by Niklas Nordenfelt, Invesco Canada

Find out how adding high yield bonds to an interest rate-sensitive fixed income portfolio can possibly lower overall volatility, while potentially adding return to the portfolio.

High fixed income valuations, low yields, tight credit spreads, and concerns of rising government bond yields introduce two important questions for 2021: How do income-focused investors navigate this environment? And how do investors balance maintaining income with the risk of falling bond prices as interest rates rise?

High yield has historically performed well in rising rate environments

The most topical issue in markets today is rising interest rates. Historically, high yield has performed well relative to other fixed income alternatives in rising rate environments. We believe that through careful security selection, a high yield portfolio can even add value in a rising rate environment as issuers improve fundamentally and this improvement is reflected in credit spread tightening.

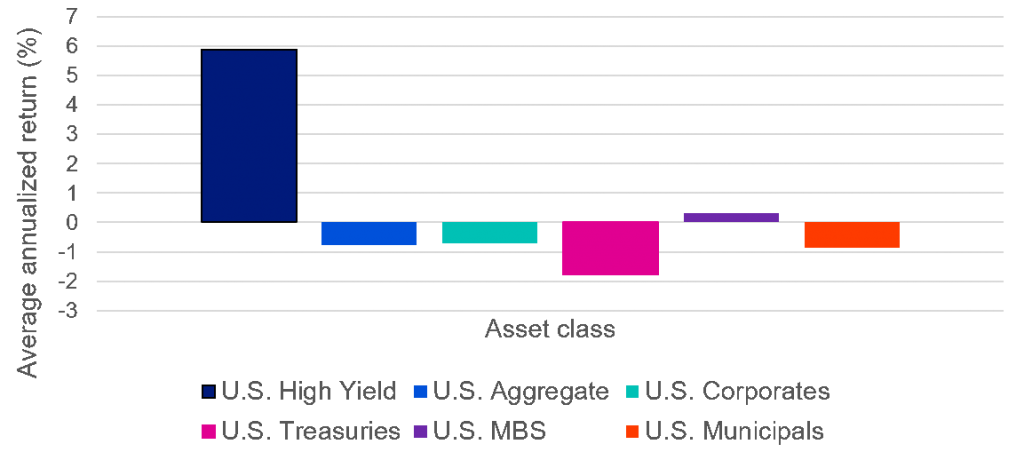

Figure 1 shows high yield’s outperformance relative to other interest rate-sensitive fixed income asset classes during periods of rising rates.

Figure 1: Average performance of major fixed income asset classes during periods of rising rates (%)

High yield potentially offers equity-like returns with lower volatility

Historically, high yield has also delivered equity-like returns with about half the volatility of equities. Since 1993, U.S. high yield has generated an annualized return of 7.59%, compared to 5.35% for the U.S. Aggregate Index, 6.25% for U.S. high grade corporates, and 5.18% for U.S. municipals.

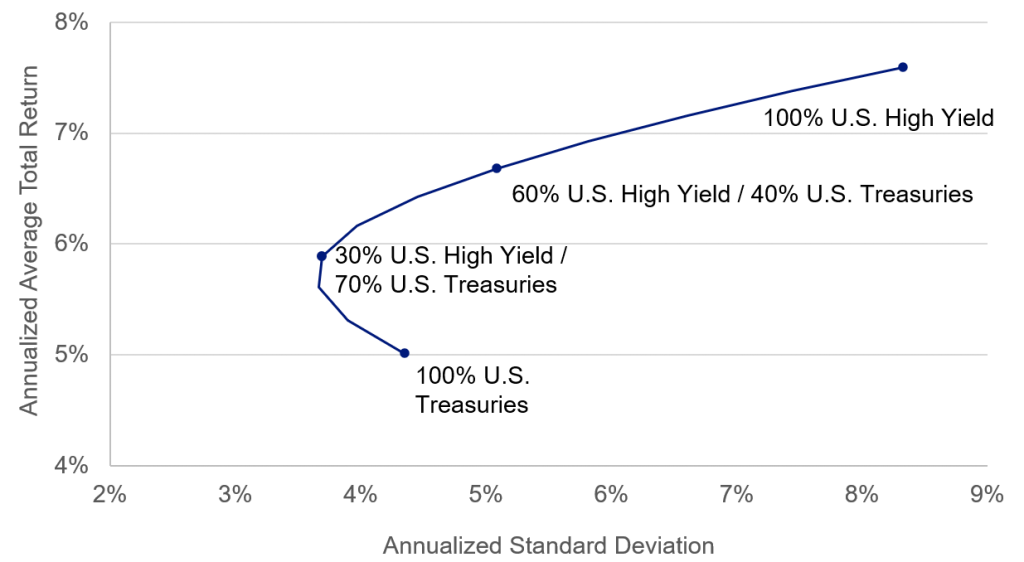

Adding high yield to an interest rate-sensitive portfolio can, therefore, potentially lower overall volatility, while adding return to the portfolio.

Figure 2 shows an efficient frontier in which adding 30% U.S. high yield to a U.S. Treasury portfolio added 88 basis points of average annualized return and lowered the portfolio’s volatility by 15%. A 60% allocation to high yield added 157 basis points of additional annualized return while adding just 73 basis points of additional volatility. At a 50% allocation, the portfolio would have experienced essentially the same volatility as a U.S. Treasuries-only portfolio but with an added 142 basis points of annualized return.

Figure 2: Adding U.S. high yield bonds to a U.S. Treasury portfolio adds return and reduces volatility

High yield offers potential diversification

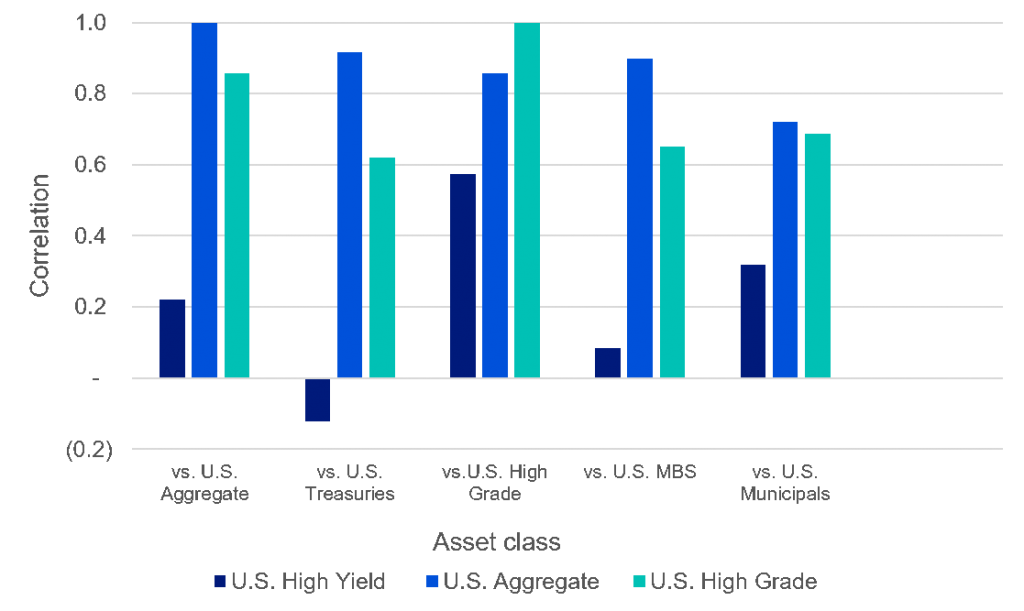

High yield also serves as a potential risk diversifier. This has tended to be true in most market environments. Adding high yield to a fixed income portfolio has tended to dampen overall volatility through its low correlation to more rate-sensitive segments of fixed income. Correlation is the degree to which two investments have historically moved in relation to each other.

The correlation coefficient’s values range between -1.0 and 1.0. A perfect positive correlation means that the correlation coefficient is exactly 1. This implies that as one security moves, either up or down, the other security moves in lockstep, in the same direction. A perfect negative correlation means that two assets move in opposite directions, while a zero correlation implies no linear relationship at all.2

Figure 3 shows the correlation of U.S. high yield to the major fixed income asset classes. It also shows the correlation of the U.S. Aggregate Index and U.S. high grade to these asset classes, highlighting the amount of diversification offered by high yield through less correlated returns.

Figure 3: High yield has exhibited low correlations to other fixed income asset classes

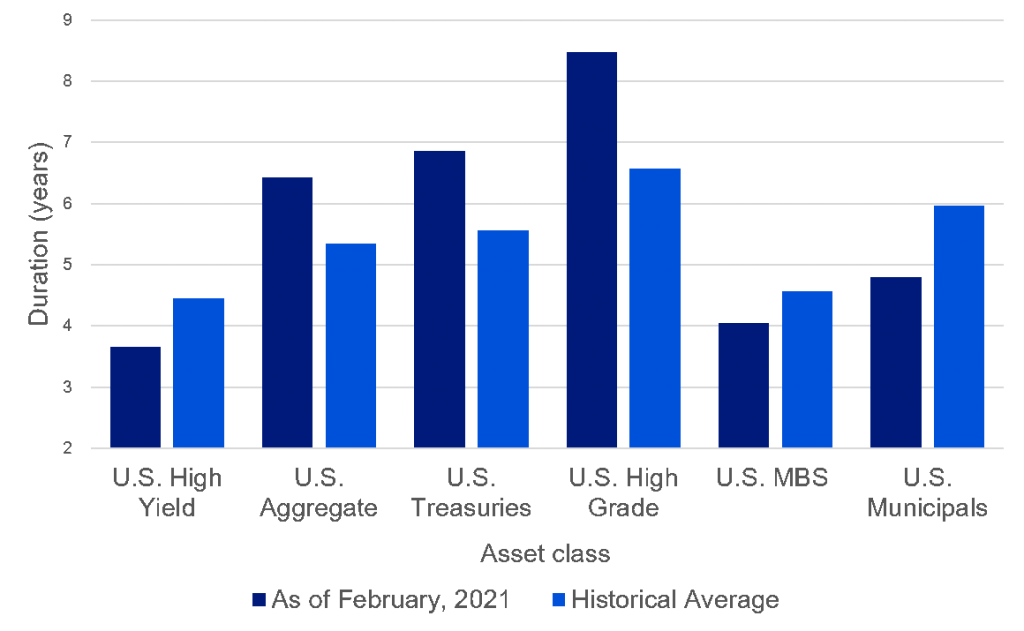

High yield’s relatively low duration profile contributes to its diversification benefits

Duration measures a bond price’s sensitivity to changes in interest rates. A bond with a longer time to maturity will have a price that is more sensitive to interest rates, and thus a larger duration than a short-term bond.

High yield tends to be of lower duration than most other fixed income asset classes and, therefore, tends to be less sensitive to fluctuations in interest rates. High yield behaves like a much shorter-duration fixed income investment than investment grade fixed income, for example.

Figure 4 highlights the differences in duration among several major fixed income asset classes. Not only does high yield typically have a lower duration, but the duration of most rate-sensitive fixed income asset classes is currently near all-time highs, while being lower than average for high yield. In other words, the relative sensitivity of most fixed income to a rise in interest rates versus high yield has never been higher, which, in theory, should maximize high yield’s potential diversification benefits.

Figure 4: High yield bonds have less duration than other fixed income asset classes, especially in the current environment

Conclusion

Investors searching for a way to combat rising rates and hedge against volatility may want to consider adding high yield to their fixed income portfolios. History shows that high yield can be a strong performer compared to other fixed income alternatives in times of rising rates.

1 Source: Bloomberg L.P., Bloomberg Barclays Indices: Bloomberg Barclays U.S. High Yield 2% Issuer Cap Index, Bloomberg Barclays Municipal Bond Index, Bloomberg Barclays U.S. Aggregate Index, Bloomberg Barclays U.S. Corporate Index. Data from Jan. 1, 1993 to Feb. 28, 2021. Past performance is not a guide to future returns.

2 Source:Investopedia

This post was first published at the official blog of Invesco Canada.