by Don Vialoux, EquityClock.com

Technical Notes for Wednesday May 5th

Global Base Metals iShares (XBM) moved above $18.89 to an all-time high extending an intermediate uptrend.

BMO Equal Weight Base Metals ETF moved above $62.01 and $62.50 to a seven year high extending an intermediate and long term trend.

Rio Tinto (RIO), one of the world’s largest base metal producers moved above $88.74 to an all-time high extending an intermediate uptrend.

Teck Resources (TECK), a TSX 60 stock moved above US$23.89 extending an intermediate uptrend.

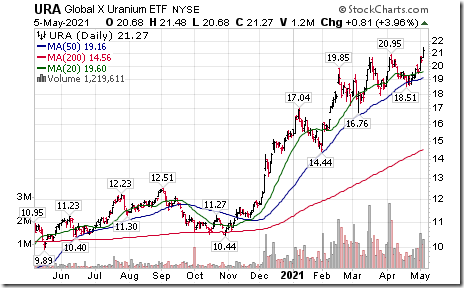

Globex Uranium ETF (URA) moved above $20.95 extending an intermediate uptrend. Uranium stocks moved higher on reports that the Biden Administration is considering subsidies for current uranium powered utilities to continue power production.

First Majestic Silver (FR) moved below $18.27 extending an intermediate downtrend.

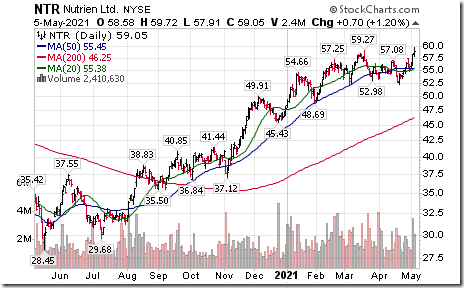

Nutrien (NTR), a TSX 60 stock moved above Cdn$73.10 and US$59.27 to a seven year high extending an intermediate uptrend.

Verizon (VZ), a Dow Jones Industrial Average stock moved above $58.84 extending an intermediate uptrend.

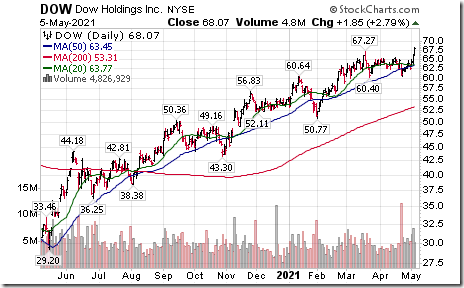

Dow (DOW), an S&P 100 stock moved above $67.27 to an all-time high extending an intermediate uptrend.

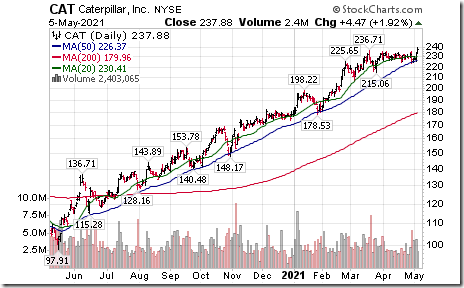

Caterpillar (CAT), a Dow Jones Industrial Average stock moved above $236.71 to an all-time high extending an intermediate uptrend.

Goldman Sachs (GS), a Dow Jones Industrial Average stock moved above $365.85 to an all-time high extending an intermediate uptrend.

Trader’s Corner

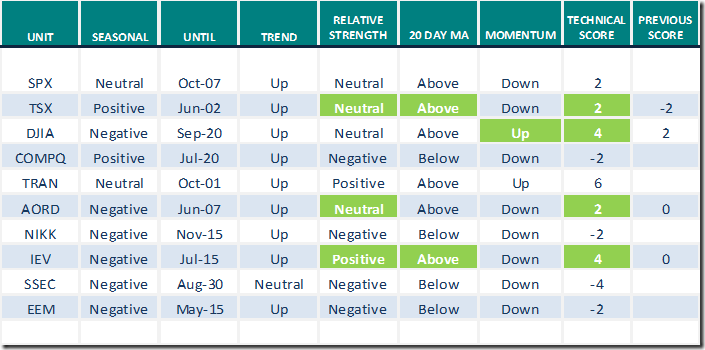

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

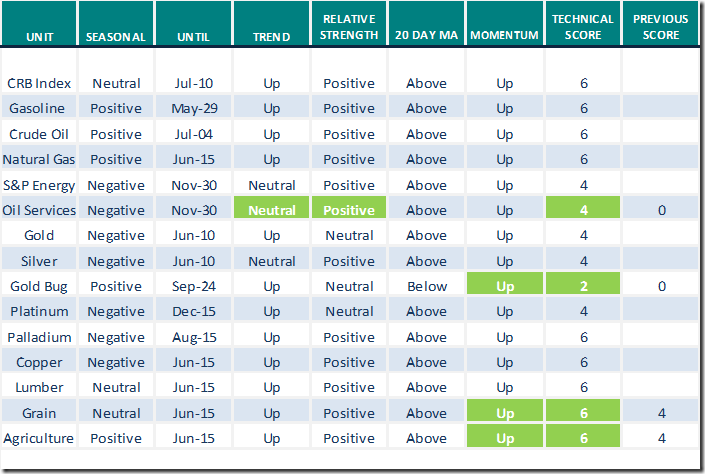

Commodities

Daily Seasonal/Technical Commodities Trends for May 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

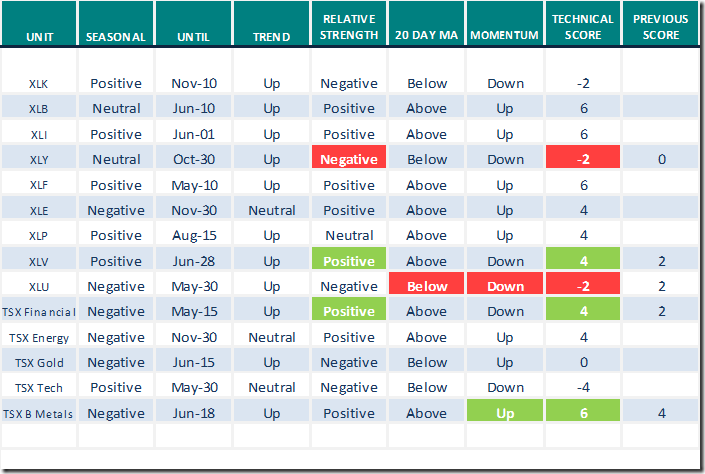

Sectors

Daily Seasonal/Technical Sector Trends for May 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometer

The intermediate term Barometer added 0.80 to 80.36 yesterday. It changed from Overbought to Extremely Overbought on a return above 80.00.

The long term Barometer slipped 0.60 to 93.19 yesterday. It remains Extremely Overbought.

TSX Momentum Barometer

The intermediate term Barometer added 2.15 to 72.00 yesterday. It remains Overbought.

The long term Barometer slipped 0.38 to 76.50 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0015_thumb-1.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0025_thumb-1.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0035_thumb-1.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0045_thumb-1.png)