by Don Vialoux, EquityClock.com

Technical Notes for Yesterday

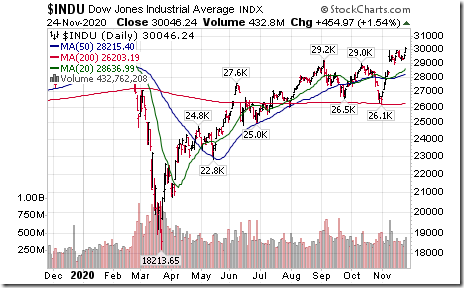

Dow Jones Industrial Average moved above 30,000 for the first time in history extending an intermediate uptrend.

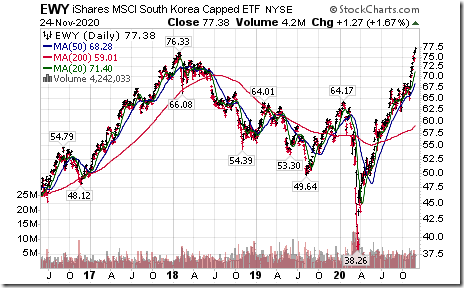

South Korea iShares (EWY) moved above $76.33 to an all-time high extending an intermediate uptrend. Look for the KOSPI to move shortly to an all-time high above 2,607.10. Far East equity indices and related ETFs continue to outperform North American equity indices.

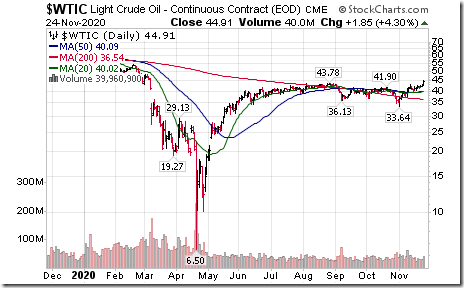

WTI Crude Oil moved above US$43.78 extending an intermediate uptrend.

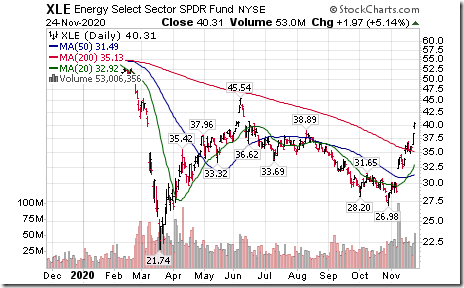

Energy SPDRs (XLE) moved above $38.89 extending an intermediate uptrend.

Oil & Gas Exploration SPDRs (XOP) moved above $57.50 extending an intermediate uptrend.

Oil Services ETF (OIH) moved above $173.86 extending an intermediate uptrend.

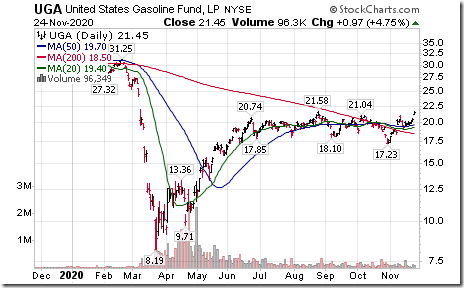

Gasoline ETN (UGA) moved above $21.58 extending an intermediate uptrend.

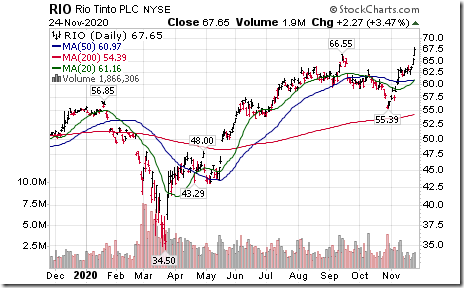

Rio Tinto (RIO), world’s largest base metal producer moved above $66.55 to an all-time high extending an intermediate uptrend.

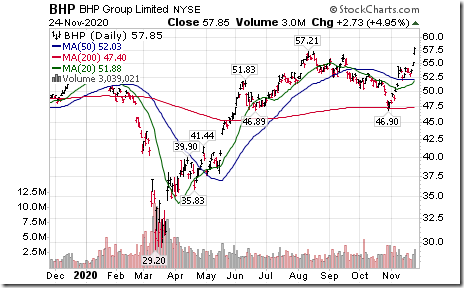

BHP Group (BHP), one of the world’s largest base metal producers moved above $57.21 to an all-time high extending an intermediate uptrend.

Teck Corp (TECK.B), a TSX 60 stock moved above $20.55 extending an intermediate uptrend

Cameco (CCO.TO CCJ), a TSX 60 stock moved above Cdn$13.47 and US$10.32 setting an intermediate uptrend.

Fertilizer stocks such as Nutrien (NTR) and Mosaic (MOS) are moving strongly higher. Mosaic moved above previous resistance at $20.20, $21.98 and $22.90 extending an intermediate uptrend.

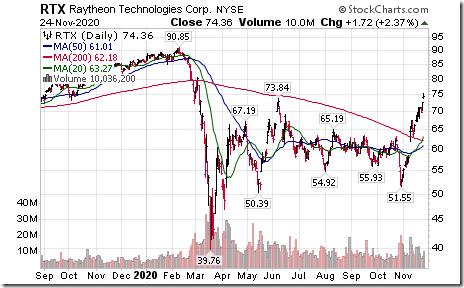

Raytheon Technologies (RTX), an S&P 100 stock moved above $73.84 extending an intermediate uptrend.

Bank of American (BAC), an S&P 100 stock moved above $28.81 resuming an intermediate uptrend.

Dollar Tree (DLTR), a NASDAQ 100 stock moved above $106.64 extending an intermediate uptrend. The company reported higher than consensus third quarter sales and earnings.

Constellation Software (CSU), a TSX 60 stock moved above $1,635.77 to an all-time high extending an intermediate uptrend.

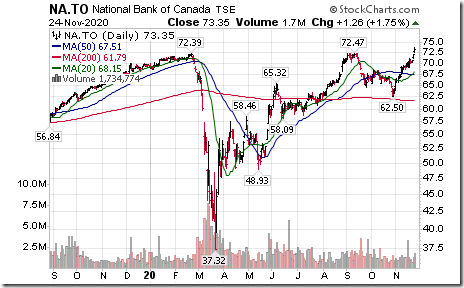

National Bank (NA), a TSX 60 stock moved above $72.47 to an all-time high extending an intermediate uptrend.

Canadian Forest Product stocks continue to outperform the TSX Composite. Canfor (CFP) moved above $19.06 to a 24 month high. ‘Tis the season!

Trader’s Corner

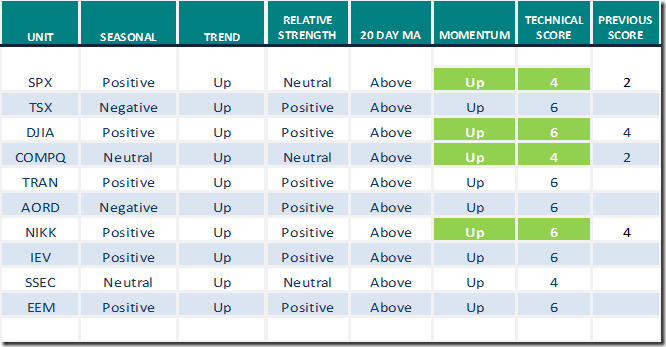

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

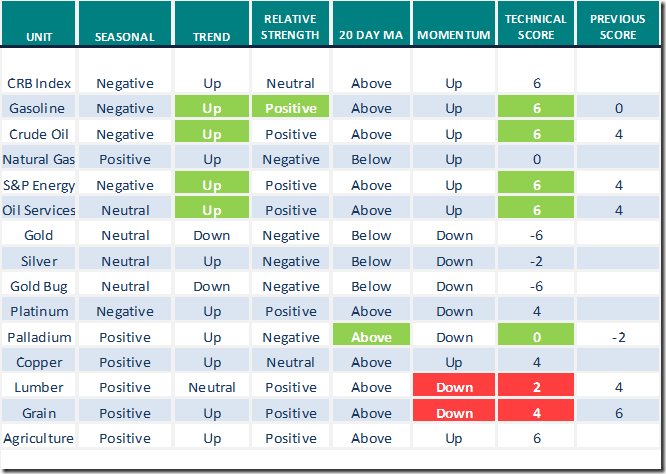

Commodities

Daily Seasonal/Technical Commodities Trends for November 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

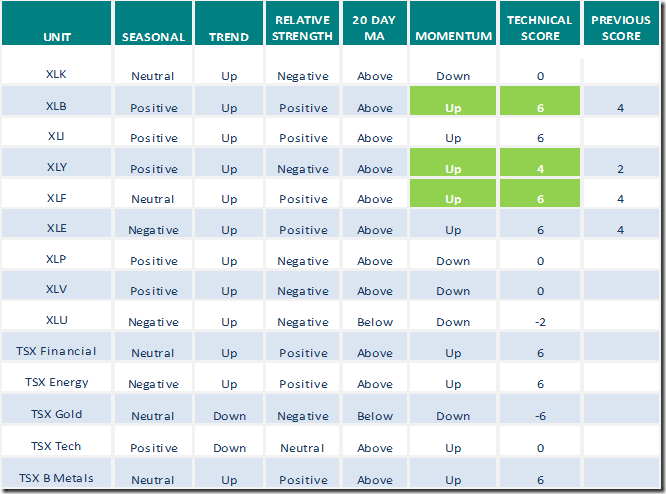

Sectors

Daily Seasonal/Technical Sector Trends for November 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

Seasonality in Gold

Gold’s best period of seasonal strength is from mid-December to the end of February. Following is a link to a recent study:

GLD: Buy The Dip In Gold (NYSEARCA:GLD) | Seeking Alpha

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.