by Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

A year ago, we spent much time contemplating the shape of the recovery: Would the economy bounce back quickly, like a V? Hold low before recovery, like a U? Recover gradually, like a checkmark? None of those simple shapes capture the up-and-down ripple effects of last year’s shutdown that are still defining today’s economy.

Any way we describe the recovery, the U.S. is clearly riding the upside of it. Consumers are returning to former patterns of activity, and confidence is elevated. Development and distribution of vaccines have been successful. Demand is outstripping supply at the moment, stressing the availability and prices of a range of goods and services. We eventually expect capacity to catch up, but that process could take a number of months.

A new viral variant that leads to renewed shutdowns remains a key risk; India should be seen as evidence that this powerful virus is not yet defeated. But absent a resurgence of infections, the U.S. is well-positioned for a great year ahead.

Influences on the Forecast

- For the U.S., the worst of the disease appears to be in the past as vaccines reduce the frequency and severity of infections. Daily vaccine doses peaked on April 1 and have trended down since; supply of vaccines now exceeds demand. Attention has turned to outreach to those who have hesitated to take the shot as well as efforts to reduce outbreaks in the hardest-hit countries, with hopes of taming the pandemic globally.

- The U.S. added 266,000 jobs in April, an underwhelming report for a month in which greater job creation was anticipated. One disappointing month is not a trend, and prospects for improvement are high. As discussed here, a variety of factors are holding workers back from returning, most of which should prove temporary. Job creation in leisure and hospitality led the growth, while a decline in manufacturing employment will pass as supply chains recover. Meanwhile, initial unemployment claims have been trending down since February after sustaining unprecedented levels for most of 2020.

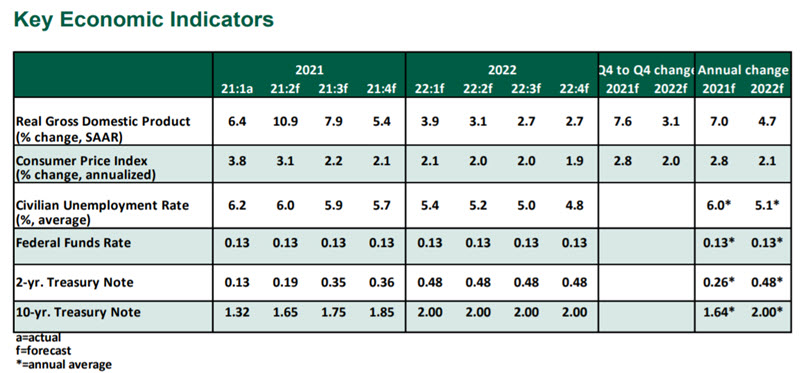

- Real gross domestic product (GDP) grew at a healthy rate of 6.4% on an annualized basis in the first quarter, and is set to get even better. GDP growth was impaired by slow exports and a depletion of inventories as supply chain bottlenecks slowed deliveries. These disruptions will be transient, and rebuilding inventories will support growth for the remainder of 2021. That boost will come on top of lively consumer spending, as stimulus and pent-up demand will allow eager consumers to return to their prior levels of consumption, and then some.

- The Biden administration has laid out its full set of proposals. The infrastructure-focused American Jobs Plan would invest in public resources, while the American Families Plan would expand education and family support. We expect a subset of these proposals will be ratified later in 2021. As infrastructure projects support growth over a long period of time, they do not lift our forecast for 2021 and 2022. Proposed tax hikes are already being negotiated down, and any increase would likely to be of a small enough magnitude as to not impair growth.

- Inflation remains a hot topic, renewed by a consumer price index (CPI) increase of 4.2% year-over-year in April, or 3.0% excluding food and energy. Base effects are making year-over-year comparisons look very high. Specific sectors are experiencing higher prices for varying reasons, like supply chain bottlenecks increasing used car prices and a rebound in travel lifting airfare and hotels. All of these factors are the ripples of reopening; we do not see high inflation taking hold in a persistent manner.

- Amid a favorable economic outlook, firm inflation and an ample supply of new debt issuance, we have revised our forecast for the 10-year U.S. Treasury note yield up to 2% in 2022. As long as the rise is gradual and for positive reasons, we do not expect this to weigh on the outlook or on market sentiment.

- The Federal Open Market Committee reaffirmed its dovish stance at its April meeting, emphasizing that employment has a long way to recover, and inflation must stay persistently elevated before it becomes a trigger to act. Tapering of asset purchases will be the Fed’s next priority, but no plans have yet been announced.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.