by Alessio De Longis, Invesco Canada

The global expansion advances further, with strong momentum in Europe and emerging markets. We are not overly concerned about rising inflation at this stage, as long as growth continues to improve.

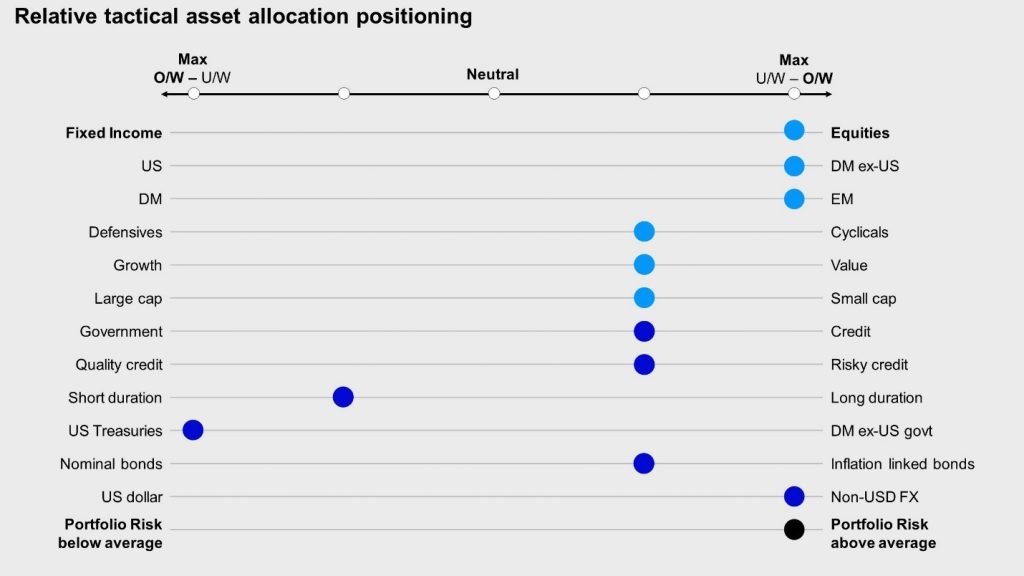

We are overweight equities and risky credit at the expense of investment grade and government bonds. We continue to favour equity markets outside the U.S., and cyclical styles/factors such as value, small-caps, and mid-caps.

Macro update

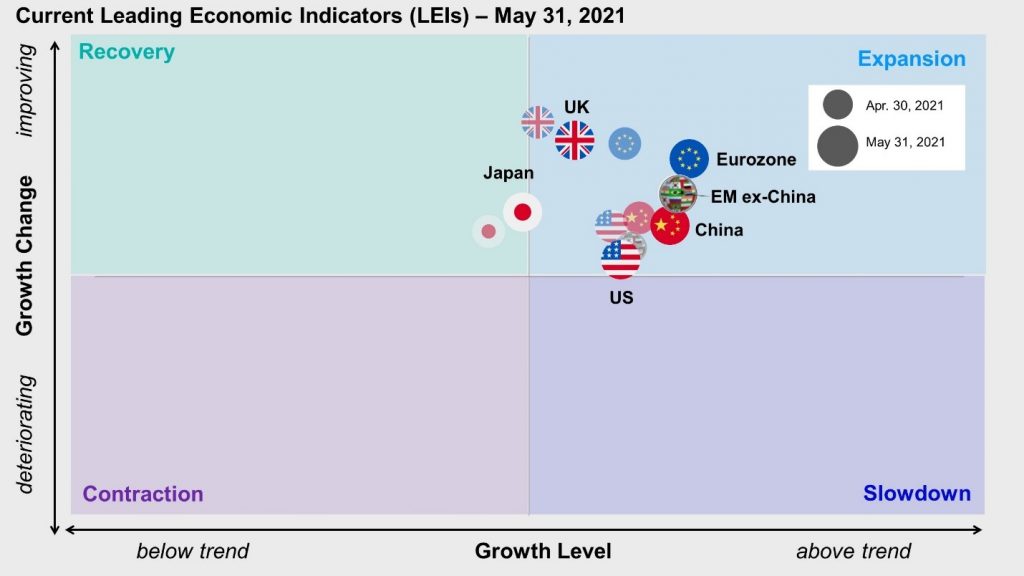

The latest read of our macro regime framework confirms the cyclical dynamics we have highlighted since the beginning of the year. The global expansion is becoming deeper and broader, with 90% of our country-level leading economic indicators now recording an expansion regime, suggesting growth is running above trend and improving across all regions.

As in the past few months, we continue to register the strongest momentum in the eurozone and the UK, where business surveys continue to signal a strong rebound in demand which, coupled with still very low inventories, is leading to a meaningful increase in production expectations.

Noticeable increases in consumer sentiment over the past month provide confirmation that the cyclical rebound is spreading across economic sectors as vaccination efforts continue and re-opening gets underway (Figure 1).

The outperformance of equity markets over fixed income markets, and cyclical sectors over defensives, suggests global risk appetite and growth expectations continue to improve.

In our last update, we outlined our perspective on inflation and the expectation for a meaningful increase in year-over-year inflation statistics in the near term due to, among other things, base effects from the recession in Q2 2020. As discussed, we expected these developments to be largely discounted by market consensus, mitigating the potential negative market impact of “high inflation headlines.”

Indeed, the reaction of U.S. Treasuries, both nominal and inflation-protected (i.e., TIPS), has been muted despite U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) data releases printing well-above economists’ consensus expectations.1 This market reaction was somewhat surprising, even to us, and may indicate that market participants have already priced in a more meaningful near-term increase in inflation compared to economic forecasters.

Figure 1: The expansion continues across regions, with strong momentum in the eurozone and the UK

On this subject, last month, we introduced a high-frequency, composite inflation momentum indicator (IMI) we use to track medium-term inflationary pressures in the economy. This indicator remains broadly unchanged since last month and continues to signal rising inflation in the near term. We map the evolution of this inflation indicator to the different stages of the business cycle, as identified by our macro regime framework. Barring exogenous supply shocks or structural forces, changes in inflation are predominantly endogenous to the business cycle, including its monetary and fiscal drivers.

Figure 2confirms this perspective on a historical basis, where inflation is more likely to increase during a recovery and expansion phase of the cycle, peak during a slowdown, and fall during a contraction.

The macro environment of the past year has, by and large, evolved in line with this historical cyclical pattern. This reflationary environment has been reflected quite broadly in financial markets across asset classes, regions, sectors, and styles. In other words, we believe rising inflation against a backdrop of improving growth is not as concerning for global equity markets, especially under the assumption of accommodative, credible central banks.

Conversely, rising inflation in a slowdown regime, coupled with tighter monetary policy, would represent a more poisonous cocktail for equity markets, given the likely combination of rising discount rates and falling earnings expectations.

Figure 2: Inflation over the past year has, by and large, evolved in line with historical cyclical patterns

Investment positioning

We have not implemented any changes to our positioning.

- Within equities, we favour emerging markets (EM) and developed markets outside the U.S., driven by improving global growth, rising risk appetite, and a rebound in growth momentum relative to the U.S. We remain tilted in favour of (small) size and value. In addition, we are tilted in favour of momentum, which, in line with the growth-versus-value rotation, is gradually moving away from quality and mega-cap stocks toward smaller-capitalization and value segments of the market.

- In fixed income, we favour risky credit despite tight spreads, seeking income in a low-volatility environment. We are overweight high yield, bank loans, and EM debt at the expense of investment grade credit and government bonds. We favour U.S. Treasuries over other developed government bond markets, given the potential yield advantage.

- In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. We remain constructive on EM foreign exchange given attractive valuations, an improving cycle, and a favourable backdrop for capital inflows, favouring the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Brazilian real. Within developed markets, we favour the euro, the yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar.

Figure 3: Global cycle remains in expansion regime

1 CPI and PPI year-over-year releases printed 4.2% and 6.2% in April, versus median economic forecasts polled by Bloomberg at 3.6% and 5.8%, respectively.

2 Credit risk defined as DTS (duration times spread).

This post was first published at the official blog of Invesco Canada.