by Avi Hooper, Invesco Canada

Resurgence in demand for scarce resources contributing to a positive outlook for the Canadian dollar.

Canada is blessed with the natural resources required for the growth and development of the global economy. For years, the prices of many of these basic materials remained depressed. China’s entry to the World Trade Organization (WTO) in 2001 was the start of the last commodity super cycle which peaked in 2008 during the global financial crisis. For years, companies have under invested, however demand from new technologies is leading to a return of pricing power for Canadian producers.

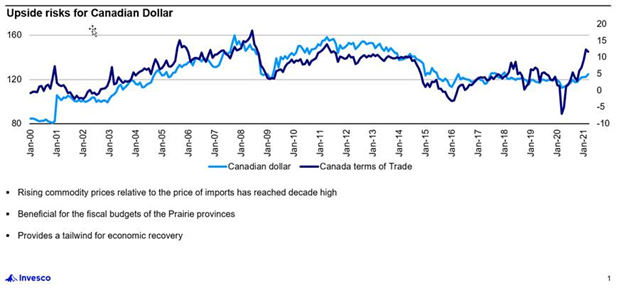

This resurgence in the demand for scarce resources is providing a supportive backdrop for the Canadian dollar’s future purchasing power. Canadian terms of trade are close to the 2008 peak, yet the trade-weighted value of the Canadian dollar is materially behind. Valuations of the Canadian dollar are the most attractive they’ve been in many years.

Canada is set to run an external trade surplus this quarter – the country’s exports will exceed imports – for the first time since 2008¹. The U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, continues to grow. The re-balancing mechanism to regain competitiveness comes via the currency channel, supporting the strong Canadian dollar outlook.

Canadian fixed income offers the highest yields of the G10 countries². Bond yields are further enhanced through the high quality credit risk of provincial government bonds. Foreign investors, faced with negative yields domestically, are increasingly active in Canadian fixed income, adding support to Canada’s capital account.

The Bank of Canada (BoC) recently became the first central bank to begin tapering bond purchases since the pandemic-driven, emergency liquidity programs began last year. At the current run rate, the BoC was set to own more than 50% of the outstanding federal government debt by year end³.

The Canadian economy has meaningfully recovered and its markets are fully functioning. Nevertheless, quantitative easing continues to support the Canadian economic recovery. Given the positive outlook for the Canadian dollar, our investment grade strategies are 100% hedged back to Canadian dollars.

Data as of April 30, 2021

- Source: Invesco Fixed Income (IFI)

- Source: Bloomberg L.P

- Source: Bank of Canada

This post was first published at the official blog of Invesco Canada.