by Don Vialoux, EquityClock.com

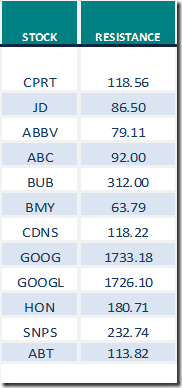

S&P 100 and NASDAQ 100 stocks breaking above intermediate resistance yesterday

ETFs breaking above intermediate resistance yesterday

Healthcare SPDRs (XLV) moved above $109.53 to an all-time high extending an intermediate uptrend .

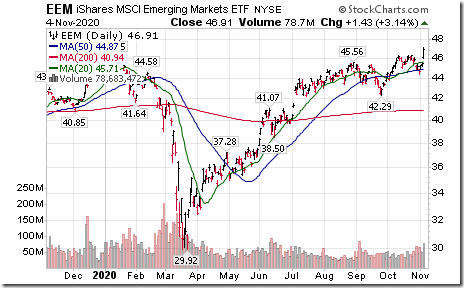

Emerging Markets iShares moved above $46.34 extending an intermediate uptrend.

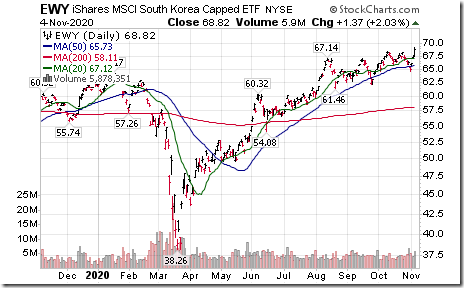

South Korea iShares moved above $68.49 extending an intermediate uptrend.

China Large Cap iShares moved above $45.93 extending an intermediate uptrend.

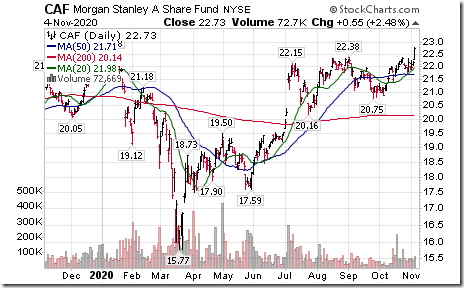

Ditto for the Morgan Stanley A shares (holding a portfolio of China A shares)!

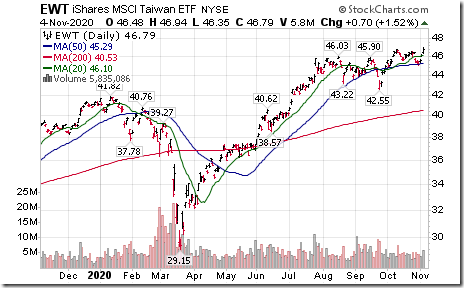

Ditto for Taiwan iShares!

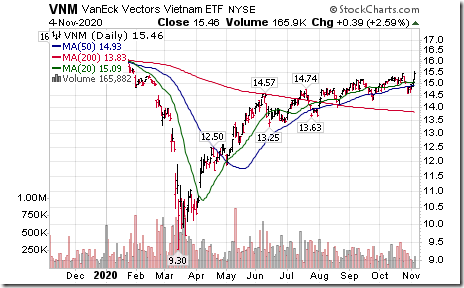

Ditto for Vietnam ETF!

Trader’s Corner

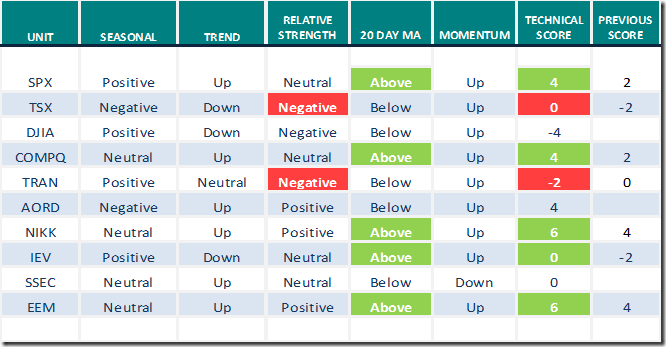

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 4th 2020

Green: Increase from previous day

Red: Decrease from previous day

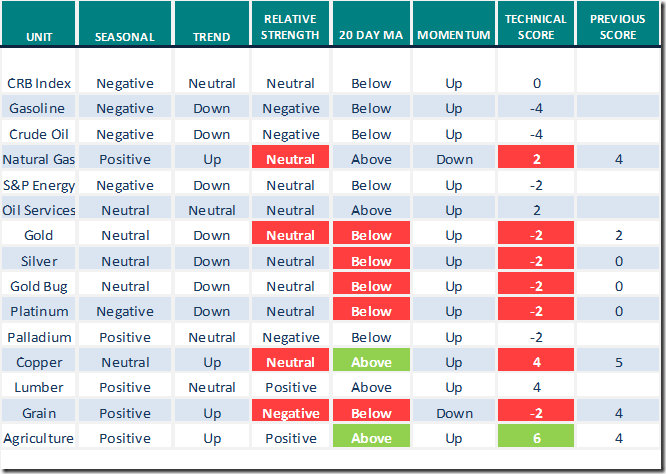

Commodities

Daily Seasonal/Technical Commodities Trends for November 4th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

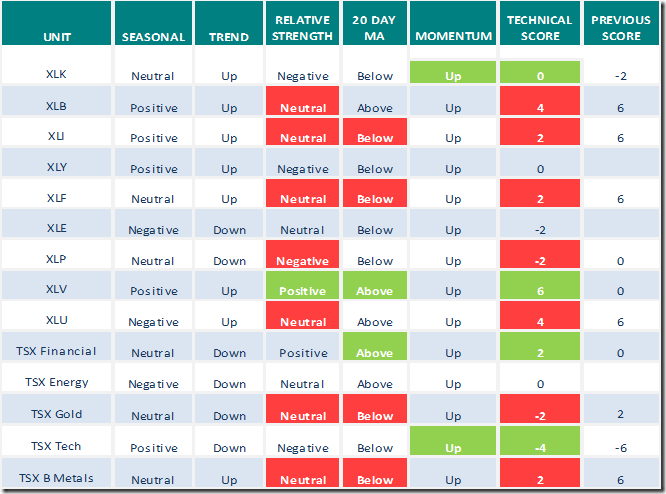

Daily Seasonal/Technical Sector Trends for November 4th 2020

Green: Increase from previous day

Red: Decrease from previous day

Market Buzz

Greg Schnell offers “Post elections ideas”. His focus is on a favourable outlook for base metal stocks. Following is a link:

https://www.youtube.com/watch?v=8ezUWqOqhP0&feature=youtu.be&ab_channel=StockCharts

P.S. Increased demand for base metals is expected to come primarily from growth by Far East markets. Possible launch of an expanded infrastructure program in the U.S. promised by both Biden and Trump also is a plus.

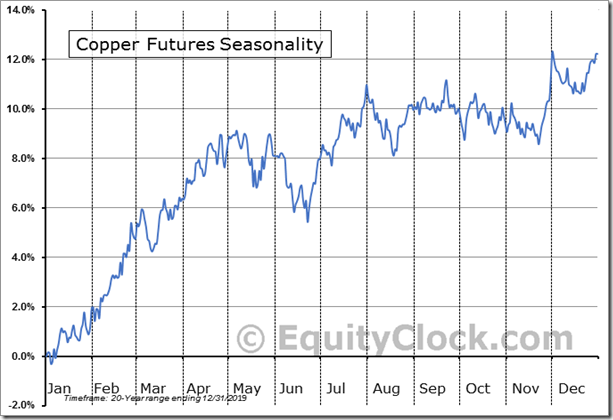

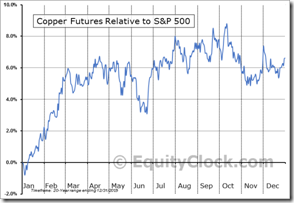

Seasonal influences for base metal prices and base metal equity sector on a real and relative basis turn positive in mid/November/early December.

Copper Futures (HG) Seasonal Chart

Copper inventories on the LME are low: They recently recovered slightly from a 5 year low setting the stage for higher prices during their next period of seasonal strength

S&P 500 Momentum Barometer

The Barometer added 2.40 to 58.52 yesterday. It remains intermediate neutral.

TSX Momentum Barometer

The Barometer slipped 0.47 yesterday. It remains intermediate neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.