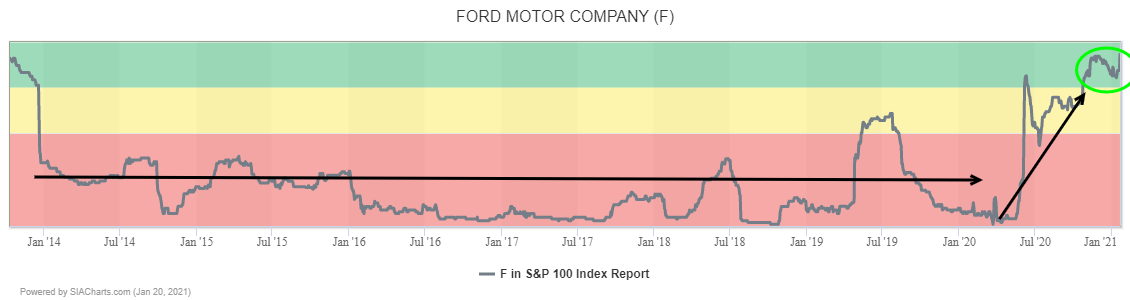

Ford Motor Company’s (F) relative strength has improved dramatically over the last six months, ending a six-year run in the red zone and driving back up into the Green Favored Zone of the SIA S&P 100 Index Report for the first time since 2014. Ford continues to climb up the rankings, rising another 9 spots yesterday to 8th place. Since we last mentioned Ford in the October 23rd issue of the Daily Stock Report, the shares have gained 32.2% and continue to climb.

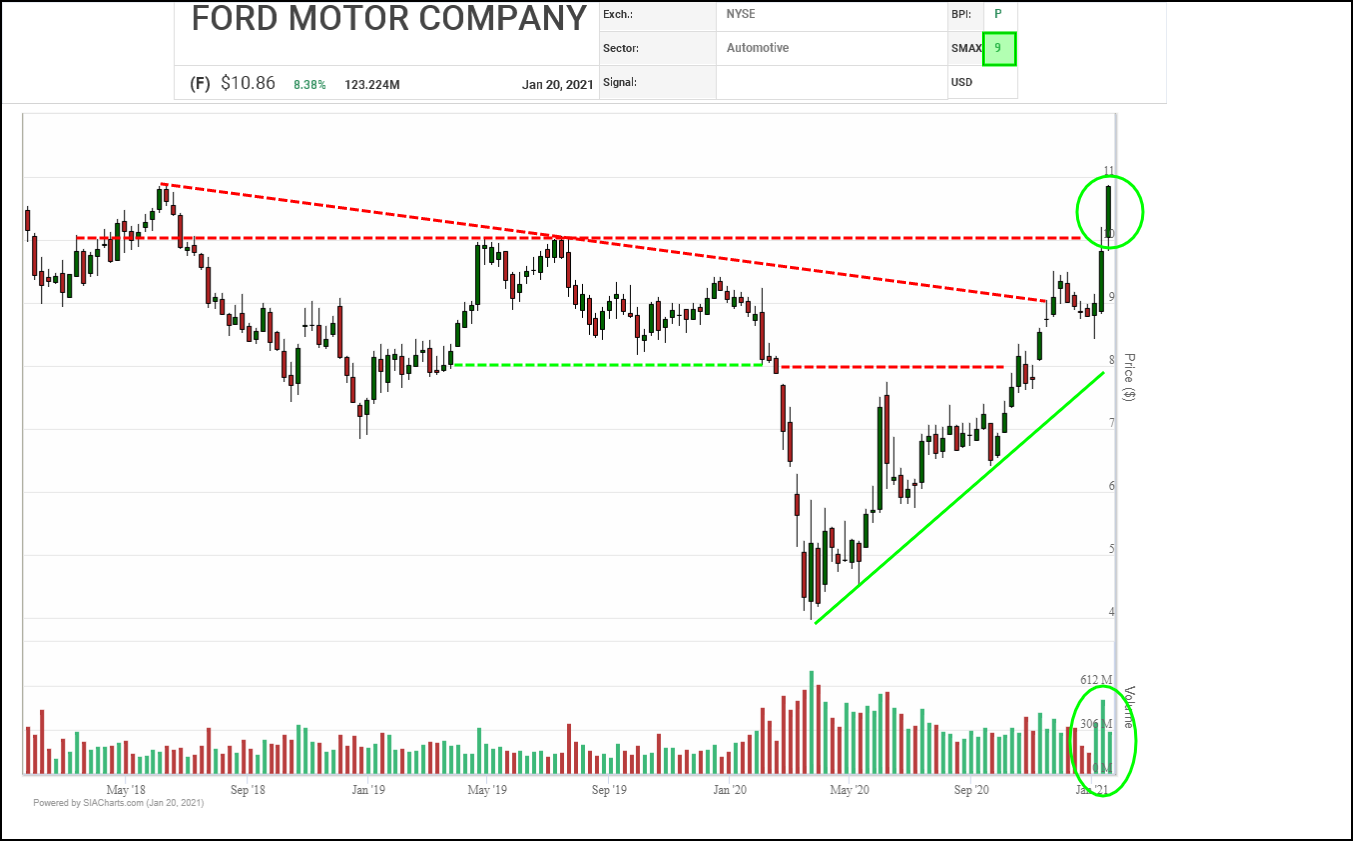

A major breakout is underway in Ford Motor (F) shares which cleared the $10.00 level yesterday for the first time since 2018. This breakout confirms the shares upward momentum remains intact, building on October’s bullish Ascending Triangle breakout over $8.00 and the November snapping a downtrend line near $9.00.

Measured moves suggest next upside resistance tests may appear near $12.00 then $13.00 on trend. Initial support moves up toward $10.00 from $9.50 both previous resistance levels and active breakout points.

Since completing a bullish Spread Quadruple Top breakout from a base back in May, Ford Motor (F) shares have been steadily recovering, completing a series of bullish pattern breakouts including a Spread Double Top and Three Double Tops, and snapping out of a three-year downtrend. The shares recently regained the $10.00 level and continue to advance.

Next potential upside resistance appears in the $11.65 to $12.15 range where several vertical/horizontal counts, plus previous column highs converge, followed by $13.65 based on a horizontal count. Initial support appears near $10.00 where a 3-box reversal, a round number and previous column highs/lows cluster.

With a bullish SMAX score of 9, Ford is exhibiting near-term strength against the asset classes.

Disclaimer: SIACharts Inc. specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment whatsoever. This information has been prepared without regard to any particular investors investment objectives, financial situation, and needs. None of the information contained in this document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. As such, advisors and their clients should not act on any recommendation (express or implied) or information in this report without obtaining specific advice in relation to their accounts and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. SIACharts Inc. nor its third party content providers make any representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein and shall not be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon. Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice.