by Don Vialoux, EquityClock.com

Editor’s Note

Don Vialoux is scheduled to appear on Michael Campbell’s “Money Talks” radio show tomorrow at approximately 9:00 AM Vancouver time (Noon Toronto time). Connect with radio CKNW at https://globalnews.ca/radio/cknw/player/#/

Technical Notes for Yesterday

Pepsico (PEP), a NASDAQ 100 stock moved above $144.11 to an all-time high extending an intermediate uptrend.

Trader’s Corner

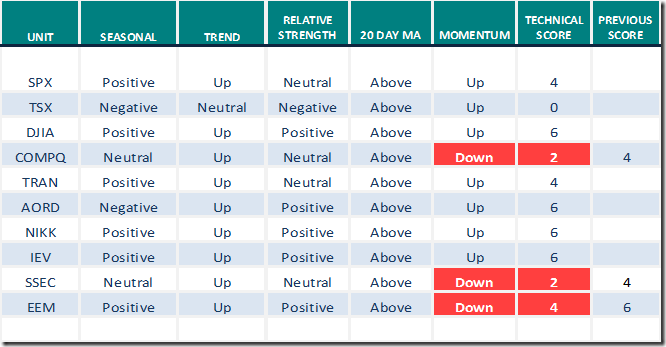

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

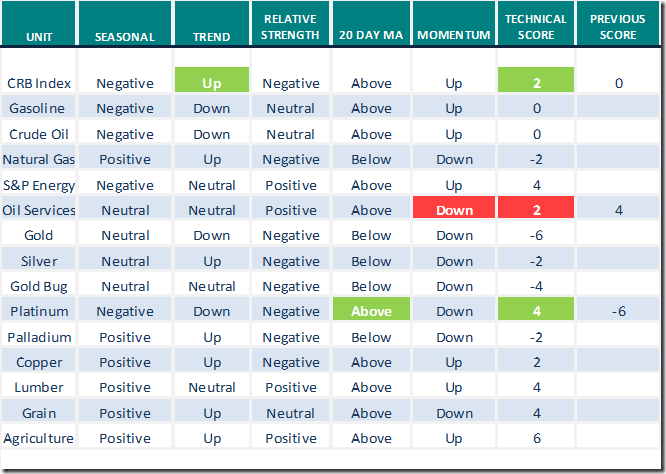

Commodities

Daily Seasonal/Technical Commodities Trends for November 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

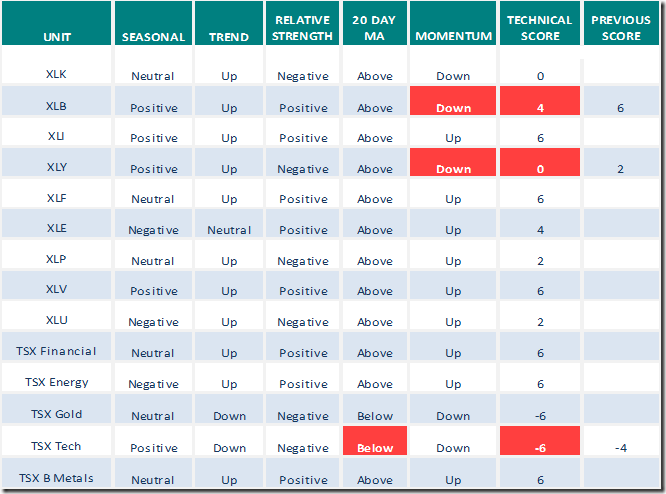

Daily Seasonal/Technical Sector Trends for November 12th 2020

Green: Increase from previous day

Red: Decrease from previous day

Schachter’s Eye on Energy

Editor’s Note: Josef continues to look for an entry point into the sector in early to mid-December. That call fits nicely with seasonal influences for the sector. Following is an excerpt from his latest report. Full service is available through a paid subscription.

The S&P/TSX Energy Index has fallen from the June high at 96.07 to the current level today of 77.41 (last week it was at 67.51). It reached 80.54 on Tuesday of this week as the euphoria of a vaccine lifted the sector. However the index is still down by 14% in four months when we recommended profit taking. We expect energy and energy service stocks to roll over shortly and recommence their descent.

The S&P/TSX Energy Index should fall below the low at 60.38 (the low in early October) in the coming weeks as tax loss selling commences. We expect to see a very attractive BUY signal generated during early to mid-December tax loss season and expect to recommend new ideas as well as highlight our favourite Table Pounding BUYS, which should trade at much lower levels than currently. Our initial downside target is for the S&P/TSX Energy Index to fall below 50 in the coming weeks.

Please consider becoming subscribers before our November 26th webinar as we will be discussing the best ideas to invest in during the upcoming tax loss selling season. In addition during the 90 minute webinar we will discuss the third quarter results (those that did well and those that did not perform) of the 27 companies we cover.

Subscribe to the Schachter Energy Report and receive access to our two monthly reports, all archived Webinars, Action Alerts, TOP PICK recommendations when the next BUY signal occurs, as well as our Quality Scoring System review of the 27 companies that we cover. We go over the markets in much more detail and highlight individual companies in our reports. If you are interested in the energy industry this should be of interest to you.

Tomorrow we will release our November Interim report. We reviewed the companies that reported Q3/20 results before our research cut-off of Friday November 6th. The report will also include an update of our Insider Trading Report and our analysis.

To get access to our research go to https://bit.ly/2FRrp6k to subscribe.

S&P 500 Momentum Barometer

The Barometer dropped 5.01 to 78.56 yesterday. It changed from extremely intermediate overbought to intermediate overbought on a drop below 80.00.

TSX Momentum Barometer

The Barometer slipped 2.36 to 67.45 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/11/clip_image0015_thumb-5.png)