by Scott Brown, Ph.D., Chief Economist, Raymond James

Chief Economist Scott Brown discusses current economic conditions.

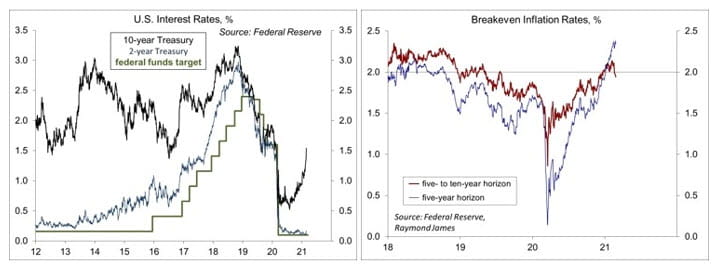

Long-term interest rates have continued to rise. While part of the increase has been fed by inflation fears, those concerns are overdone. Yet, long-term interest rates should rise as the economy recovers and it’s reasonable to expect that rates will eventually return to pre-pandemic levels. At the same time, increased government borrowing and the Fed’s ongoing purchases of long-term Treasuries and mortgage-backed securities will push in different directions.

In 2013, the Fed was in the third round of its Large-Scale Asset Purchase (LSAP) program, more commonly known as QE3. In congressional testimony that May, Fed Chair Bernanke hinted that the pace of monthly asset purchases would be reduced (“tapered”) at some point. Bond yields snapped higher. The stock market sold off a month later when Bernanke signaled that tapering would happen by the end of the year.

In his monetary policy testimony, Fed Chair Powell indicated that the Fed has no intention of altering the monthly pace of asset purchases (currently $120 billion per month). The Fed’s focus is on the job market and Powell said that the Fed is still a long way from achieving its inflation and employment goals. Other Fed officials echoed this view.

Inflation expectations have picked up, but not by a lot. Breakeven inflation rates (the yield difference between inflation-adjusted and fixed-rate Treasuries), while not exactly inflation expectations (although close enough) are moderately higher over the next five years, but have held close to 2% for the five years after that. That’s consistent with the Fed’s revised monetary policy framework, which calls for a period of inflation moderately above 2% (following a period of inflation below 2%), maintaining a long-term goal of 2%.

The price of a stock can be modeled as a risk-adjusted discounted stream of future earnings. Future earnings are discounted by the interest rate. Hence, all else equal, an increase in long-term interest rates implies a greater discounting of future earnings – and a lower share price. However, if interest rates are rising because of strong economic expectations, then expectations of future earnings will also be rising. Whether the share price rises or falls will depend on which effect is greater. This is the theoretical underpinning, but valuations are much more complex in practice.

In 2013, the taper tantrum have a significant impact on emerging market economies, many of which has large amounts of dollar-denominated debt. Currently, the global economic outlook is mixed. Aggressive monetary and fiscal policy is expected to lead to a more rapid economic recovery in the U.S. than in other advanced economies. Bond yields are much more attractive in the U.S., which should help prevent our yields from rising to rapidly.

Bond market participants have long had the adage, “be on the bus or be under it,” meaning that large moves in yield can be self-enforcing. We saw this with disappointing Treasury note auctions last week. Where bond yields will settle is an open question, but a moderate increase in unlikely to be much of a restraint on economic growth this year.

Recent Economic Data

Real GDP rose at a 4.1% annual rate in the 2nd estimate for 4Q20 (vs. +4.0% in the advance estimate).

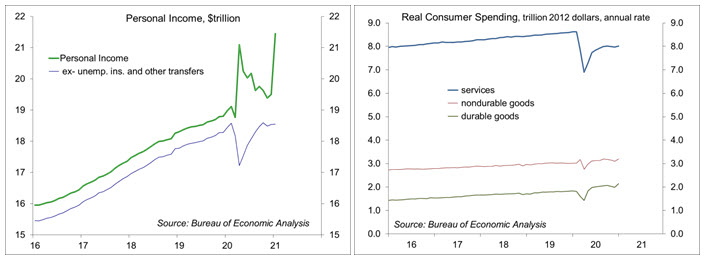

Personal income jumped 10.0% in January, boosted by an increase in pandemic support (checks to individuals and extended unemployment benefits) and amplified by how the numbers are reported (monthly figures at an annual rate). Consumer spending jumped 2.4%, led by an 8.4% increase in consumer durables. Spending on consumer services rose 0.7%, down 5.3% from a year ago.

The PCE Price Index rose 0.3% in January (+1.5% y/y), up 0.3% ex-food & energy (+0.252% before rounding,

+1.5% y/y). The core CPI rose 0.031% (+1.4% y/y).

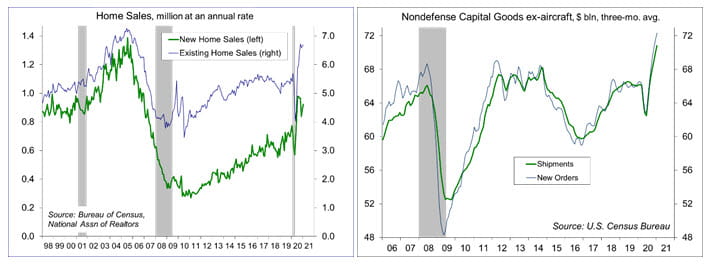

New home sales 4.3% in the initial estimate for January, up 19.3% year-over-year. Separately, the Pending Home Sales Index fell by 2.8% in January (+14.0% before seasonal adjustment), up 13.0% from a year ago. The National Association of Realtors noted that there are not enough homes to match demand.

Durable goods orders rose 3.4% in January, more than expected, boosted partly by a quirk in civilian aircraft orders. Ex-transportation, orders rose 1.4% (+6.6% higher than a year ago. Orders for nondefense capital goods ex-aircraft rose 0.5% (+8.3% y/y), while shipments rose 2.1% (+7.7% y/y).

The Chicago Business Barometer slipped to 59.5 in February, vs. 63.8 in January. New orders and production slowed from strong gains in January. Employment remained in contraction for the 20th consecutive month.

Gauging the Recovery

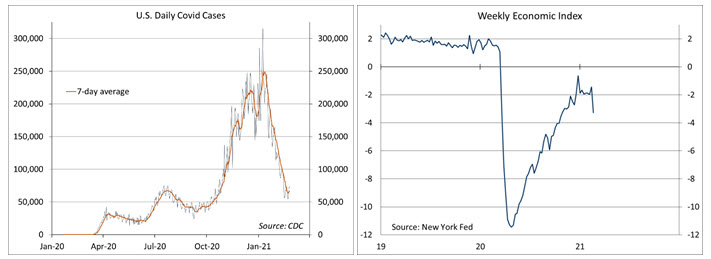

The number of new daily COVID-19 cases may be stabilizing following a sharp decline from a highly elevated level in early January. The drop has led to a relaxation in social distancing directives, which should help the economy into 2Q21. The number of U.S. deaths from the coronavirus has surpassed 500,000.

The New York Fed’s Weekly Economic Index fell to -3.27% for the week ending February 20, down from -1.44% a week earlier (revised from -2.31%) and a low of -11.45% at the end of April. The drop reflected a weather- related decrease in fuel sales and rail traffic. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously).

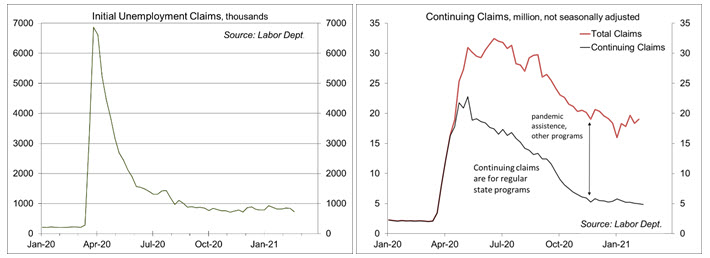

Jobless claims fell by 111,000, to 841,000, in the week ending February 20 (710,313 before seasonal adjustment), likely reflecting the impact of poor weather and still very high by historical standards). Claims totaled 6.16 million over the first seven weeks of the year.

The University of Michigan’s Consumer Sentiment Index settled at 76.8 in the full-month assessment for February (the survey covered January 27 to February 22), vs. 76.2 at mid-month and 79.0 in January. The report noted reduced expectations for households with annual incomes below $75,000, despite pandemic assistance. Inflation expectations ticked up (after rising in January), but remained moderate.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.