by Alessio De Longis, Invesco Canada

We expect the global economy to remain in an expansionary regime and see inflation developments as consistent with historical cyclical patterns. While we expect inflation to stabilize towards the end of 2021, we monitor its evolution across categories, with particular attention to wages and inflation expectations.

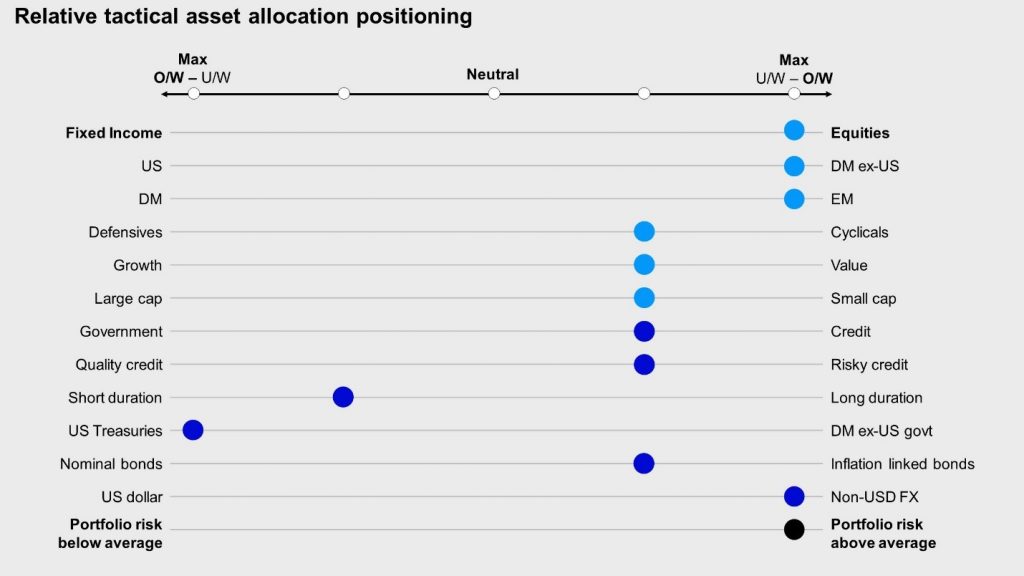

We continue to overweight equities and risky credit at the expense of investment grade and government bonds and continue to favour cyclical segments of the market.

Macro update

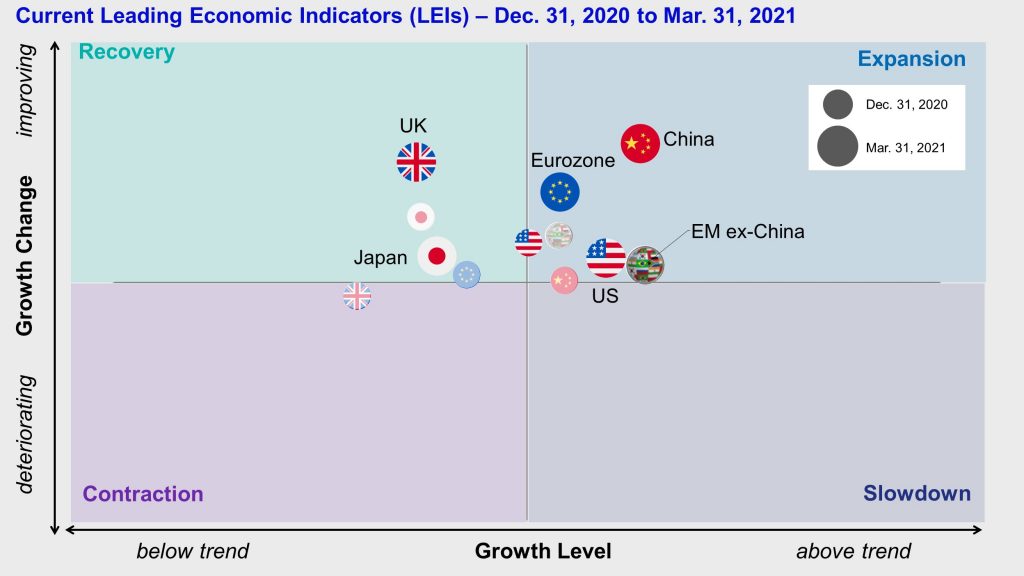

The global cycle continues to expand with growth above its long-term trend and expected to improve across both developed and emerging markets. Our indicators suggest positive economic momentum is widespread across all major countries. At a regional level, we continue to see the strongest momentum in the eurozone and the UK, where business surveys continue to signal a strong rebound in demand and production expectations, coupled with low inventories and a steady improvement in consumer sentiment. These dynamics increase the probability of positive growth surprises in the region in the second half of 2021 as economies re-open and vaccinations continue.

Our global risk appetite framework suggests market sentiment continues to improve, signaling growth expectations should continue to be revised to the upside.

Figure 1: The expansion continues across regions, with strong momentum in the eurozone and the UK

Taking a closer look at inflation

As discussed in our last update, the macro environment of the past year has, by and large, evolved in line with historical cyclical patterns. As growth moves above trend and the economy enters an expansion phase, inflation begins to rise. This reflationary environment has been reflected quite broadly in asset prices across assets classes, regions, sectors, and styles. In some cases, strength of this reflation trade has led to the rise of inflationary fears, with concerns that rising inflation may turn from a desirable cyclical development to a more enduring and pernicious long-term problem.

We expect headline and core inflation to rise through 2021 in most of the world, driven by several transitory factors, including “base effects” in year-over-year calculations. The large price declines caused by lockdowns in the first half of 2020 will drop off the year-over-year statistics in the coming months, likely causing headline inflation to breach the cyclical highs of the past few cycles. These effects tend to occur during every recession and recovery but, given the severity of the 2020 recession, they are likely to be quite large in 2021. Additionally, positive momentum in commodity prices is likely to provide upward pressure on headline inflation for a few months. These developments are consistent with typical cyclical patterns of an expansionary regime and, at this stage, do not imply a new, structurally higher inflation regime.

The U.S. Federal Reserve and the European Central Bank have gone out of their way to communicate their intentions to see through these transitory effects and, additionally, their willingness to let inflation run “above average” also on a medium-term, cyclical basis. Therefore, assuming we can rule out a premature tightening in monetary policy, the question is whether this cyclical build-up in inflation will lead to an orderly or disorderly bear steepening in the yield curve, and what the impact of these two scenarios would look like for our asset allocation.

In an orderly scenario, we can expect market volatility to decline and our current expansion/reflationary portfolio to perform well. In a disorderly scenario, market volatility and dispersion between asset class returns are likely to increase meaningfully. We would expect equities, value, and cyclicals to still outperform fixed income, quality, and defensives, respectively, given their relative exposures to interest rate risk. However, given the potential rise in U.S. dollar funding risk, our emerging markets tilts are likely to underperform relative to developed markets across equities, fixed income, and currencies. We believe the underperformance of emerging markets in the past two months partially reflects some pricing of this disorderly scenario.

The probability of a disorderly market reaction is likely to increase with upside surprises in wage inflation, inflation expectations, and end-consumer prices, as these categories tend to be less volatile. In this regard, to support our assessment of inflationary pressures, we gather information on price trends from different parts of the economy and summarize them into a composite Inflation Momentum Indicator (IMI).The indicator measures the acceleration/deceleration in inflation on a trailing three-month basis, covering consumer and producer prices, inflation expectation surveys, import prices, wages, and commodity prices. A positive (negative) reading implies inflation has been rising (falling) on average over the past three months. While inflation is rising across all sectors of the economy, above-average contributions have come from import prices (energy prices and dollar depreciation) and the manufacturing goods sector, while wages, consumer prices, and inflation expectations have been more muted.

By design, the indicator is mean-reverting and captures only short-term fluctuations in inflation. However, the persistency of a positive reading over multiple months (or quarters), coupled with its composition across categories, could provide early signs of a more persistent inflation problem.

Figure 2: Inflation momentum indicator

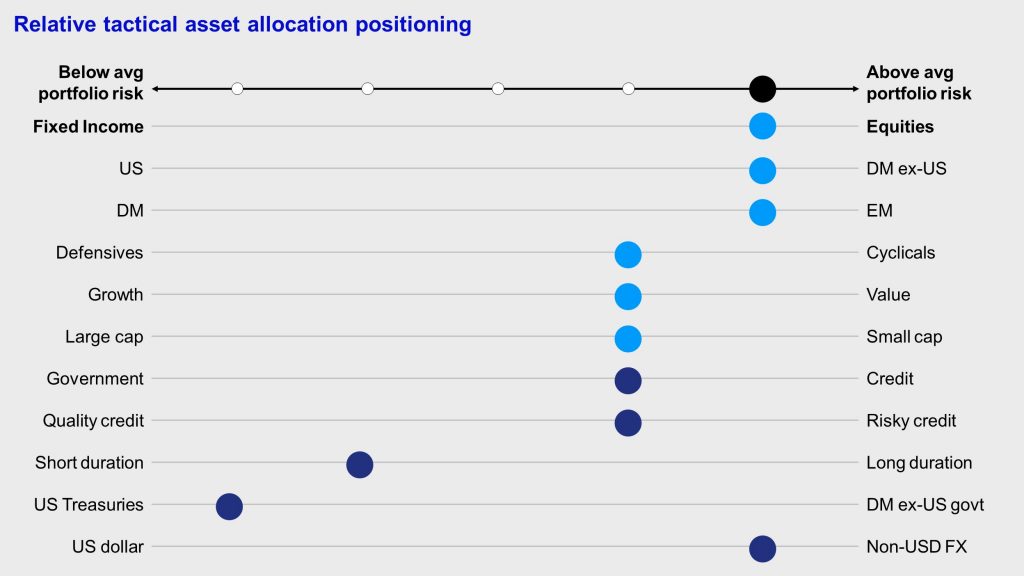

Investment positioning

We have not implemented any changes to our positioning.

- Within equities, we favour emerging markets and developed markets outside the U.S., driven by improving global growth, rising risk appetite, and a rebound in growth momentum relative to the U.S. We remain tilted in favour of (small) size and value. In addition, we are tilted in favour of momentum which, in line with the growth versus value rotation, is gradually moving away from quality and mega-cap stocks toward smaller-capitalization and value segments of the market.

- In fixed income, we are overweight credit risk1 and underweight duration. We favour risky credit despite tight spreads, seeking income in a low-volatility environment. We are overweight high yield, bank loans, and emerging markets debt at the expense of investment grade credit and government bonds. We favour U.S. Treasuries over other developed government bond markets given the yield advantage.

- In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. We remain constructive on emerging markets foreign exchange given attractive valuations, an improving cycle, and a favourable backdrop for capital inflows, favouring the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Brazilian real. Within developed markets, we favour the euro, the Japanese yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar.

Figure 3: Global cycle remains in expansion regime

1 Credit risk defined as DTS (duration times spread).

This post was first published at the official blog of Invesco Canada.