by Joseph V. Amato, President and Chief Investment Officer—Equities, Neuberger Berman

When Erik Knutzen wrote our last Asset Allocation Committee (AAC) Outlook in mid-October, he described a broad consensus in favor of risk assets over the next 12 months, tempered by short-term uncertainty that was “centered on the U.S. election and the path of coronavirus.”

November has seen encouraging news from clinical trials of two coronavirus vaccines. Others are still being tested, and each new set of successful results increases the chances of wide distribution of virus protection next year. We also have more clarity on the U.S. political landscape for the next two years, albeit with two Senate seats still up for grabs.

That is why our AAC reconvened last week for a mid-quarter meeting to reassess its views. Has clarity on these two issues heightened our risk appetite for 2021?

Hurdles and Uncertainties

It is more accurate to say that the AAC has confirmed many of its existing views. We were already positive on equities and credit over government bonds, and we were turning a slight bias to quality growth into a more constructive view on cyclical and economically sensitive assets. We anticipated a consolidation of the recovery already underway.

So why not tilt more decisively toward risk assets and cyclical exposures? Because, as we discussed while putting together the 10 broad themes for last week’s Solving for 2021, we still face short-term hurdles and longer-term uncertainties.

First, we think a $500 billion-plus fiscal stimulus package, with income replacement and support for state and local government, could pass before the administrative transition (if not during the lame duck session, then soon thereafter), that would still be modest next to what was anticipated under a “blue sweep” of the U.S. government. Further consensus could be more difficult, not least because upbeat economic data, the resilient consumer and the reopening of the economy as people learn to live with the virus raise questions about whether the U.S. actually needs more stimulus.

Second, while vaccine success is potentially great news for the economy in the second half of 2021, until then the story is about dealing with the current surge of new infections, followed by the logistical and behavioral challenges of distributing the vaccines and persuading people to accept them.

And third, while we do think inflation is going to rise up the agenda for investors next year, as our top theme in Solving for 2021 puts it, we still believe the longer-term outcome will be a return to secular stagnation.

Overlapping Factors

If that isn’t enough, we regard the fierce rotation that swept through markets at the first news of vaccine success on November 9 as a warning against big factor biases in equity portfolios. We believe it is risky to focus entirely on either the positives of medium-term virus relief, or on the negatives of the short-term battle with new infections or the longer-term threat of secular stagnation.

Balance is, therefore, key in our view. But achieving balance in the current, highly unusual environment will be complex.

The factor dynamics of equity markets in recent months are often described in terms of growth outperforming value. That is true, but it is far from the whole story.

To a large extent, the outperformance of growth has been a function of duration rather than growth itself. Duration, or sensitivity to changing interest rates, is usually associated with bonds, but we can also see it in stocks with more stable and visible earnings. Declining real rates have expanded the valuation multiples of long-duration growth companies such as the technology mega-caps, at the same time as compressing the multiples of shorter-duration stocks with more volatile earnings.

Does long-duration versus short-duration equities overlap with defensive versus cyclical? Yes, but not perfectly. Neither do these factors map perfectly onto the new, “coronavirus factor” at work in the market. If long duration versus short duration went through a larger rotation than either growth versus value or defensive versus cyclical on November 9, the rotation in stay-at-home versus travel-and-leisure was larger still. If you were underweight airlines, transport, retail and leisure stocks, the pain was severe.

That is why we think it’s important that all of these factors are each considered on their own terms, and then carefully balanced in equity portfolios.

To sum up, we remain positive in our view on risk assets over the next 12 to 18 months. The election and coronavirus vaccine news has reassured us in those views. Nonetheless, the range of potential outcomes remains wide. Those medium-term tailwinds are still competing with near-term and longer-term headwinds—as well as crosswinds coming from an unusually complex tangle of risk factors.

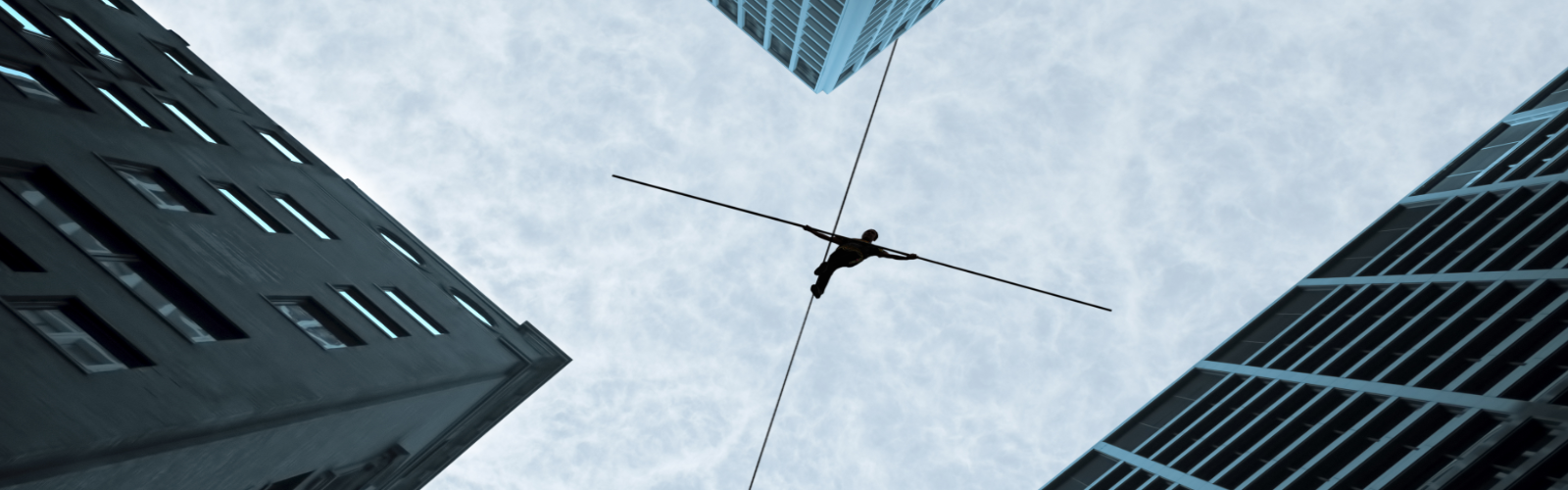

We think balance will be key to staying on the market tightrope over the coming months. Achieving it will be the challenge.

Copyright © Neuberger Berman