by Don Vialoux, EquityClock.com

Technical Notes for Wednesday February 10th

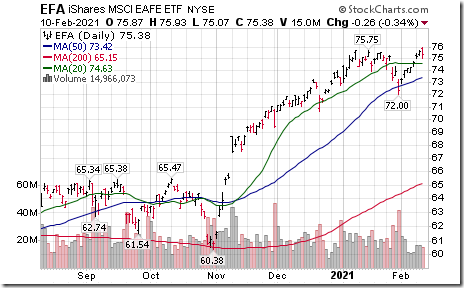

EAFE (EFA) moved above $75.75 to an all-time high extending an intermediate uptrend.

Shanghai Composite Index moved above 3637.10 to a six year high at 3665.09 extending an intermediate uptrend.

American International Group (AIG), an S&P 100 stock moved above $42.57 extending an intermediate uptrend.

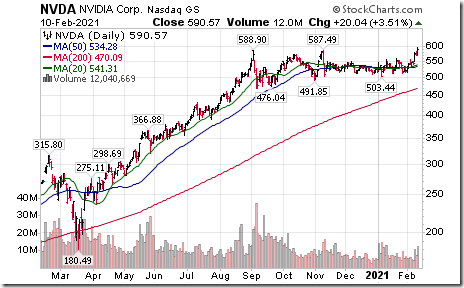

Nvidia (NVDA), a NASDAQ 100 stock moved above $588.90 to an all-time high extending an intermediate uptrend.

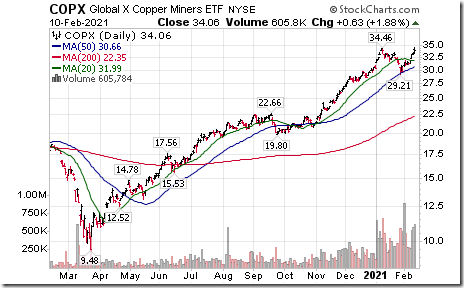

Copper Miners ETF (COPX) moved above $34.46 to an all-time high extending an intermediate uptrend.

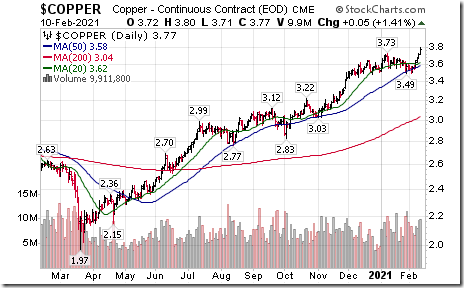

Copper moved above $3.79 per lb.to an eight year high extending an intermediate uptrend.

Okta (OKTA), a NASDAQ 100 stock moved above $287.35 to an all-time high extending an intermediate uptrend.

Intuit (INTU), a NASDAQ 100 stock moved above $398.12 to an all-time high extending an intermediate uptrend.

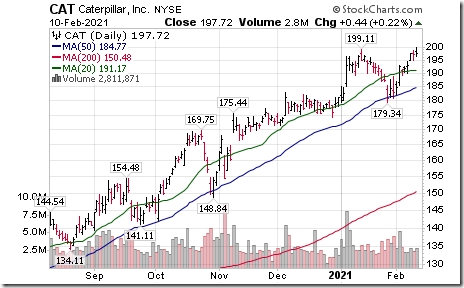

Caterpillar (CAT), a Dow Jones Industrial Average stock moved above $199.11 to an all-time high extending an intermediate uptrend.

Cannabis stocks and related ETFS “have gone parabolic”

Trader’s Corner

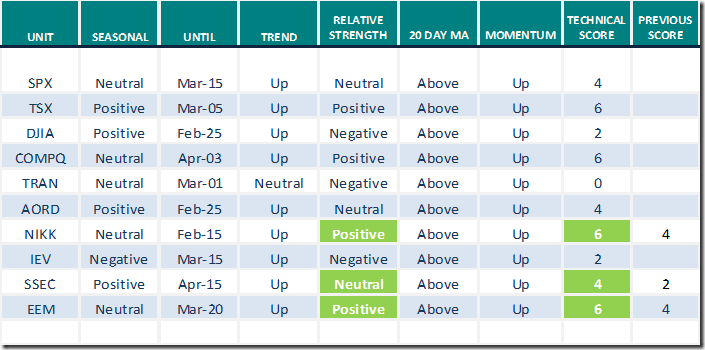

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for February 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

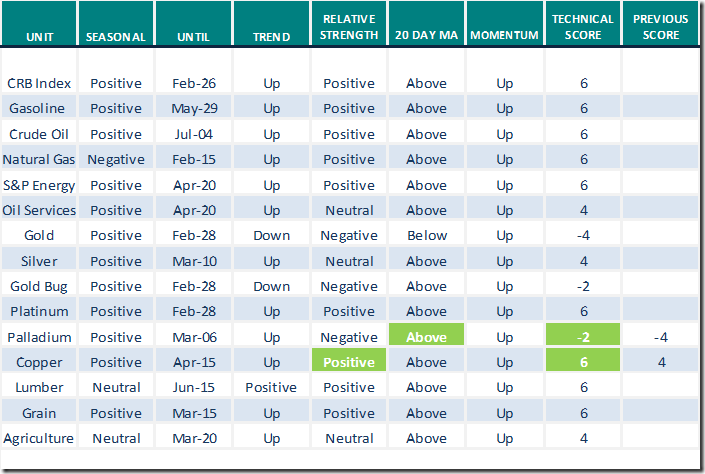

Commodities

Daily Seasonal/Technical Commodities Trends for February 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

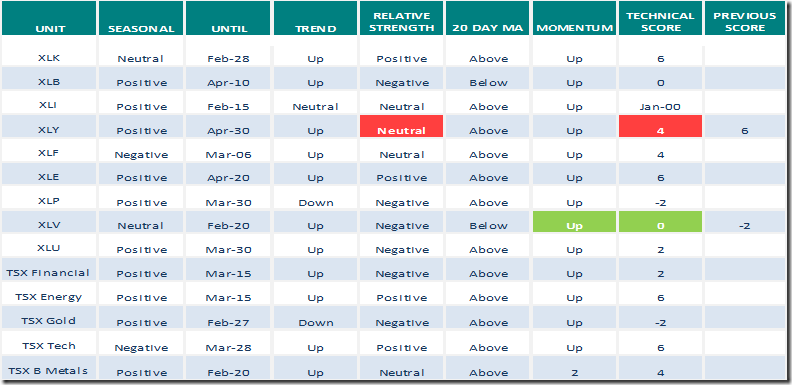

Sectors

Daily Seasonal/Technical Sector Trends for February 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

Market Buzz

Greg Schnell discusses “February new highs”. Following is a link:

https://www.youtube.com/watch?v=xeTE_fOVg7g&feature=youtu.be&ab_channel=StockCharts

S&P 500 Momentum Barometer

The intermediate Barometer added 1.20 to 74.15 yesterday. It remains intermediate overbought.

The long term Barometer slipped 0.40 to 90.38 yesterday. It remains extremely long term overbought.

TSX Momentum Barometer

The intermediate Barometer added 1.92 to 69.71 yesterday. It remains intermediate overbought.

The long term Barometer was unchanged yesterday at 77.88. It remains long term overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed