by Don Vialoux, EquityClock.com

The Bottom Line

Most major equity indices around the world moved sharply higher last week. Greatest influences remain growing evidence of a second wave of the coronavirus (negative), possible approval of a vaccine (positive) and final returns from the U.S. President and Congress elections (uncertain).

Observations

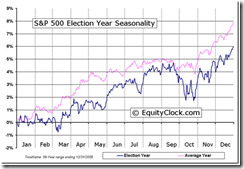

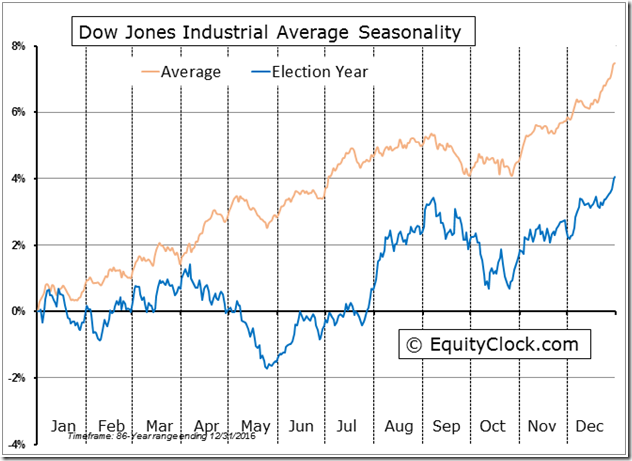

The Dow Jones Industrial Average and S&P 500 Index are following their historic trend after a U.S. Presidential Election. Indeed, the strongest 12 week period during the four year U.S. Presidential Cycle has occurred from U.S. Presidential Election Day to Inauguration Day in the third week in January. Since 1952, the S&P 500 Index advanced in 11 of 17 periods. Average gain per period was 2.6% excluding one important event in 2008 when Obama first became President with a “super majority” in Congress. Regardless of final results of the recent election, the “super majority” scenario recorded in 2008 did not happen. Accordingly, the stage is set for higher U.S. equity indices by Inauguration Day on January 20th.

Results of the U.S. President and Congressional elections (as reported to last Saturday) suggest that history by U.S. equity indices is about to repeat between Election Day and Inauguration Day. Biden became President, control of the Senate remained Republican with a smaller majority and control of the House of Representatives remained Democrat with a smaller majority. Net result is political gridlock for the next two years, a scenario that historically has been mildly bullish for U.S. equity markets.

Medium term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved sharply higher last week. It changed from intermediate oversold to intermediate overbought. See Barometer chart at the end of this report.

Medium term technical indicator for Canadian equity markets also moved higher last week. It changed from intermediate oversold to intermediate overbought. See Barometer chart at the end of this report.

Short term short term momentum indicators for U.S. markets/commodities/sectors (20 day moving averages, short term momentum indicators) turned higher last week

Short term momentum indicators for Canadian markets/sectors turned higher last week

Year-over-year 2020 consensus earnings and revenues declines by S&P 500 companies ebbed again last west. According to www.FactSet.com, third quarter earnings are expected to fall 7.5% (versus a decline of 9.8% last week) and revenues are expected to slip 1.7% (versus previous decline of 2.1%). Fourth quarter earnings are expected to drop 10.9% (versus previous decline of 11.2%) and revenues are expected to decline 0.3% (versus 0.5% last week). Earnings for all of 2020 are expected to fall 14.8% (versus previous decline of 15.5%) and revenues are expected to decline 2.2% (versus previous decline of 2.3%).

Consensus estimates for earnings and revenues by S&P 500 companies turn positive on a year-over-year basis in the first quarter of 2021. According to www.FactSet.com earnings in the first quarter of 2021 are expected to increase 14.5% and revenues are expected to increase 3.3% (versus previous 3.4%). Earnings in the second quarter are expected to increase 44.0% (versus previous increase of 44.2%) and revenues are expected to increase 13.7%. Earnings for all of 2021 are expected to increase 22.4% (versus previous increase of 23.0%) and revenues are expected to increase 7.9%.

Economic News This Week

U.S. October Consumer Price Index to be released at 8:30 AM EST on Thursday is expected to increase 0.2% versus a gain of 0.2% in September. Excluding food and energy, U.S. October Consumer Price Index is expected to increase 0.2% versus a gain of 0.2% in September.

U.S. October Producer Price Index to be released at 8:30 AM EST on Friday is expected to increase 0.2% versus a gain of 0.4% in September. Excluding food and energy, U.S. October Producer Price Index is expected to increase 0.2% versus a gain of 0.4% in September.

November Michigan Consumer Sentiment to be released at 10:00 AM EST on Friday is expected to increase to 81.9 from 81.8 in October.

Selected Earnings News This Week

Frequency of quarterly reports from major U.S. and Canadian companies winds down this week: 89% of S&P 500 companies have reported to date with 86% reporting higher than consensus quarterly earnings and 79% reporting higher than consensus quarterly revenues. Another 15 S&P 500 companies (including three Dow Jones Industrial Average companies) are scheduled to release results this week. Selected U.S. and Canadian reports include:

Trader’s Corner

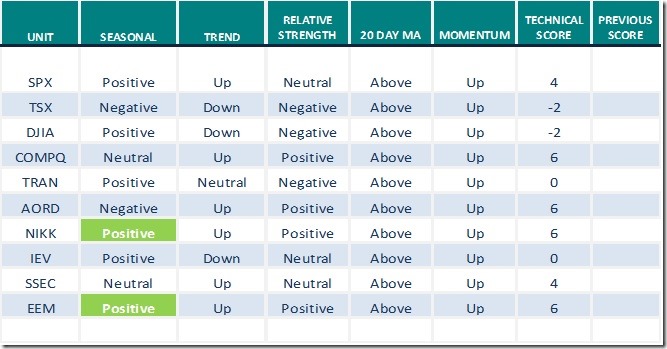

Equity Indices and Related ETFs

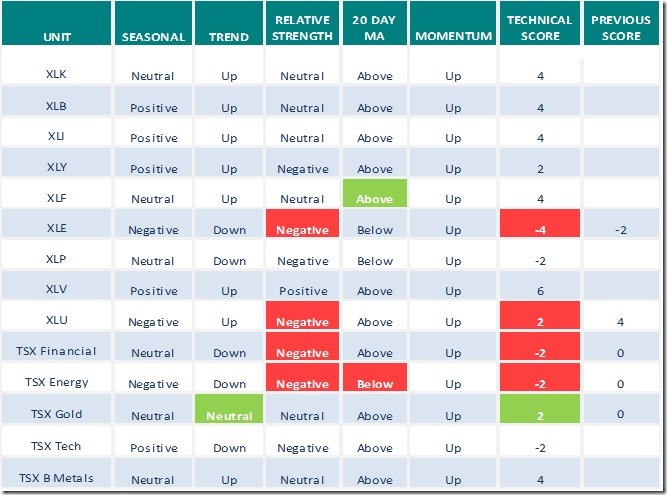

Daily Seasonal/Technical Equity Trends for November 6th 2020

Green: Increase from previous day

Red: Decrease from previous day

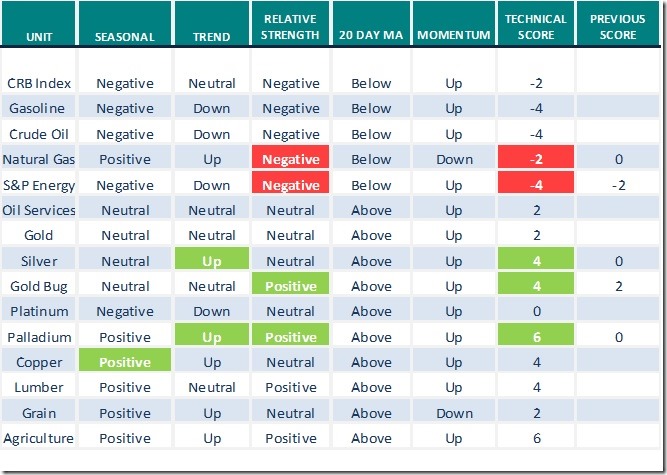

Commodities

Daily Seasonal/Technical Commodities Trends for November 6th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for November 6th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday November 6th

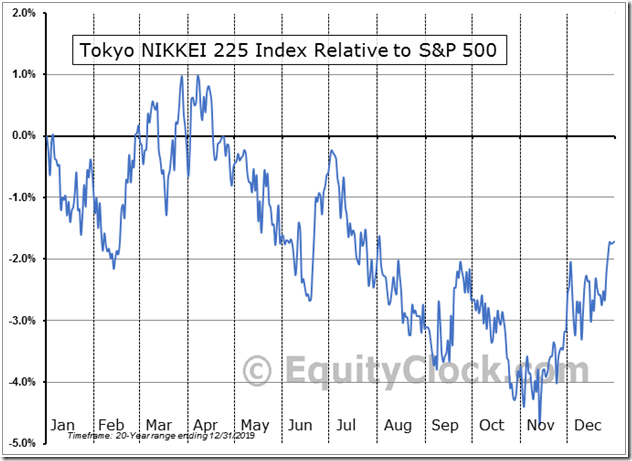

The Nikkei Average advanced 219.35 to 24,325.23 to a 24 month high.

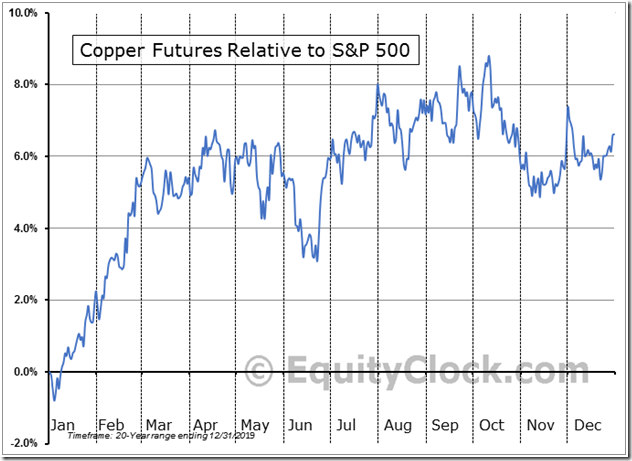

Globex Copper Miners (COPX) moved above $22.90 extending an intermediate uptrend.

Lundin Mining (LUN.TO), a base metals producer moved above Cdn$8.55 extending an intermediate uptrend.

Chile iShares (ECH) moved above $25.83 extending an intermediate uptrend. Units responded to higher base metal prices.

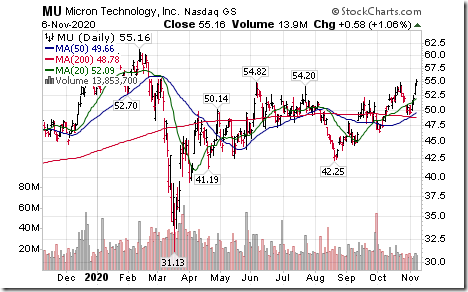

Micron (MU), a NASDAQ 100 stock moved above $54.82 extending an intermediate uptrend.

T-Mobile (TMUS), a NASDAQ 100 stock moved above $123.42 to an all-time high extending an intermediate uptrend.

CVS Health (CVS), an S&P 100 stock moved above $66.60 resuming an intermediate uptrend.

Natural Gas ETN (UNG) moved below $10.73 setting an intermediate downtrend.

Palladium ETN (PALL) moved above $232.40 extending an intermediate uptrend.

The U.S. Dollar Index dropped 2.24% last week. The drop prompted strength in the prices of industrial and precious metals commodities.

Changes in Seasonal Ratings

Rating on the following markets change from Neutral to Positive this week:

S&P 500 Momentum Barometer

The Barometer slipped 3.28 on Friday, but gained 34.00 to 64.46 last week. It changed from intermediate oversold to intermediate overbought on moves above 40.00 and 60.00.

TSX Momentum Barometer

The Barometer slipped 1.90 on Friday, but gained 32.70 last week. It changed from intermediate oversold to intermediate overbought on moves above 40.00 and 60.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.