by Don Vialoux, EquityClock.com

Technical Notes for Yesterday

Silver Miners Equity ETF (SIL) moved below $40.62 extending an intermediate downtrend.

Notable among U.S silver stock breaking intermediate support was Pan American Silver

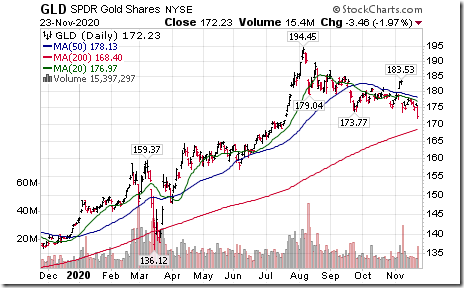

U.S. Gold Bullion ETF (GLD) moved below $173.77 extending an intermediate downtrend.

Western Digital (WDC), a NASDAQ 100 stock moved above $43.77 extending an intermediate uptrend.

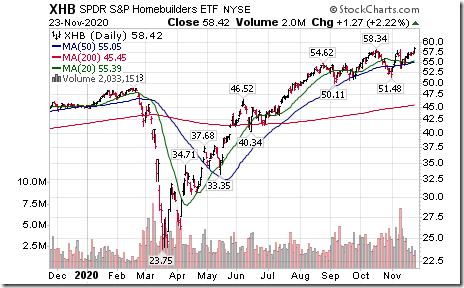

Home Builders SPDRs (XHB) moved above $58.34 to an all-time high extending an intermediate uptrend.

Tesla (TSLA), a stock recently added to the S&P 500 Index moved above $502.49 to an all-time high extending an intermediate uptrend.

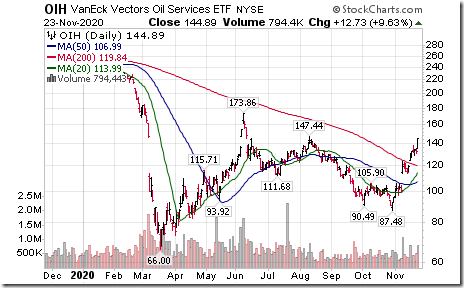

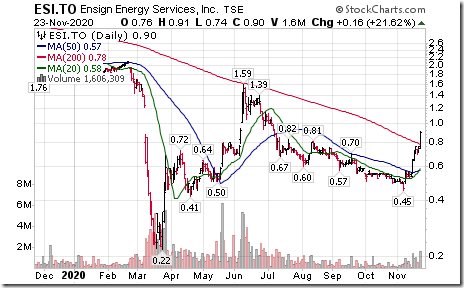

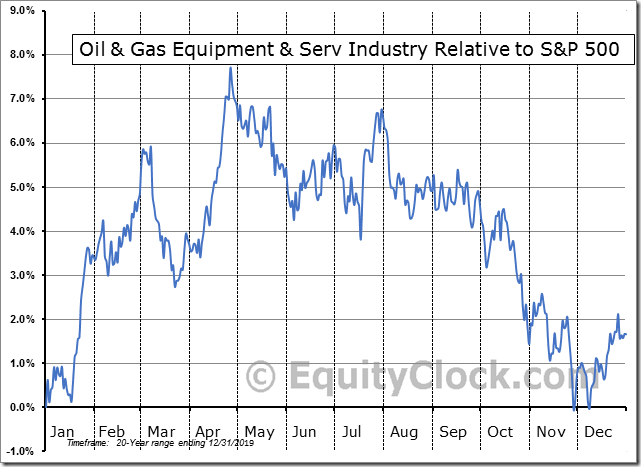

Energy services stocks on both sides of the border recorded exceptional gains, particularly Canadian energy service stocks.

‘Tis ths season for the start of strength in the energy services sector!

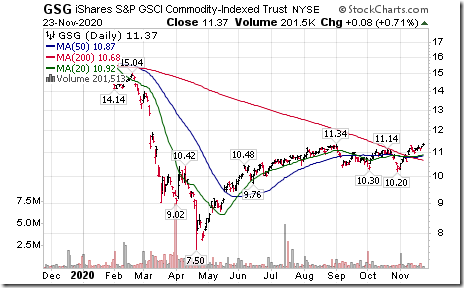

Commodity ETN (GSG) moved above $11.34 extending an intermediate uptrend.

Strength in commodity prices was lead by crude oil and grains.

Trader’s Corner

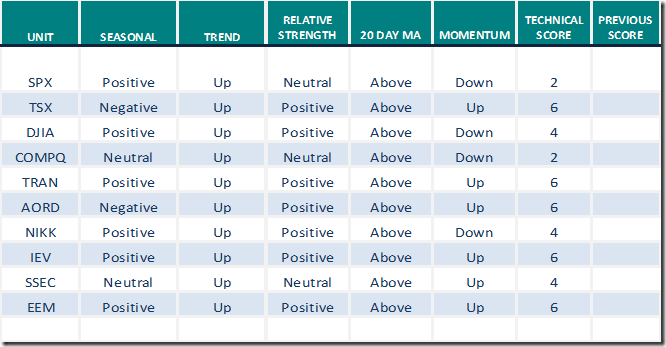

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

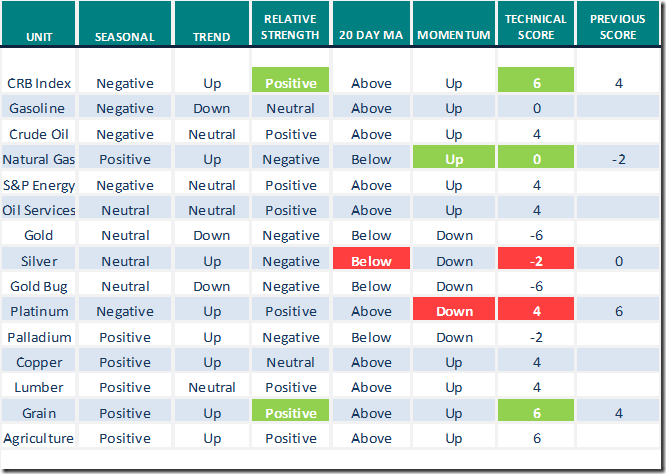

Commodities

Daily Seasonal/Technical Commodities Trends for November 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

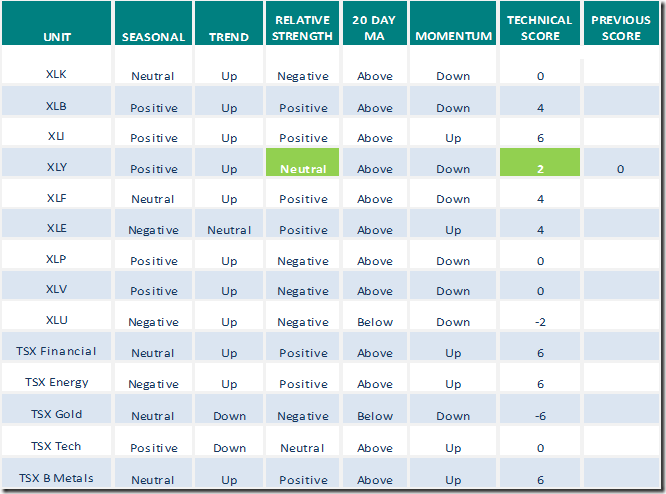

Sectors

Daily Seasonal/Technical Sector Trends for November 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads, “Constitutional rage, Topping appearance, Dead stimulus, Outperforming value, Floundering gold, Perking oil”. Following is the link:

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.