by Brian Levitt, Talley Léger, Invesco Canada, Invesco Canada

As we say good riddance to 2020, we enter 2021 with a confidence that new market and business cycles have arisen. We believe the economy, out of the depths of the COVID-induced recession, has entered what will be a protracted recovery, complete with the inevitable fits and starts, as experienced at the end of 2020. It may be years before the U.S. returns to its full productive capabilities and full employment has been restored. Nonetheless, we believe the markets will be focused on the improvements in economic activity in the coming years.

In the following outlook we articulate our views for the next 12 months by answering three main questions that we believe all investors need to assess:

- In which direction is the economy trending?

- What will be the policy response?

- What will be the impact on market leadership?

(Access the full outlook, with charts, here.)

1. In which direction is the economy trending?

Our colleague Kristina Hooper recently laid out three scenarios for the global economy, including our base-case expectation that the world economy and all its major regions will experience a recovery in 2021.

That includes the U.S. economy. After experiencing significant demand destruction in early 2020, the U.S. economy is recovering — nonetheless, it remains well below its projected productive capabilities, suggesting it may take a prolonged path back toward “normal” levels. We believe a protracted recovery, supported by accommodative monetary policy, is likely to be a sound backdrop for risk assets, as was the case between 2009 and 2014.

Taking a look at different parts of the U.S. economy, the manufacturing and service economies have been staging recoveries, the “at-home” economy has benefited (as evidenced by a surge in e-commerce sales), and the “re-opening” economy (travel, restaurants) will be dependent on further medical/scientific breakthroughs and may continue to be challenged in early 2021.

2. What will be the policy response?

The U.S. economy may not be back to full employment for years. Continuing jobless claims have been recovering but remain above the peak reached in 2008. In addition, inflation expectations remain near the bottom of the Federal Reserve’s perceived “comfort zone.”

Given these factors, the Fed appears to be committed to maintaining significant monetary policy support in 2021 and beyond. As of early December, 13 of 17 Fed officials have stated that they expect interest rates to remain near zero through 2023.

And the Fed isn’t alone. Most major central banks are undertaking a range of policies to support economies, including resuming their balance sheet expansions via large-scale asset purchases. Broad money growth historically has supported spending and is likely to lead to a reflation of asset prices.

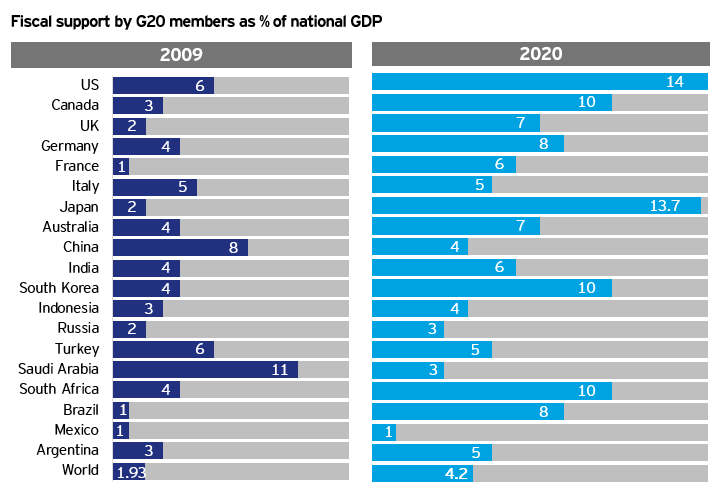

In terms of fiscal policy, countries across the globe have enacted outsized spending programs to support economies through the COVID-19 outbreak, far surpassing the actions undertaken in the Global Financial Crisis.

Sources: IMF Policy Tracker, IMF GDP Data, Atlantic Council, DE Data Wrapper, Invesco. Calculations based on data at various national release and announcement dates, and Atlantic Council as of 7/26/20. 2009 based on IMF, Eurostat and G20 data. NB: Calculations exclude deferrals and guarantees; include discretionary fiscal support programs (aside from “automatic stabilizers”); announced and implemented programs — all scaled against 2008 and 2019 GDP, respectively. The “World” aggregate represents G20 nations – G20 comprises 19 major economies plus the EU.

3. What will be the impact on the market?

Interest rates/yield curve. In economic recoveries, long-term interest rates usually drift higher and the yield curve steepens. U.S. government bond yields do not yet appear to fully reflect the improvement in economic activity. The copper/gold ratio, an indicator of the health of the global economy, has been turning up while U.S. Treasury rates remained relatively compressed. With the federal funds rate anchored at zero, the yield curve is likely to steepen.

The U.S. dollar. The post-financial crisis period of prolonged U.S. dollar strength appears to have concluded. Indeed, strong dollar cycles tend to end when Fed tightening cycles end. However, we would not expect a collapse in the U.S. dollar versus other developed world currencies as many of the U.S.’ major trading partners have been growing well below trend.

Commodities. The direction of the U.S. dollar typically determines whether commodities may be stronger, stable or weaker. History suggests that a softer currency is generally associated with firmer commodity prices, and we expect this time to be no exception. We expect ongoing Fed dovishness and continued efforts to maintain easy financial conditions to weaken the U.S. dollar and provide support to commodities.

Stocks or bonds? We believe these conditions are favorable to stocks, which tend to outperform bonds when the economy is improving and policy is supportive. Furthermore, we favor cyclical stocks, which tend to be impacted by changing economic conditions, versus defensive stocks, which tend to be less affected by economic cycles. We also favor small caps over large caps, and emerging markets over developed markets. And we believe that value stocks may be poised to benefit from an accelerating economy before returning to the “old normal” of structurally impaired economic growth.

For details on why we favor these asset classes, read our full outlook.

Conclusion

In short, we believe that a U.S. economic recovery, notwithstanding the inevitable fits and starts, is likely to play out in the coming year — and that betting against a recovery is akin to betting against medicine and science. We believe monetary policy will remain designed to support economy activity and is likely to reflate asset prices. Additional fiscal support is likely to be forthcoming. And finally, a much-anticipated recovery trade appears to be in the offing.

This post was first published at the official blog of Invesco Canada.