by Don Vialoux, EquityClock.com

Technical Notes for yesterday at

George Weston $WN.CA a TSX 60 stock moved above $119.87 to an all-time high extending an intermediate uptrend.

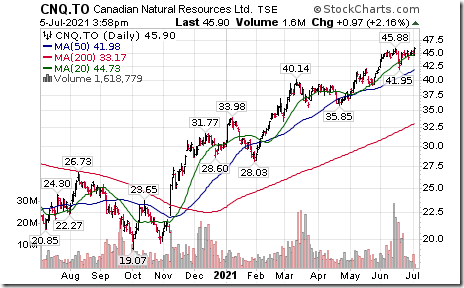

Canadian Natural Resources $CNQ.CA a TSX 60 stock moved above $45.88 to an all-time high extending an intermediate uptrend.

Trader’s Corner

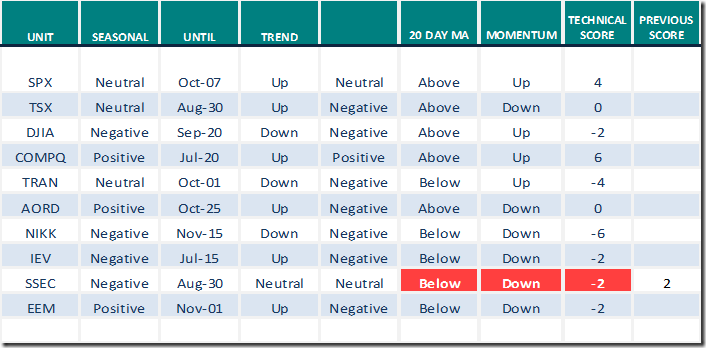

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 5nd 2021

Green: Increase from previous day

Red: Decrease from previous day

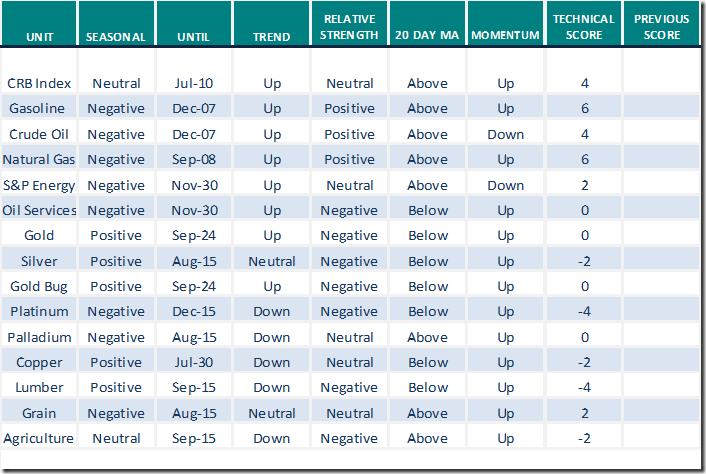

Commodities

Daily Seasonal/Technical Commodities Trends for July 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

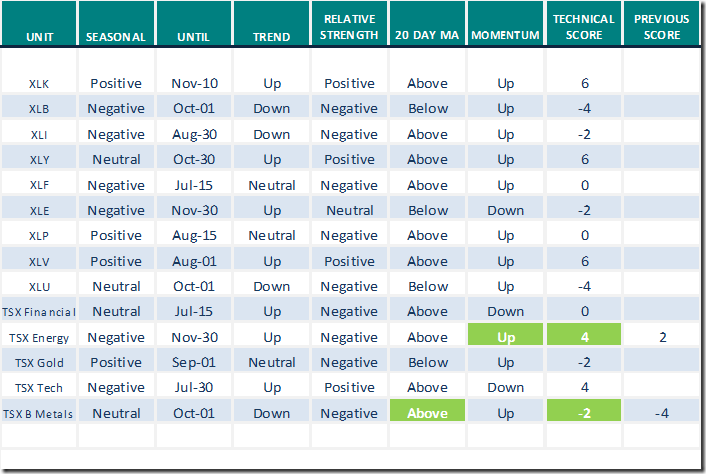

Sectors

Daily Seasonal/Technical Sector Trends for July 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

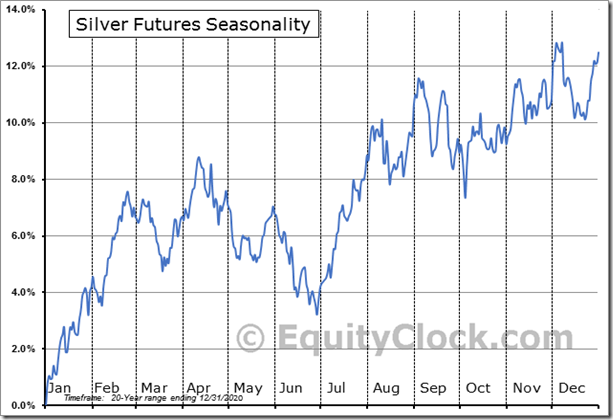

Seasonality Chart of the Day from www.EquityClock.com

Precious metal prices and precious metal equity prices have a history of moving higher from late June to early September. In addition, Silver futures since 2020 have significantly outperformed the S&P 500 Index and Gold futures during the late June to early September period.

Short term technical indicators (Daily Stochastics, RSI and MACD) turned higher last week corresponding to start of the late June/early September period of seasonal strength. A move by Silver above its 20 day moving average at US$26.82 and its 50 day moving average at US$27.13 will provide additional technical proof that favourable seasonal influences are working this year.

Symbol for Silver iShares is SLV.

Precious metals equity ETFs including XGD.TO, GDX, GDXJ and SIL have a similar short term technical pattern.

Article from “uncommon SENSE Investor”

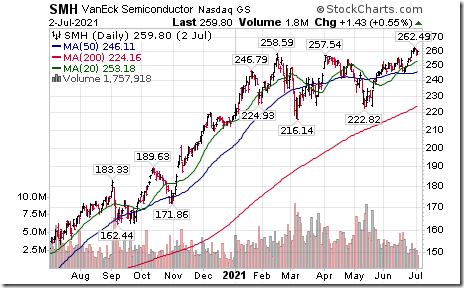

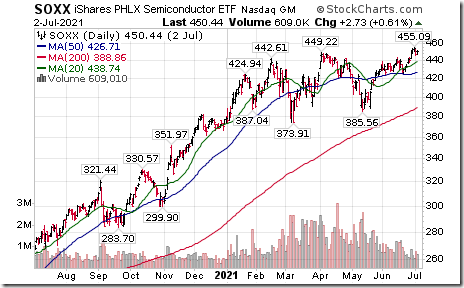

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a link to the following article entitled “Seven Sizzling Semiconductor Stocks to Buy”. Following is the link:

7 Sizzling Semiconductor Stocks to Buy | Kiplinger

Editor’s Note: Seasonal influences for the semiconductor sector are positive from late June to late November. See www.EquityClock.com for seasonality charts on SOXX and SMH. Both units broke to an all-time high last week.

TSX Momentum Barometers

The intermediate term Barometer added 0.91 to 64.09 yesterday. It remains Overbought.

The long term Barometer added 0.45 to 76.36 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.