by Don Vialoux, EquityClock.com

The Raid against the Shorts

One of the reasons for weakness by major U.S. equity indices yesterday was a social media raid against hedge funds. Hedge funds holding large short positions were forced to cover and subsequently were forced to liquidate long positions to cover margin calls. After the close yesterday, the SEC expressed its concern about “market volatility” related to the event.

Examples of equities with large short positions that were squeezed include GameStop, AMC Sirius and Blackberry.

The VIX spiked in response.

Technical Notes for Wednesday January 27th

Editor’s Note: The “Santa Claus Hangover” struck with vengeance yesterday. Weakness in U.S. equities was “across the board” and extensive. Exceptions were the “bull raid” stocks.

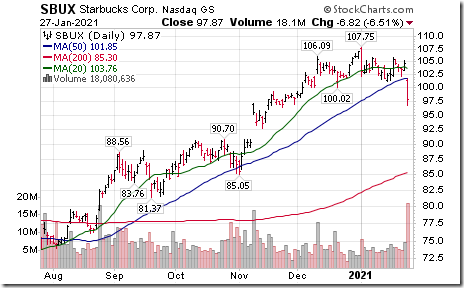

Starbucks (SBUX), a Dow Jones Industrial Average stock moved below support at $100.02 after releasing lower than consensus U.S. comps.

Sirius (SIRI), a NASDAQ 100 stock moved above $6.70, $6.72, $7.33 and $7.52 to an all-time high extending an intermediate uptrend.

Trip.com (TCOM), a NASDAQ 100 stock moved below $31.19 extending an intermediate downtrend.

American Express (AXP), a Dow Jones Industrial Average stock moved below support at $113.32 despite reporting higher than consensus fourth quarter results.

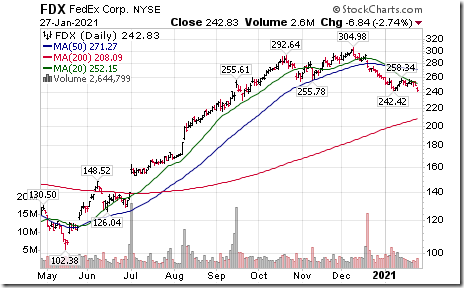

FedEx (FDX), an S&P 100 stock moved below $242.42 completing a Head & Shoulders pattern.

MMM (MMM), an S&P 100 stock moved above $179.62 extending an intermediate uptrend. Response to stronger than expected quarterly report.

Union Pacific (UNP), an S&P 100 stock moved below support at $197.46

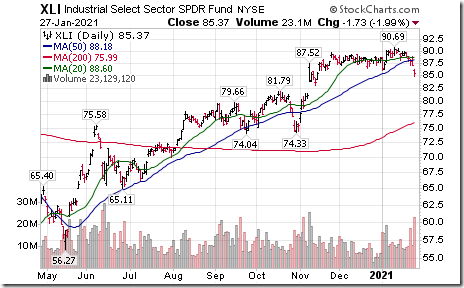

Industrial SPDRs (XLI) moved below $85.92 completing a double top pattern.

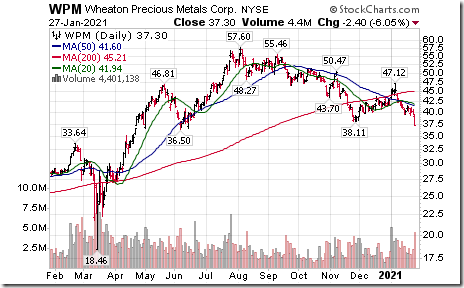

Wheaton Precious Metals (WPM), a TSX 60 stock moved below US$38.11 extending an intermediate downtrend.

Base Metals ETN (i/3 each in copper, zinc and aluminum) moved below $17.19 completing a double top pattern.

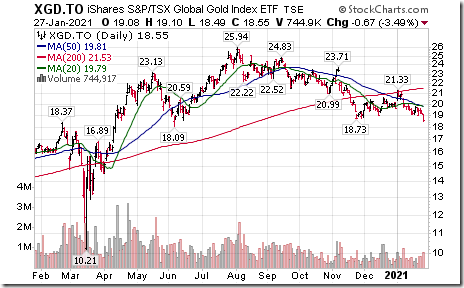

TSX Gold iShares (XGD) moved below Cdn$18.73 extending an intermediate downtrend.

Peleton (PTON), a NASDAQ 100 stock moved below $140.74 completing a double top pattern.

Barrick Gold (ABX), a TSX 60 stock moved below Cdn$28.59 extending an intermediate downtrend.

Kinross (K), a TSX 60 stock moved below Cdn$8.75 and US$6.85 extending an intermediate downtrend.

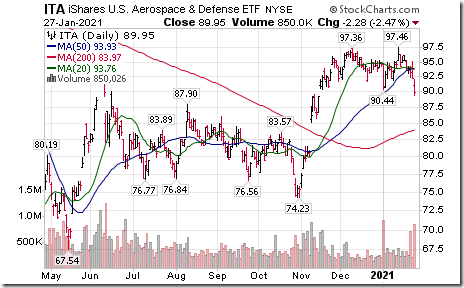

Aerospace iShares (ITA) moved below $90.44 completing a double top pattern.

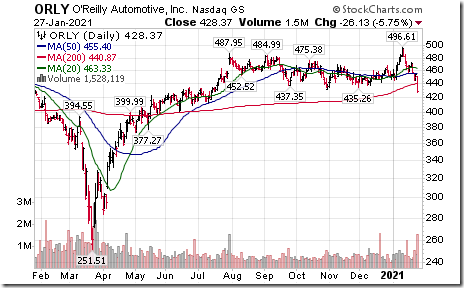

O’Reilly (ORLY), a NASDAQ 100 stock moved below $435.26 setting an intermediate downtrend.

Waste Connections (WCN), a TSX 60 stock moved below $127.42 completing a Head & Shoulders pattern.

Canadian National Railway (CNR), a TSX 60 stock moved below $130.90 completing a double top pattern. Thirteen brokers either downgraded the stock or lowered their target price after the company issued lower than consensus guidance.

Verizon (VZ), a Dow Jones Industrial Average stock moved below intermediate support at $55.43.

Seattle Genetics (SGEN), a NASDAQ 100 stock moved below $163.54 completing a double top pattern.

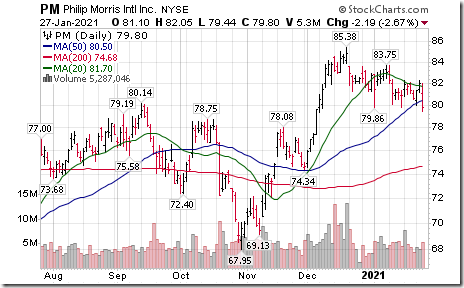

Phillip Morris (PM), an S&P 100 stock moved below $79.86 completing a double top pattern.

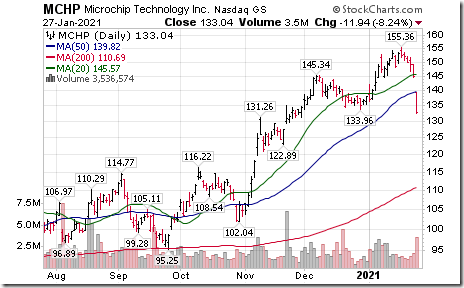

Microchip Technologies (MCHP), a NASDAQ 100 stock moved below intermediate support at 133.96.

Saputo (SAP), a TSX 60 stock moved below $34.67 completing a double top pattern.

Trader’s Corner

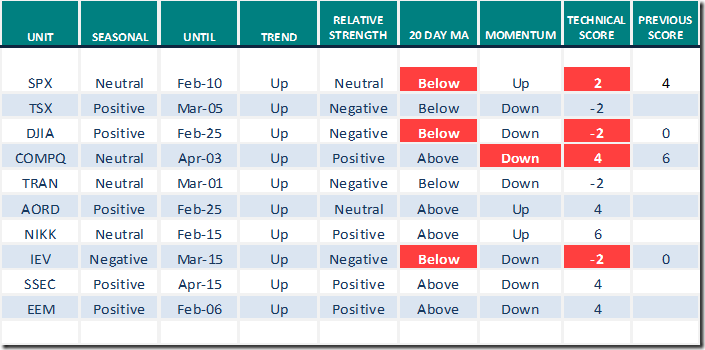

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

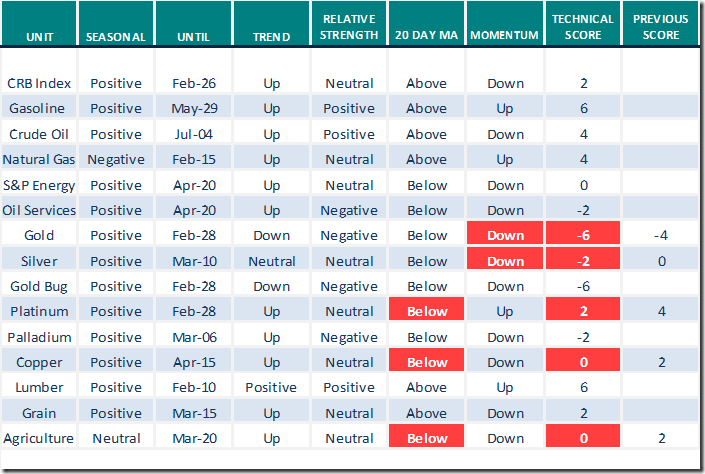

Commodities

Daily Seasonal/Technical Commodities Trends for January 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

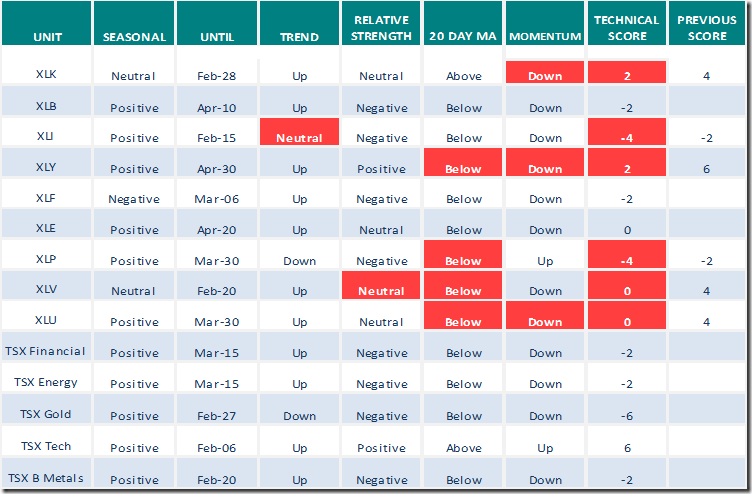

Sectors

Daily Seasonal/Technical Sector Trends for January 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate Barometer plunged 21.24 to 46.29 yesterday. It changed from intermediate overbought to intermediate neutral on a move below 60.00. Trend remains down.

The long term Barometer slipped 3.21 to 88.38 yesterday. It remains extremely long term overbought and has started to trend down.

TSX Momentum Barometers

The intermediate Barometer plunged 15.53 to 44.66 yesterday. It changed from intermediate overbought to intermediate neutral on a move below 60.00 and continues to trend down.

The long term Barometer dropped 3.88 to 74.27 yesterday. It remains long term overbought and continues to trend down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.