by Alessio De Longis, Invesco Canada

Global recovery begins to mature, leading to expansion

Macro update

The year 2020 will certainly go down in history as one of the most disruptive to societies around the world, with enduring social and economic consequences for years to come. 2020 will also be a record-breaking year in financial markets’ history, with stories and anecdotes to be told to future generations of investors. It was the year when oil prices traded to -38 U.S. dollars per barrel,1 or when the worst global recession in history was accompanied by a market sell-off lasting only four weeks, just to name a few.

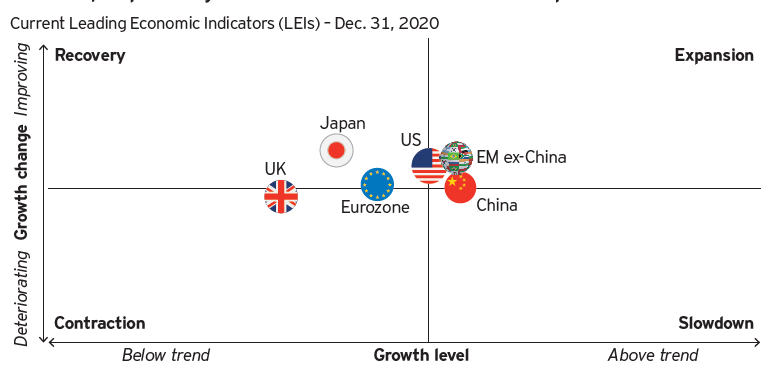

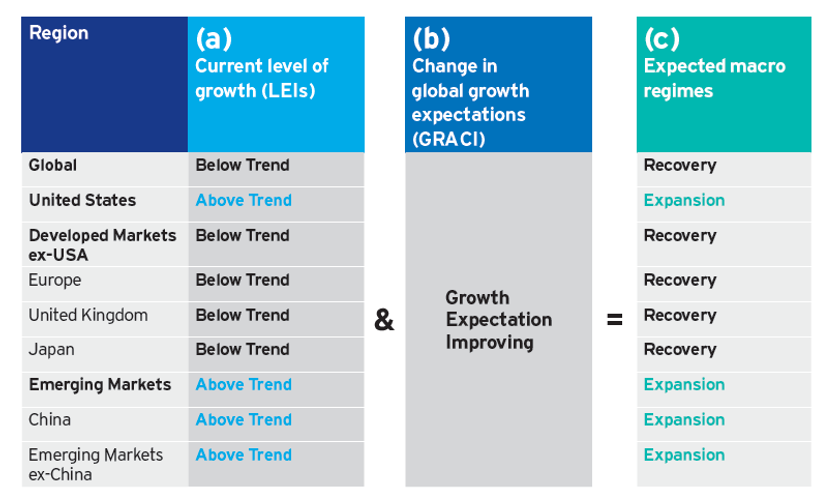

Financial markets enter 2021 with strong positive momentum, on the back of vaccine breakthroughs followed by a nearly instantaneous rollout around the world. The global recovery continues. Our macro framework now suggests U.S. growth is likely to move back above its long-term trend on a year-on-year basis for the first time in six quarters. Hence, we see the U.S. moving into an expansion regime, joining China and the rest of emerging markets. While other developed economies are still improving at a slower pace given renewed lockdown measures in Q4 2020, we expect them to catch up to the rest of the world over the next few quarters. Overall, we see strong evidence for a “clockwise” evolution in the global business cycle, which we expect to move forward into an expansion regime, rather than backward into a contraction, barring any exogenous shock. Investors’ appetite toward risk continues to be strong, suggesting improving growth expectations. Furthermore, economic and financial market volatility tend to decline as the economy moves into an expansion phase, which should further support risk-taking and investor confidence over the next few months.

Our research indicates risky assets could continue to perform well as the economy transitions from a recovery to an expansionary regime. However, the return drivers tend to be different. In a recovery phase, risky assets are mainly boosted by easy monetary policy, falling bond yields, and improving financial conditions despite a weak growth environment. In an expansion phase, we expect earnings growth and lower market volatility to be the primary drivers of investors’ risk appetite and asset prices, while bond yields gradually normalize to higher levels assuming limited inflationary pressures.

We expect Democratic control of the Senate to have a positive impact on our model portfolio, with emerging and developed markets outside the U.S. being the main beneficiaries of lower trade uncertainty, and the U.S. dollar likely to depreciate in tandem.

Figure 1: Leading economic indicators and market sentiment suggest the global recovery continues, despite rising infection rates and renewed lockdowns in part of the world.

Investment positioning

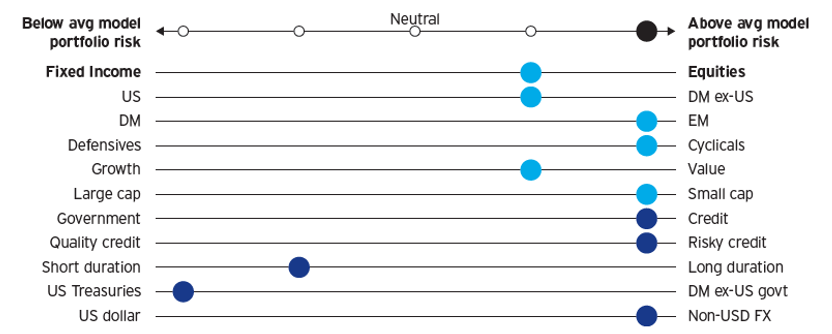

We believe the macro backdrop remains supportive for equity and credit premia, cyclical factors, and risk assets more broadly. We maintain a higher risk posture than our benchmark in the Global Tactical Asset Allocation model,2 sourced through an overweight exposure to equities and credit at the expense of government bonds. In particular:

We have made no change to our exposures within fixed income. We remain constructive on risky credit despite the compression in spreads. As the cycle matures, moving from a recovery to an expansion regime, volatility in financial markets tends to decline, turning the investment case for credit from capital appreciation (i.e., spread compression) to income generation. We are overweight U.S. high yield credit, bank loans, and emerging markets sovereign dollar debt at the expense of investment grade corporate credit and government bonds. We favour U.S. treasuries over other developed government bond markets. Overall, we are overweight credit risk3 and underweight duration versus the benchmark, expecting yields to rise and the curve to steepen in an orderly fashion.

In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. Within developed markets, we favour the euro, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar. In emerging markets (EM), we favour the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Colombian peso. We expect the EM FX carry trade to play catch-up sometime in 2021, having lagged in performance compared to most recovery trades in 2020.

Figure 2: Budding expansion results in a shift towards DM ex-U.S. and a reduced overweight to value relative tactical asset allocation positioning

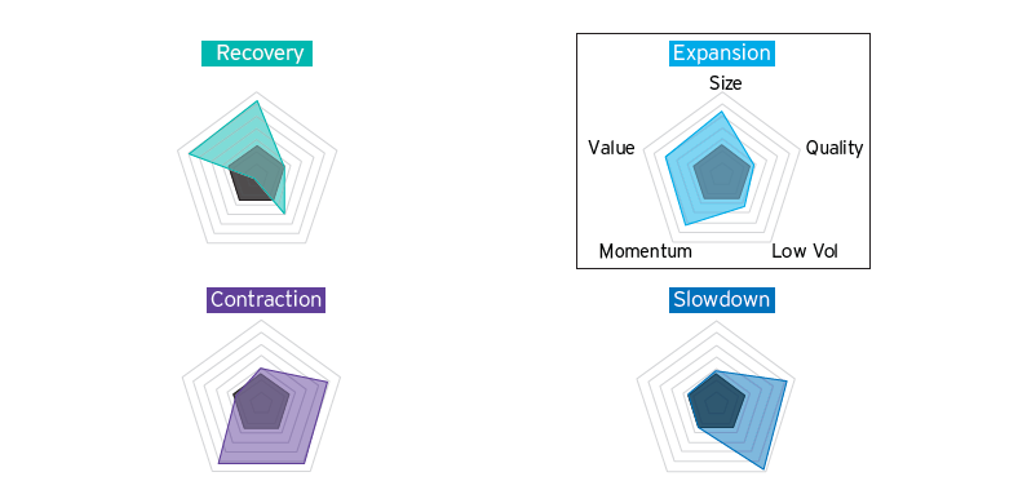

Figure 3: Factor tilts within the expansion regime result in a reduced overweight to size and value, while increasing the momentum exposure, relative to the recovery regime

Regime-dependent factor exposures – Dynamic (shaded) versus benchmark (black)

1 Source: Bloomberg L.P. as of Dec. 31, 2020

2 Global 60/40 benchmark (60% MSCI All Country world Index / 40% Bloomberg Barclays Global Agg USD Hedged)

3 Credit risk defined as DTS (duration times spread).

This post was first published at the official blog of Invesco Canada.