by Don Vialoux, EquityClock.com

Responses to the Federal Reserve’s statement on interest rates

The Federal Reserve announced at 2:00 PM EDT yesterday that the Fed Fund Rate will remain at 0.00%-0.25%. Current policies are expected to be maintained well into 2012. The Federal Reserve predicted the possibility of two rate hikes in 2023. Responses in markets were as follows:

S&P 500 Index initially moved lower, but partially recovered by the close

The VIX Index measuring equity volatility initially moved higher, then flat, then higher.

The U.S. Dollar Index and its related ETN moved higher.

Long term Treasury Bond prices moved lower as interest rates moved higher.

Bank stocks and related ETFs moved higher in anticipation of an increase in interest rate spreads

Gold prices moved lower

Technical Notes

released yesterday at StockTwits.com@EquityClock

With the Fed on tap on Wednesday, the limits of the short-term rising span provide logical levels to track to gauge investor reaction and how to position within our portfolio. equityclock.com/2021/06/15/… $SPX $SPY $ES_F $STUDY #FED #FOMC

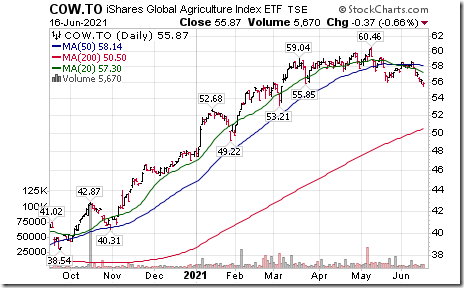

Global Agriculture iShares $COW.CA moved below $55.93 and $55.85 completing a Head & Shoulders pattern.

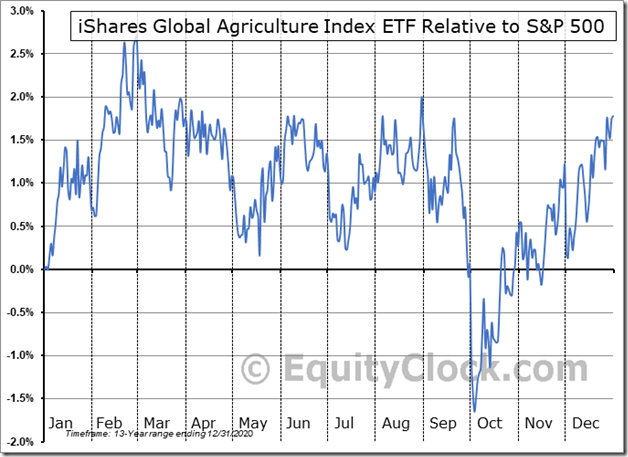

Seasonal influences on a real and relative basis (relative to the S&P 500 Index) for Global Agriculture iShares $COW.CA turn negative in mid-June

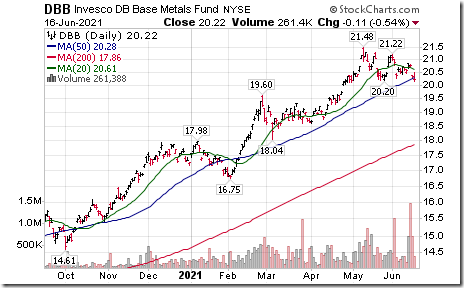

Base Metals ETN $DBB consisting of 1/3 each in copper, zinc and aluminum moved below $20.20 completing a double top pattern.

Southern Companies $SO an S&P 100 company moved below $63.02 completing a double top pattern.

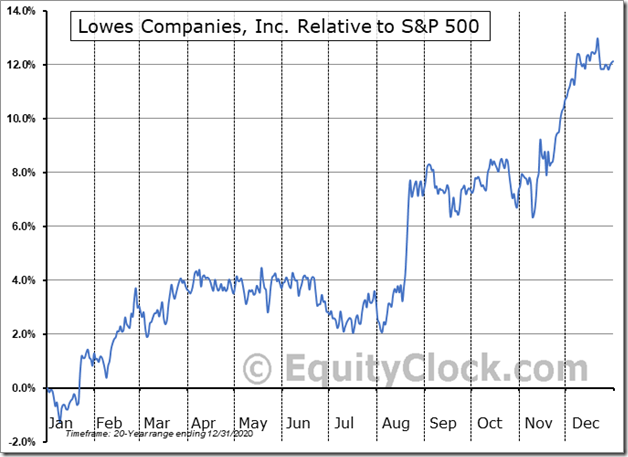

Lowe’s $LOW an S&P 100 stock moved below $186.38 completing a modified Head & Shoulders pattern.

Seasonal influences for Lowes Companies $LOW on a real and relative basis (relative to the S&P 500 Index) turn negative in mid-June.

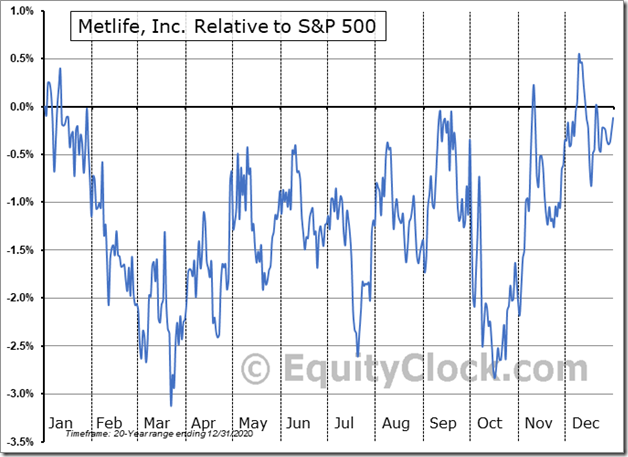

Met Life $MET an S&P 100 stock moved below $62.84 completing a double top pattern.

Seasonal influences for Metlife $MET on a real and relative basis relative to the S&P 500 Index) turn negative in mid-June

MMM $MMM a Dow Jones Industrial Average stock moved below $196.94 completing a double top pattern.

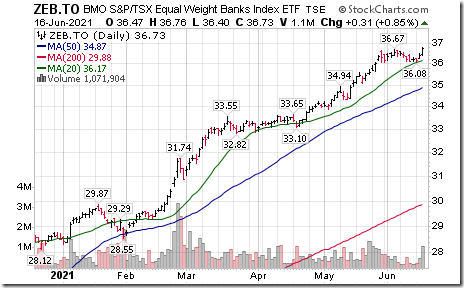

Major Canadian bank stocks and their related ETF $ZEB.CA that offer U.S. bank operations exposure also responded favourably to the Federal Reserve announcement at 2:00 AM EDT.

The ETF moved above $36.67 to an all-time high extending an intermediate uptrend.

Late Addition

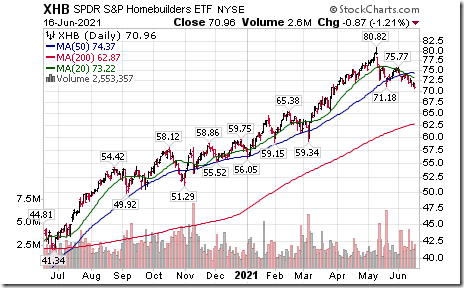

Home Builders iShares $XHB moved below $71.18 completing a double top pattern.

Trader’s Corner

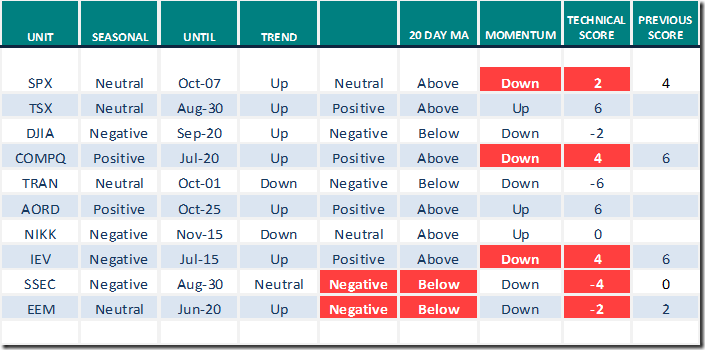

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 16th 2021

Green: Increase from previous day

Red: Decrease from previous day

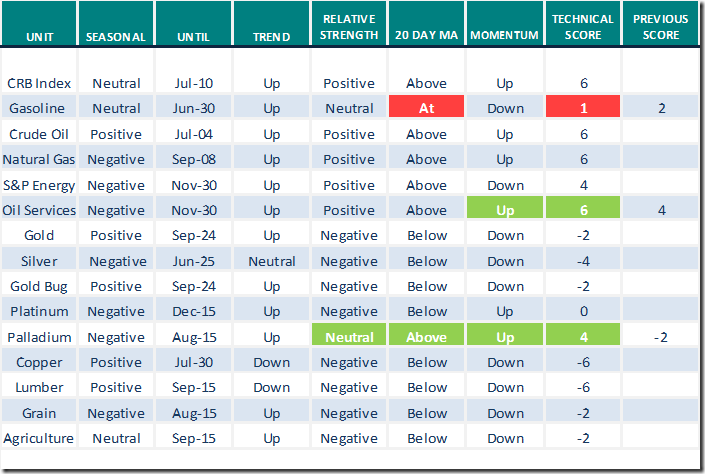

Commodities

Daily Seasonal/Technical Commodities Trends for June 16th 2021

Green: Increase from previous day

Red: Decrease from previous day

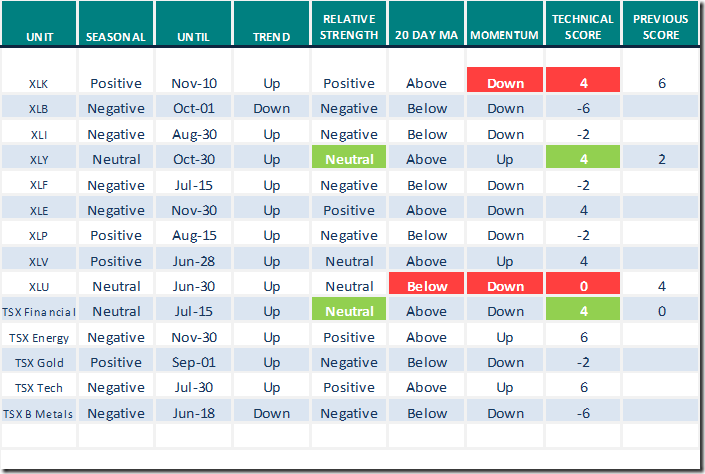

Sectors

Daily Seasonal/Technical Sector Trends for June 16th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Market Buzz

Greg Schnell discusses “Thread the Fed”. Comment was offered prior to release of the Federal Reserve’s decision at 2:00 PM EDT yesterday. Following is a link:

https://www.youtube.com/watch?v=j9f8tdGZkAg

Editor’s Note

Technicals for Chinese equities and related ETFs have been under pressure recently due to a breakout of COVID 19 in Chinese south east ports. Time for turn around by ships exporting Chinese goods from the area recently increased from 12 hours to 16 days. This is a warning sign for other countries that may have started to reopen their economies prematurely (Think Canada and the U.S.).

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 7.21 to 56.91 yesterday. It change from Overbought to Neutral on a move below 60.00 and extending its downtrend.

The long term Barometer slipped 1.60 to 90.38 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer dropped 2.66 to 68.37 yesterday. It remains Overbought.

The long term Barometer slipped 0.83 to 76.74 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.