by Alessio De Longis, Senior Portfolio Manager, Invesco Investment Solutions, Invesco Canada

We expect the global economy to be in an expansionary regime, with growth above its long-term trend and continuing to improve. Growth is accelerating across the developed world, with the eurozone and the UK seeing meaningful momentum driven by a rebound in the inventory cycle. Emerging Asia is accelerating again, driven by China’s real estate market and a pickup in trade activity across the region. In this month’s update, I explain why this expansionary regime is favourable to equity and credit premia, cyclical factors, and risk assets more broadly.

Macro update

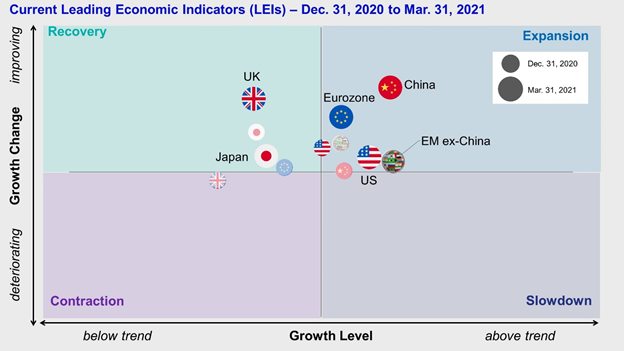

The global economy is moving further into an expansionary regime, with growth above its long-term trend and expected to improve further. While the U.S. improves at a steady pace, our leading economic indicators (LEIs) are registering additional positive momentum in the rest of the world, especially in regions that have lagged the global upswing, such as Europe, or that recently stabilized after leading the post-COVID recovery, such as emerging Asia. An overview of our LEIs across regions reveals several highlights:

- The U.S. is in expansion. Business confidence is stabilizing at cyclical highs, while we register strong improvements in consumer sentiment, industrial orders, and housing market activity. The labour market is improving at an impressive clip, as exemplified by the most recent employment report. Credit conditions remain very favourable, as lagged effects from monetary easing and the steepening of the yield curve provide support to economic growth.

- The eurozone moves into expansion. After spending the last two quarters on the verge of another contractionary phase, our composite LEI for the region shows renewed, strong positive momentum across all its components. Our framework indicates a favourable inventory cycle in the months ahead with industrial orders and export demand rising at a time of low inventories in the manufacturing sector, leading to a significant increase in production expectations. Consumer confidence is also rebounding after the setback in the fourth quarter of 2020.

- The UK and Japan remain in a recovery regime,with growth below trend but continuing to improve at a steady pace. In the UK we register similar dynamics to the eurozone, where surveys point to meaningful improvements in consumer confidence and rising demand expectations in the manufacturing sector which, given low inventories, suggest increasing industrial production in the month ahead. In Japan we expected a more moderate growth increase, given a less pronounced inventory cycle at this stage.

- Emerging Asia is rebounding after the deceleration of the past few months, with positive contributions across all major economies such as China, India, South Korea, and Taiwan. Meaningful improvements in China’s housing market activity and industrial production over the past couple of months are the primary contributors to the rebound of the China LEI back into expansion. In addition, a significant improvement in export numbers across the region confirms renewed growth momentum in Asia, with positive implications for the global manufacturing cycle. The strength in emerging Asia is more than offsetting the deceleration we register in Latin America, moving our emerging markets composite back into expansion.

Our global risk appetite framework suggests market sentiment continues to improve despite the recent increase in global bond yields. With the exception of the underperformance in emerging market equities relative to developed markets, the broader capital markets spectrum continues to reflect an improving growth outlook, with credit markets outperforming government bonds, lower credit quality outperforming higher credit quality, and equities outperforming fixed income. Based on our framework, we believe this is consistent with rising growth expectations and further improvements in our LEIs over the next few months.

Looking back over the past year, our framework has led us to position for a cyclical, reflationary outlook since June 2020. With a few exceptions, global capital markets have largely performed in line with these expectations. Today, the length and strength of this reflation trade has led to the rise of inflationary fears, with concerns that rising inflation may turn from a desirable cyclical development to a more enduring and pernicious long-term problem. At this stage our expectations align with the former scenario, and we plan to discuss the subject in more detail in our next update.

Figure 1: The expansion broadens, with renewed momentum in Europe and emerging Asia

Sources: Bloomberg L.P., Macrobond. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions. Macro regime data as of March 31, 2021. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A GRACI level above (below) zero suggests above (below) trend risk sentiment. For illustrative purposes only.

Investment positioning

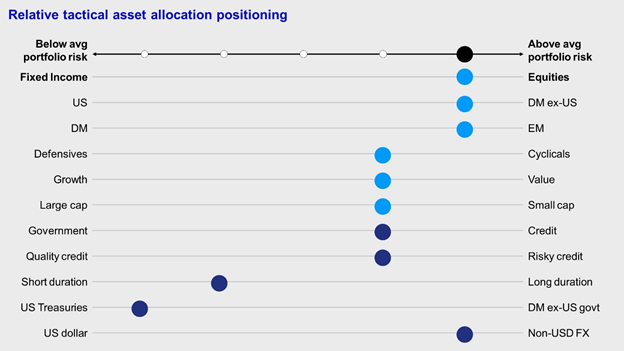

Expansionary regimes favour equity and credit premia, cyclical factors, and risk assets at the expense of safer asset classes.

- Within equities, we favour emerging markets and developed markets outside the U.S., driven by improving global growth, rising risk appetite, and a rebound in growth momentum relative to the U.S. Despite recent strength in the greenback, we continue to expect a weakening U.S. dollar trend, historically supportive of emerging markets via capital inflows and easing of financial conditions. We remain tilted in favour of cyclical factors levered to an improving global cycle, namely (small) size and value. In addition, we are tilted in favour of momentum which, in line with the growth versus value rotation, is gradually moving away from quality and mega cap stocks toward smaller capitalization and value segments of the market.

- In fixed income, we are overweight credit risk1 and underweight duration versus the benchmark. We favour risky credit despite the compression in spreads. As volatility declines, we expect attractive risk-adjusted returns from income generation. We are overweight high yield, bank loans, and emerging markets debt, local, and hard currency, at the expense of investment grade credit and government bonds. Despite their underperformance, we favour U.S. Treasuries over other developed government bond markets, expecting yields to stabilize and the income differential to drive total returns.

- In currency markets,we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. This positioning has been challenged year-to-date by U.S. dollar strength, particularly versus emerging currencies. We remain constructive on emerging markets foreign exchange given attractive valuations, an improving cycle, and a favourable backdrop for capital inflows, favouring the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Brazilian real. Within developed markets, we favour the euro, the Japanese yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar.

Figure 2: Global cycle remains in expansion regime

Source: Invesco Investment Solutions, March 31, 2021. DM = developed markets. EM = emerging markets. For illustrative purposes only.

1 Credit risk defined as DTS (duration times spread).

This post was first published at the official blog of Invesco Canada.

Copyright © Invesco Canada