by Talley Léger Sr. Investment Strategist, Invesco Canada

The not-so-mighty “buck” continues to face long-term challenges, which may remain favourable for international stocks.

A weak U.S. dollar is commonly seen as a benefit to international stocks as foreign companies’ returns appear more attractive in dollar-denominated terms. So it’s no surprise that, as an equity strategist, I’m often asked about my outlook for the U.S. dollar.

After a dramatic “risk-on” rotation beginning in early 2020, we greet the new year with a technically oversold U.S. currency and overbought stock market. In other words, investor positioning has become lopsided, arguing that a countertrend bounce in the “greenback” and near-term drawdowns in stocks may be in store.

Looking further ahead, however, I believe the “buck” should continue to depreciate for a host of reasons, and expect the current weak dollar cycle to last for years to come.

A history of U.S. dollar cycles

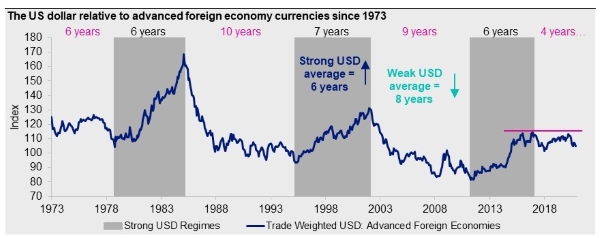

The trade-weighted U.S. dollar Index measures the value of the United States dollar relative to other major world currencies. Since the early 1970s, the relative value of the U.S. dollar has ebbed and flowed between long and well-defined periods of strength and weakness. As illustrated in Figure 1, it seems the “greenback” is only four years into the current weak dollar cycle. On average, such cycles have lasted about eight years, the longest having been roughly 10 years.

Figure 1. It seems the “greenback” is only four years into the current weak dollar cycle.

Factors that support a weak U.S. dollar

While past dollar cycles can offer clues about what the future may hold for the currency, history isn’t enough on its own. As such, I assembled a number of other factors that I believe support a weak dollar, including:

- Valuations suggest that a swath of international currencies are trading at substantial discounts, especially in emerging markets (EM), meaning that they may have more room to strengthen compared to the dollar.1

- The U.S. Federal Reserve (Fed) remains firmly in monetary easing mode, which means the path of least resistance seems to be downward for the U.S. currency. If quantitative easing (QE) represents a choice between the economy and the “greenback,” the Fed has opted to save growth and jobs by opening the spigots and inflating the monetary base at the expense of the currency. From a long-term perspective, I think it’s reasonable to expect the U.S. dollar to weaken further should the Fed keep such an abundant supply of currency in circulation.

- The deep economic impact of the coronavirus pandemic has necessitated counter-cyclical government support to an unprecedented degree. In turn, ballooning twin deficits have become stiff fundamental headwinds for the U.S. dollar. Why? When the U.S. spends more than it earns, it floods the global financial system with U.S. dollars, placing downward pressure on the value of its currency.

My recent chartbook – Seven reasons for a weaker U.S. dollar and stronger international stocks – takes a deeper dive into these factors, as well as other reasons why I believe we may only be halfway through the current weak U.S. dollar cycle.

Investment implications

In a global context, currency dynamics are an important component of investors’ total returns. For example, EM currency strength (the flipside of U.S. dollar weakness) has boosted dollar-based investors’ returns on EM stocks (priced in U.S. dollars).

Why have EM stocks moved in the same direction as their currencies? It’s a virtuous, self-reinforcing “flow” argument. Before foreign capital can flow into EM stocks, foreign currency-denominated assets must be sold in exchange for EM currencies.

Apparently, improving fundamentals versus 2015/16 have made the emerging market economies a more attractive destination for foreign capital, and the Fed’s dovishness is helping the situation.

For investors, this isn’t just an EM story. It’s a bigger message — one that I believe has positive ramifications for international stocks more broadly.

1 Source: OECD, Invesco, 12/31/19. Most recent data available. Valuations based on purchasing power parities (PPPs): the rates of currency conversion that try to equalize the purchasing power of different currencies by eliminating the differences in price levels between countries.

2 Source: Bloomberg L.P., Invesco, 11/30/20, based on the MSCI Emerging Market Index and the MSCI Emerging Market Currency Index

This post was first published at the official blog of Invesco Canada.