by Thomas Reithinger, Fixed Income Portfolio Manager, Capital International Asset Management

How is Canada’s business model faring? Thomas Reithinger examines the current state of Canada’s economy and the potential investment implications.

As an investment analyst and portfolio manager, when I look at companies, I analyze their business models and their competitive advantages. I do the same thing for a country when I examine its macro environment. For Canada, I break down the country’s “business model” into three pillars: real estate, oil and the real economy. The COVID pandemic has upended Canada’s economy and changed its trajectory. Here is my current assessment of the three pillars and how they impact bond markets.

Real estate, or housing, is every Canadian’s favourite financial topic. Over the last 10 years or so, this sector has contributed a large chunk of growth to Canada through construction, finance and household wealth accumulation. The outlook is extremely strong, and there are three good reasons for that.

The first reason is huge demand for detached houses. Given the COVID-induced lockdowns, many people think living in the suburbs is cool again. They want more space and they want a backyard – that's changed, within the last year.

The second factor: aggregate household income has increased during the pandemic, which seems counterintuitive. But with so much government stimulus and unemployment benefits, people have money to spend on housing now. The reality is, the money might not be equally divided or very fairly divided among Canadians, but the money is there, so people can invest it on housing.

The last factor is low mortgage interest rates in Canada. Real estate is one of the most interest-rate sensitive parts of the economy. The rate cuts last year by the Bank of Canada pushed mortgage rates down, which has led to a frenzy of refinancing and new housing investment. Overall, I see solid prospects for the real estate sector.

At Capital Group, we don’t have one “house view” on a topic. Personally, I'm quite bullish on oil. COVID caused supply to be reduced. For the people of western Canada, I'm sure you know of oil wells lying dormant. At the same time, demand was reduced. There were cutbacks on airline travel and reduced car usage because of lockdowns. Looking ahead, when vaccines take hold and demand returns, it may come roaring back to such an extent that supply will not be able to keep up with it. That means in the short term — one to two years – oil prices should rise, and that's good news for Canada.

The third pillar I call the “real economy” and it includes car manufacturers, technology companies and other traditional industries in Canada. It boils down to two things: manufacturing and services. The manufacturing sector was not impacted significantly by COVID. Most manufacturing could continue shortly after the first lockdowns last year, and low interest rates and high demand for physical goods have prompted manufacturing companies to invest in new capacity. Service sector demand was hit harder by the strict lockdowns. However, that demand has been plugged by government stimulus. Demand for services could come back quickly once lockdowns are lifted. There are certain services that will take longer to recover, like tourism, but in general, I believe the mechanical reopening of the economy will bring back the service sector to near its pre-pandemic level. So overall, the real economy looks to be recovering well after COVID.

Fixed income positioning based on the three pillars

It seems like the Canadian economy is clicking on all cylinders. One concern now is: is it too good? Given the record stimulus in the system – both monetary and fiscal – plus the potential for a strengthening economy, and you have the risk of inflation. The Bank of Canada has two options. One is to just ignore it and let the economy overheat and cause inflation. That generally is bad for long maturity bonds, so we must be careful in our long bond exposure. The Bank of Canada’s other option is to hike interest rates and fight inflation preemptively. That is bad for the front end of the yield curve: bonds with shorter maturities. In my opinion, interest rates are likely to grind higher, so I’ve positioned my portion of the portfolio for that scenario. As I have said, Capital Group doesn’t have one single viewpoint on a topic, so other portfolio managers may take different approaches based on their view. That’s what The Capital SystemTM represents: investment professionals basing decisions on their core convictions. This approach can enhance diversification in portfolios.

Consider Canadian Core Plus Fixed Income

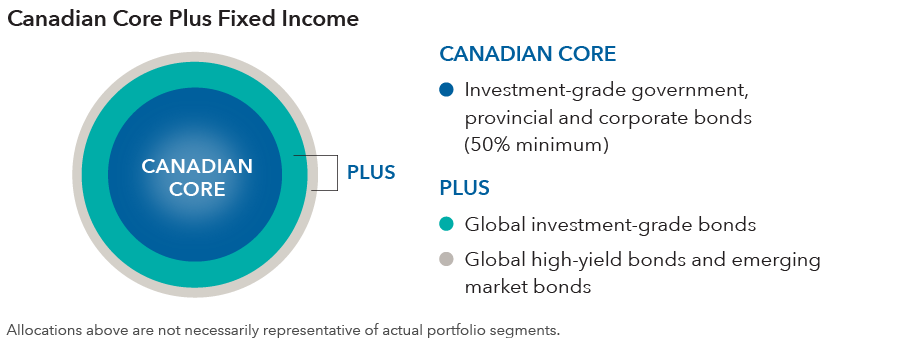

I’ve been a manager on Capital Group Canadian Core Plus Fixed Income FundTM (Canada) since 2019. The mandate invests in a broad range of Canadian and global fixed income securities.

Put simply, we want this bond mandate to behave like a bond mandate. We strive for it to function as a counterweight to equities. One of the key functions of bonds is to assist in providing stability to a diversified portfolio. The Canadian Core Plus mandate has historically had low correlation with equities, meaning it hasn’t tended to move in sync with equities. This can help smooth the ride for investors, and keep them invested when equity markets hit rough patches.

About

Thomas Reithinger Fixed income portfolio manager

Thomas Reithinger Fixed income portfolio manager

Thomas is a portfolio manager on Capital Group Canadian Core Plus Fixed Income FundTM (Canada). As a fixed income investment analyst, he covers sovereign debt. He has 10 years of investment industry experience and has been with Capital Group for seven years. Prior to joining Capital, Thomas worked as an analyst at Monashee Investment Management and as a research associate at Dix Hills Partners. He holds an MBA from Harvard Business School and double bachelor’s degrees in business & management and computer engineering from Rensselaer Polytechnic Institute graduating summa cum laude. Thomas is based in London.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2020. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, "Bloomberg"). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, "Barclays"), used under licence. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds and Capital International Asset Management (Canada), Inc. are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.