by Don Vialoux, EquityClock.com

Technical Notes

released yesterday at StockTwit.com@EquityClock

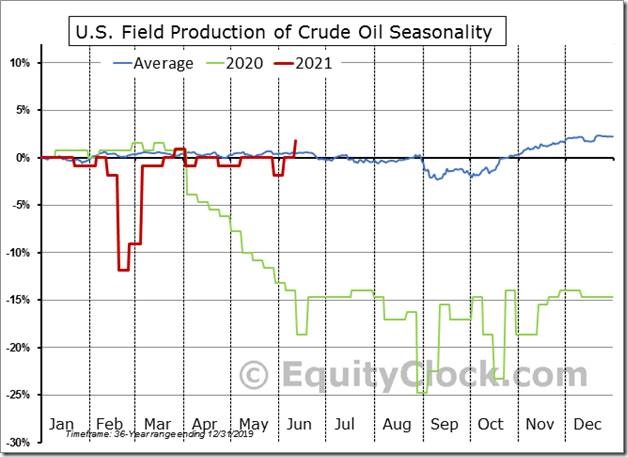

Our enthusiasm towards the energy sector has been dampened following the latest inventory report. Find out why in today’s report. equityclock.com/2021/06/16/… $XLE $XOP $USO $CL_F #Oil

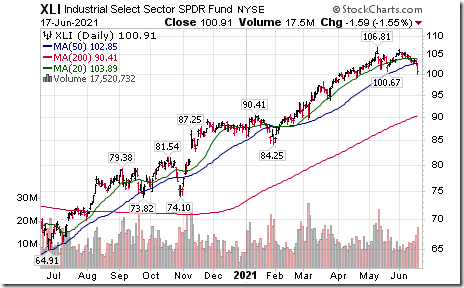

Industrial SPDRs $XLI moved below $100.67 completing a double top pattern.

Steel iShares $SLX moved below $60.42 completing a double top pattern.

Global Base Metals iShares $PICK moved below $44.83 completing a double top pattern. Individual base metal stocks that also completed double top patterns this morning included $RIO $BHP and $LUN.CA

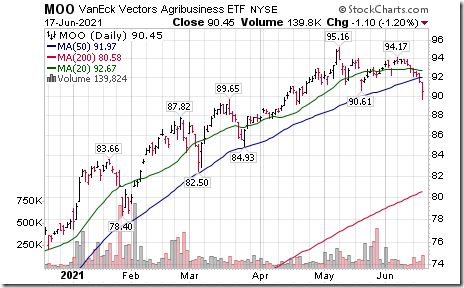

Agriculture ETF $MOO moved below $90.61 completing a double top pattern

Insurance iShares $IAK moved below $78.29 completing a double top pattern.

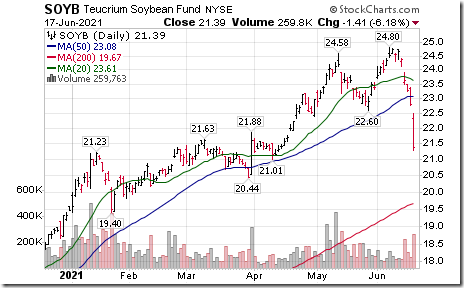

Soybean ETN $SOYB moved below $22.60 completing a double top pattern

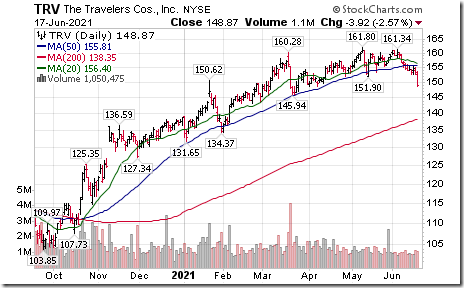

Travelers $TRV a Dow Jones Industrial Average stock moved below $151.90 completing a double top pattern.

Canadian gold stocks responded to the drop in gold prices. Kinross Gold $KGC moved below support at US$6.99. Kirkland Lake Gold $KL.TO moved below Cdn$50.67 completing a double top pattern.

Platinum ETN $PPLT responded to lower gold prices by completing a double to pattern on a move below US$104.41

Palladium ETN $PALL responded to lower gold prices by completing a double top pattern on a move below US$254.86

Technology SPDRs $XLK moved above $143.77 to an all-time high extending an intermediate uptrend.

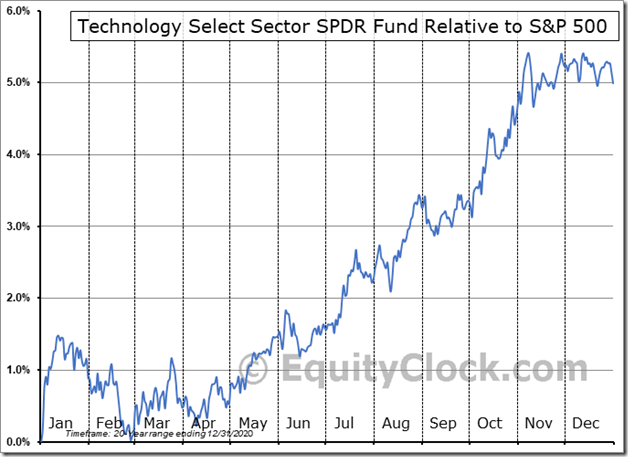

Seasonal influences for the U.S. Technology sector and related ETFs $XLK are Positive on a real and relative basis (relative to the S&P 500 Index) between mid-June to the first week in November.

S&P/TSX Technologies iShares $XIT.CA moved above $50.30 to an all-time high extending an intermediate uptrend.

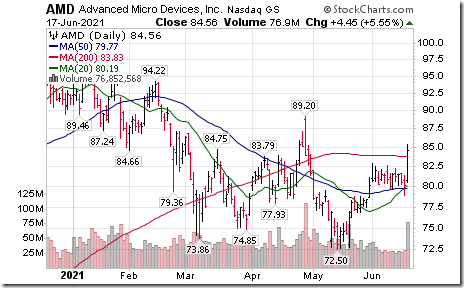

Advanced Micro Devices $AMD a NASDAQ 100 stock moved above $82.91 completing a double bottom pattern

Splunk $SPLK a NASDAQ 100 stock moved above $124.00 completing a double bottom pattern.

Seasonal influenced for Splunk $SPLK are positive on a real and relative basis (relative to the S&P 500 Index) between now and the end of November.

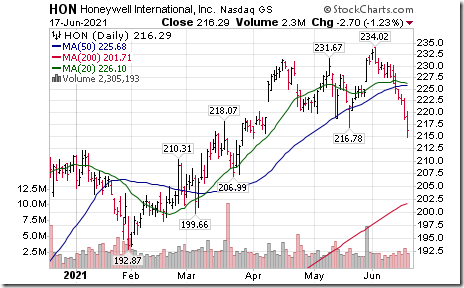

Honeywell $HON an S&P 100 stock moved below intermediate support at $216.78

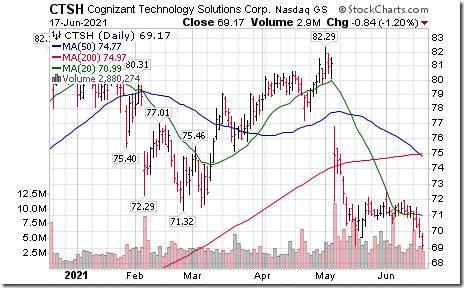

Cognizant $CTSH a NASDAQ 100 stock moved below $69.17 extending an intermediate downtrend.

Trader’s Corner

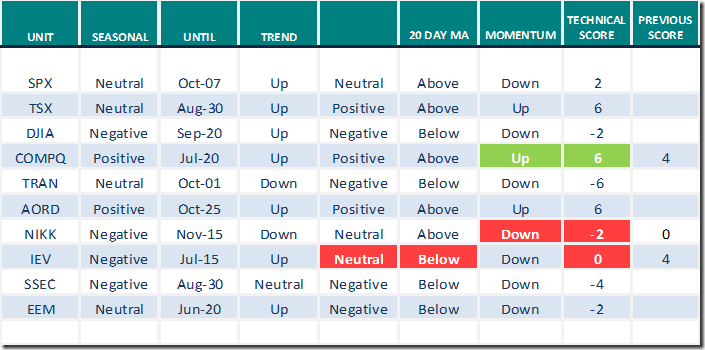

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

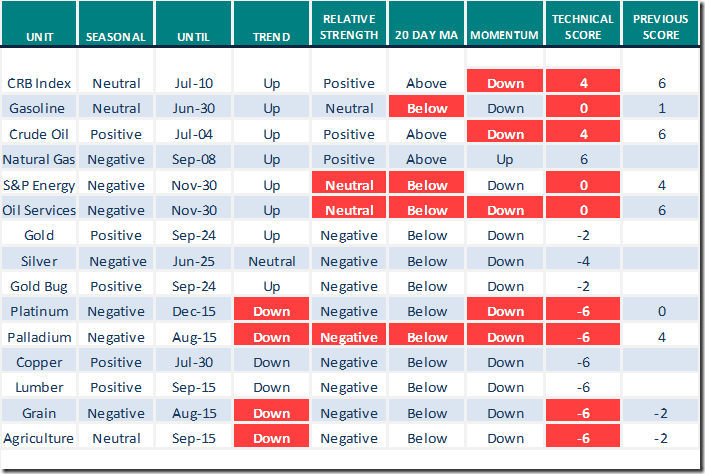

Commodities

Daily Seasonal/Technical Commodities Trends for June 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

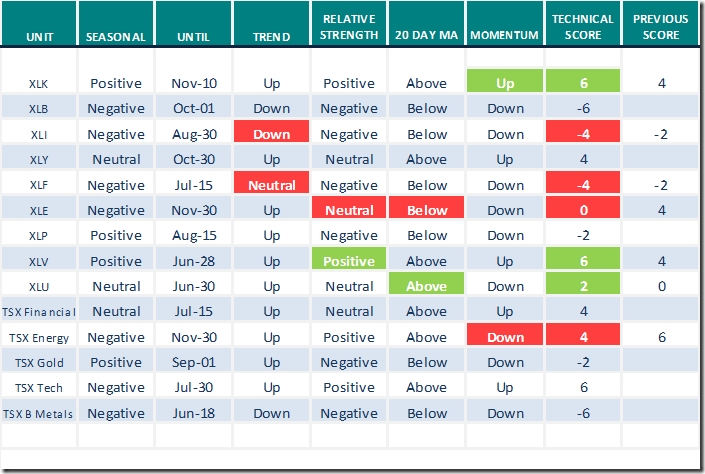

Sectors

Daily Seasonal/Technical Sector Trends for June 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 11.42 to 45.49 yesterday. It remains Neutral and is trending down.

The long term Barometer added 0.20 to 90.58 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer plunged 8.22 to 62.15 yesterday. It remains Overbought.

The long term Barometer slipped 1.04 to 75.70 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.