by Don Vialoux, EquityClock.com

Technical Notes for Wednesday January 20th

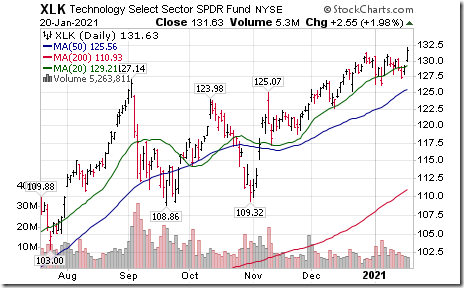

Technology SPDRs (XLK) moved above $131.40 to an all-time high extending an intermediate uptrend.

TSX Technology iShares (XIT) moved above $47.01 to an all-time high extending an intermediate uptrend.

Amex Biotech ETF (FBT) moved above $189.64 to an all-time high extending an intermediate uptrend.

Intuit (INTU), a NASDAQ 100 stock moved above $387.32 to an all-time high extending an intermediate uptrend.

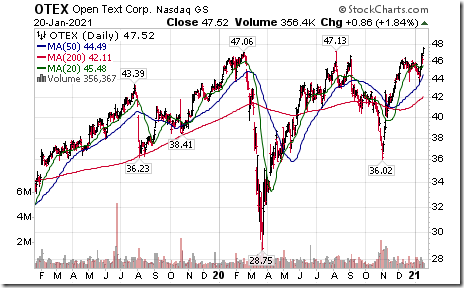

Open Text (OTEX), a TSX 60 stock moved above US$47.13 to an all-time high extending an intermediate uptrend.

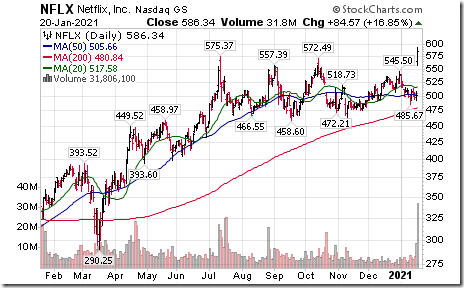

Netflix (NFLX), a NASDAQ 100 stock moved above $575.37 to an all-time high extending an intermediate uptrend.

Alphabet (GOOGL and GOOG), an S&P 100 stock moved above $1,843.83 and $1,847.20 respectively to an all-time high extending an intermediate uptrend.

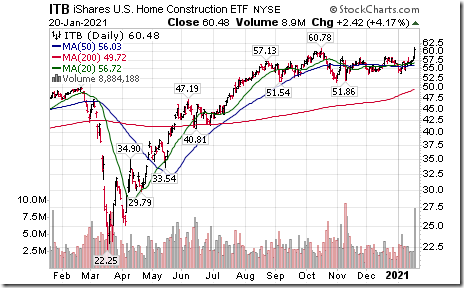

U.S. Home Construction iShares (ITB) moved above $60.78 to an all-time high extending an intermediate uptrend. President Biden has promised to give first time home buyers a $15,000 tax credit

Trader’s Corner

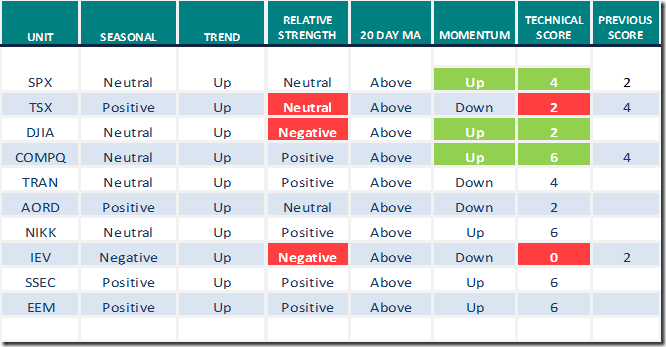

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

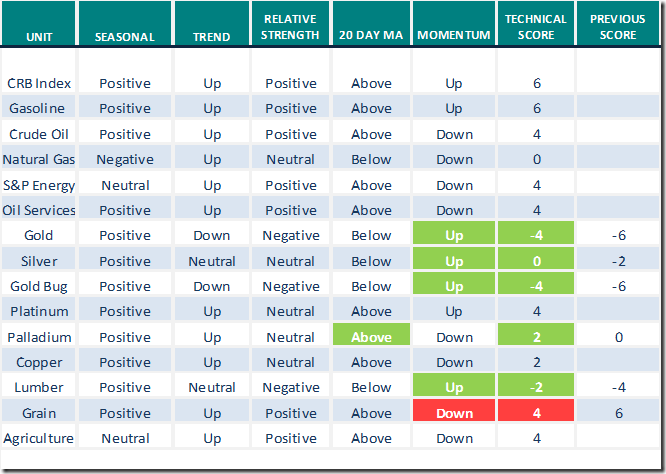

Commodities

Daily Seasonal/Technical Commodities Trends for January 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

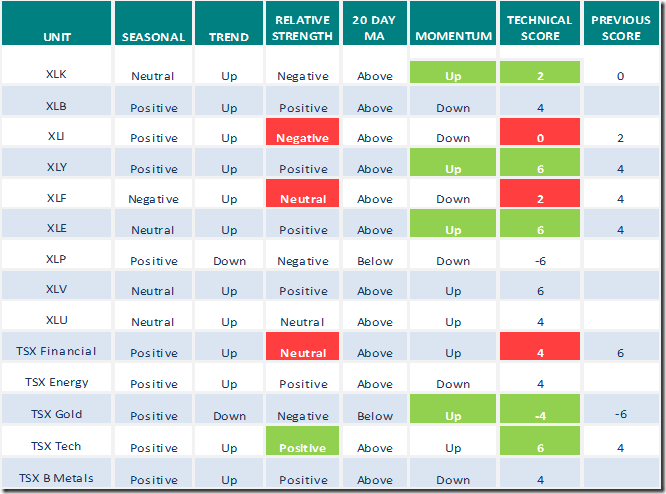

Sectors

Daily Seasonal/Technical Sector Trends for January 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

The Canadian Technician

Greg Schnell discusses “MANGA-Back to Leadership Role”. Following is a link:

MANGA – Back To Leadership Role | The Canadian Technician | StockCharts.com

Market Buzz

Greg Schnell notes that his top technical momentum indicator shows the S&P 500 Index currently at its most overbought level in the past 80 years, but has yet to show signs of peaking. Following is a link:

https://www.youtube.com/watch?v=2lrekTdYr0s&feature=youtu.be&ab_channel=StockCharts

S&P 500 Momentum Barometers

The intermediate Barometer advanced 5.01 to 78.16 yesterday. It remains intermediate overbought.

The long term Barometer added 0.40 to 91.58 yesterday. It remains extremely long term overbought.

TSX Momentum Barometers

The intermediate Barometer added 1.95 to 68.93 yesterday. It remains intermediate overbought.

The long term Barometer gained 1.15 to 80.10 yesterday. It changed from long term overbought to extremely long term overbought on a return above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.