by Frank Beaudry, equity investment analyst

Matt Lanstone, ESG head of research and investing

David Polak, investment director, Capital Group

Investors are seeking companies that address their concerns about environmental, social and governance issues. Deep ESG analysis can help find them.

Capital Group investment analyst Frank Beaudry goes the extra mile to research a company’s approach to environmental, social and governance (ESG) issues.

Beaudry recently bicycled through the Dolomites in Italy alongside the CEO of energy company Enel. Previously head of the company’s renewables division, Francesco Starace is changing Enel’s way of doing business. It was not a typical research trip, but being on the ground gave Beaudry a chance to gain a deeper understanding of how the company is managed.

“Looking at external ESG metrics a few years ago, one might have seen Enel as a state-owned, carbon-emitting, sleepy giant,” Beaudry says. “But it has transitioned to become a completely different company.” While biking up winding inclines, they discussed the learning curve, approach to risk management and the long process of developing renewable energy.

“I wouldn’t have seen any of that with a colour-coded outside rating five years ago,” notes Beaudry. “I needed to be talking to the CEO and CFO about their vision of the cycle from capital expenditure to earnings with renewables.”

Energy and mining analyst Frank Beaudry is also a cycling enthusiast.

Maintaining a long-term ongoing dialog with company management, rather than merely reviewing their financial records, can reveal how they think about — and act on — ESG issues. A sustainable business plan must include ESG considerations if it intends to look beyond quarterly returns and positively impact the next quarter century. The challenge is to determine which ESG issues are material and gauging how that will be reflected in share prices over time.

Growing demand for ESG funds

Many investors drawn to ESG funds may believe it’s an easy fix — a fast track to putting their money where their heart is. But there’s no one size fits all.

“You've got some of the obvious priorities, like climate change or human rights or board diversity,” notes Matt Lanstone, Capital Group’s head of ESG research and investing. “But there are other aspects of ESG that haven't been in the headlines quite as often — things like supply chain issues or providing for underserved communities.”

With awareness of ESG surging, it’s important to evaluate how it fits within portfolios. “If I think back a decade ago, there were specialist firms doing impact investing or some exclusionary screening, but the majority of asset managers weren't talking much about ESG,” says Lanstone. “Fast-forward to today and pretty much every large asset manager has integrated ESG into their investment process — or is playing catch-up to do so.”

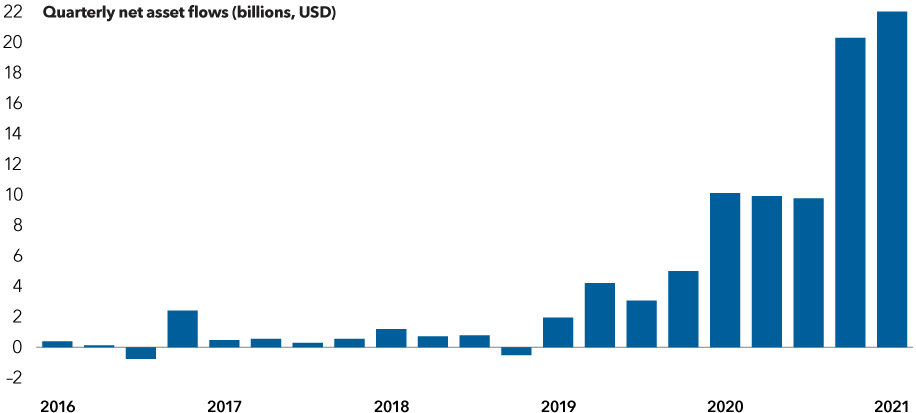

Reflecting the rising demand, U.S. investors have poured assets into sustainable funds in record-breaking numbers in each of the last five calendar years. In 2019, flows quadrupled to US$21.4 billion. And 2020 saw US$51.1 billion channeled into sustainable funds, accounting for one-fourth of the net flows into mutual funds that year. And the trend continued in the first quarter of this year.

ESG funds attract record-breaking inflows

Sources: Capital Group, Morningstar. As of 3/31/21. Includes U.S. mutual funds and ETFs but excludes fund of funds.

David Polak, an equity investment director at Capital Group, says it’s only the beginning. “We’re in the early stages of the evolution of ESG investing. It’s going to take at least five years for the investment community to begin to understand exactly how they fit into this.”

And asset managers are finding various ways to fit in. Dozens of new sustainable funds have been launched each year since 2015, and there are now nearly 400 open-end and exchange-traded sustainable funds for U.S. investors to consider.

There are several methods for applying ESG. Some exclude industries like fossil fuel or gun manufacturers, while others look for individual issuers considered the best-in-class ESG performers. A thematic approach could focus on specific trends, such as climate change or the energy transition.

Some asset managers can attract ESG-focused investors by repurposing existing funds. In an economic example of reuse and recycle, an actively managed fund can maintain its AUM but shift the strategy — and often give it a new name. It’s crucial that investors look below the surface of any sustainable fund to understand how a manager builds its ESG philosophy and portfolio.

“I think the first response from some investment management firms has been to create new strategies or new product around ESG,” notes Polak. “However, we're beginning to see an approach that thinks about integrating ESG into everything that investment managers do.”

So how can investors find truly sustainable investments? Ratings by third-party research firms, including Sustainalytics and MSCI, are often the first step.

Third-party ratings are helpful but incomplete

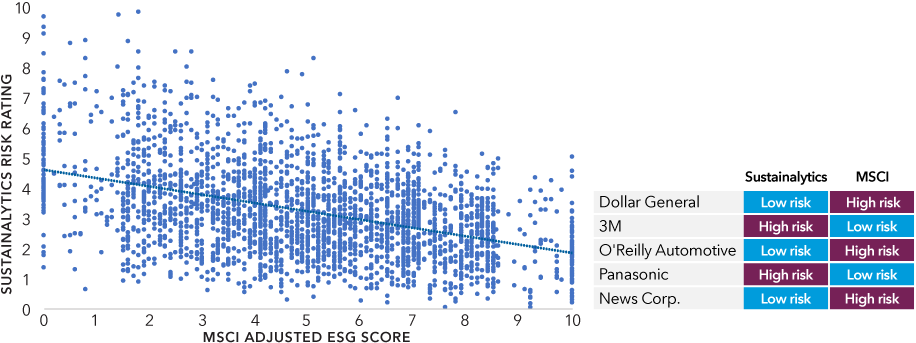

With increased public interest in ESG investing comes increased interest in how to assess a corporation’s commitment to ESG and measure its impact. But even the ratings agencies don’t agree on what makes a good sustainable investment.

MSCI’s ratings, for example, evaluate a company in relation to its peers in the same industry. Sustainalytics, from Morningstar, scores a company based on its exposure to the ESG risks of an industry or region, accounting for a company’s actions to manage that risk.

A recent study by MIT Sloan School of Management found a low correlation of just 0.61 between the major providers. In comparison, credit-rating agencies share a more reliable correlation of 0.92.

Third-party data alone will not provide answers for those who seek to invest in companies that reflect their own ESG priorities. A single company can receive very different ratings, so investors also need to understand what isn’t captured in traditional metrics.

ESG ratings show a cloudy picture

Sources: Capital Group, Morningstar, MSCI. As of 12/31/20. Dots represent all companies in the MSCI ACWI Index. Sustainalytics is a globally recognized leader in ESG ratings and research, and is wholly owned by Morningstar.

“Data is a good starting point, but in and of itself, it's not sufficient,” Polak says. “We want to understand where there might be an opportunity the market is not yet recognizing. Or, we may have identified something that is yet to be understood as a risk. Most importantly, third-party ratings look to the past, while investors focus on the future. There are no future facts.”

Lanstone recalls one recent example. “A well-known retail company received high ratings by third-party firms, and there was a lot of interest from investors. However, our analyst’s on-the-ground research raised questions about supply chains and the sustainability of margins. We were not shocked when subsequent news and claims regarding the supply chain vindicated our analyst's approach.”

Investors must try to be a step ahead if they want to help shape the future. Deep research and one-on-one interaction with company management can uncover opportunities and risks that scores don’t reflect, and an active manager can decide to invest or divest based on new information. Passive ESG vehicles, however, can’t make human judgments or investment decisions, as they generally track the index on which they are based.

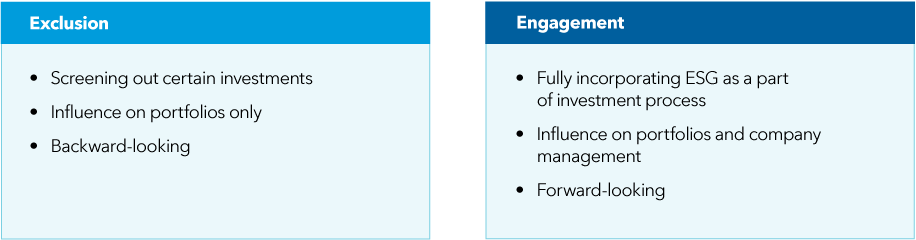

Two approaches to ESG: Exclusion or engagement

In search of ESG-friendly investments, some managers or products may shun entire industries. That may make investors feel good, but does it actually make a difference?

“The benefit of exclusion is that you feel an instant impact,” Lanstone says. “But by walking away from an industry, you’re voting with your feet. You have no more say in how that company or industry will approach sustainability. And, ultimately, you may be excluding sustainable investments that could generate returns.”

Two approaches to ESG investing

Source: Capital Group

In contrast, continuing to invest and engage with those companies can provide active managers some leverage to influence change.

“Engaging can take a while to have an effect,” Lanstone continues. “What matters is having a long-term perspective and understanding that the improvements in ESG performance can ultimately translate into superior returns.”

However, engagement may not always work. “Of course, we have to accept that some companies won't commit to improvement,” says Polak, “and an active investor can choose to divest. We will certainly exclude individual companies if we don't think they're going to be good long-term investments due to ESG issues.”

With ownership comes responsibility, as fund managers communicate with corporate managers on behalf of shareholders.

“Proxy is one day in the year,” notes Beaudry. “When I come to vote a proxy, I look back at my notes for the past two, three years of meetings, see how a company's been trending, see which message I want to send and how it's consistent with our past conversations. I don't know how people vote proxies without that context.”

Joining the energy revolution

Being actively engaged can position an asset manager to encourage progress toward a cleaner, greener future.

“One of the best investments out there could be perceived as a filthy polluter that’s flagged and rated with a valuation that reflects it,” Polak says. “But forward thinking analysis might reveal that such a company is cleaning up its act. In three to five years the market would recognize that, while investors on the ground floor could have benefited.”

The sectors that Beaudry covers can be problematic. Utilities and mining have a lot of touch points with governments and the public, along with risk of controversies, from carbon emissions to safety fears to the interaction with local communities.

“ESG considerations are highly integrated into my thought process as an analyst,” Beaudry says. “It can mean the difference between an asset that keeps operating and one that has only short-term earnings for the next five years. It’s not about putting solar panels on a roof; it’s asking if a business will still exist in 10 or 20 years.”

Environmental, social or governance issues may seem intangible, but they can have a very real effect on long-term returns.

“ESG issues will hit the financial statements over time,” Beaudry continues. “I need to understand ESG if I want my assumptions about growth, costs, and longevity and sustainability of earnings to mean anything. I need to understand the industry’s structural trends and determine if the earning stream will grow. Companies were good at building coal plants a few years ago, but now they need skills that will expose them to growth, and that’s renewables.”

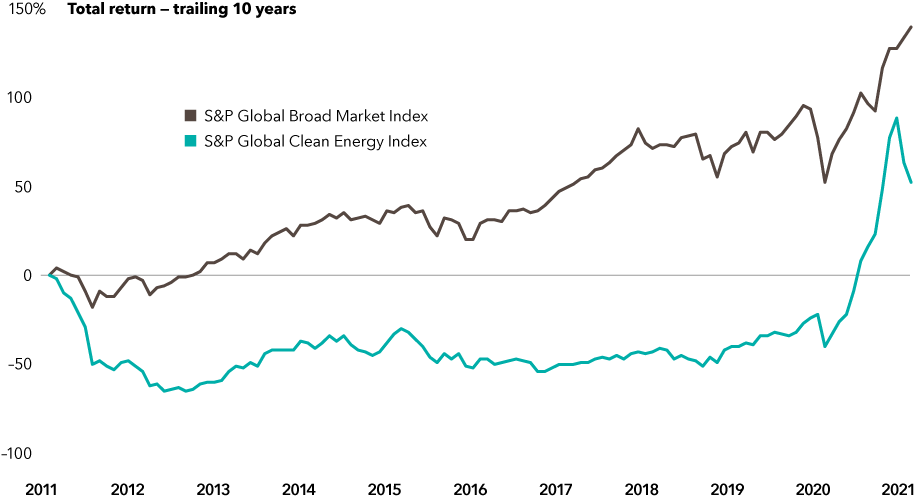

The profit potential of clean energy

Sources: Refinitiv Datastream, Standard & Poor's. As of 3/31/21. Values in USD.

While last year saw a spike in returns for the S&P Global Clean Energy Index, “we should not let the recent market returns of renewable energy companies distract us from looking at the long-term opportunity,” Beaudry warns. “2020 was a time of indiscriminate exuberance, with many speculative renewable energy companies coming to market, and some of these gains have faded. Disruptive innovators should survive and outgrow the others by striving to make the world better and more sustainable.”

One of those may be Ørsted, formerly Danish Oil and Natural Gas, which no longer produces any oil or natural gas. Instead it has become the largest developer of offshore wind farms.

“In the late 2000s, management realized the company had no future as a fossil fuel-based utility and went on a mission to make offshore wind economically competitive,” Beaudry explains. “And now it is. The East Coast of the U.S. is going to have lots of offshore wind. You're going to see some in Japan, Korea and Taiwan. This is a very real technology.”

This is just one example in which environmental and economic concerns can overlap.

Capital Group’s approach to ESG

While you won’t currently find one fund specifically titled ESG or sustainable, “we’re integrating ESG across all of our strategies” Polak says. “Over time, we may think about how other approaches suit us, but our focus is to ensure that we have consistent integration across our process, and that the outcome is durable.”

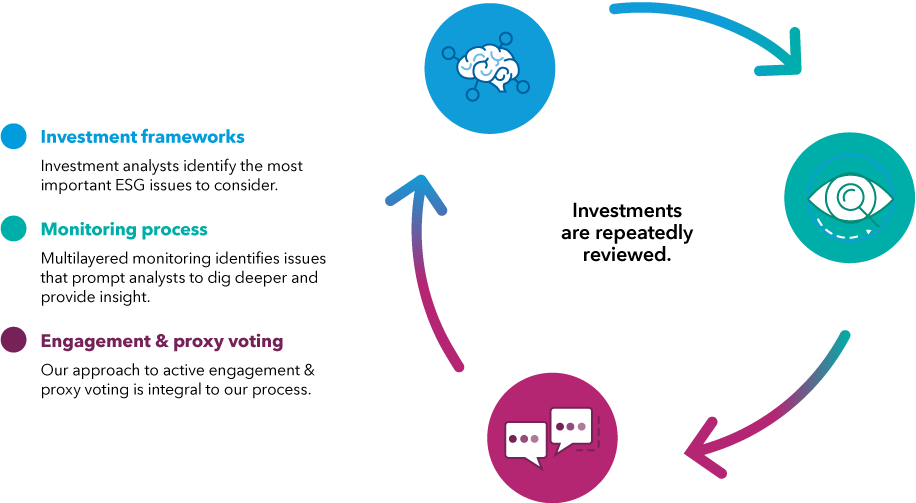

Capital Group’s ESG strategy features three interrelated components

Source: Capital Group.

It’s a natural fit for Capital Group. “ESG integration is one of our key strategic priorities, and it plays to our strengths as an organization,” Lanstone adds. “It’s fundamental and fully incorporated into our investment process, based on three tightly woven components: proprietary ESG investment frameworks developed by experienced analysts, ongoing monitoring of potential issues, and active engagement and proxy voting.”

About

Frank Beaudry Equity investment analyst

Frank Beaudry Equity investment analyst

Frank Beaudry is an equity investment analyst with 11 years of industry experience. He holds an MBA from London Business School, as well as a bachelor of civil law and common law from McGill University.

Matt Lanstone ESG head of research and investing

Matt Lanstone ESG head of research and investing

Matt Lanstone is a global head of research and investing in ESG with 28 years of industry experience (as of 12/31/2020). He holds a bachelor’s degree first class in economics and accounting from the University of Bristol.

David Polak Investment director

David Polak Investment director

David Polak leads the investment specialist team representing Capital Group's global equity services. He has 35 years of industry experience and holds a bachelor's degree in economics from University College London.