by Stephen H. Dover, CFA, Franklin Templeton Investments

Within Franklin Templeton, we have investment teams around the world with independent investment processes. Yet, if you had asked any of us for our predictions a year ago, none of us would likely have predicted the COVID-19-induced equity market volatility in early 2020, nor that equity markets would quickly rebound and remain near all-time highs almost a year later.

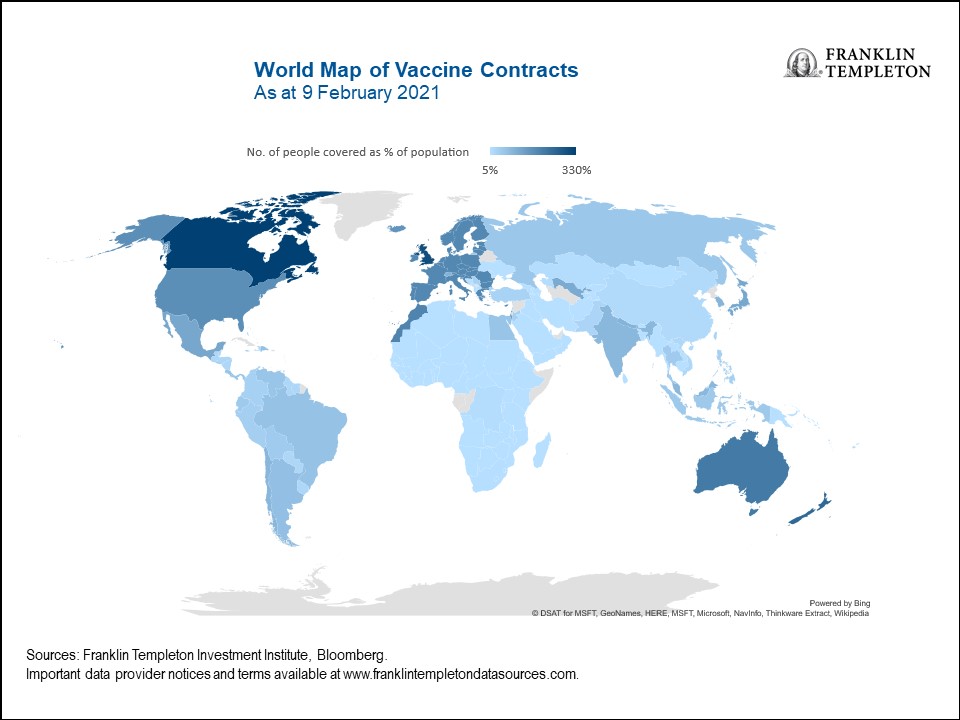

So, the question now is: where do we go from here? Despite the recent strong global equity market performance, the pandemic is ongoing and most of the world is still waiting for vaccinations, putting a strain on the global health and economic systems.

Below, we highlight four things we are watching regarding equity markets and the global recovery from the pandemic.

1. The Return to Normal

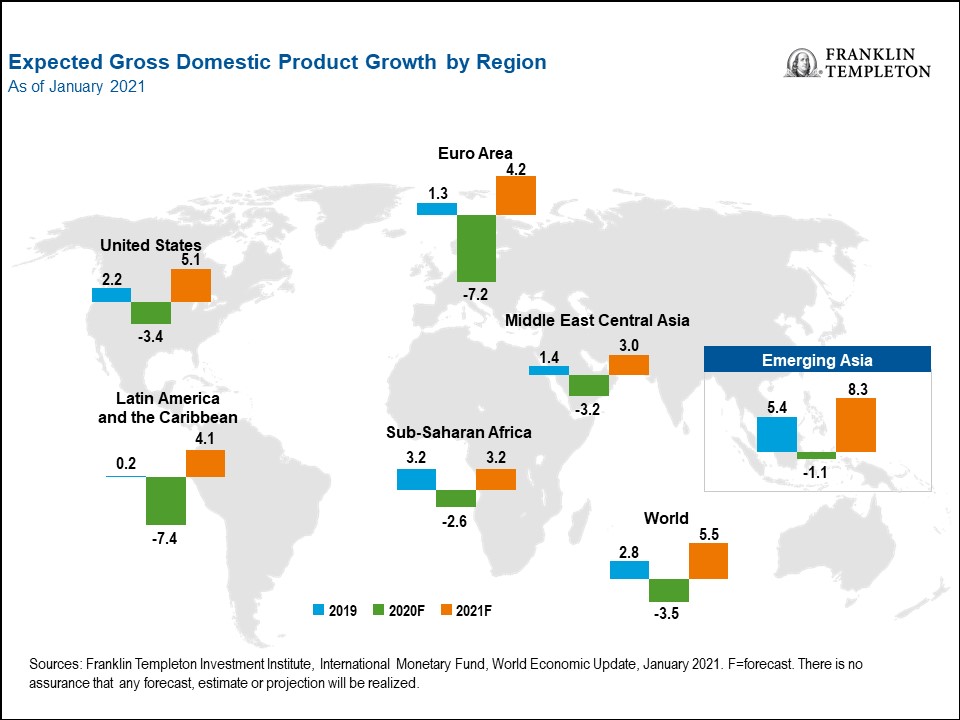

Global equity valuations appear to reflect the presumption that many regions of the world will reopen this year and gross domestic product (GDP) growth will rebound from 2020 levels when consumption picks up. According to our analysis, there is considerable pent-up consumer demand and a tremendous amount of stimulus in the system.

However, we believe the global COVID-19 vaccine rollout will ultimately determine the pace and breadth of the global economic recovery. Although the rollout has been slower and less efficient than we hoped, we believe the magnitude and efficiency should pick up over the next few months.

2. Equity Valuations

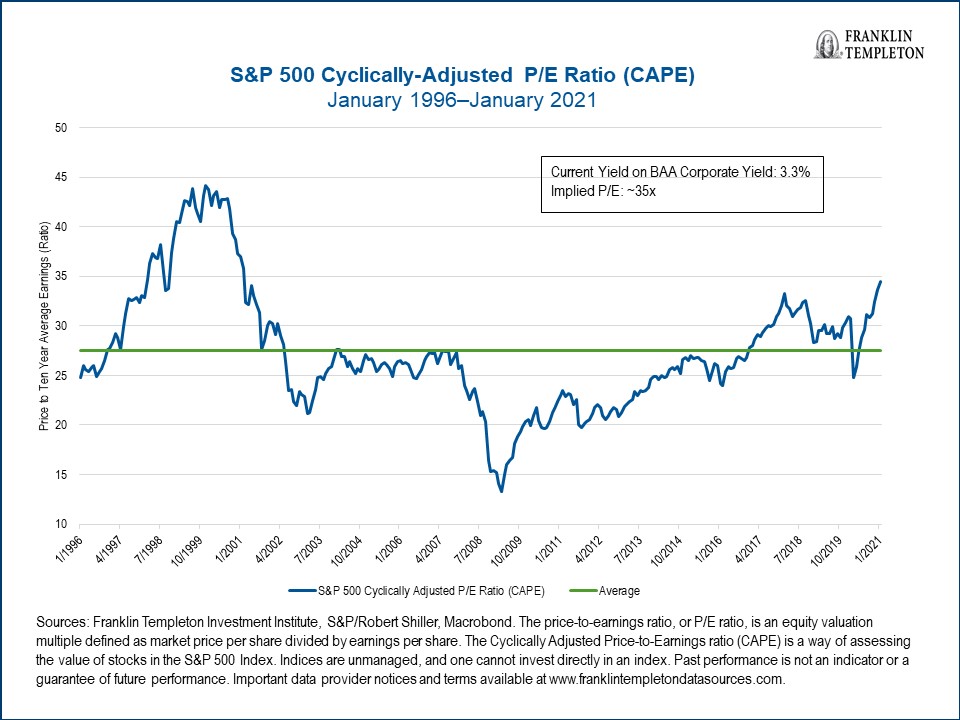

The most common question investors around the world ask us is: are equity markets overvalued? Overall, we believe earnings multiples for global equities are generally reasonable based on history and bond alternatives, as illustrated by the chart below.

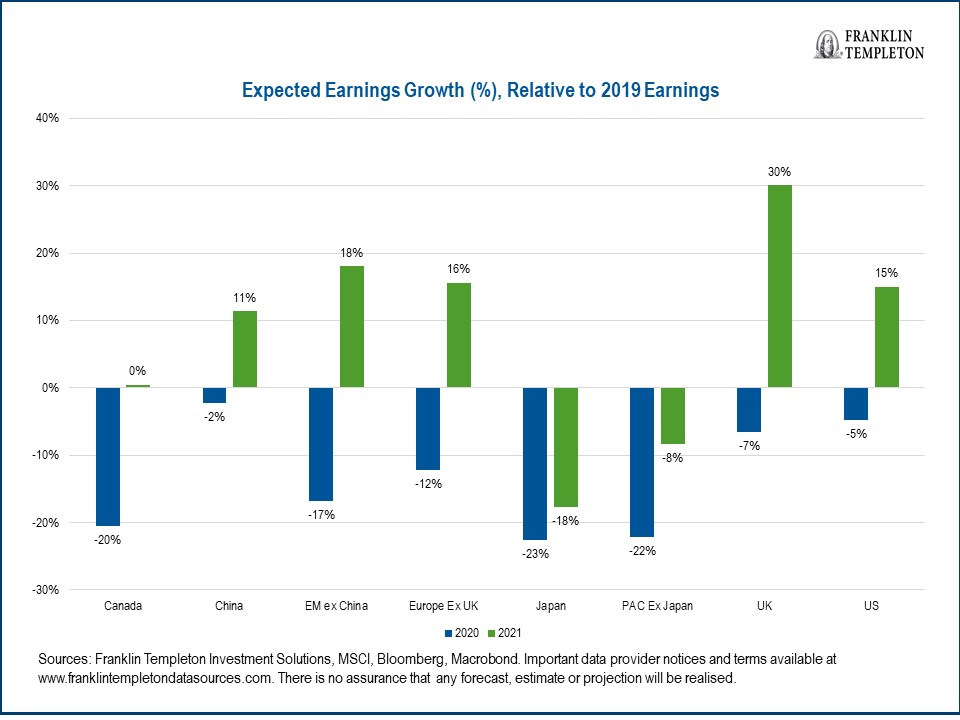

That said, as professional investors, we look at several metrics to determine if equity prices are reasonable, including current and potential earnings growth, price-to-earnings ratios, dividend yields, exchange rates and the supply of equity. Looking at potential earnings growth, for example, earnings are projected to improve this year for companies in many of the world’s largest economies, as shown below.1

However, we urge investors not to place too much faith in these projections until economies reopen and companies’ earnings improve. This is one of the reasons we think the price-to-earnings-ratio is likely to be a poor indicator of whether an equity market is overvalued or undervalued until the pandemic is resolved.

3. Stimulus

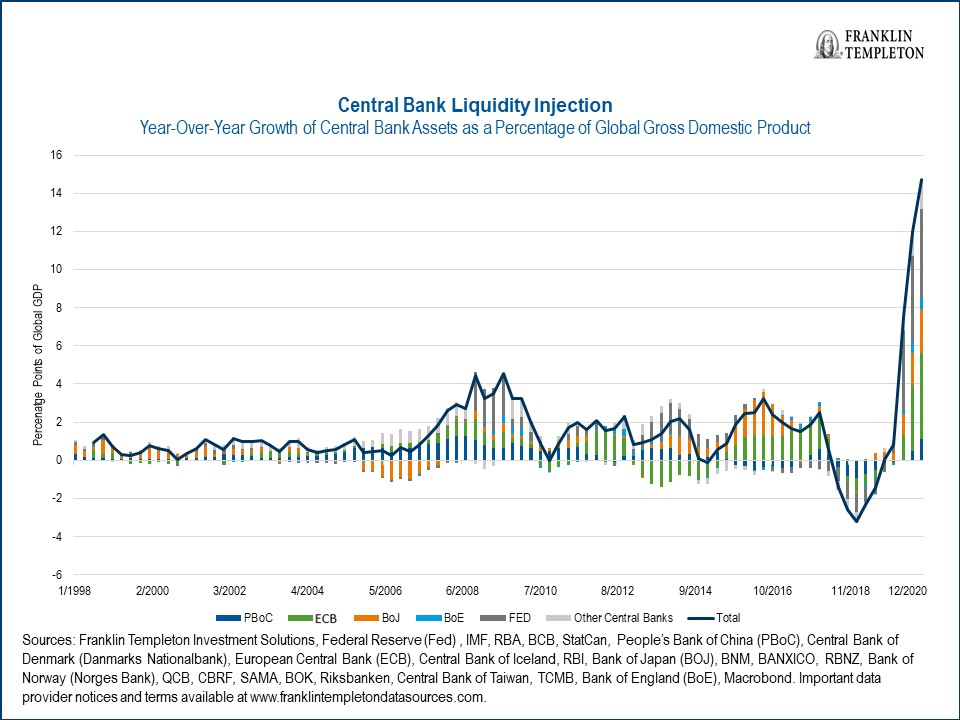

Monetary and fiscal stimulus, which are the primary drivers of liquidity globally, have ballooned during the pandemic. Yet, the extraordinary stimulus has gone into savings accounts and equity markets more than into consumption.

As a result, we think this stimulus will likely be a significant contributor to upcoming gross domestic product (GDP) growth across major regions. If global stimulus does indeed lead to an economic boom when local economies reopen, we believe it will likely be favourable for equities in emerging markets, which stand to benefit from the production and export of materials and commodities.

Another byproduct of this stimulus is that corporations have records amount of cash on their balance sheets and have taken on debt to buy back shares. So, the supply of equity has shrunk, while the demand for stocks has grown.

4. Global and Value Markets

Despite our positive overall outlook on global equities, we believe investors should prepare for a period where more balance returns to the market. We could see some rotation out of some of the US growth stocks that have done well over the past few years and into value stocks, including those positioned to benefit when the global economy returns to some semblance of normalcy.

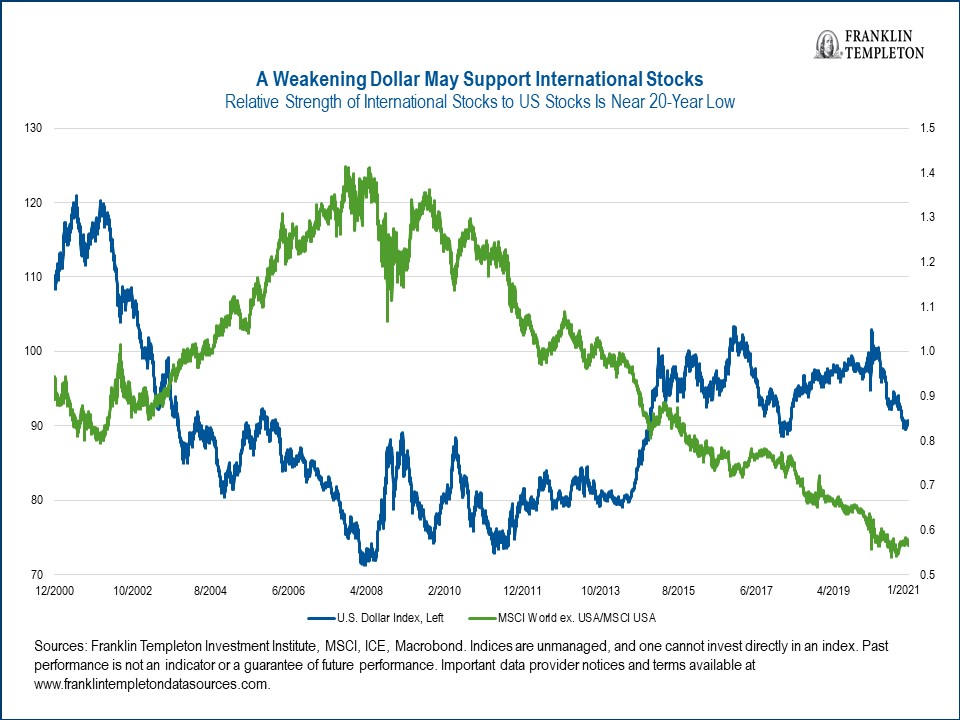

What’s more, we predict the US dollar is likely to weaken, which will likely support international stocks, as shown in the chart below. We particularly like the prospects for equities in emerging markets, where indices are starting to reflect the new economy and growth, and in Japan, where corporations are cleaning up their balance sheets.

Finally, we believe investors will likely explore “green” investment opportunities, as governments pour more money into clean energy initiatives, and institutions get stricter mandates on climate issues. Yet, we think companies that are labeling themselves as “green” have to prove that earnings follow the multiple expansion.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own investment professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Value securities may not increase in price as anticipated or may decline further in value. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

_____________________

1. There is no assurance that any forecast, estimate or projection will be realised.

This post was first published at the official blog of Franklin Templeton Investments.