by Don Vialoux, EquityClock.com

The Bottom Line

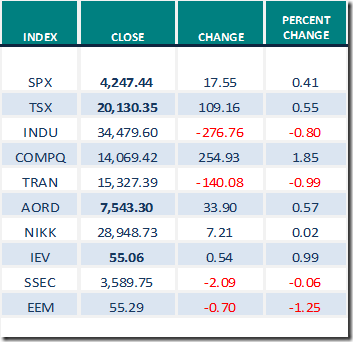

Most world equity indices were mixed last week, recorded small gains or small losses Greatest influences on North American equity markets remain possibility of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a vaccine (positive).

Observations

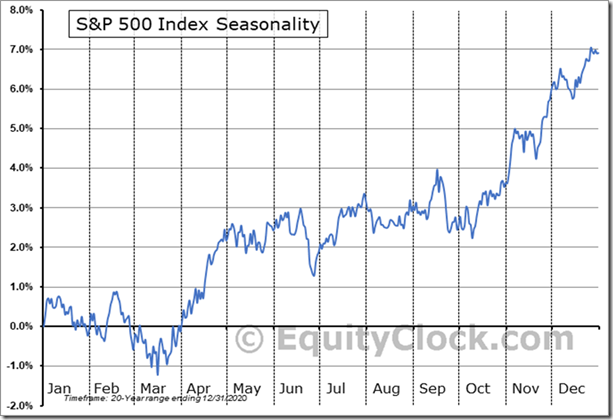

The S&P 500 Index is following its historic seasonal pattern for this time of year, a mixed, choppy period between early May and the second week in October. Average return during this period is close to zero. Positive returns are possible by selecting sector investments that outperform during the period.

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) were mixed last week.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved lower again last week. It remained Overbought. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) was virtually unchanged last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were virtually unchanged again last week.

Intermediate term technical indicator for Canadian equity markets moved slightly higher again last week. It remains Overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) was virtually unchanged last week with an Overbought rating. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase from our report last week. According to www.FactSet.com earnings in the second quarter are expected to increase 61.5% (versus previous estimate at 61.0%) and revenues are expected to increase 19.3% on a year-over-year basis. Earnings in the third quarter are expected to increase 22.9% (versus previous estimate at 22.7%) and revenues are expected to increase 12.0% (versus previous estimate at 11.9%). Earnings in the fourth quarter are expected to increase 17.3% (versus previous estimate at 17.2%) and revenues are expected to increase 8.9% (versus previous estimate at 8.8%). Earnings for all of 2021 are expected to increase 34.7% (versus previous estimate at 34.4%) and revenues are expected to increase 12.1% (versus previous estimate at 12.0%)

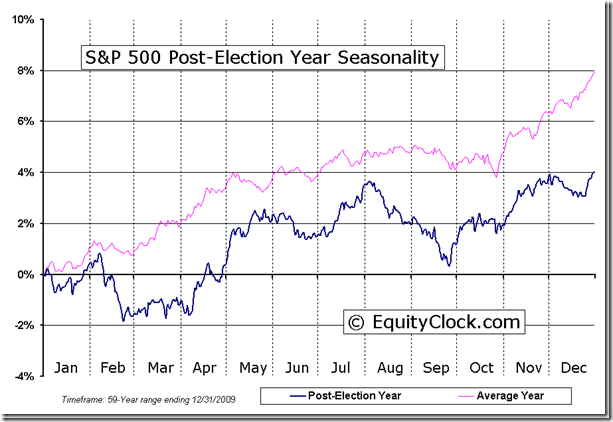

Peak sales and earnings gains by S&P 500 companies into the second quarter of a Post Presidential Election Year historically have prompted the S&P 500 Index to move higher until the end of July. Thereafter, the S&P 500 Index has moved into an intermediate correction when the recently elected President finds that major parts of his progressive agenda are less likely to be approved by Congress.

Economic News This Week

May Producer Price Index released at 8:30 AM EDT on Tuesday is expected to increase 0.6%. versus an increase of 0.6% in April. Excluding food and energy, May Producer Price Index is expected to increase 0.5% versus a gain of 0.7% in April.

May Retail Sales released at 8:30 AM EDT on Tuesday are expected to drop 0.4% versus no change in April. Excluding auto sales, May Retail Sales are expected to increase 0.5% versus a drop of 0.8% in April.

June Empire State Manufacturing Survey released at 8:30 AM on Tuesday is expected to slip to 22.50 from 24.30 in May.

May Capacity Utilization released at 9:15 AM EDT on Tuesday is expected to improve to 75.0 from 74.6 in April. May Industrial Production is expected to increase 0.5% versus a gain of 0.5% in April.

April Business Inventories released at 10:00 AM EDT on Tuesday are expected to slip 0.1% versus a gain of 0.3% in March.

May Housing Starts released at 8:30 AM EDT on Wednesday are expected to increase to 1.630 million units from 1.569 million units in Apri.

May Canadian Consumer Price Index released at 8:30 AM EDT on Wednesday is expected to increase 0.4% versus a gain of 0.5% in April.

FOMC announces its Fed Fund rate at 2:00 PM EDT on Wednesday. Rate is expected to remain unchanged at 0.00%-0.25%

June Philly Fed Index released at 8:30 AM EDT on Thursday is expected to slip to 31.0 from 31.5 in May.

May Leading Economic Indicators released at 10:00 AM EDT on Thursday are expected to increase 1.3% versus a gain of 1.6% in April

Earnings News This Week

Another quiet week for reports by S&P 500 and TSX 60 companies!

Trader’s Corner

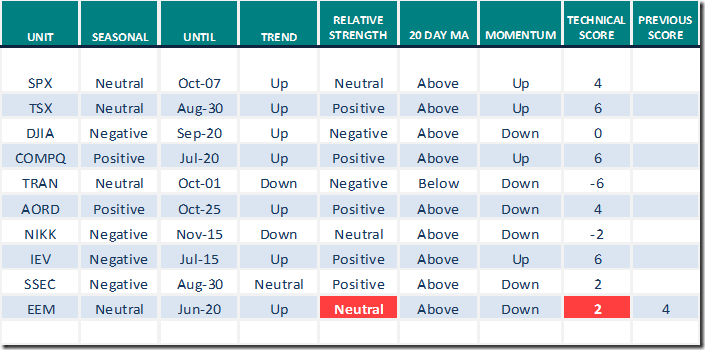

Equity Indices and Related ETFs

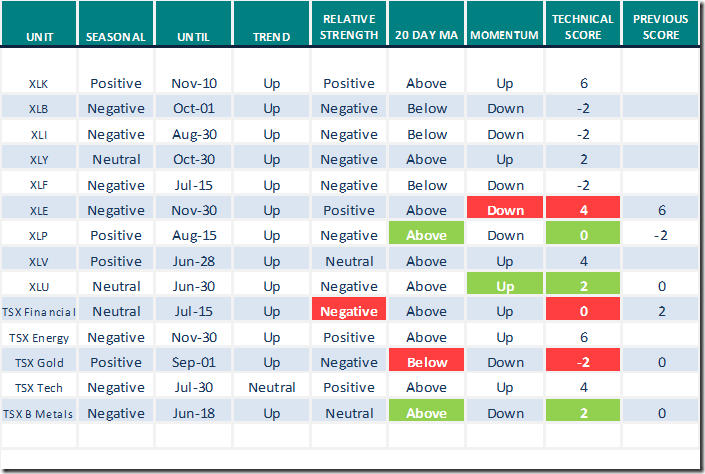

Daily Seasonal/Technical Equity Trends for June 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

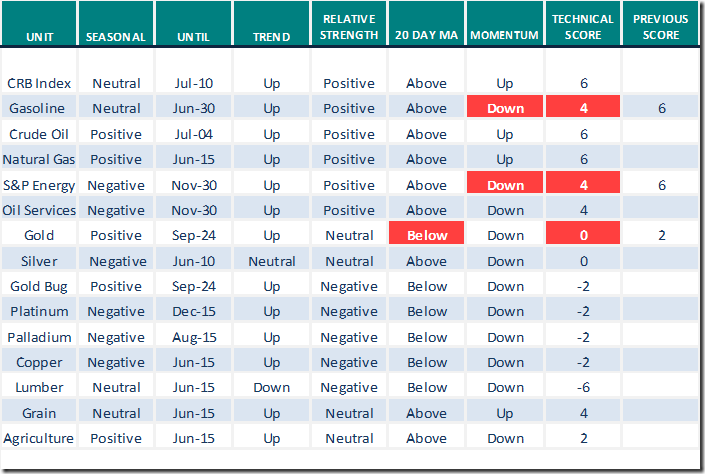

Commodities

Daily Seasonal/Technical Commodities Trends for June 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for June 11th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Scoop

Thank you to David Chapman and www.EnrichedInfesting.com for a link to their weekly comment:

Technical Notes

released on Friday at StockTwits.com@EquityClock

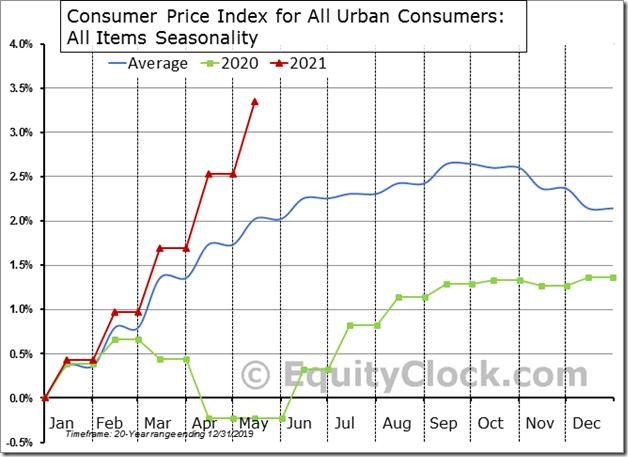

Consumer prices are showing the fastest rise through this point in the year since 1981. equityclock.com/2021/06/10/… $TIP $STUDY $MACRO #Economy #CPI

Vertex Pharmaceutical $VRTX a NASDAQ 100 stock moved below $202.57 and $204.62 extending an intermediate downtrend following news that development of its experimental drug has been halted. Stifel Nicolaus and Evercore lowered their target price on the stock.

Adobe $ADBE a NASDAQ 100 stock moved above $536.88 to an all-time high extending an intermediate uptrend.

Natural Gas ETN $UNG moved above $11.37 completing a double bottom pattern.

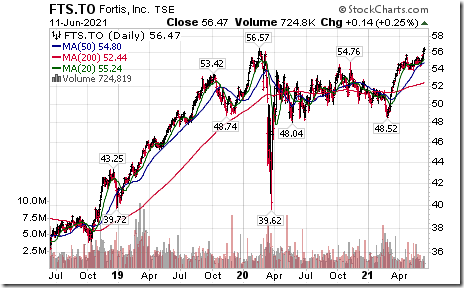

Fortis $FTS.CA a TSX 60 stock moved above $56.57 to an all-time high extending a long term uptrend.

Interesting Chart

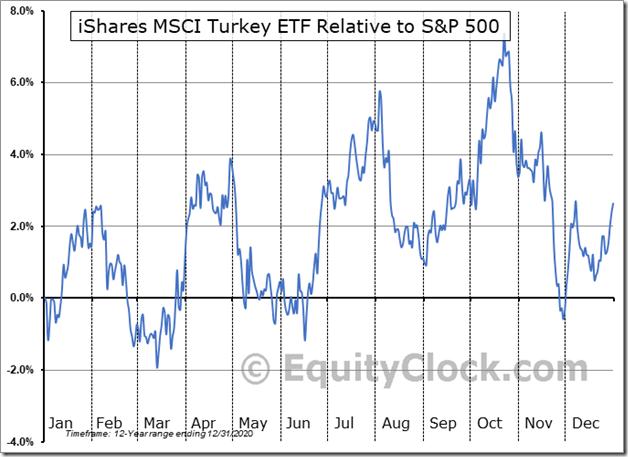

The ETF for Turkey (TUR) completed a Head & Shoulders pattern by moving below$25.57. It subsequently completed a reverse Head & Shoulder pattern on Friday by moving above $23.57.

Seasonal influences for TUR turn positive in the middle of June on a real and relative basis.

S&P 500 Momentum Barometers

The intermediate Barometer added 1.20 on Friday, but dropped 6.22 last week. It remains Overbought and is trending down.

The long term Barometer added 0.40 on Friday and added 1.60 last week. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer added 1.40 on Friday and 2.21 last week to 79.91. It remains Overbought.

The long term Barometer slipped 0.93 on Friday and added 0.38 last week. It briefly moved above 80.00 to an Extremely Overbought level, but closed on Friday below 80.00 and an Overbought rating.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.