by Greg Valliere, AGF Management Ltd.

THE FOCUS INSIDE THE WASHINGTON BELTWAY is on election irregularities and Donald Trump’s next moves — but throughout the country a deepening humanitarian crisis is totally out of control, and the weary public seemingly has given up.

THE STATISTICS ARE ASTONISHING: Yesterday there were 152,391 new Covid-19 cases in the U.S. and 66,606 hospitalizations, both daily records. Fatalities now exceed 1,000 per day. The impact is greatest in Middle America, from El Paso to the Dakotas, where hospitals can’t handle the burden.

THE EUPHORIA OVER VACCINES by spring overlooks what’s happening now, as cold weather finally returns to much of the country. Fatalities are certain to surge this winter and lockdowns suddenly have returned as options. Family gatherings will increase the crisis; upcoming holidays will be “super spreaders.”

WASHINGTON SEEMINGLY IS OBLIVIOUS to this crisis. Donald Trump still insists he won, he’s in a bitter feud with Fox News, and he’s about to fire more officials who were not sufficiently loyal to him. Incredibly, he’s plotting another run for the presidency in 2024, even as his White House is now crippled by the virus.

WE EXPECT THE BIDEN ADMINISTRATION will impose strict mask-wearing standards and social distancing regulations, but that would come after the Jan. 20 inauguration. In the meantime, a pandemic relief bill is urgently needed.

STEVE MNUCHIN STILL WANTS A DEAL, but the key antagonists — Nancy Pelosi and Mitch McConnell — continue to talk past each other. She couldn’t take “yes” for an answer before the election, when she could have gotten $1.8 trillion. Yesterday Pelosi repeated her demand for at least $2 trillion, while McConnell’s Senate Republicans don’t want much more than $500 billion. The impasse persists.

WE STILL BELIEVE THERE WILL BE A BILL, but it’s impossible to accurately predict when it will get done. It may come in December, or after the Jan. 5 Georgia runoffs, or it may not come until just after Biden’s inauguration. He’s eager to “go big,” sources predict.

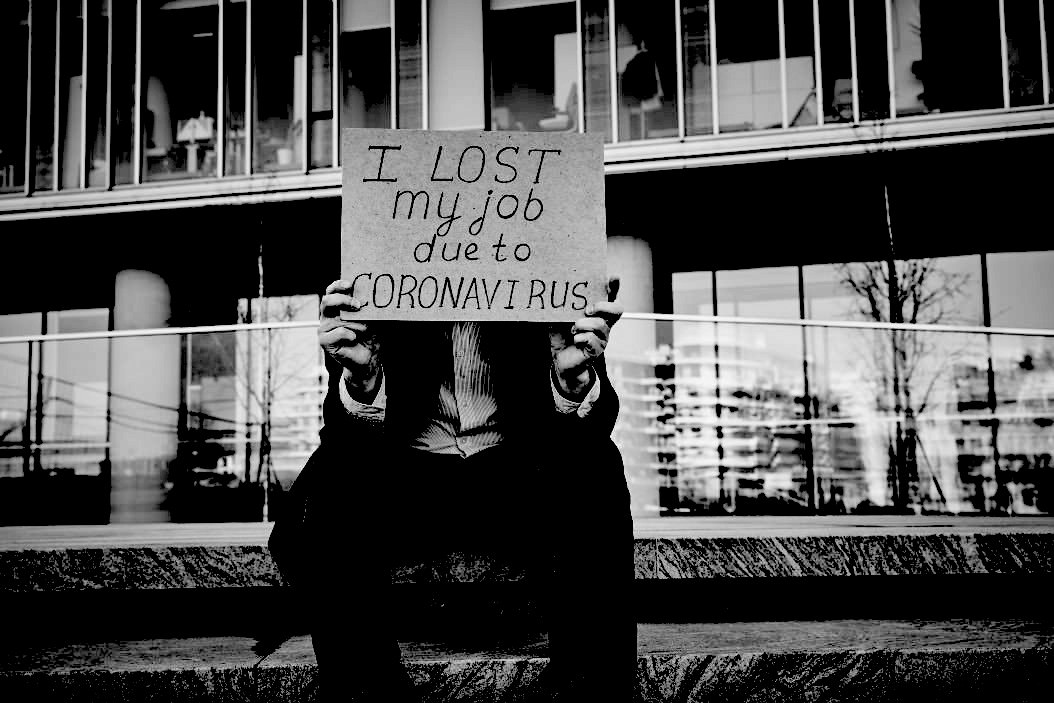

THE ECONOMY HAS BEEN A PLEASANT SURPRISE in recent months, but the staggering acceleration of Covid-19 cases surely will drive people indoors and away from shopping malls, restaurants and airplanes for most of the winter. The spring looks promising — but that’s five months away.

WE USUALLY SEE THE GLASS AS HALF FULL, but this crisis still hasn’t peaked in much of middle America. Countless small cities lack the resources to cope with the virus. This requires an aggressive response from Washington, but this city is still debating the election outcome and Trump’s next moves — not this deepening humanitarian crisis.