by Stephen Duench, CFA®, AGF Management Ltd.

One of the many tenets of quantitative equity analysis is the idea that factors perform differently in relation to each other depending on the stages of a market cycle. Value, high-beta, high-leverage and small-capitalization, for instance, are widely expected to outperform during cyclical upturns, while quality, growth and momentum are the anticipated laggards.

[Tweet "While value has fallen short of expectations by not outperforming at the start of this new cycle, quality is overshooting the mark by underperforming more than expected. Stephen Duench, AGF"]But most “quants” also understand this isn’t as simple as it sounds. Yes, these tendencies have played out time and again through history, but rarely does short-term factor performance repeat itself in the exact same way or with the exact same timing.

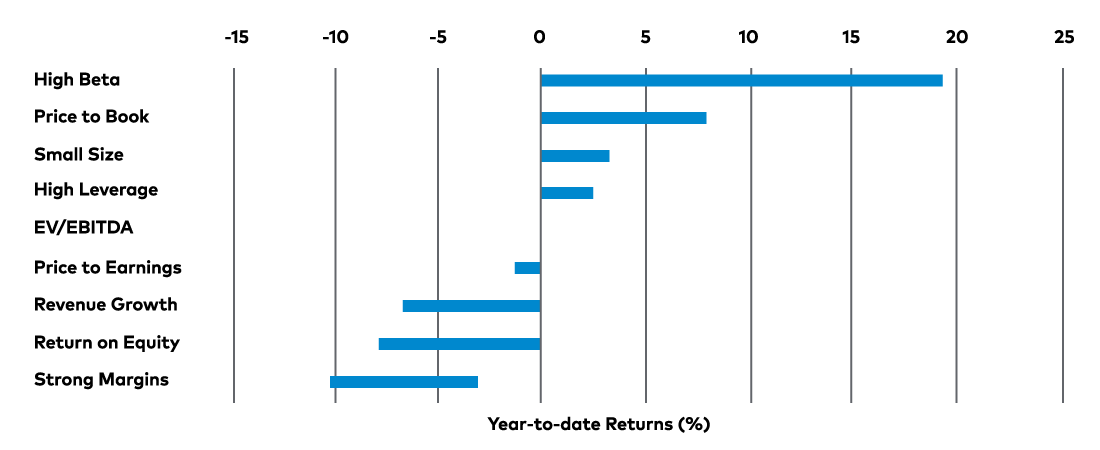

Take the current environment, for instance. Equity markets have continued to soar since the start of 2021, namely on the promise of an economic rebound from the pandemic-induced recession that occurred last year. And yet, while high-beta, high-leverage and small cap have led the charge higher just as expected, one factor that has been uncharacteristically absent from this leader’s pack is value.

S&P 500 Factor Returns (year-to-date through February 28, 2021)

Source: AGFiQ with data from FactSet as of February 28, 2021.

In fact, despite clear signs that a new cycle has begun, several metrics synonymous with value, including trailing and forward price/earnings multiples, are associated with some of the weakest returns over the past year, and that trend has only accelerated through January and February, according to our research.

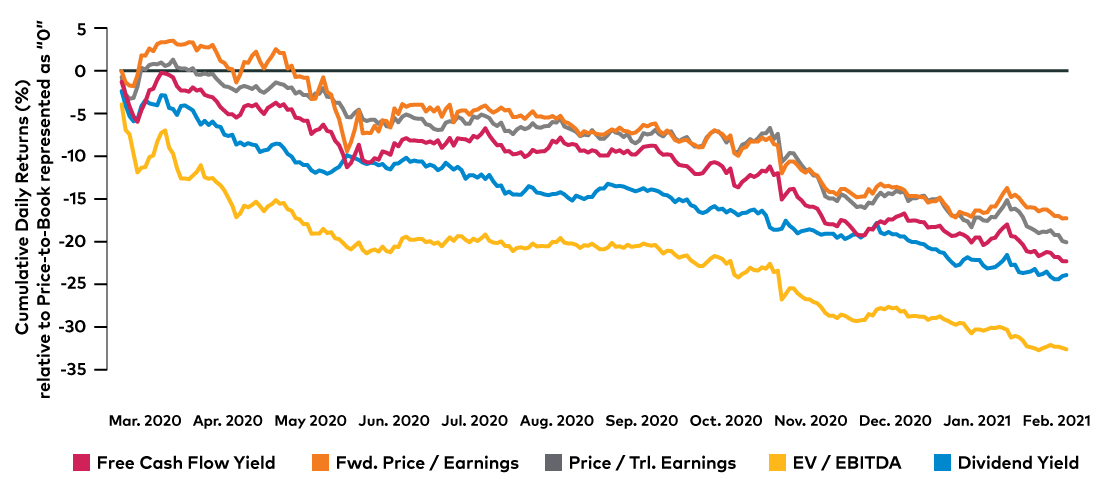

Price-to-book, moreover, represents the one – if not only – value ratio that has even remotely held its own from an overall factor perspective over this stretch. And even then, it may be just the exception that proves value’s recent struggles.

S&P 500 Value Factor Performance: Price-to-Book Vs. Other Metrics

Source: AGFiQ with data from FactSet as of February 28, 2021.

Clearly then, value’s recent run represents one of the biggest anomalies in equity markets right now, but it’s also not the only factor being taken to extremes these days. Our research shows that quality, a perennial underperformer during early stages of a new cycle, has not lagged this much in several years relative to other factors. In particular, companies with strong return on equity and high margins relative to their own sectors are faring worse now than they did immediately following the Global Financial Crisis and in the early aftermath of the Tech Wreck in the early 2000s. And because the magnitude of the underperformance has been so steadfast this time around, quality’s prior cycle gains have all but been erased.

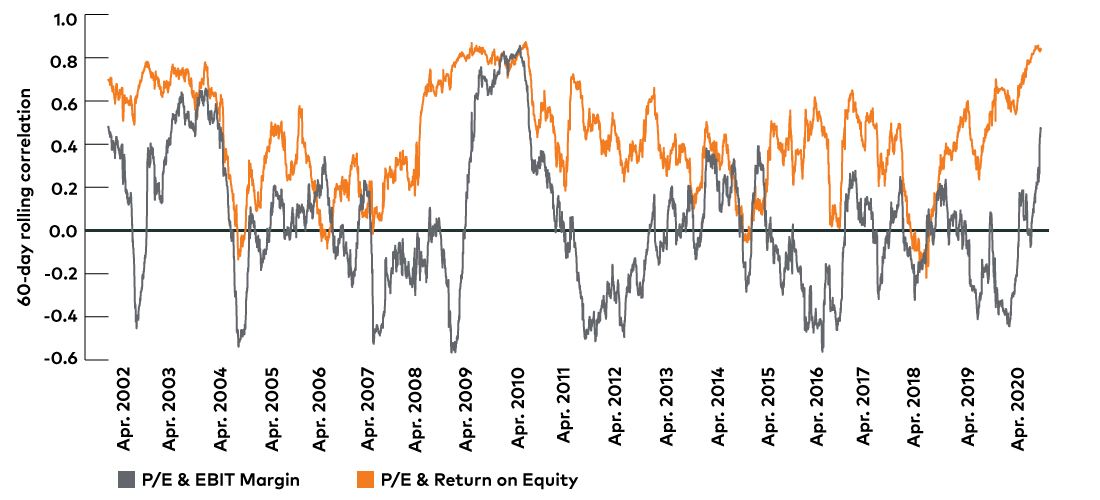

In other words, while value has fallen short of expectations by not outperforming at the start of this new cycle, quality is overshooting the mark by underperforming more than expected. But what’s more important to note, perhaps, is that when these two anomalies are taken together, a third anomaly emerges that may have even greater significance to investors. More specifically, our analysis shows the overlap in rolling correlations of price-to-earnings multiples in relation to various quality factors is now near decade-highs, meaning quality and value have rarely been this inexpensive at the same time.

S&P 500 Rolling Correlations Between Value and Quality

Source: AGFiQ with data from FactSet as of February 28, 2021.

So, what does all of this mean to investors? At least in the short term, both value and quality could continue down the extreme paths they have recently travelled and put further strain on portfolios that are not properly diversified or that are tilted too heavily towards these factors over others. However, sooner or later, there is every reason to believe that the performance of both these factors will revert to their historical means and make up for lost ground. As such, the potential opportunity of recognizing these factor anomalies may already be at hand. Indeed, there may be no better time to start adding value and quality to a portfolio than now.

Stephen Duench is a vice president and portfolio manager with AGF Investments Inc. He is a regular contributor to the AGF Perspectives blog.

To learn more about our quantitative capabilities, please click here.

The commentaries contained herein are provided as a general source of information based on information available as of March 5, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF and includes AGF Investments Inc., AGF Investments America Inc., AGF Investments LLC, AGF Asset Management Limited and AGF International Advisors Company Limited. The term AGF Investments may refer to one or more of the direct or indirect subsidiaries of AGF or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

™ The “AGF” logo is a trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.