Index sitting in record high territory, well above its 50-day moving average, only half of its constituents are above this intermediate-term hurdle. equityclock.com/2021/07/07/… $SPX $SPY $ES_F $STUDY

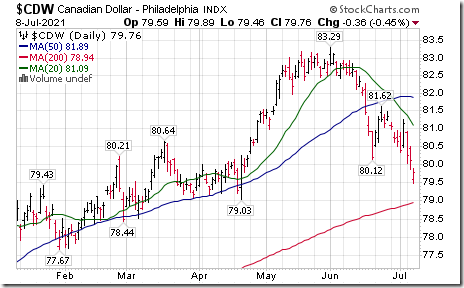

Canadian Dollar $CDW moved below US 80.12 cents setting an intermediate downtrend.

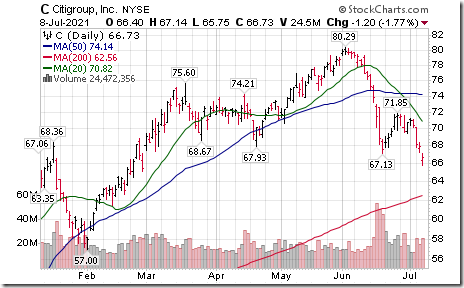

S&P 100 and NASDAQ 100 stocks that broke intermediate support by 10:30 AM EDT included $FOX $JD $BAC $C $MET $SPG $GE $ASML $BIDU $CTSH $NTES $LRCX

Major U.S. Bank SPDRs $KBE moved below $49.15 completing a double top pattern.

Another U.S. bank breakdown in late trading! Bank of New York Mellon $BK moved below $48.04 extending an intermediate downtrend

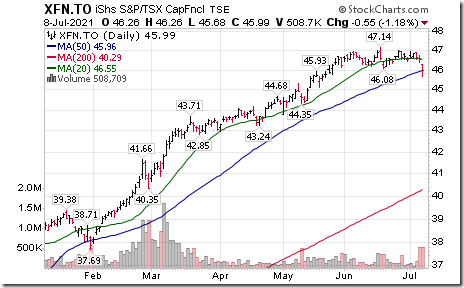

Canadian Financial stocks breaking intermediate support this morning included $BNS.CA $TD.CA and MFC.CA. Also, Canadian Financials iShares $XFN.CA broke intermediate support

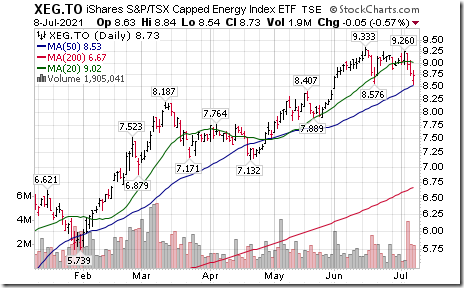

Canadian energy ETFs moving below intermediate support included ZEO.CA and XEG.CA. Among the major equities, SU.CA broke intermediate support.

Europe iShares $IEV moved below $53.00 completing a double top pattern

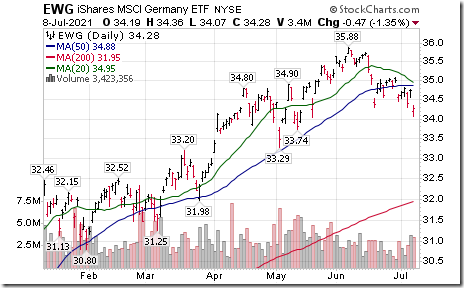

Germany iShares $EWG moved below $34.28 completing a double top pattern

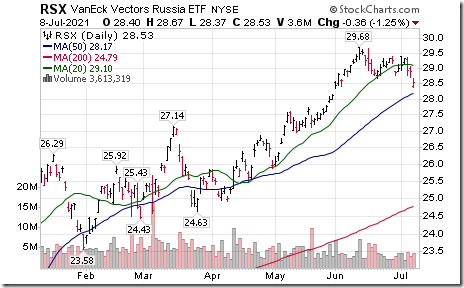

Russia ETF $RSX moved below $28.67 completing a double top pattern.

Chile iShares ECH moved below $27.04 extending an intermediate downtrend.

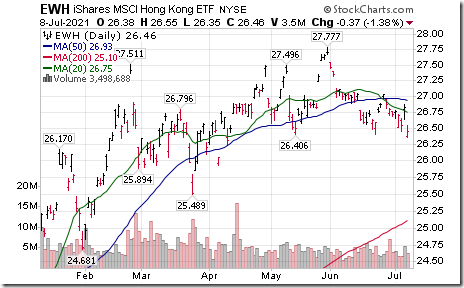

Hong Kong iShares $EWH moved below $26.40 completing a Head & Shoulders pattern

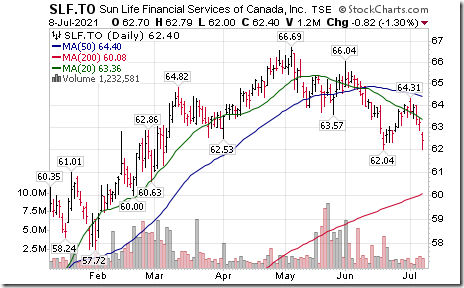

SunLife $SLF.CA a TSX 60 stock moved below $62.04 extending an intermediate downtrend

Metro $MRU.CA a TSX 60 stock moved above $59.97 extending an intermediate uptrend

Trader’s Corner

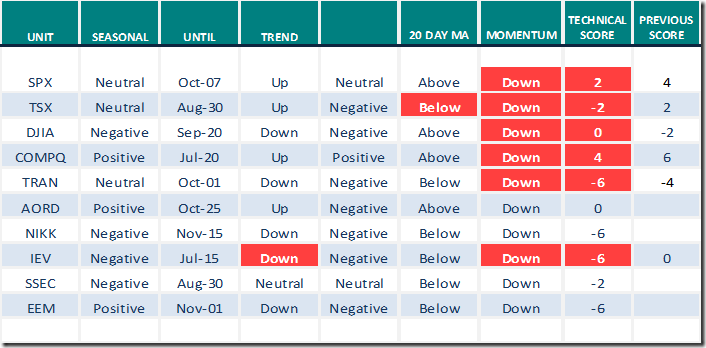

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

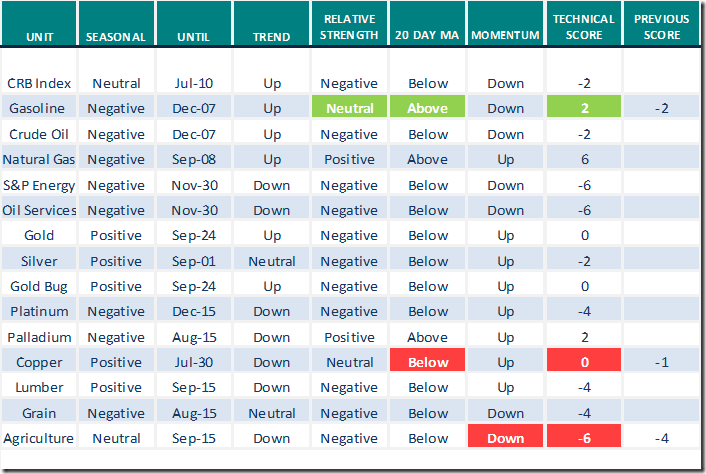

Commodities

Daily Seasonal/Technical Commodities Trends for July 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

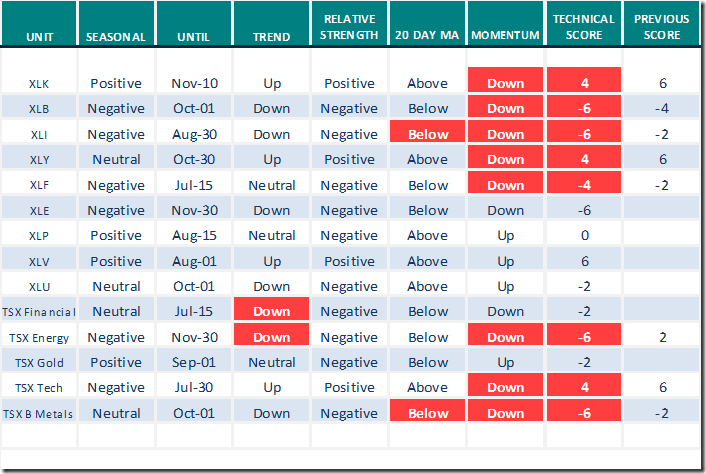

Sectors

Daily Seasonal/Technical Sector Trends for July 8th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Market Buzz

Greg Schnell comments on the Consumer Discretionary sector. Following is a link:

https://www.youtube.com/watch?v=5NEz3GO1dTc

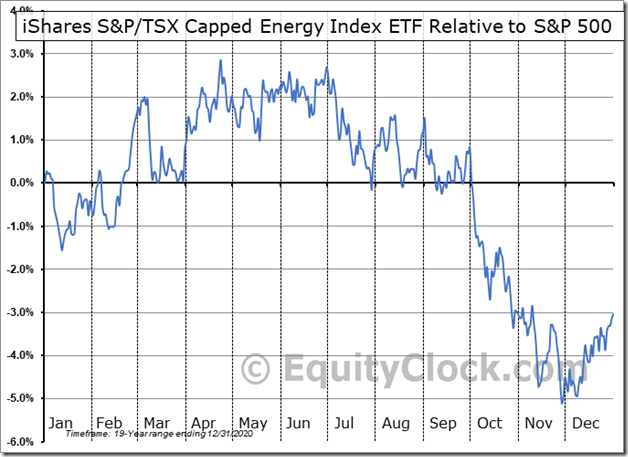

Seasonality Chart of the Day from www.EquityClock

Seasonal influences for Canadian energy ETFs including Energy iShares (XEG) and BMO Equal Weight Canadian Oil ETF (ZEO) have a history of moving lower on a real and relative basis from early July to the end of November.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 7.01 to 44.29 yesterday. It remains Neutral.

The long term Barometer slipped 0.40 to 91.98 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer dropped 5.94 to 52.97 yesterday. It remains Neutral and trending down.

The long term Barometer slipped 2.28 to 74.43 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.