by Rick Rieder, CIO, Fixed Income, Blackrock

Rick Rieder and team think that today’s potent policy cocktail holds important implications for the path of economic growth, markets and the value of a dollar.

Does Policy Path Call Into Question Economic Axioms?

The path toward an erudite grasp of personal finance is replete with age-old kernels of wisdom, like “money doesn’t grow on trees,” or “you’ve got to learn the value of a dollar.” Such phrases intend to instill the principles of monetary conservatism upon the financial learner, but for those who have been trained to adhere to such advice, 2020 was a bit of a curveball.

Indeed, the policy response to the Covid pandemic marked a profound pivot toward historically aggressive policy stimulus, with liquidity injections and debt monetization that has no modern precedent. Considering the record-shattering injections of fiat currency into global real and financial economies, it’s not unreasonable for one to question those embedded lessons regarding the “value of money.”

However, unlike numerous naysayers, we are embracing the new reality of highly liquid financial and real economies and believe that the policy response to the global pandemic will be viewed favorably through a historical lens. In fact, we think that this record-shattering liquidity, when married to a post-pandemic resumption of economic velocity, will be a powerful catalyst for both nominal GDP growth and financial markets.

Potent Policy Cocktail Impacts Economy, Markets and Dollar

Specifically, the U.S. M2 measure of money supply has surged by nearly $4 trillion over the last year, creating an outcome where more than 20% of all U.S. broad money now in circulation was created during the last 250 trading days. Moreover, U.S. M2 as a percentage of household real estate wealth and financial assets is near all-time highs, creating a powerful tailwind for assets offering positive real returns (see first graph). And since these liquidity injections are permanent, it is likely that the U.S. nominal economy has also shifted to a permanently higher equilibrium.

U.S. M2 Money Supply Growth a Likely Support for Financial Assets

Sources: Bloomberg and BlackRock; data as of November 30, 2020

That potent policy cocktail has favorably altered the global foreign exchange markets. The pre-pandemic environment was characterized by a shortage of U.S. dollars relative to the structural global demand for the world’s reserve currency. More than 50% of global commerce, and more than 80% of global trade finance, is U.S. dollar-denominated, so a shortage of dollar liquidity can be a dangerous anchor on the global real economy. In March 2020, dollar funding costs spiked, as crisis-related demand for dollars surged – accelerating the Federal Reserve’s easing cycle. Now, however, with the Fed leading the charge by injecting copious amounts of liquidity, a virtuous equilibrium has been restored that is evidenced by a welcome removal of stubborn USD strength.

Considering a confluence of resurgent financial markets and sharply rebounding nominal GDP growth, the backup in U.S. Treasury yields over recent weeks is a logical result. Yet, understanding the component parts of any contribution to a rise in yields is of critical importance. The recent backup in nominal yields has been dominated by a rise in the inflation component, while real yields have remained at cyclical lows. While we fully expect a cyclical upturn in inflation from depressed pandemic-driven levels during 2021, we are convinced that the majority of resurgent nominal GDP growth over coming quarters will be comprised of real growth rather than of inflation. Therefore, we would expect that a further backup in the yields from here would likely be more driven by a rise in real yields from record low levels, which is a healthy evolution that would prevent dollar weakness from becoming destabilizing.

Still, the Question of Inflation is Complex

We think that rebounding cyclical inflation from depressed levels is to be expected, given the severe depth of the recession and the rapid recovery that is now underway. Historically, inflation has been driven by a combination of strong demand growth combined with widespread supply constraints, and the 2021 real economy will likely be impacted by both of those influences. Pandemic-related supply constraints are causing price spikes in many commodities, like oil, copper and lumber, which are feeding through to the industrial economy; itself subject to some supply bottlenecks. Simultaneously, the prolific ongoing spread of Covid is creating severe labor shortages across numerous industries, which ultimately could lead to higher wages.

However, while inflation is likely to be higher in the coming months than anything we’ve seen over the past few years, it will be difficult to achieve the dangerously high levels of inflation that many prognosticators envision. For many years, we have argued that powerful secular influences will mitigate inflationary impules indefinitely. In our view, the demographic trend of population aging is combining with disinflationary technological headwinds to keep generalized price increases moderate for years to come. The Covid crisis did nothing to alter these long-term trends, and in fact may have ended up accelerating the adoption of some technologies that will serve to continue to reduce costs to consumers, or expand previously unused capacities.

Many of today’s market participants like one-word answers like “reflation,” or “deflation,” but it’s quite hard to capture the nuances around inflation in a single word. We still think there could be some upside to inflation breakevens, but at today’s price of more than 2%, there are substantial inflationary expectations already baked into that price. Yet, there are other assets that could see outsized benefits from a stable 2% to 2.5% inflationary regime. For instance, high yield spreads and equity risk premiums could both compress further, as companies’ ability to use technology to manage costs gains further ground, while firms regain some pricing power, which could result in expanded profitability, all else equal (the tax regime under the Biden administration is certainly something to monitor).

Relationship Between Fed Policy Rate and Inflation Has Weakened

Sources: Federal Reserve, Bloomberg and BlackRock; data as of November 30, 2020

It is also important not to mistake the policy response to inflation for inflation itself, when it comes to assessing asset returns during inflationary environments. The 1970s provide an excellent case study, with equity returns stagnating during the most prominent inflationary decade in the last century. But while inflation certainly reached a “dangerous” 14% back then, Fed Funds reached 20%, resulting in high and rising positive real rates (second graphs, LHS). Further, in prior decades it was common to think that higher rates of inflation would result in a higher Federal Funds rate, almost immediately, but the relationship between the Fed’s policy reaction function and the change in the inflation rate has diminished greatly in the last few decades (second graphs, RHS). Today, developed market (DM) risk free rates are near 0% and are likely to stay there for some time, creating a negative real return environment. Real assets (which is to say, assets that can’t be printed), including stocks and real estate, thrive in such an environment.

Follow Rick Rieder on Twitter

Investment Implications: Keep a Close Eye on Cash Flows

In addition, we think companies that are able to build cash flow-generating real assets including intangible assets, by investing in capital expenditures and research and development today, are likely to outperform. It is even possible that a dollar invested in building the right cash-generating intangible asset, such as brand loyalty (think Nike), could be worth more than a dollar invested in a tangible asset. Technology and communication companies, long since the leaders in such intangible investment, captured 47% of economic profit in 2019. But while large cap tech companies have seen their market caps grow somewhat commensurately, subsectors like semiconductors, at 3% of global market cap, are still smaller than they have been historically, with perhaps more room for appreciation. The semiconductor industry has also been investing aggressively to build both tangible and intangible cash-generating assets.

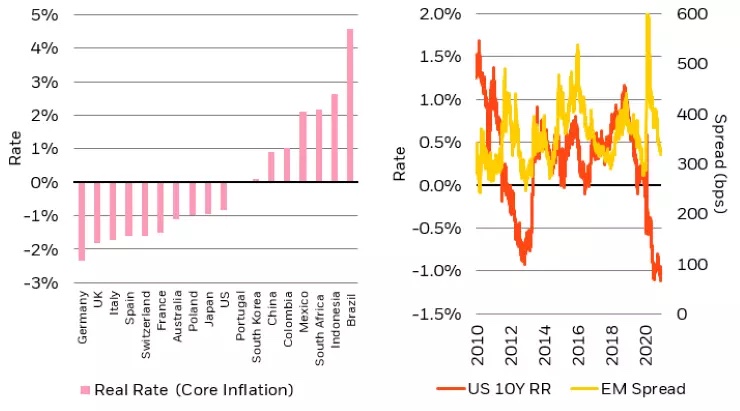

Select EM Real Rates Still High and EM Sovereign Spread Can Compress

Sources: Bloomberg and BlackRock; data as of January 7, 2021

So, while we are underweight negative-real-returning developed market sovereign bonds, and like owning developed market and select Asian equities for their lofty risk premiums, we actually think emerging market (EM) fixed income is quite attractive. Sovereign spreads between DM and EM have room to compress back to pre-Covid levels, especially as inflation in emerging markets tends to be held in check by dollar weakness, as imports in local currency become cheaper (see third graphs, RHS). Real rates in parts of EM are high (Brazil has a real rate seven percentage points, 7%, higher than Germany’s), offering policymakers a good deal of flexibility (third graphs, LHS). The overwhelming flow of dollars into high quality fixed income markets in 2020, now facing negative real returns, will almost certainly flow back out in search of higher real returns as the pandemic subsides.

The market’s imagination for positive real returns has not been limited to traditional assets in fixed income and equities, and today undoubtedly includes gold and Bitcoin. Yet, we’re convinced that the tail risk of unmitigated U.S. dollar downside- that might warrant “capital flight” into alternative currencies- is quite insignificant. If the combination of ongoing fiscal and monetary policy support gets channeled into the right productive uses, coupled with a resolution to the pandemic (which we expect in 2021), then real growth will likely surprise to the upside, perhaps significantly. Furthermore, real yields and real returns should follow suit. In such an environment, income generating dollar-denominated assets will be back in high demand. In the meantime, until more clarity emerges on “the value of a dollar,” maintaining exposure to positive real returning assets, using volatility tools to manage risk when cheap, or to create income when rich, and holding some cash to take advantage of future opportunities should all help make a dollar in portfolios today worth a dollar and change tomorrow.

Rick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income and is Head of the Global Allocation Investment Team. Russell Brownback, Managing Director, is Head of Global Macro positioning for Fixed Income. Trevor Slaven, Managing Director, is a portfolio manager on BlackRock’s Global Fixed Income team and is also the Head of Macro Research for Fundamental Fixed Income. Navin Saigal, Director, is a portfolio manager and research analyst in the Office of the CIO of Global Fixed Income, and he serves as Chief Macro Content Officer.

Copyright © Blackrock